Technology’s enhanced product features attract parents…and their wallets

Summer is in full swing, but retailers and brands are already thinking about the upcoming year. While many products benefit from the back-to-school season, for laptop brands and retailers, back-to-school is truly a critical time to meet consumer needs and build sales going into the holiday season.

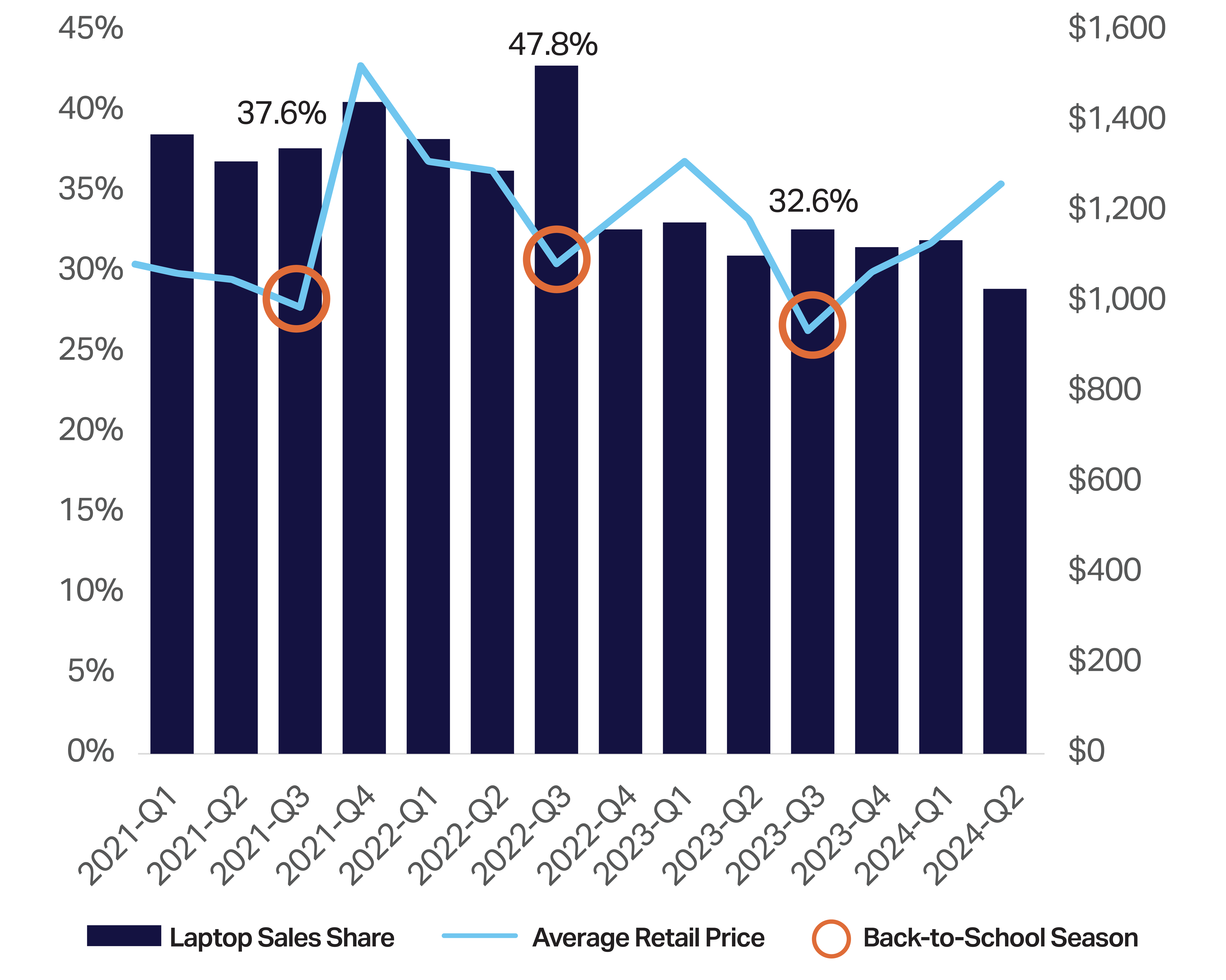

Back-to-school is high season for laptop sales (with headphones trailing in importance) as parents and students flock to stores looking for the new and innovative computer technology. While unit volumes are higher during the holiday season, the back-to-school demand for the newest laptops spurs less entry-level price activity and more demand at higher price points, as well as the accompanying more robust feature sets.

