Key insight: UK consumers replace tech products long before they’re broken or obsolete

Point of sale (PoS) data tells you what consumers buy as well as when and where they make their purchase. When you calibrate this data with actionable consumer insights, you can maximize its potential by understanding who the purchasers are, how and why they make their buying decisions, and answer questions like:

- What triggers a consumers’ need to purchase?

- What proportion of consumers are upgrading a working product and what proportion are replacing a faulty product?

- Which marketing channels are consumers receptive to at this early stage of the purchase journey?

This is the level of high-impact insight you can get from the GfK Consumer Journey module of the Consumer Insights Engine – the only solution that provides a full view of the online and offline consumer purchase journey for the technology and consumer durables industries. Our solution takes you beyond PoS* by combining sales data with market research, online consumer behavior data, and advanced analytics in a single interface.

Over this series of blog posts, I’ll look at practical examples of how this new solution brings brands closer to their customers, allowing them to understand the story of a customer’s purchase from the realization of a need up to early usage. We’re looking at how customers in the UK start on the road to buy a new television in this first post in the series.

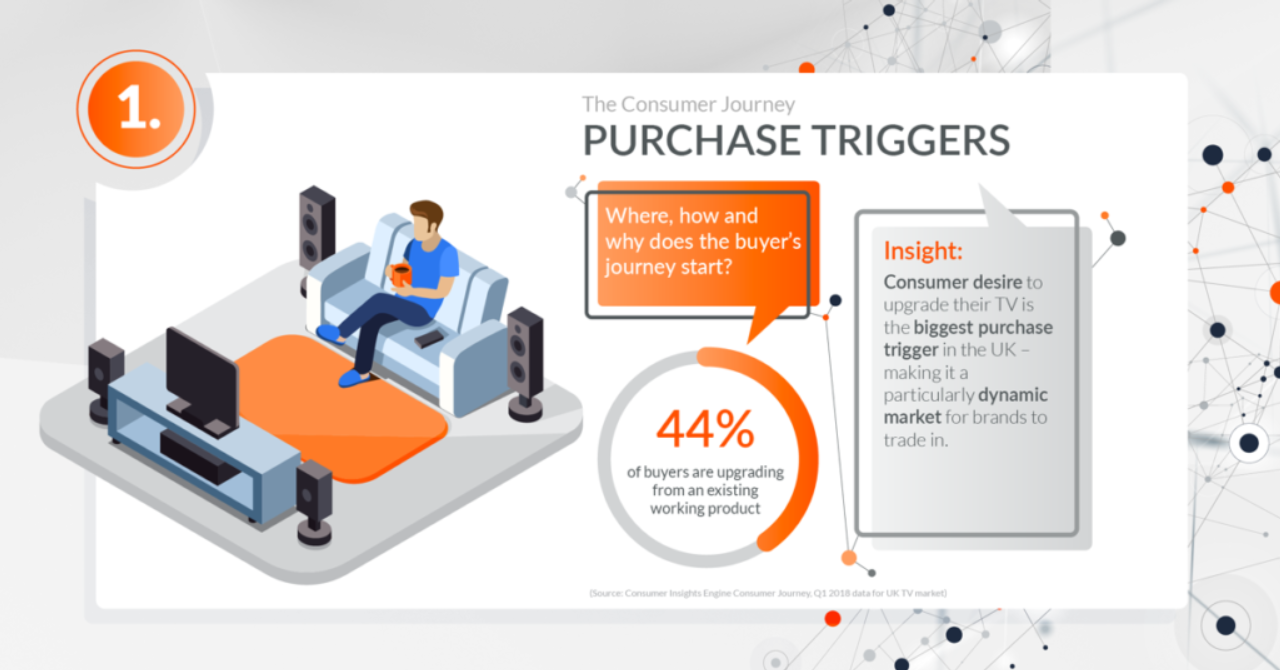

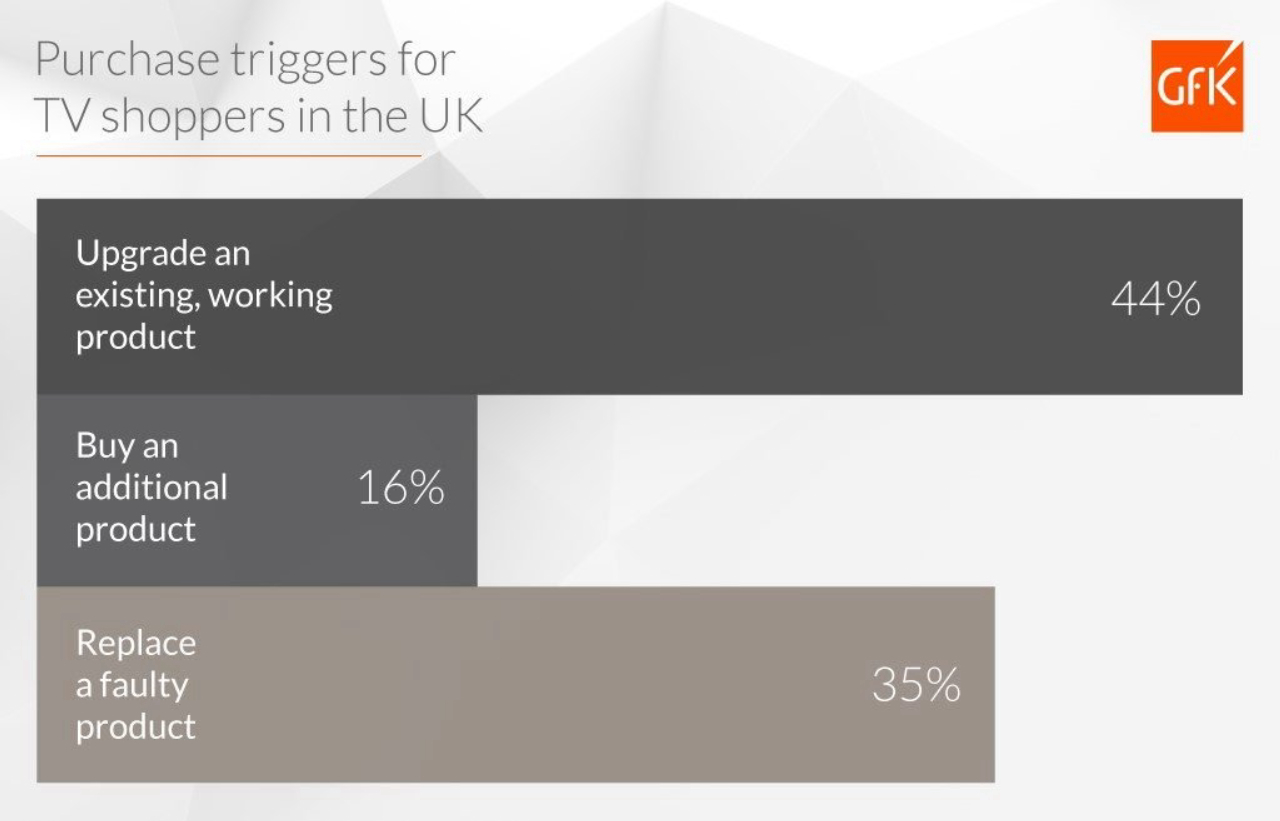

Let’s start by considering the purchase triggers for television shoppers in the UK.

Most UK television purchase journeys begin because customers want to upgrade their TV or buy an extra unit for the home, not because they’re replacing a faulty product. By contrast, in Germany, more than half of new TV purchases replace a broken product. What’s more, some 12% of UK TV purchasers are acquiring a new television to replace one that is two years old or newer.

Interestingly, this dynamic is present in other segments of the UK consumer durables and tech market. Some 12% of new dishwasher purchases and 10% of washing machine purchases replace functional products that are not older than two years. Clearly, the typical UK consumer is proactive and ready to seek a newer and better product long before the existing one breaks or becomes obsolete.

As we can we see from this data, major tech and durable purchases no longer necessarily have a long lifespan in the UK consumer’s home. To capitalize, brands need to dig deeper to understand which consumers are happy to replace large appliances at regular intervals and the factors that prompt them to make a new purchase:

