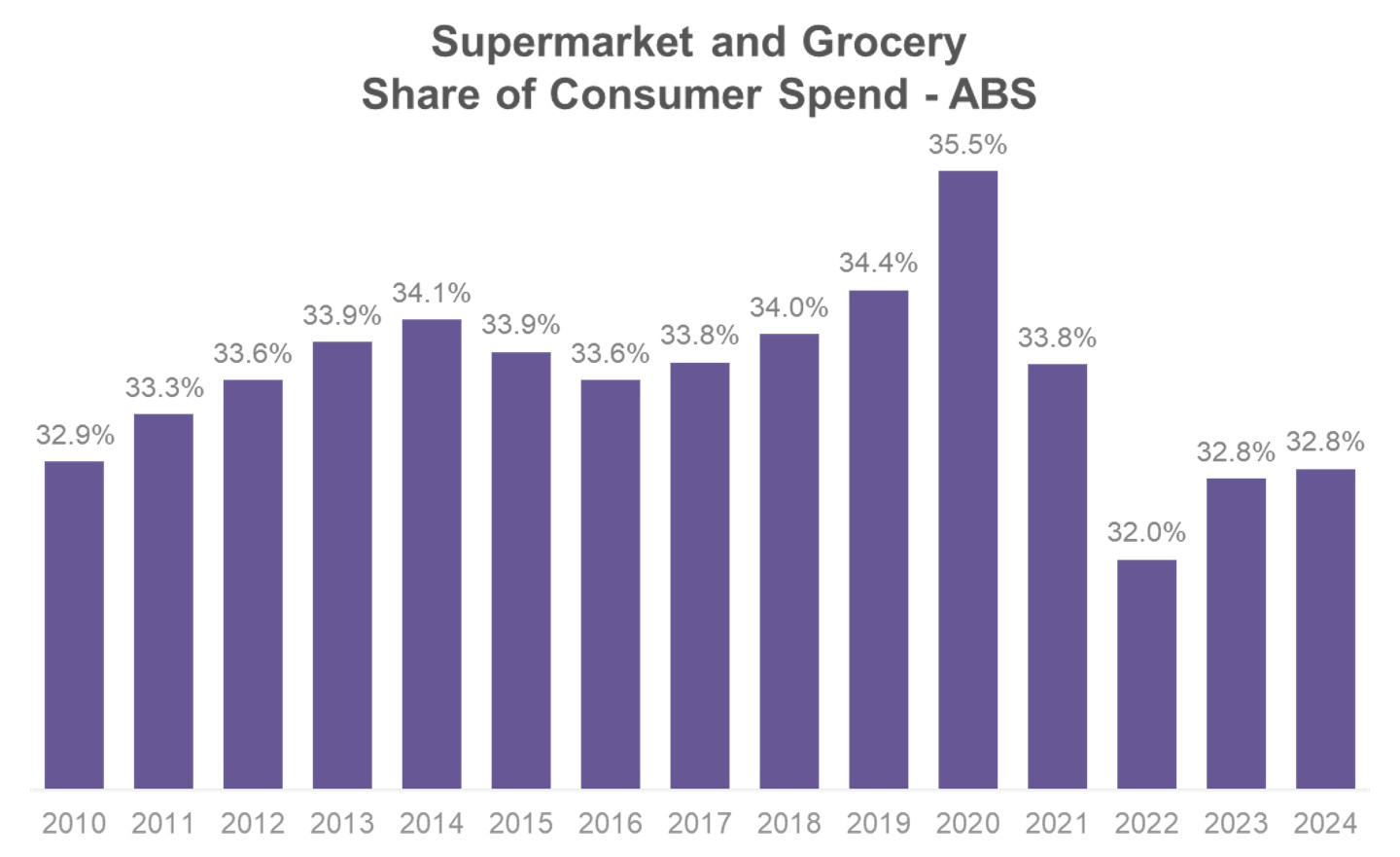

Unsurprisingly, according to ABS (Australian Bureau of Statistics), Supermarkets’ share of consumer spend is sitting at 32.8%, still has not recovered its pre-COVID (2019) levels of 34.4%. This gap means that there are approximately $2.2 billion annual sales that left supermarkets and went to other channels.

