Beyond the Trend: A Market Reality

The Growth of the Second-Hand Market in Europe

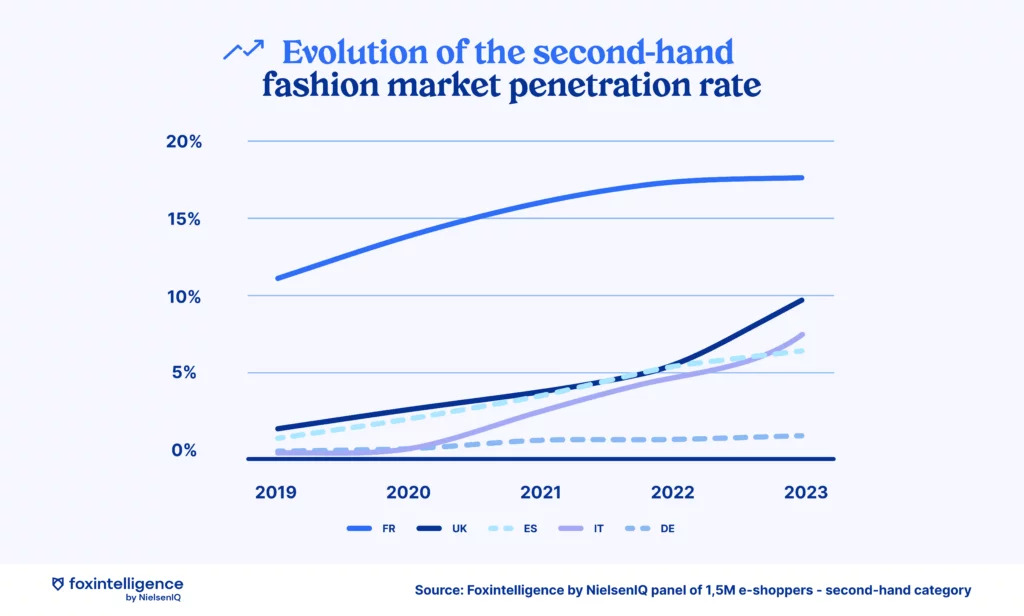

The evolution of the second-hand market in Europe shows varying dynamics across different countries, with significant growth in some.

France stands out as the most mature market, with the share of the second-hand market reaching 17.8% in 2023, up from 11.3% in 2019. This rapid progression underscores the growing acceptance of this consumption model among French consumers.

Other European markets are also experiencing notable acceleration. In the UK, Italy, and Spain, the share of the second-hand market has significantly increased, illustrating a particularly dynamic trend.

These variations reflect different consumer behaviors across Europe, but a common trend emerges: the rise in the share of the second-hand market is undeniable, driven by consumers’ growing interest in economical and practical alternatives, as well as an increasingly diverse and attractive offering.

A Rapid and Sustainable Expansion

The rise of the second-hand market is no longer just a passing trend. This exponential growth is based on several key factors that make it an essential market reality:

- Ease of Use: Platforms like Vinted make buying and selling second-hand items intuitive, attracting a broad audience.

- Commitment to Sustainability: Environmental awareness is driving many consumers to choose resale to reduce their carbon footprint.

- Cost Savings: Consumers find fashion items at significantly lower prices, boosting demand for second-hand goods.

- Environmental and Economic Impact: Resale contributes to reducing textile waste and supports a more sustainable circular economy.

The Rise of the Mixers Trend: Combining New and Second-Hand

An emerging trend is gaining traction in the fashion market: mixers. These consumers no longer limit themselves to one mode of purchase but opt for a blend of new and second-hand clothing, creating a new paradigm in the fashion industry.

In Europe, the proportion of mixers continues to grow, while that of buyers exclusively focused on new items is decreasing.

In fact, the percentage of mixers ranges from 7% in Germany to 28% in France. In the UK, this share reaches 24%, while in Italy and Spain, it is 12% and 10%, respectively. Overall, the figures are rising across all European countries.