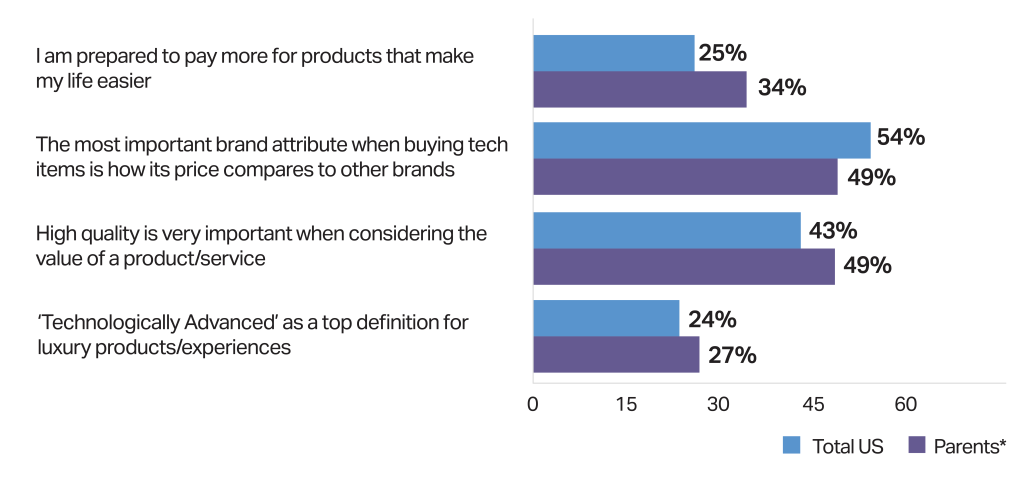

Parents are highly confident in their personal financial situation—34% compared to 27% of the total US population, according to NIQ Consumer Life data. They’re also highly motivated by the opportunities that technology represents for their children. Parents are less price sensitive when choosing the brand of a tech item (with more than one-third of parents choosing to pay more for products ), are more focused on service quality (more than 10% higher than the general population), and view higher-level experiences as an important indicator of technology and innovation (more than 25% of all parents agree with this sentiment).

Among consumers with one or more children in the household, who had low or no price sensitivity and purchased a laptop in-store during Q3 of last year, product features was the #1 purchase driver, followed by brand, and then design. The most common age group among these consumers was 25-34. Back-to-school is an opportunity to highlight these attributes to parents, when they are focused on the PC as part of their child’s learning experience.

Parents, Premium, and Price

*Parents with children age 5-19 in the home

Source: NIQ Consumer Life

Premium-brand laptop sales peak during Back to School season

Consumers are more likely to shop for premium attributes when buying for a student than when buying for basic use (or as a gift). That drives buyers’ tolerance for pricing into higher price ranges and premium brand products into the mix. Data from Fox Intelligence shows that core premium brands gain share during the back-to-school period—a combination of the more aggressive premium price points and back-to-school shoppers’ higher interest levels in better feature sets. Higher value demand that spurs higher prices also benefits retailers that have strong relationships with these brands and a focus on premium products at premium values. For those consumers with one or more children and low to no price sensitivity, premium brands topped the list of purchased brands in Q3 ’23.

Premium Laptop Performance: Price vs. Share

Source: Fox Intelligence, eComm Laptops, January 2021-June 15th, 2024 excl. Walmart volume

Among those same consumers—this time, price sensitive or not—who bought laptops offline in Q3 cited product features and brand as their purchase drivers, behind price. Online laptop purchases among this group also put product features at the forefront, with price second. No matter the mode of shopping, parents were willing to sacrifice lower prices for more advanced capabilities.

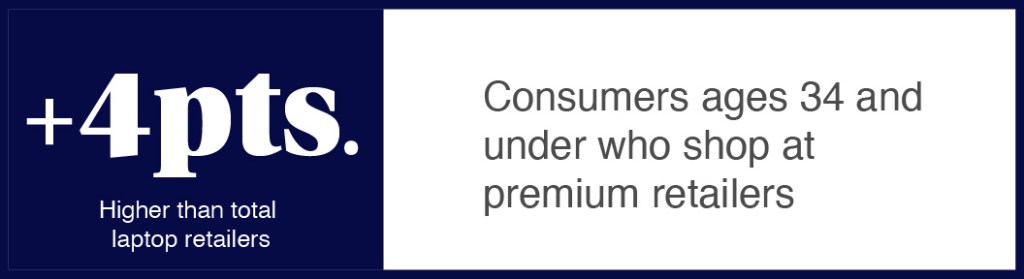

For premium laptop retailers and brands, back-to-school is the most important season as the overarching focus of seasonal selling is on the PC, and parents’ focus on higher value creates an advantage for retailers who can leverage their ability to sell and market those higher-end attributes as opposed to just focusing on price. GfK data shows that retailers with a premium orientation tend to do very well in this period with younger shoppers, under 34 years of age, over-indexing compared to other retailers, likely as a result of their strong premium brand positioning.

