The Journey: Liquor consumption trends over four years

2020-2022: The rise of at-home consumption: Lockdowns redefined liquor consumption, with sales flowing toward at-home channels. This trend persisted into early 2022, as consumers adjusted to new habits shaped by the pandemic.

2022-2023: Revenge spending takes over: In 2022, consumers began to make up for lost time, fueling a revival of On-Premise consumption. Venues witnessed a surge in demand as people sought social connections and experiential outings.

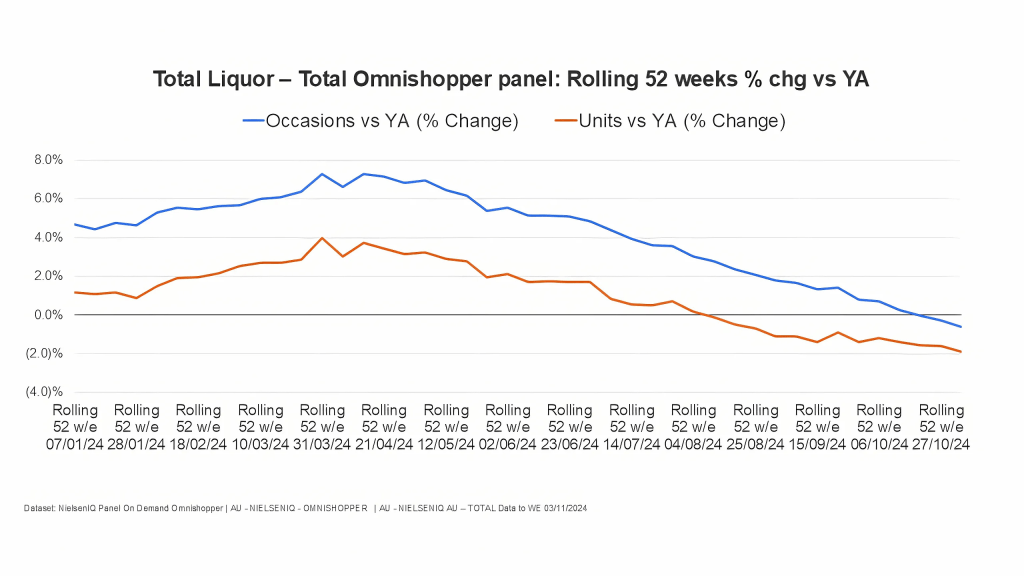

2024: A calculated approach amid financial pressures: Financial constraints in 2024 prompted a more reserved On-Premise attitude. Consumers became strategic about when and where to spend, resulting in a mid-year flow back to at-home consumption. NIQ data captured a peak in Off-Premise purchasing occasions and unit growth during mid-2024, followed by a decline later in the year.

The grand return of the On-Premise for 2025?

Recent NIQ data reveals signs of resurgence in On-Premise consumption. Our Spring 2024 OPUS data shows a significant increase in monthly On-Premise occasions, with consumers visiting venues twice as often compared to the same time last year.

