Financial pressures and uncertainty are changing buying decisions

The global economic uncertainty, political tensions, and the lingering impact of COVID-19 have made the current conditions tough for everyone. Despite the inflationary pressures, FMCG manufacturers can draw some relief from the fact that groceries are quite resilient and remain a top priority for Australians. However, Australians have become more cautious in some aspects and have made a number of changes to their buying decisions in order to adapt.

- Shopping around: Consumers are going the extra mile to find the best bargains. They are shopping more often, yet with a relatively small basket size per trip. Our NIQ Homescan states that 75% of Australian consumers shop at 3+ different retailers each quarter.

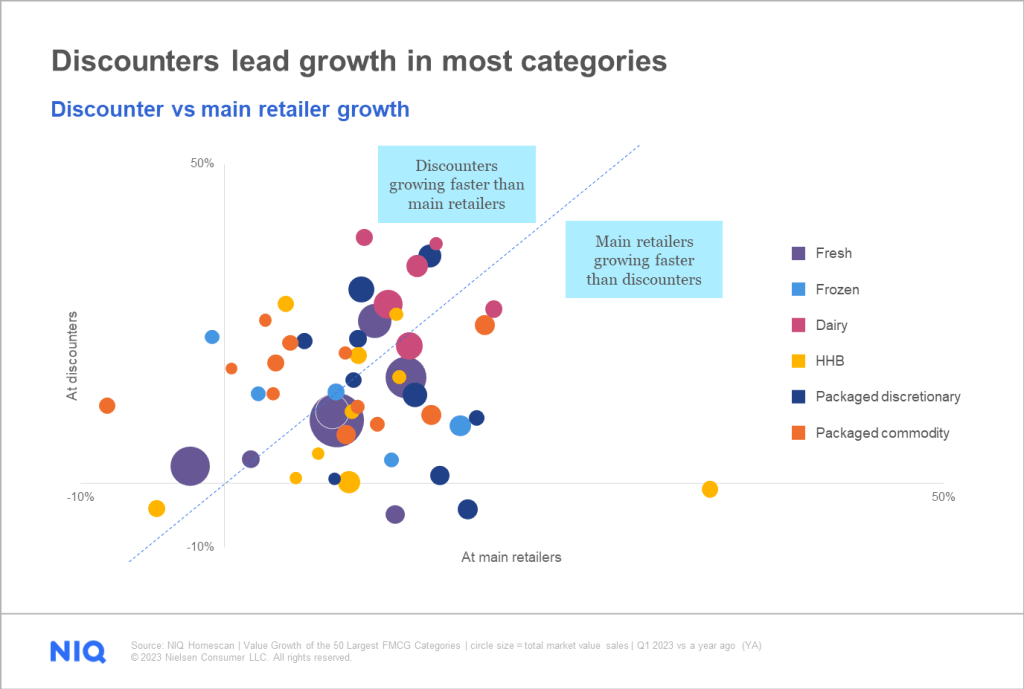

- Trying out discounters: 44% of discounters volume growth is coming from competitor switching as more and more Australians are giving discounters a try. As a result, discounters have led the growth in most categories over main retailers.