Social Media shopping: buying for back-to-school is just a

“button” away

This becomes important for these retailers as they can more easily access this core demographic, driven by their interest in premium for back-to-School, which tends to favor online shopping and influencer marketing. This is especially true in the crucial high school and college age demographics, with parents indexing over 50% higher in influencer marketing impact. Today’s parents for that school age demographic are likely to be older Millennials or early-stage Gen X and have grown up recognizing the value of the PC and its important role in education.

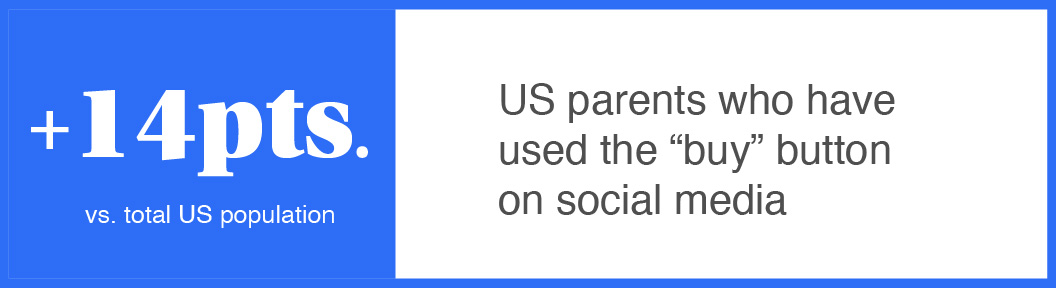

Naturally, they are likely to turn to the marketing and advertising tools that they are most comfortable with, such as social media and influencer marketing, with more than two-thirds of parents identifying social media as an important driver in shopping activity. That turn is also likely to be encouraged by the students themselves, who also consume the same types of media. These parents are much more likely to be impacted by influencer marketing and to have made purchases on social networks. In fact, parents are 50% more likely to have bought via social media, according to NIQ Consumer Life. This opens up opportunities for brands and retailers to leverage modern marketing tools to talk to this core demographic as they are in the market to buy.

Retailers with a premium pricing position, but also a reputation for pricing aggressiveness, and a wide range of product choices will once again emerge as the winners in this environment. The back-to-school shopper has always been one that values the process of buying a PC, viewing it as both an investment and a tool. Retailers able to offer a shopping experience that reflects that desire are likely to be the winners in back-to-school shopping periods.

While the growth of e-Commerce and the plethora of DTC opportunities all compete for premium laptop dollars, they also all combine to help showcase the best of the currently available goods and help create demand. These highly engaged shoppers use their PCs intensely for education and for leisure pursuits (such as gaming), and this helps create premium demand. This virtuous circle of brand, price reputation, and premium selection makes premium-branded laptops and the retailers that carry them the natural market participants to take advantage of this unique period of opportunity.

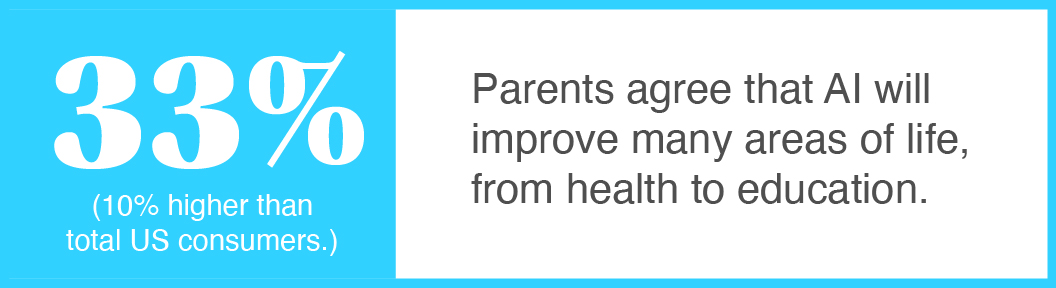

The focus on innovation, high feature sets, and quality, as well as more marketing to parents and children–with an increasingly sophisticated notion of their computer needs–dovetails perfectly this year into the broader release of the so-called AI PC. The potential benefits of AI to knowledge-hungry students should combine to create a new spark of demand over and above the normal back-to-school fray. Parents are engaged by opportunities in AI, over-indexing in focus on innovation and interaction with AI, as well as confidence in its benefits (more than 25% above the total population does), as well as the future opportunities presented by this revolution in technology.

Finally, as we’ve seen, parents are also highly motivated by innovation and perceived “better” technology, both attributes well represented by AI-focused PCs. While the past few years have been a challenge for the consumer electronics industry as the pandemic spike in ownership reduced the average age of the installed base and let consumers reallocate that spend elsewhere, once the pandemic ended, the opposite is now true. Aging laptops, combined with a surge of innovation and the recognition of the long-term value of the PC in education, are likely to spur back-to-school sales, both this year and going forward.