From stigma to status:

Private label is growing more than just sales

Private Label’s Steady Rise

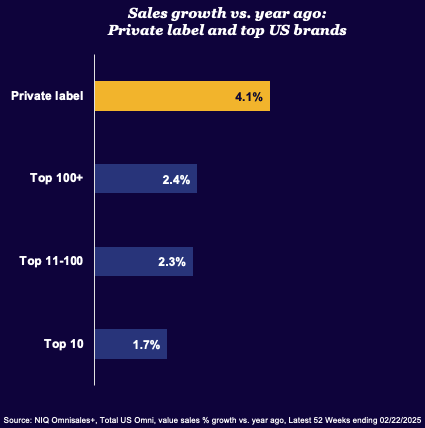

Private label is no longer the underdog—it’s a cornerstone of modern retail strategy. Sales of private label products in the U.S. grew 4.1% year over year, reflecting a powerful shift in consumer behavior.2 U.S. consumers continue to be “sold” on private label, in the same way they were a year ago. In an inflation-conscious landscape, value matters—but increasingly, shoppers are choosing private label not just because it’s cheaper but because it meets their evolving expectations for quality, innovation, and purpose.

Retailers are leaning into this momentum by building private label brands that rival—and often outperform—national brands. Whether it’s a growing selection of in-house beverages or an expansive store-brand expansion, private label is being positioned not just as a cheaper option but as a destination in its own right. The consumer response is clear: 75% say private label products offer good value, and 72% view them as strong alternatives to national brands.1 The message? Private label isn’t a compromise—it’s a choice.

Short on time?

Get the U.S. Executive Report

Why Brands Still Matter

Despite the continued rise of private label, national brands still hold a powerful place in the hearts—and carts—of U.S. consumers. In fact, 62% of shoppers say they still default to the branded products they know and trust.1 This emotional connection remains a defining advantage. Whether it’s nostalgia from a childhood favorite, trust built over decades, or the prestige associated with recognizable names, national brands continue to resonate in ways that go beyond function or price. In fact, consumers have a 2x emotional connection with brands over private label.1

This is especially true in categories where perceived efficacy and quality are paramount, such as health, beauty, and wellness. Consumers are more cautious and brand-loyal when it comes to what they put in or on their bodies, making these categories harder for private labels to penetrate. Brand attributes like trust, heritage, and aspirational appeal are more than twice as associated with national brands compared to private labels, giving them a meaningful edge where it counts. Still, sales growth is slowing compared to private label brands.

Three Ways Private Label and Branded Products Coexist

The competition between private label and branded products isn’t a zero-sum game—it’s an evolving balance that’s reshaping shelf strategy. While private label continues to deliver growth and value, national brands bring emotional resonance, trust, and innovation that many consumers still seek. The smartest retailers aren’t choosing sides—they’re creating ecosystems where both can thrive.

With that in mind, here are three ways private label and branded products are successfully coexisting on the U.S. shelf:

1. Tiered Assortment Strategy

Retailers are no longer treating private label as a single-tier offering. Instead, many are adopting a tiered assortment strategy—featuring value, mid-tier, and premium private label lines alongside national brands. This approach ensures that shoppers can find products that meet their needs across a variety of price points and occasions, whether they’re looking for everyday essentials or specialty indulgences. And with 60% of U.S. consumers say they’re buying more brands, across more categories than ever before, there’s ample opportunity.1

This model not only prevents private label from cannibalizing national brand sales but also expands the category by attracting different shopper segments. By thoughtfully curating the mix, retailers can drive total category growth while offering more choice and reinforcing their own-brand credibility. It’s a win-win—retailers grow margins, and consumers feel they don’t have to compromise on quality or price.

2. Trust and Halo Effects

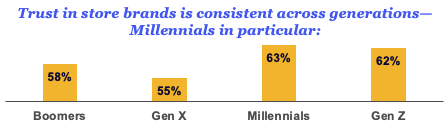

While private label continues to gain ground, national brands still hold a powerful position in the hearts and habits of consumers—especially in categories where trust, efficacy, and emotional connection drive purchase decisions. Brands in the health, beauty, and wellness space, for example, not only attract loyal shoppers but also create a halo effect that can lend credibility to adjacent private label offerings on the shelf. 59% of U.S. consumers say they trust store brands, as they are endorsed by the retailer.1

Branded products also maintain stronger omnichannel engagement, performing especially well online, where consumers are more likely to seek out trusted names. Retailers can harness this behavior by using brand recognition to guide product discovery through thoughtful product placement, bundled promotions, or personalized recommendations across digital and in-store touchpoints. Done right, branded products become both a conversion driver and a credibility boost for private label peers in the same basket.

3. Private Label as Traffic Driver

Private label has evolved from a value alternative to a destination driver. Today’s most innovative store brands—whether launching trend-forward flavors, sustainability claims, or elevated packaging—aren’t just competing with national brands; they’re actively pulling shoppers into stores and digital platforms. This dynamic benefits both private label and branded products. Shoppers may be initially drawn by a private label offer but end up adding branded items to their basket.

And with 54% of U.S. consumers saying the brand doesn’t matter if the product fits their needs, the opportunity lies in visibility and relevance.1 Retailers should continue investing in private label innovation while also giving branded items space to shine—through strong in-store storytelling, end-cap displays, and digital content that highlights performance, heritage, or unique value propositions.

Implications for Retailers and Brands

As private label gains ground, retailers must strike a careful balance. While store brands offer higher margins and shopper loyalty, an overreliance on them can erode the strength of national brands that still carry significant consumer trust and emotional pull. The goal is a curated assortment strategy that delivers value, variety, and innovation without crowding out the brand equity shoppers still seek. Retailers that maintain a thoughtful mix of private label and branded products can drive total category growth while meeting diverse consumer needs.

For brands, the stakes are equally high. To remain essential in an era of private label expansion, national brands must double down on their key strengths: storytelling, emotional connection, and innovation. Shoppers gravitate toward brands that speak to their values, whether that’s through heritage, sustainability, or wellness positioning. Opportunities for collaboration also remain underleveraged. Co-branded product launches, limited-time exclusives, and joint promotions can deliver fresh excitement, helping both sides win with shoppers and drive category engagement. Above all else, retail media investments will be key going forward, with +$1.3T of enterprise value from retail media in the U.S. by 2026.3

From Competition to Collaboration

The evolving retail landscape isn’t about private label versus national brands—it’s about how both can thrive together. As consumers continue to prioritize value, trust, and innovation, the most successful retailers and brands will be those that meet shoppers where they are with smart assortments, emotionally resonant products, and seamless omnichannel experiences. By embracing collaboration and leaning into their respective strengths, private label and branded products can coexist in ways that enhance shopper satisfaction and unlock sustainable growth for the long term.

Ready to learn more about how private label and branded products are creating a new retail landscape?

Sources:

1 NIQ 2025 Private Label & Branded Products report global survey with regional data references

2 NIQ Omnisales+, Total private label sales, Growth calculated vs. year ago, Annual period ended 2/22/25, Value % growth