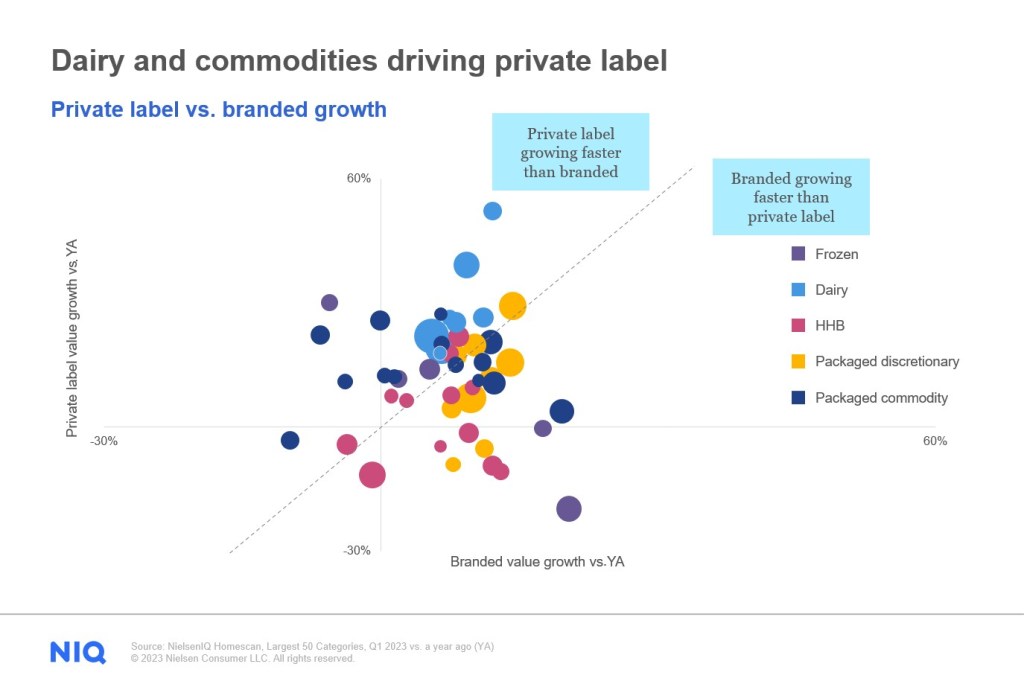

- Buying private labels: 99% of Australian households continue to buy private labels, and while quality has been a concern in the past, 50% of Australians now think the quality of private label brands is comparable to most other brands. The private label share in Australia is growing faster than branded goods and is being driven primarily by dairy and commodities. At 23%, the private label share in Australia is currently 3% above the global share average (20%), which is more than the U.S. but still less than that of Europe.

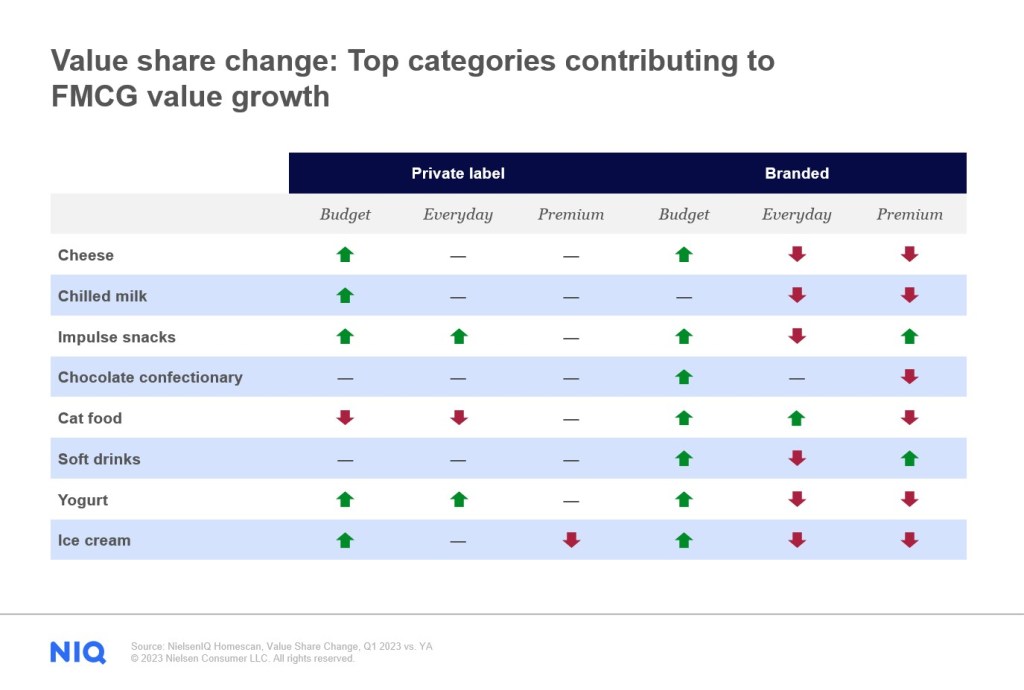

It is also interesting to note that when the market faced headwinds in the past, premium FMCG brands tended to perform better as consumers wanted to reward themselves with something premium yet still cheaper than what they would have spent out of the supermarket. This effect has been known as the “lipstick effect.” However, the current conditions are not looking to bring back this effect. Among the top growing categories, both premium branded and premium private label products are, on the whole, not gaining shares. Instead, share is being acquired by budget private labels and budget brands.