Beauty Retail in Transition: Traditional Channels Hold, But Digital Gains Ground

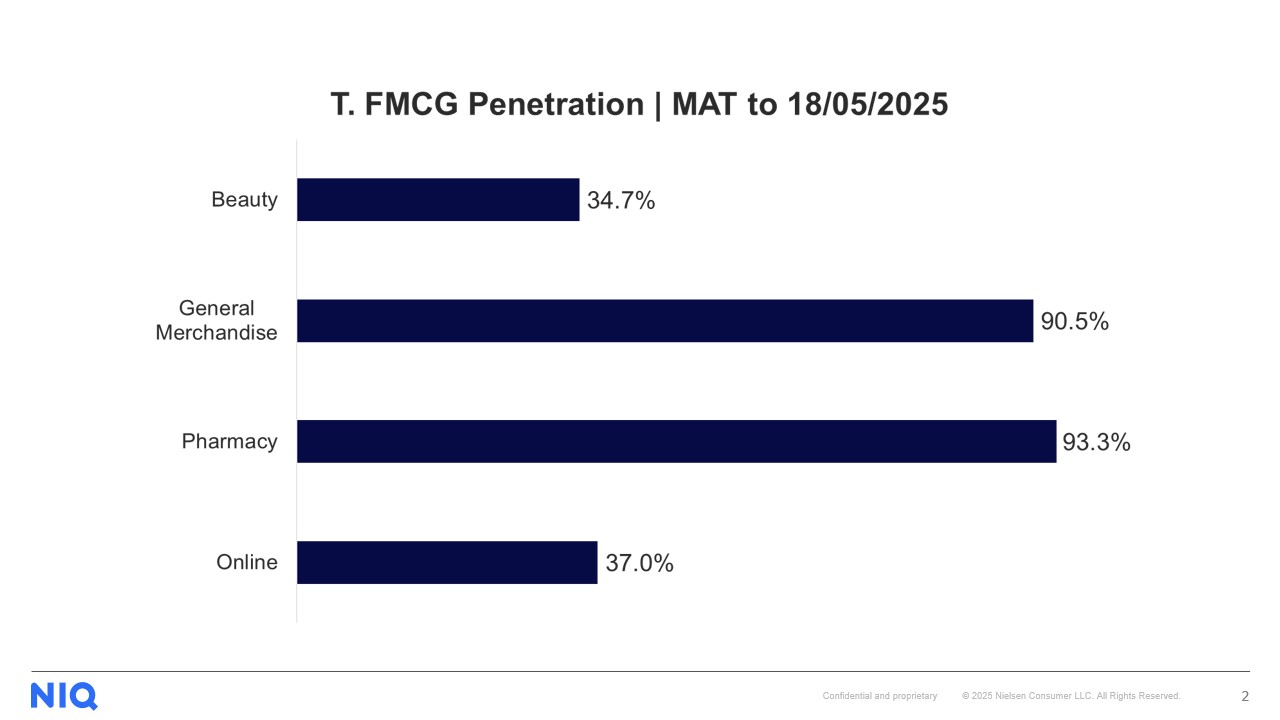

For beauty categories, although grocery and pharmacy are still the most dominant channels, 34% of consumers shopped at beauty specialty stores on an annual basis, highlighting the growing relevance of alternative retail channels for this industry. Moreover, the rise of digital and multi-channel shopping is reshaping the landscape, presenting an opportunity for brands to engage consumers beyond the traditional grocery and pharmacy channels, highlighting the importance for beauty manufacturers to adopt a holistic and broad view of the market. Brands must ensure their products are visible and accessible across key shopping destinations. At the same time, they need to stay alert to competitors who may be concentrating their efforts in specific retailers, potentially gaining an edge in those spaces.

