Food Dominates but Drinks Opportunities are Alive and Kicking

Food-led venues continue to lead the Dutch HoReCa market, with restaurants being the most visited channels for three quarter (75%) of consumers in a three-month period, followed by eat cafés for half (48%). This dominance reinforces the importance of food offerings for encouraging footfall.

But drink-led strategies remain highly viable, particularly in brown cafés and pubs, which have seen a +13pp increase in engagement among beer and spirits drinkers.

On the other hand, brands targeting Gen Z consumers should prioritise late night channels, with nightclubs and cocktail bars/late-night bars particularly seeing notable visitation increases. Their growing presence in these settings presents a compelling window of opportunity to engage this younger demographic.

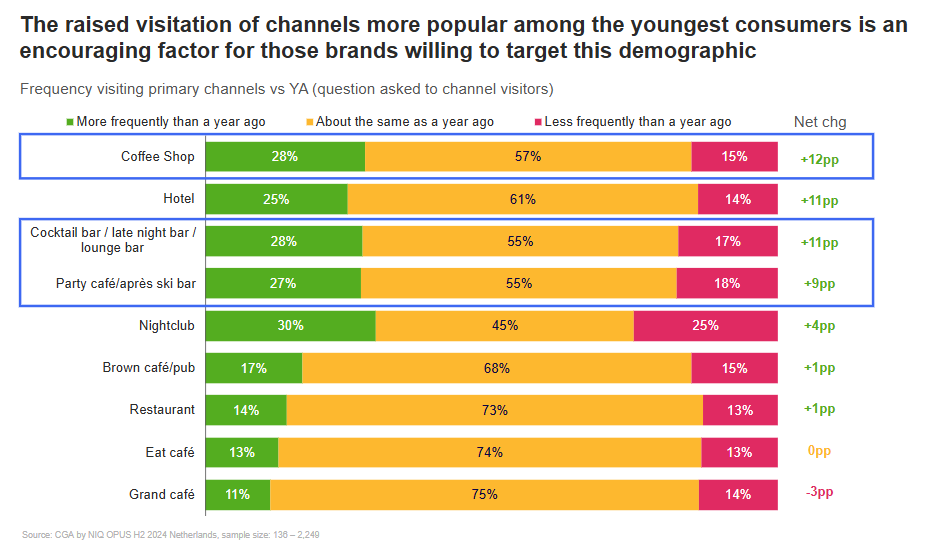

Frequency Trends Indicate Changing Preferences

Coffee shops (+12pp), cocktail bars/late-night bars (+11pp), and après-ski bars (+9pp) have all experienced notable increases in visitation compared to the previous year. Hotels also remain stable, with a quarter (25%) of visitors frequenting them more than a year ago, consolidating their continued relevance as HoReCa destination venues.

Balancing Generational Differences

It’s fundamental to understand consumer preferences across generations in order to identify exactly where the most promising opportunities lie for strategic brand and product positioning.

Take casual and relaxed drinks. 60% of all HoReCa visitors enjoy them. But two thirds of Gen X (64%) and Boomers (67%) over-index for these lower key outings.

In contrast, Gen Z (32%) and Millennials (26%) are over-indexing demographics for after work drinks. Similarly, Gen Z (24%) and Millennials (18%) over-index for high tempo drinking occasions.

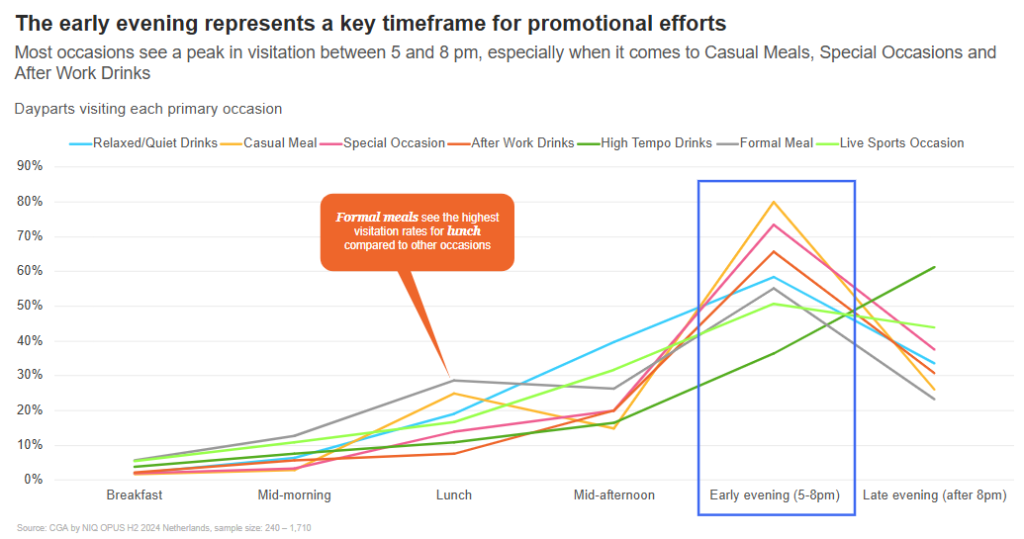

The Early Evening Advantage

Despite generational differences, peak visitation for most demographics and occasions happens between 17:00 – 20:00, particularly for casual meals, special celebrations, and after work drinks. Conversely, formal meals attract the highest engagement at lunchtime.

It’s another clear example of the need for tailored promotions based on both occasions and dayparts. Not forgetting the most popular products to suit each scenario.

Drinks Gaining and Losing Traction

Beer (43%) and wine (44%) remain the top sellers.

But spirits are now in close competition with no/low alcohol alternatives, signalling the importance of targeting Gen Z through cocktails and premium serve strategies to raise distribution.

There’s also an increasing buzz around alternative LAD categories, including cider (+24pp) and craft beer (+14pp), with local and Belgian brands gaining traction.

Soft and hot drinks also perform well with 45% engagement. Moreover, the growing market for no/low alcohol alternatives (19%) cannot be ignored.

Interestingly, 37% of Dutch consumers say they’re prioritising a healthier lifestyle. The decline in high-ABV and sugar-heavy categories like vodka and shooters, plus the upsurge of no/low beer (+20pp), suggest a shift toward more conscious drinking choices.

Carmela Asinas, CGA by NIQ Client solutions Manager EMEA said “The Dutch HoReCa is evolving, offering strategic opportunities for brands and operators willing to move beyond a one-size-fits-all approach. Success will come from recognising the shifting generational and occasion-led preferences – where, when, and how consumers engage with drinks – learning from these insights and creating experiences in alignment with evolving expectations.”

Explore NIQ’s HoReCa solutions

Click here to discover NIQ’s HoReCa consumer insights offering to support winning brand strategies and opportunities across The Netherlands.

For the latest HoReCa news and insights – sign up to The Measure, NIQ’s On Premise newsletter

Get our latest thought leadership, events information, and more delivered straight to your inbox