Australians still dining out despite the tough times

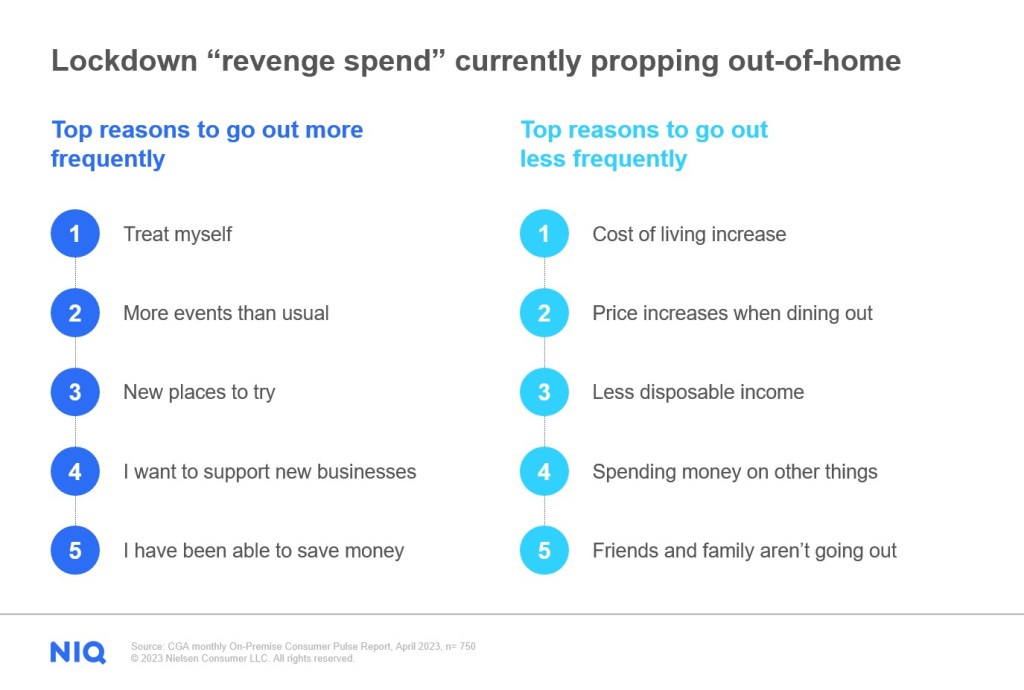

One likely reason for the “lipstick effect” not happening as expected is that most Australians have decided to use the remaining amount of money they have to go out, known as lockdown “revenge spend,” which is currently propping up for out-of-home (OOH) spending. However, a news article from The Guardian stated that Australian fine dining cancellations are up 88% from last year as customers turn to pubs. Therefore, while Australians have good reasons to go out more frequently, some reasons hold them back.

Positioning your brand for growth

The current environment is undoubtedly tricky for everyone, so what can brands do to position themselves for growth? First, brands must identify what drives volume in order to drive value. For example, our analysis of the Asia-Pacific (APAC) region has shown that out of the 277,912 brands evaluated, 39% declined in value, and only 34% managed to grow. However, to see the real success stories, we can’t just look at brands that grew by price increases. When looking at commonalities between growing brands, we found that 84% of the brands that grew in value also managed to grow in volume at a faster rate than their price growth. So what can brands do to achieve this if volume is key?

We found a common thread across all the top-performing brands, and that is innovation. While some manufacturers have scaled back on their innovation agenda due to the persisting inflationary pressures, brands can actually position themselves for growth through investment in product innovation.

3 broad shifts to anticipate by 2030

Looking ahead, here are several anticipated shifts that we expect to drive change in the FMCG space:

- Expanding wellness: The health and wellness industry will continue to expand and create more opportunities for retailers and manufacturers due to a number of factors, such as the high costs of healthcare, the prevalence of modern-day health challenges, and increased education and aspiration that has made health and wellness an asset or currency. As a result, retailers and manufacturers can seize opportunities in preventative and lifestyle wellness areas while some markets are approaching increased aged healthcare demand.

- Mandated sustainability: The impact of climate change has heightened consumer awareness of the need for urgent action when it comes to climate change. There are also signs that the current Government is more committed to taking action and enforcing new policies and requirements that organizations will have to adhere to in the future. Companies need to be more sustainable in their approach to conducting their business.

- Rethinking aging: Despite having purchasing power, the older generations have been overlooked for decades. It’s time for companies to finally start addressing the needs of this forgotten group, or else they will find their “silver” dollar will be lost to competitors who meet the needs of the aging population. The percentage of Australians over 60 years old is estimated to change from 17% in 2000 to 27% in 2040.

Get the Full View™ of Australia’s FMCG industry

To navigate the shifts in the industry, you need the most accurate and trusted data. Book a meeting with us to see how we can help you make data-backed decisions for your business.