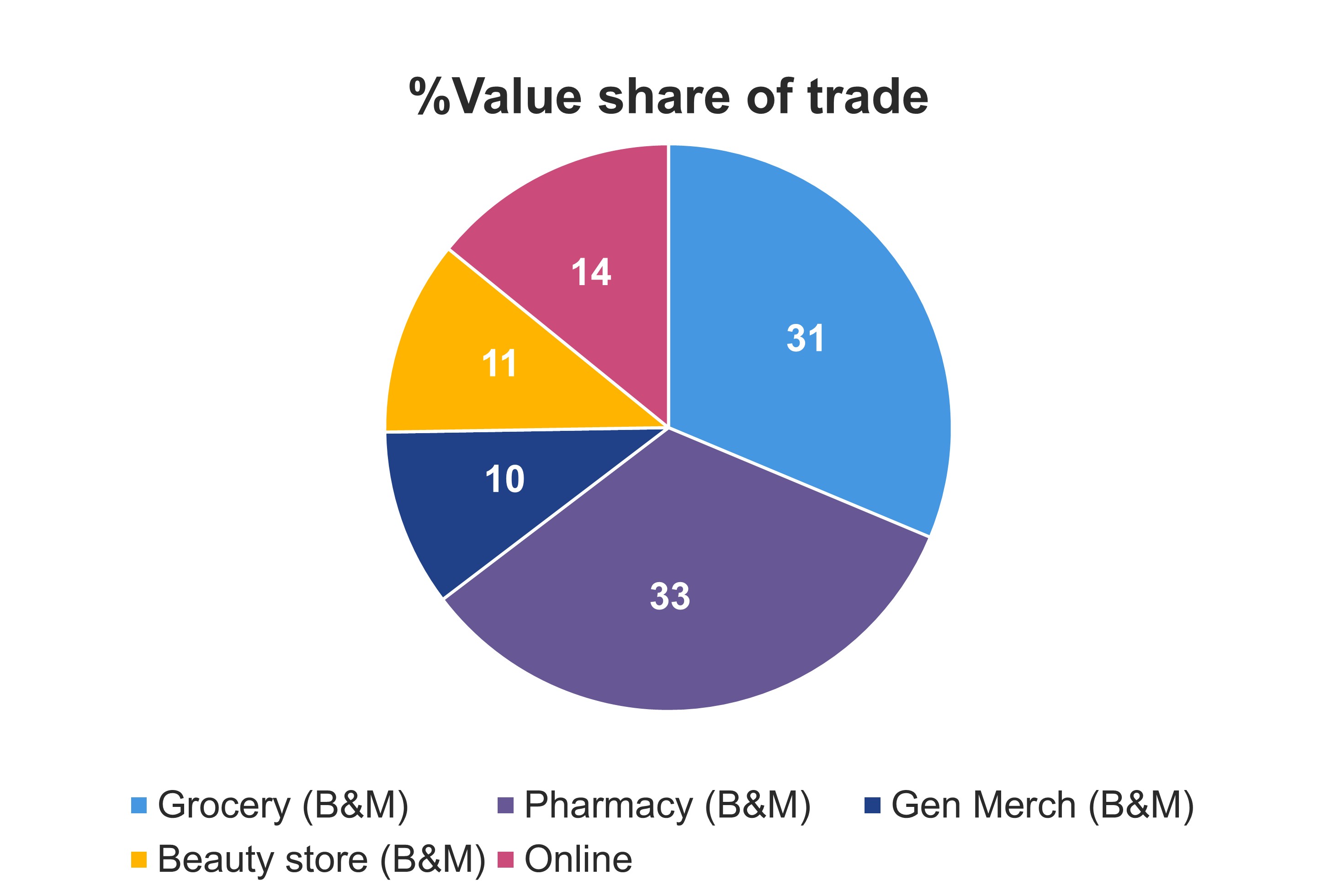

One third of Beauty sales happens outside of Grocery and Pharmacy B&M stores

Beauty sales can be split almost evenly into 3 channels: Grocery B&M, Pharmacy B&M and Alternative Channels. Although Pharmacies and Grocery stores continue to be the top destinations for beauty shoppers, concentrating two thirds of the sales, they are followed by emerging channels that offer different propositions of convenience, range and pricing, such as Online, Beauty and General Merchandisers.

With average transaction values of $32 at pharmacies and $12 at grocery stores, these channels remain trusted and convenient options for everyday beauty needs. Beyond the top two, General Merchandise stores show a strong 65% shopper penetration, while Beauty Specialty stores attract 34% of beauty consumers. These channels offer variety and targeted product selections, appealing to shoppers looking for more curated experiences.

