As financial institutions continue to struggle to attract younger customers and companies compete to capture a share of the ever elusive millennial wallet, we may want to step back and take a closer look at the way their grandparents use their phones and shop online. Like a genetic trait that skips a generation, there is evidence that indicates that the Millennials are much more like their grandparents than we could have ever imagined, especially when it comes to online and mobile shopping.

To better understand how Millennials, those aged 25-34, are shopping online, why they are shopping online, and what they are buying – GfK conducted a proprietary survey of shopper attitudes and behaviors across generational groups called FutureBuy.

FutureBuy is fielded annually since 2006. The 2014 survey was twenty minutes long and covered seventeen countries and included 1000 consumers that were 18 and older. The survey covered topics such as; Omni-channel shopping, shopping touch points, mobile payments, and other special topics like showrooming, privacy, and security.

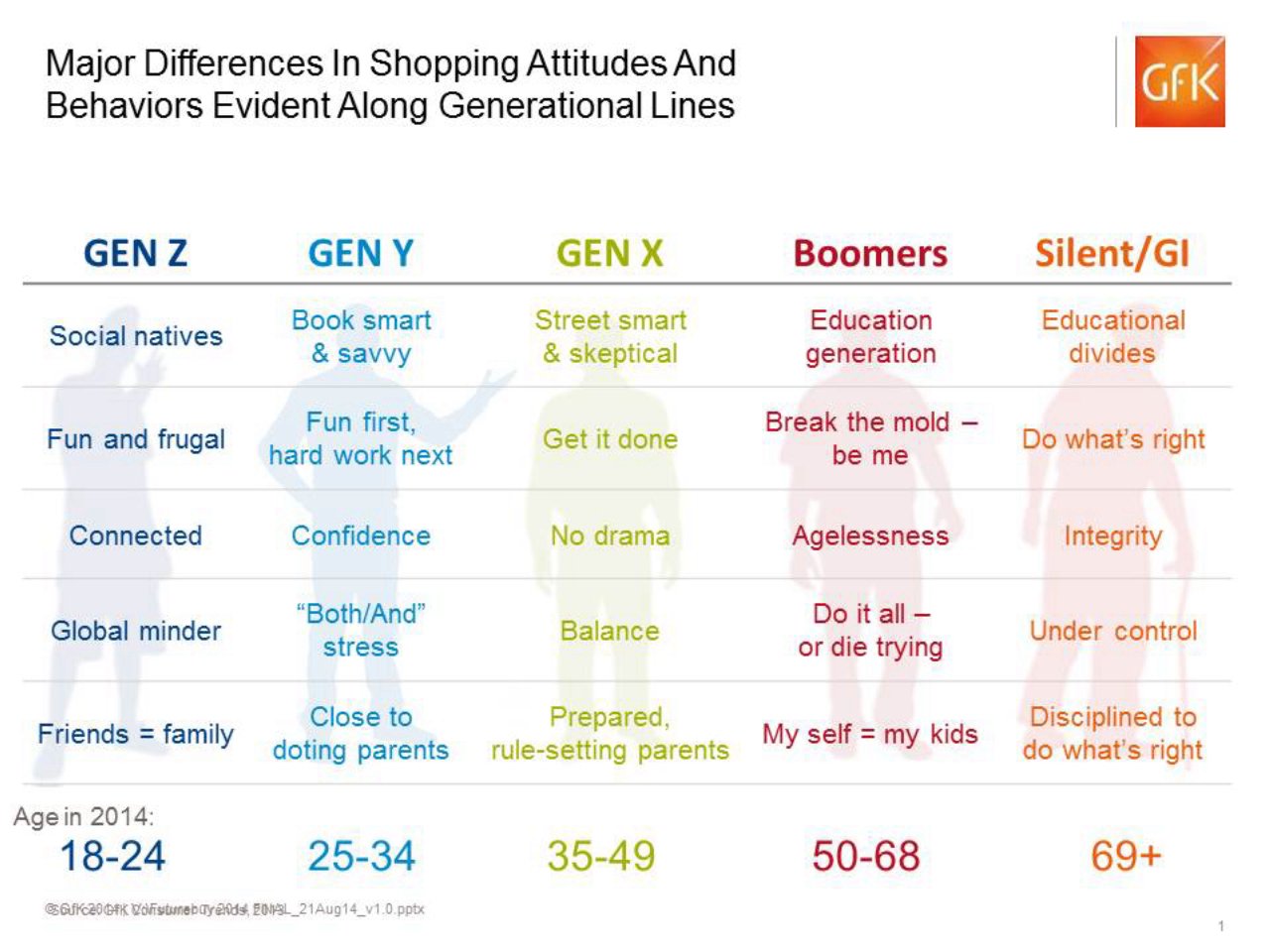

Generation Difference in Shopping

Broadly, Millennial’s are considered to be more book-smart and savvy which is in line with the boomer generation who are considered to be the ‘education generation’. Both generations have conservative approach when it comes to finances and savings and both generations are focused on family and being in touch with loved ones.

Mobile Trends

There is no question that Millennials are using their smartphones at a near constant rate, but when we look at shopping activity, Millennials only make up only 15% of all online shopping activity on smartphones in the US. This is a smaller share of activity than either Gen X or Gen Z at 25% and 21% respectively.

What type of activities are Millennials doing?