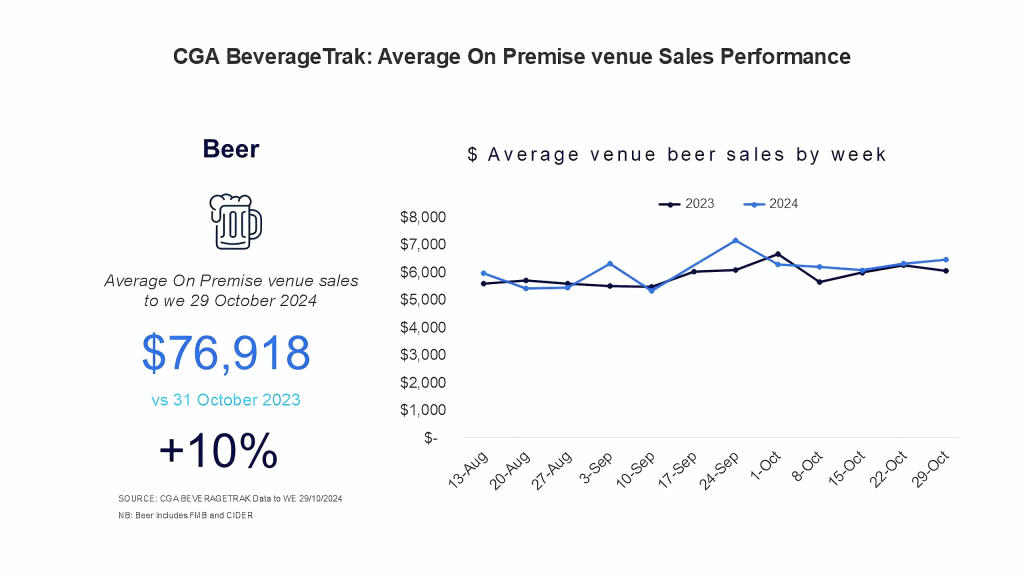

Sales performance of liquor in On-Premise venues also indicate recovery. The beer category has been a standout performer, with our Pulse+ sales report showing a +10% increase in beer dollar sales for the average venue during the last quarter, surpassing 2023 comparisons.

However, not all categories are thriving equally. Spirits sales remain flat, and wine continues to underperform year-over-year, reflecting shifting consumer preferences and behaviors.

Positioning for success: 2025 On-Premise strategies

If the On-Premise is primed to benefit from a renewed appetite for consumption, what will success look like? NIQ anticipates several critical battlegrounds for suppliers and operators to navigate:

- Elevating experiences and social currency: Experience-led occasions now dominate On-Premise consumption, accounting for 39% of all occasions. Australian consumers are increasingly seeking venues that deliver unique, memorable experiences they can share on social media.

Action point : Operators should prioritize experiential offerings and communicate these effectively to target audiences. Drink suppliers can collaborate with venues to elevate in-venue experiences, ensuring their brands play a pivotal role. - Adapting to shifting dayparts: Post-pandemic, consumers are venturing out earlier in the day, leaving before traditional late-night hours. This trend disproportionately impacts spirits brands, which are traditionally associated with late night consumption.

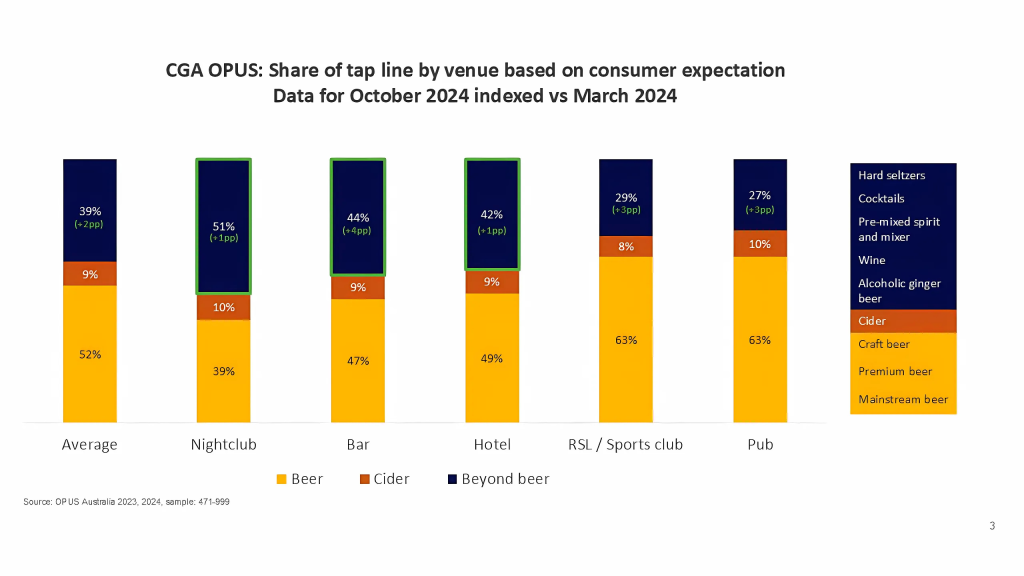

Action point: Spirits brands should rethink their On-Premise strategies, aligning with earlier dayparts by introducing lighter serves or innovative cocktail options. - Rethink tap-line strategy: Ready-to-drink (RTD) beverages are gaining traction, with operators increasingly allocating taps to non-beer products. This shift presents both challenges and opportunities for drink brands to rethink their approach to tap-line allocation.

Action point: Collaborate with operators to identify the optimal balance of tap-line categories, ensuring alignment with evolving consumer preferences.

2025: A pivotal year for On-Premise Liquor Success

The Australian liquor industry is poised for transformation in 2025. From the resurgence of On-Premise consumption to shifting dayparts and the rise of RTDs, the landscape is dynamic and filled with opportunities.

Are you ready to navigate these shifts and capitalize on emerging trends? Let NIQ’s data and insights guide your journey toward success in this evolving market.