Key Beverage Alcohol Trends for 2025

In 2024, Beverage Alcohol struggled to achieve value and volume sales growth, but the industry is set to navigate a dynamic year in 2025, with shifting consumer preferences and macroeconomic factors redefining the market landscape. From the rise of health-conscious and sustainability-driven choices to the growing influence of younger generations like Gen Z (of legal drinking age), the industry faces both opportunities and challenges. By understanding the key trends shaping the Beverage Alcohol space in 2025, industry players can position themselves to meet evolving consumer demands and drive sustainable growth.

With that in mind, here are 5 key trends to keep an eye on in 2025:

1. Consumer Recruitment

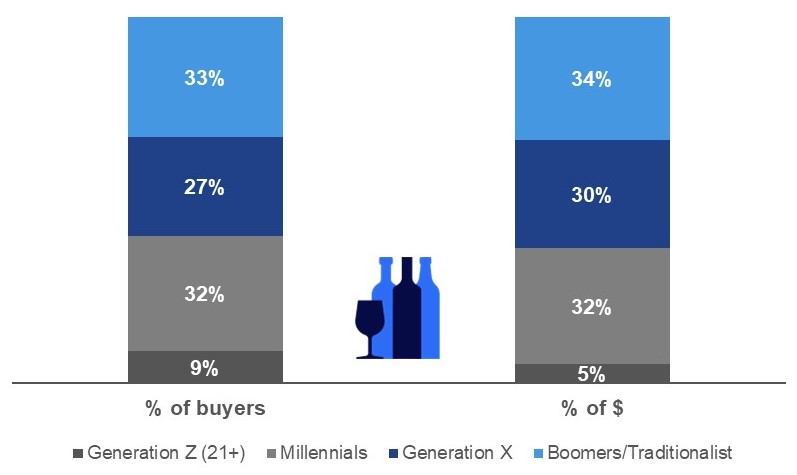

Understanding generational preferences is crucial for success in recruiting new consumers. In particular, this means understanding the role generation plays in Beverage Alcohol sales. Each age group brings distinct expectations and behaviors to the market, shaping trends and opportunities for brands. Gen Z (21+), which now comprises 9% of Beverage Alcohol buying households, for instance, values authenticity, sustainability, and experiences over material goods, making them more likely to gravitate toward purpose-driven brands and innovative, eco-friendly packaging. Their preference for low-ABV or non-alcoholic options further underscores their interest in wellness and mindful consumption.

Millennials (32% of buyering households), on the other hand, remain a powerful force in the premiumization trend. They prioritize quality and are willing to spend more on craft beverages, organic wines, and artisanal spirits. Meanwhile, Gen X and Baby Boomers, while traditionally more loyal to legacy brands, are increasingly open to exploring new categories, such as Ready-to-Drink cocktails or niche spirits like Mezcal and Japanese Whisky. Beverage Alcohol brands that segment their strategies to meet the unique preferences of these generational groups—whether through targeted marketing, tailored flavor profiles, or sustainability commitments—can maximize their appeal and relevance in 2025.

2. Health & Wellness Evolution

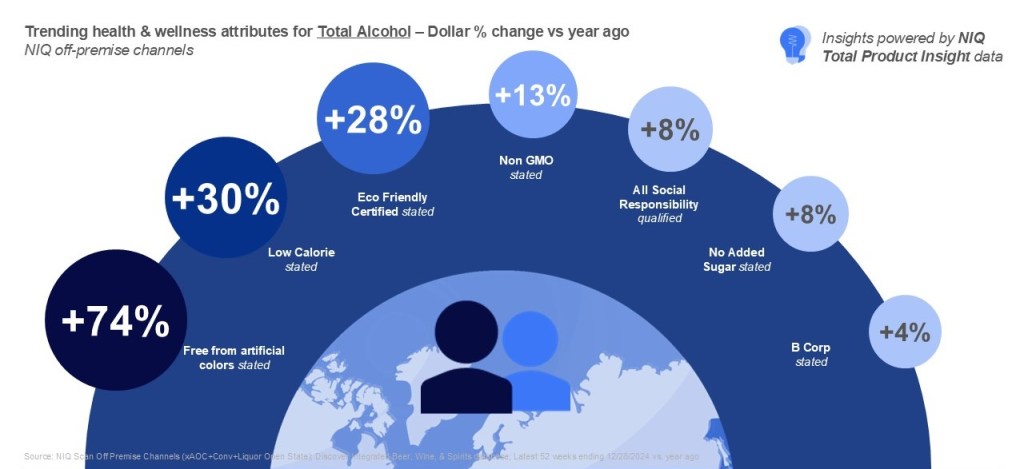

In 2025, the health and wellness movement will continue to redefine the Beverage Alcohol landscape as consumers prioritize healthier lifestyles and mindful consumption. This shift is evident in the growing demand for low- and no-alcohol beverages, which offer the social experience of traditional drinks without compromising health goals. Beverages leveraging “better for you” product attributes are also seeing strong growth. For example, products that stated they were “free from artificial colors” saw +74% growth in dollar sales over last year, and those labeled as “Eco Friendly Certified” were up +28%. Beverage Alcohol brands offering Non Alcohol products are uniquely positioned to benefit from this shift for occasions where someone may have opted to not drink for health and wellness purposes.