In the markets we track, UK TV purchasers are among those that are most receptive to inspiration from marketing materials, even when they are not actively seeking to replace a product. This opportunity is nearly as large as the market of consumers who buy a new TV because they are dissatisfied with their current model. Brands should not ignore this.

The effect is especially strong with people aged 25 to 34; some 34% in this group are spurred to upgrade by stimuli such as advertising. To make this insight actionable, we need to get more specific. For instance, we might want to know which touchpoints are best for reaching 25 to 29-year-old consumers who might be persuaded to upgrade to a 4K 65-inch television.

Among UK shoppers looking to upgrade TVs rather than replace faulty units, 43% reported that in-store displays are their biggest inspiration. This indicates that even in a digital age, you still need a presence in the high street.

Using the Consumer Journey solution, we could quickly identify several key insights that any player in this category can act on, including:

• Around 10% of UK consumers are highly proactive, and ready to actively replace products within two years.

• Consumers can be inspired to upgrade by strong above-the-line marketing.

• When purchasing a new TV, brick-and-mortar stores are still a dominant influence in the decision-making process.

These insights can be distributed to the relevant business functions to inform tactical and strategic planning processes, where they can make a difference to category performance.

My next blog will drill deeper into which specific touchpoints consumers interact with when they are looking for a new TV and which are most influential.

In the meantime, try our online Consumer Journey demo to discover how we can help your business to make faster, smarter decisions.

Note: *In the US, GfK does not have access to Point of Sale data. US data is calibrated using information gathered from a telephone survey based on probability-based sample representative of both mobile phones and landlines. No retailer data is used in the development of the US offering.

Discover more consumer journey insights from the rest of our ‘Beyond Point of Sales Data’ blog series:

Beyond Point of Sale Data: Search and evaluation in the consumer journey

Go Beyond Point of Sale Data: Understand the Moment of Purchase

Beyond Point of Sale Data: The importance of understanding early usage in the consumer journey

![Understanding your audience: The power of segmentation in retail [podcast]](https://nielseniq.com/wp-content/uploads/sites/4/2025/07/Podcast-Understanding_your_audience-The_power_of_segmentation_in_retail-mirrored.jpg?w=1024)