Top Brands by Channel

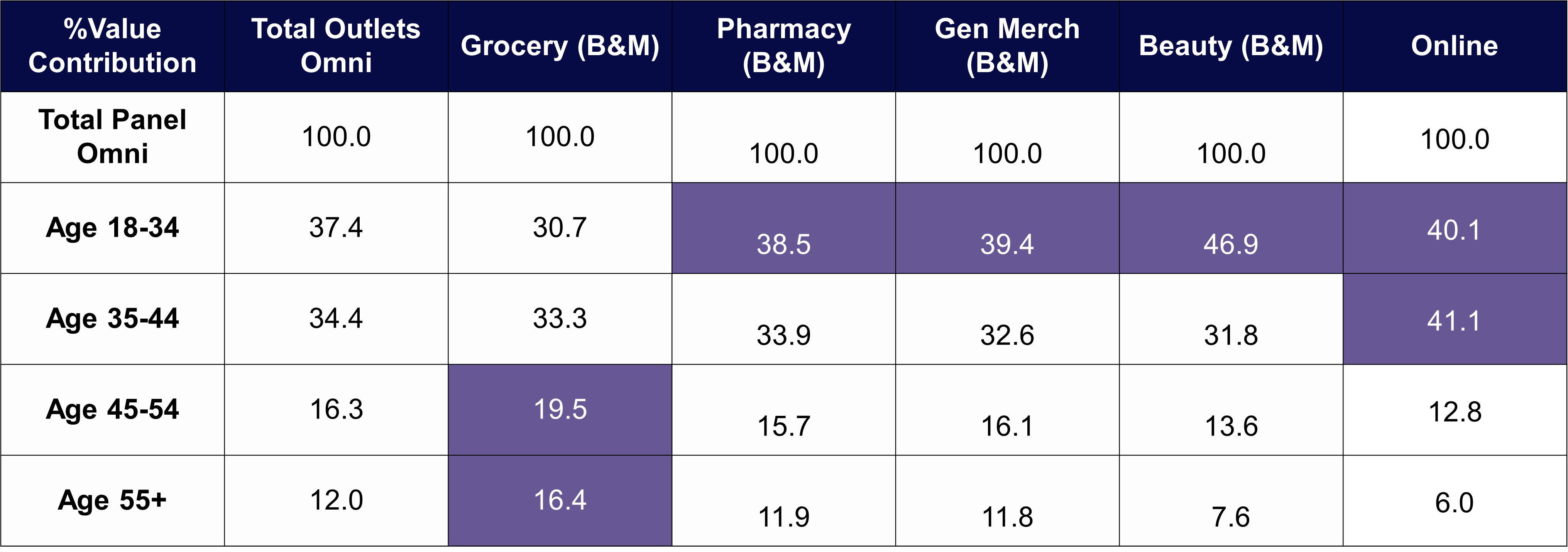

As expected, the tech savvy Millennials and Gen-Z find online appealing. They are the most experimental consumers, shopping beauty categories in multiple channels, such as Pharmacy and General Merchandising stores, which offer not just top brands but also dupe products.

Leading Categories Driving the Beauty Market

In today’s value-conscious environment, consumers are returning to the fundamentals of their beauty routines, focusing on essential, high-utility categories. Skincare and hair wash products continue to lead the market, with both achieving over 80% household penetration—highlighting their role as non-negotiables in daily self-care. The top five most important categories for shoppers are body washes, deodorants, and facial cleansing products, reflecting a broader shift toward practicality and maintenance, as consumers prioritize core hygiene.

Young Beauty Shoppers Splurge Less Often, But Spend More Per Trip

In today’s cost-of-living crisis, younger beauty shoppers are adjusting their habits—but not without a twist. Despite having less purchasing power, they’re making their beauty shopping trips count. Shoppers under 35 spend the most per visit for beauty categories, averaging $25, as they compensate for fewer store visits with higher basket sizes.

In contrast, older shoppers maintain more frequent shopping routines. Those aged 45–54 shop beauty categories an average of 34 times per year, followed by 55+ at 31 visits, and 35–44 at 28 visits. This suggests that while older consumers may spend less per trip, they remain highly engaged with in-store beauty shopping. This trend is seen when they purchase haircare and deodorants products.

These behaviours suggest a generational divide in shopping behaviour. Younger consumers are more selective and strategic, likely influenced by tighter budgets and a shift towards online and omnichannel shopping. However, when it feels like a treat, Gen Z doesn’t mind spending and visit store more for category such as cosmetics, skincare and sunscreen.

In the meantime, older shoppers continue to rely on regular in-store visits, maintaining traditional shopping patterns and concentrating their spend in more traditional channels such as Grocery and Pharmacy.

As beauty shoppers continue to diversify their paths to purchase—blending traditional, digital, and specialty channels—manufacturers must evolve their strategies to keep pace. The days of relying solely on Grocery and Pharmacy insights are behind us. To truly win in this dynamic market, brands need a panoramic view of where, how, and why consumers shop.

NIQ’s Omnishopper consumer panel offers unparalleled visibility into these behaviours, helping you uncover hidden opportunities, track competitive shifts, and make data-driven decisions with confidence. Subscribe today and stay one step ahead in the ever-evolving beauty landscape!

Authors

- Marco Silva – Customer Success Director, NIQ

- Safa Chowdhury – Customer Success Manager, NIQ

- Tia Daryatmo – Senior Customer Success Manager, NIQ

NIQ Omnishopper

NIQ Omnishopper consumer panel offers unparalleled visibility into these behaviors, helping you uncover hidden opportunities, track competitive shifts, and make data-driven decisions with confidence.

Get in touch with an NIQ expert today.