Trend 1: Shifting shopping behaviors

Shoppers are in a constant state of flux – a fluid economy, global instability, and product innovations are prompting consumers to rethink how they live and where they spend money.

Convenience

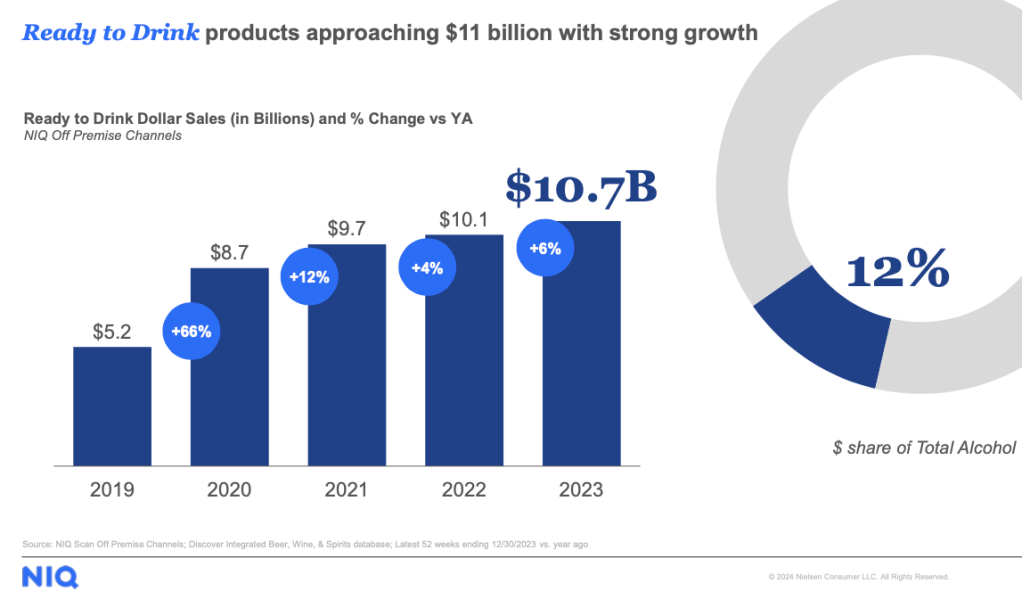

Consumers value time – and that shows. Ready to drink (RTD) products are climbing in popularity, with sales topping $10.7B in 2023.1 Since 2019, the volume of RTD sales has grown YoY. Pandemic-related momentum is resonating with consumers who see the value in grab-and-go beverages, which will likely continue in the year ahead.

But it’s not just convenient products. As beer and cider sales dropped across most channels in 2023, sales grew at convenience outlets by 3.1%.1 Similarly, wine sales were down overall by 1.4%1 – but convenience boosted the trend with sales up 9.6%1 vs. the year before. Consumers are valuing experiences more, and getting out of the house is putting convenience outlets front and center.

Health and Wellness

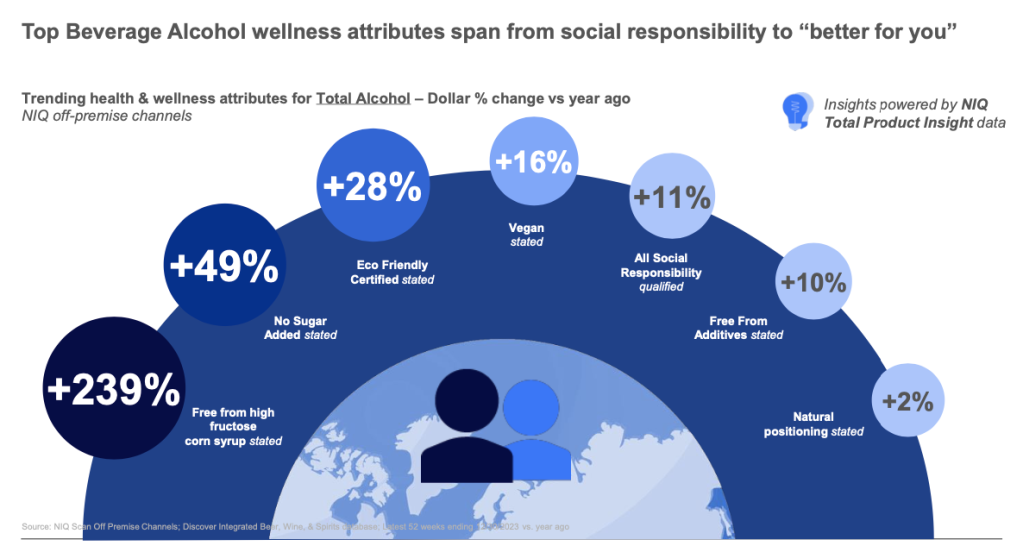

Today’s consumer is more in touch with the benefits of reduced alcohol consumption. In fact, the sale of non-alcoholic beer, wine, and spirits reached $565M in 20231 – up 35% from the year before. While this method of consumption gains momentum, wellness isn’t restricted to just alcohol-free – products with the following attributes saw a big jump in sales vs. previous years:

Trend 2: Dynamic demographics

As younger consumers reach the legal drinking age and demographics evolve, the product landscape evolves too. Gen Z consumers age 21-21+emerged in 2023 with progressive views that challenged what’s traditional – which will inevitably continue in the years to come:

Brands must think tactically as a large majority of Gen Z (21+) won’t enter the market traditionally, especially as this group leads the charge in the non-alcohol space

Consider

How can we reposition our brand to connect with today’s younger, more in-touch consumer?