Functional beverages are also gaining traction, blending wellness benefits with indulgence. Products infused with adaptogens, vitamins, and botanicals are reshaping how consumers think about Beverage Alcohol. For instance, beverages that support relaxation, gut health, or energy are becoming staples in the wellness-focused Beverage Alcohol consumer repertoire. Traditional Beverage brands that embrace transparency and innovation in labeling—emphasizing clean ingredients, calorie content, and added health benefits—are well-positioned to resonate with this growing consumer segment.

3. Flavor Expansion or Flavor Fatigue

Flavor innovation remains a critical growth driver for the BevAl market, particularly in the Ready to Drink (RTD) segment. With strong growth between 4% and 5% YoY for the past 4 years, RTD now makes up 12% share of Total Alcohol dollar sales. Convenience, versatility, and innovation are driving factors behind this trend, as consumers increasingly gravitate toward pre-mixed beverages that offer high-quality taste without the need for preparation. RTDs appeal to a wide range of demographics, from Millennials and Gen Z (21+) seeking portable options for social gatherings to time-strapped professionals looking for quick indulgence. The category’s flexibility has allowed it to expand into diverse flavor profiles and alcohol bases, including spirits, wine, and malt beverages, providing options that cater to evolving palates and lifestyles.

Innovation within the RTD category is also pushing boundaries with seasonal and limited-edition releases that create excitement and urgency among consumers. NIQ data shows that 50% of innovation dollars in the category are spent in RTD. Additionally, premiumization is making its mark, as brands elevate RTDs with craft-inspired recipes and high-quality ingredients. As consumers continue to seek both convenience and unique drinking experiences, RTDs are positioned to grow even further, offering beverage alcohol brands a lucrative avenue for expansion and differentiation in a competitive market.

4. Economic Headwinds

Significant price increases for beer, combined with consumers’ sensitivity to price changes, have contributed to volume pressures across all alcohol segments in 2024. Economic pressures will remain a significant challenge for the Beverage Alcohol industry in 2025. The overall cost of living continues to rise, up +2.7%, prompting shifts in how they allocate their budgets. Still, in the Beverage Alcohol category, premiumization is thriving, especially among Super Premium+ Spirits, Super Premium Beer and Imports, and wines priced around $20.

At the same time, premiumization trends persist among higher-income consumers, highlighting the importance of catering to diverse needs. For Beverage Alcohol brands, this means striking a balance between value-oriented offerings and premium products. Strategic pricing, effective promotions, and clear communication of a product’s value proposition are essential for retaining customer loyalty in a competitive landscape. Brands that can address these dual demands—providing affordable options while emphasizing quality and innovation—will be better equipped to navigate economic headwinds and sustain growth in a challenging market.

5. Digital Engagement & the Influence of AI

Digital engagement is revolutionizing the Beverage industry, reshaping how consumers discover, interact with, and purchase their favorite brands. Social media platforms like Instagram, TikTok, and Pinterest are leading this transformation, serving as hubs for inspiration, education, and commerce.

Artificial intelligence (AI) is further enhancing digital engagement by enabling brands to deliver tailored experiences and predictive insights. AI-powered tools can analyze consumer preferences, recommend products, and optimize marketing strategies in real-time, helping brands stay ahead of rapidly shifting trends. Additionally, AI algorithms can identify emerging flavor preferences and buying behaviors, guiding product innovation and inventory planning. By integrating AI into their digital strategies, Beverage brands can not only meet but exceed consumer expectations, creating more meaningful and efficient engagement across the omnichannel landscape.

Opportunities for Growth

The Beverage Alcohol industry is poised for significant opportunities in 2025, driven by changing consumer preferences, technological advancements, and emerging market segments. One of the most promising areas lies in innovation within the wellness and moderation space. With more consumers prioritizing their health, non-alcoholic beverages, low-ABV options, and functional offerings like adaptogenic cocktails are gaining traction. Brands that invest in expanding their product lines to include these options can tap into a growing audience seeking balance between enjoyment and health-conscious choices. By leveraging these trends, companies can create products that resonate with evolving lifestyles while differentiating themselves in the market.

Embracing digital transformation is another critical avenue for growth. Strength in click and collect may be the key differentiator between strong growth and tepid sales. For brands that can harness the power of digital marketing and analytics, the opportunity to build personalized, long-lasting relationships with shoppers is immense, creating a foundation for sustained growth in the years to come.

Stay ahead of 2025

Beverage Alcohol Trends

Success in the space means monitoring On- and Off-premise outlets at a granular level and watching 2025 Beverage Alcohol trends as they evolve. Best-in-class data providers offer the markets, channels, states and category analysis you need to stay ahead of trends and act on them with precision.

Ready to learn more about the Beverage Alcohol market in 2025?