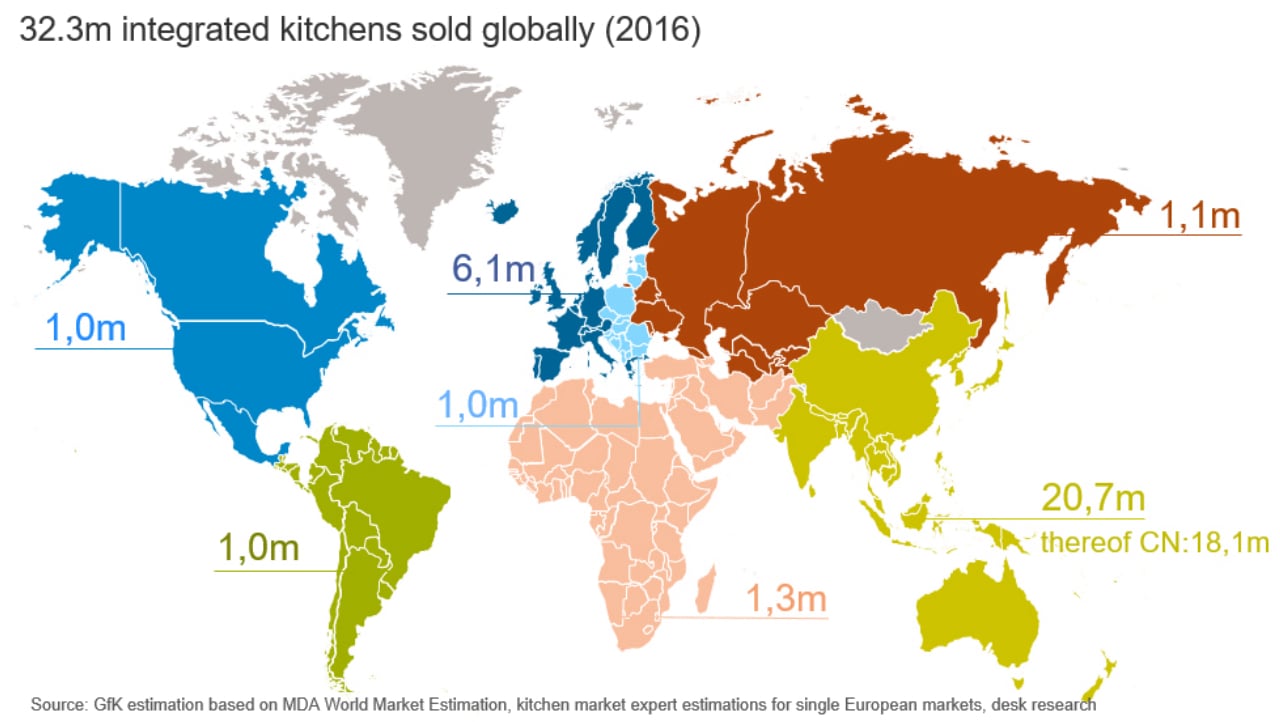

The future of the kitchen is bright, with integrated kitchens and connected built-in appliances emerging as key trends in a healthy market with attractive opportunities for brands. 32.3 million integrated kitchens were sold globally in 2016, with China being far and away the number one leading market at 18.1 million integrated kitchens sold. However, accelerated growth is expected globally with all major regions forecasting to be positive in 2017 and beyond. While Asia shows the biggest growth potential, built-in connected appliances have been a major innovation driver in Western Europe, specifically in Germany which accounts for two thirds of the market.

Taking a closer look at leading edge consumers in China

‘Western’ appliances like dishwashers, (steam) ovens and microwaves are mainly sold with premium pre-decorated flats to date. We expect a spill-over into the mass market over the coming years as Western manufacturers ramp up production capacities for such appliances in China. Still integrated cabinets, along with hoods and built-in hobs will also in the nearer future be the main driver for the double digit value growth potential of the integrated kitchen market in China.

The market has benefitted from a unique channel shop type structure, with cabinet stores (37% of sales), built-in appliance stores (31%), kitchen and appliances stores (30%) and DIY superstores (2%) all contributing to its success. With a market value size of 118 billion CNY in 2016, China’s integrated cabinet market is expected to continue to grow steadily and should experience ~15% year over year growth with a projected market value of 155 billion CNY in 2018 and 177 billion CNY in 2019.

Connected appliances – A fast growing niche in Western Europe

In Western Europe, connected built-in appliances have been a major innovation driver as a fast growing niche. Germany has taken a commanding lead in market share this year (67%), followed by Austria (7%) and Great Britain (6%), according to measurements of fourteen Western European countries by GfK Point of Sales Tracking.

Factors contributing to market strength

Changing household structures and a significantly increasing number of one and two person households have been a positive baseline factor for the integrated kitchen market. In Asia, massive growth of the Middle Class is another contributing factor of note.

Integrated kitchens have proven to be a healthy market with attractive opportunities. Knowing which markets have the greatest growth potential and which products are driving innovation are the insights that will prove to be most valuable to brands.

For more information on our sales data for major domestic appliances (as well as small domestic appliances and other product groups), please email me at anton.eckl@gfk.com.