Gen Z (21+) only make up for 6% of the market2, but this number will continue to climb in 2024 and beyond. Also, as older generations age and exit the market, dynamics will shift.

Consider

How do we evolve our marketing strategies to capture the attention of a diverse, progressive generation?

Trend 3: Psychology of premiumization

Moderated consumption in the beverage alcohol space meant consumers drank less in 2023 – but some spent more on the alcohol they did buy. Premiumization helps consumers create an experience, though other factors will continue to bring premium products to the spotlight in 2024:

Beer premiumization was driven by import brands, where sales were up 9.4%1 compared to the year before

Craft brands usually carry a premium price tag, and many consumers sought out these brands as a focus on local or specialty products rose

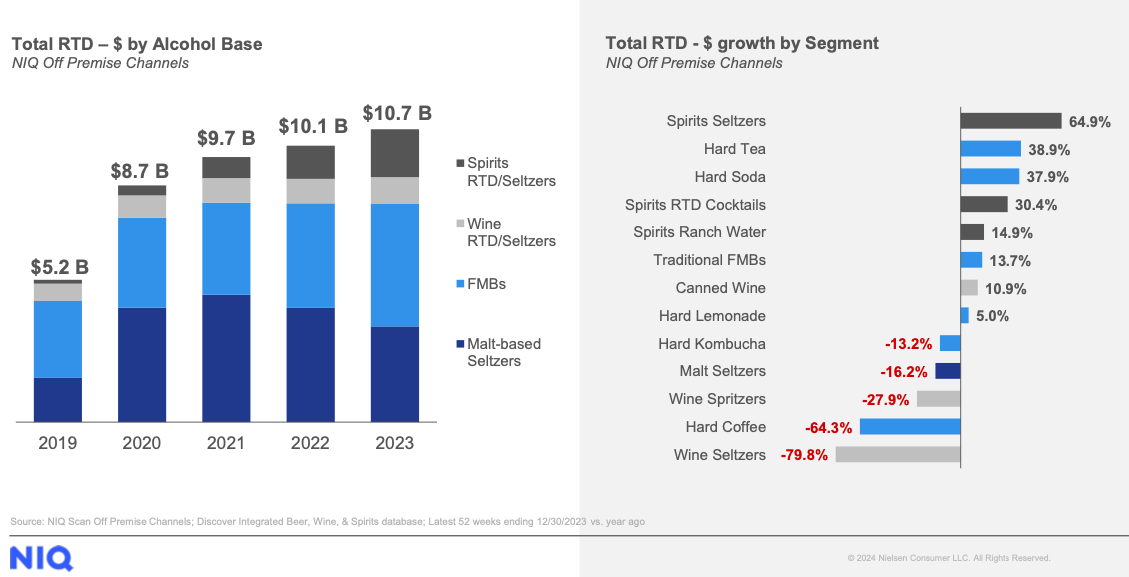

Premium spirits continue to capture consumer attention as sales remained consistent, yet spirit based RTDs drove this segment’s growth

Trend 4: Flavor forward

From RTDs to wine, flavor and variety were key players in driving consumer spending last year. The growing popularity of RTDs will primarily drive this trend in 2024 also, allowing consumers to experiment in trying new, bold flavors with minimal cost and effort:

- Diverse consumer backgrounds are opening the door to flavor-forward products, as emerging generations seek flavors that align with personal cultural backgrounds

- Hispanic influence will proliferate in 2024

- Health-conscious consumers who want to avoid sugar and additives will also drive this trend with cocktail-inspired RTDs and seltzer beverages that deliver flavor, but possess healthier product attributes

BevAl in 2024: Value and volume

With all this in mind, brands must consider a big challenge for 2024 that carries over from 2023: balancing value and volume. 2023 was defined by the value and volume disparity, where overall growth was a struggle to come by.

For example, the overall value ($) of the RTD segment (including seltzers, FMBs, spirit-based RTDs, and wine-based RTDs) grew by 5.9%1 – but volume (EQ) dropped by nearly 1%.1 Consumers might just be growing fatigued by a growing number of sub-segments and almost too much choice on store shelves.

Sources

- NIQ Scan Off Premise Channels; Discover Integrated Beer, Wine, & Spirits Database

- NIQ Omnishopper, US ALC – Integrated (21+ Only) Database