Comparing prices and searching for information about products and services were ranked number one and two respectfully, which is exactly what the boomer indicated. Generation X and Z indicated completely different uses; Gen Z is using their phones more often to check store locations and availability than other generations while Gen X ranked comparing prices, searching for information about products and services and reading reviews, in that order.

Millennials had the highest instance of webrooming; looking at the product online and then going into the store to purchase the product, than any other generation. This speaks to their ranking of reviews and their conservative nature and also indicated that traditional brick and mortar locations are important to Millennials.

Marketing Financial Services has been very difficult for a number of reasons including the lag for which financial institutions innovation their products and services combined with the Millennials high expectations of service, need to be heard and omni-channel usage. When we looked at the drivers of purchase for financial services for Millennials they indicated much higher than other generations the importance of demonstrating the service, at 17%, versus the next closest Generation X at 12%. The need to be shown the features and capabilities of a service resonated with the Millennials more than any other generation. But relying on family, friends and that coveted word of mouth recommendation was the most highly selected at 36% top two box score on a 7 point scale. The second most indicated was a consumer opinion websites like eOpinions or Consumer Reports at 35%. Millennial’s also rely more heavily on social media for make choices about their financial institution at 19% versus the next nearest generation X and Z at 8% top two box score.

The reliance on recommendations, opinions and reviews defines the Millennial generation and they behave uniquely when it comes to what they deem important when choosing a financial institution.

Mobile Payments

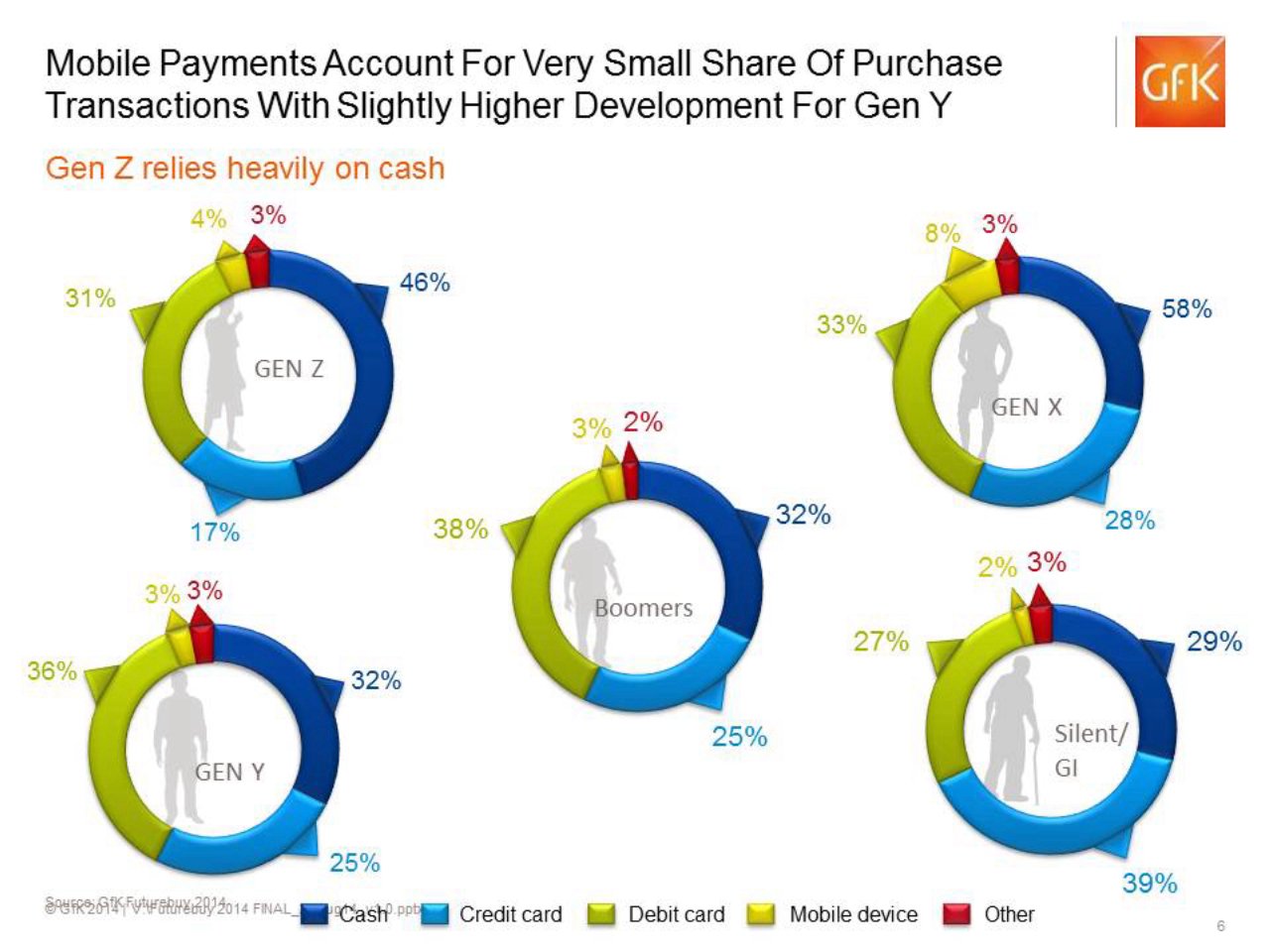

When it comes to mobile payments specifically, Gen Y’s preferences nearly match those of the boomer generation with higher indications across; easier, faster, more efficient and how I pay when possible and much lower than both, Gen X or Gen Z. Again, this speaks to a unique attitude towards mobile payments, much like mobile shopping, that is conservative and more in line with an older generation. Gen X and Z were nearly identical with Gen X indicating slightly higher in agreeability.

Purchase Transactions for Gen Y

When we looked at the usage of share of cash used for purchases versus other payment methods such as; credit, debit and mobile payments, the Millennial’s usage practically mirrors the usage of the Boomers, both at 32%. Generations X and Z had the highest instance of cash usage at 58% and 48% respectively. The generation that used cash the least was surprisingly enough, the oldest generation, those aged 69 and older, with only 29% usage.

To explain the Millennial’s behaviors towards shopping with a smartphone and making online payments we can look at the issue of security, where the trend between the Millennials and Boomers continues.

Both Millennials and Boomers indicated lower than either Gen Z or Gen Z when we asked if they thought that Mobile payment were more secure versus other payment methods and if they were confident that mobile payments are 100% secure.

Gen Z Emerging

When we asked if they were worried about personal information when making a mobile payment, both the Boomers and Millennials indicated that they were more worried than other generational groups. And although Gen X also indicated that they were worried about their personal information when making a mobile payment, this is not a deterrent like we see with Millennials and Boomers.

With the Millennial’s unique behaviors and attitudes towards financial services products and mobile phone usage, developing products, services and experiences that resonate with the Millennial generation is undoubted a challenge. Understanding the trend of how the young influencers are similar to the older generation of Boomers can give us a head start and point us in the right direction in terms of creating an experience that speaks to Millennial’s conservative and questioning nature while at the same time educates and informs them to the point of creating a comfortable environment that influences behavior.

Just as we begin to understand Millennials the next on deck is Generation Z, which will again challenge us to continue to innovate and understand the are quickly coming of age where they will be making financial decisions and have more purchasing power.

Tim Spenny is Vice President on GfK’s Financial Services team in North America. He can be reached at tim.spenny@gfk.com.