Contrary to the common belief that consumers must choose between new and second-hand, mixers embrace both aspects of fashion, demonstrating a significant evolution in consumption habits

🦊 Discover your true online market share and trends

Vinted: The Phenomenon Challenging Traditional Fashion Players

Vinted: Up Against the Fashion Giants

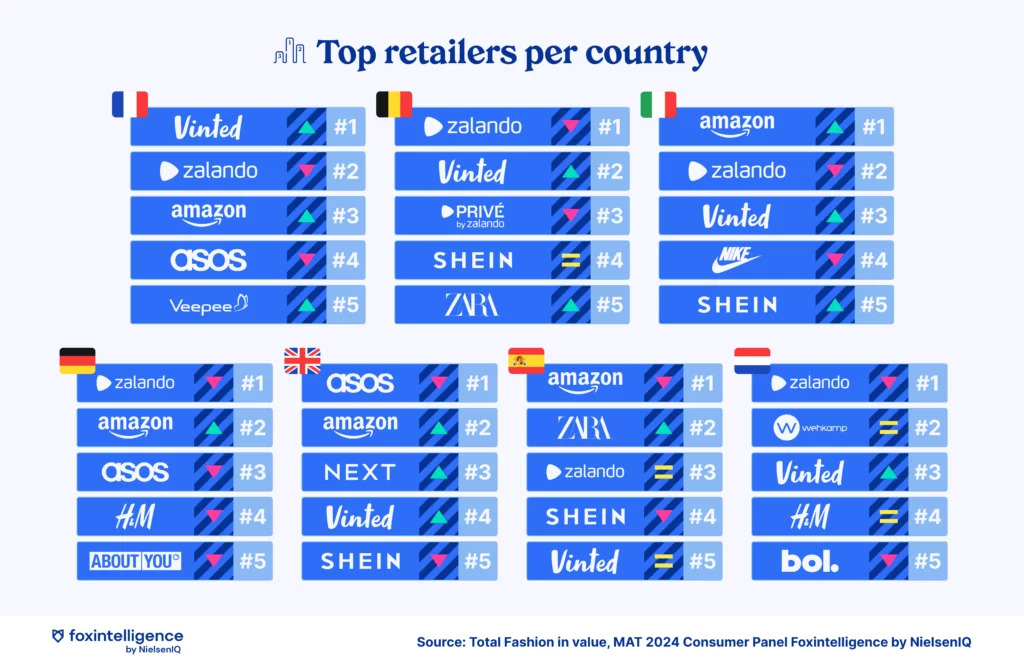

Vinted is firmly positioning itself as one of the leading fashion players in Europe with a steady climb in the rankings of the most influential brands. In every European country, Vinted is gaining market share, illustrating its growing dominance in the online fashion sector.

In France, where the second-hand market is the most mature, Vinted has reached the top of the rankings, becoming the number one online brand. Its popularity is such that it even surpasses traditional fashion giants. In the vast majority of European countries, Vinted is ahead of renowned players like Zara and H&M.

This ranking demonstrates Vinted’s increasing strength in the European fashion market, its ability to meet the changing needs of consumers, and its role as a go-to destination for those seeking quality clothing and accessories at affordable prices.

Vinted: A Transgenerational Platform

The success of Vinted transcends generational barriers, attracting a diverse and wide-ranging audience. Contrary to the common belief that Gen Z would dominate the use of Vinted, no single generation significantly outpaces the others. Vinted’s popularity is truly universal.

In Spain, Vinted’s penetration rate is 7% for Gen Z and 5% for Generations Y, X, and B. In France, where the gap is most pronounced, Gen Z leads with a 17% penetration rate, followed closely by Generations Y and X with 16%, and finally, Generation B with 10%.

These figures show that consumers of all ages are adopting second-hand shopping, demonstrating Vinted’s ability to meet the varied needs of its users. This inclusivity is a major asset for the platform, allowing it to reach a broad spectrum of consumers.

Vinted is not only challenging traditional fashion players; it is redefining consumption norms, engaging users of all generations, and consolidating its position as the leader in the second-hand market in Europe.

Key Insights

- France stands out as the most mature market, with the share of the second-hand market reaching 17.8% in 2023, up from 11.3% in 2019.

- Consumers are adopting a mixed purchase model, combining new and second-hand clothing.

- In most European countries, Vinted is ahead of renowned players like Zara and H&M.

Find More Market Studies: