Drive business growth amidst stagflation with consumer-led strategic direction

Act with laser-focused clarity to navigate your brand through a recession. Get this clarity through a consumer-centric, evidence-based brand marketing strategy that harmonizes both your short- and long-term growth ambitions. Here’s how.

The war in Ukraine, its spillovers, and a broadening of price pressures are expected to elevate inflation for longer than previously forecast. Higher-than-expected inflation worldwide has triggered tighter financial conditions — especially in the United States and major European economies. Added to that: the worse-than-anticipated slowdown in China, reflective of outbreaks of COVID-19 and lockdowns. Which signal that the pandemic that struck the first weakening blow to the economy is far from over.

It takes a bold strategy to achieve growth in an economy like this one: where consumers’ confidence plummets and the intention to purchase is delayed. But, with 78% of CEOs looking to their CMOs to drive growth, marketing leaders need to step into innovative and intentional ways of leading the charge.

While it’s tempting to pivot towards short-term tactical reaction, successful marketers will invest in developing a consumer-led strategy that brings clear decisive direction to their tactics, and drive growth over the long term. According to Marketing Week columnist Mark Ritson “It was companies that deployed a mix of defensive moves to reduce costs while offensively investing in growth strategies that were most likely to not only survive but thrive in the recessionary and post-recessionary months ahead.”

One example of this is P&G, who anticipate net sales growth of up to 2% in 2023, and organic sales growth of 3–5% through a “commitment to keep investing to strengthen the superiority of our brands across innovation, supply chains and brand equity to deliver superior value for consumers, in every price tier in which we compete.” According to CEO Jon Moeller, P&G “believe [the economic downturn] is a rough patch to grow through, not a reason to reduce investment in the long-term health of the business.”

At GfK, we have observed five growth hacks across a broad variety of clients and industries that help redefine marketing strategies, and ensure they master crises and emerge stronger.

#1 Strategy first

Marketers can expect to face budget cuts, as their brands face escalating input costs and supply chain shortages without the usual increase in demand. Successful marketers will refuse to pivot and adjust their tactics to achieve short-term relief without first reflecting on a consumer-centered marketing strategy that finds new creative avenues of activating demand.

To switch focus from business requirements to customer obligations aligns strategies across the organization with the consumer as the guiding principle — its North Star. Tactical responses are then always in sync with a consumer-centered holistic growth strategy, ensuring brand responses encompass consumer empathy and embrace new business opportunities.

The basic marketing best practice holds true even during a time of stagflation: strategy first, tactics only in alignment with this strategy.

#2 Put your growth lenses on

To make uncovering growth opportunities the foundation of your brand strategy, you need data-led evidence that patterns the market to unlock different — and new — drivers of demand. Mapping the market through this lens of quantified demand entails breaking down the consumer landscape into meaningful parts, achieved through a deep understanding of the intersection between consumers’ mindsets and category behavior in context. This process structures consumers’ worlds to reveal the pathways of demand.

Rachel Thompson, a GfK Strategic Consultant for more than 20 years, explained that based on her experience, “Brands that grow embrace consumers’ complexity. They do this by first understanding consumers’ overall category mindset, then layering this with an understanding of the dynamic interactions consumers have with the category. In this way, they gain valuable insight into the different pathways of opportunity available to their brand.”

#3 (Re)focus

Successful marketers are selective. Marketers facing budget cuts are under pressure to prioritize their efforts and budgets to deliver the greatest short-term reward. Selection means targeting, but successful targeting means only focusing on the highest growth spaces that require the lowest effort.

To make smart choices, marketers need data-led insights into the cost-benefit offering of each opportunity. Backing their prioritization decisions with evidence. Each growth opportunity must be quantified in terms of the opportunity potential it offers, and the brand’s current position or right-to-play in the space. Doing so brings clarity of action: helping marketers identify the highest growth targets and the lowest hanging fruit that can be activated in the context of lower marketing budgets. The result? A clear path to the highest, short-term sales potential.

But refreshing your perspective and refocusing efforts is about more than targeting effectively: it’s about challenging and redefining traditional targets to broaden the perspective, so it encompasses new opportunities.

A recession puts pressure on many consumer groups, leading to changes in purchase behavior. According to GfK’s Behavior Change Survey in 15 EU countries in April 2022, using a car, going out or enjoying out of home entertainment can be expected to decline, on the other hand, plans for home improvements are on the rise.

In times of change there will be winners and losers. To be successful, brands must spot recession opportunities that emerge out of shifts in consumer behavior.

“Change gives brands an opportunity to rethink their core target strategy, and look for potential new targets that will bring new revenue when their original customer base is trading down. Reflecting carefully on what we call ‘Reachable Fruits’, and what it takes to win them, might offer new avenues of demand. These may come only after increased effort, but will secure future revenue,” explains Rachel Thompson.

#4 Serve the job to be done

Battling soaring inflation and the associated cost-of-living increases, consumers are scrutinizing their purchases — justifying each one based on the value it brings to their lives. To grow in this climate, marketers must craft and maintain strong brand positioning that brings consumers empathy and ultimate value through products and experiences in line with their new real-life context.

Recent GfK Brand Architect data confirms that trust and meeting consumer needs are the core drivers for brand choice, or how likely people are to purchase your brand over competitors’.

However, the data also reveals that excellence and uniqueness are key drivers of brand premium, consumers’ willingness to spend more money on one brand than another. Brand premium is a key measure during a recession, since it indicates the financial worth your brand holds in consumers’ lives. This presents an opportunity for your product to find its sweet spot: adding value that justifies its price. Driving brand premium may deliver more rewards than focusing on cost savings: products that add value can charge a higher price if the benefits are worthwhile — a win-win for consumers and your brand.

Understand consumers’ behavioral context, and you discover their core needs in the moment: uncovering clues to how your proposition can bring more meaning to their lives. To crystallize these requirements and ensure they serve the moment, marketers must switch gears from focusing on the product, to focusing on the end-job consumers expect these products to accomplish. Positioning opportunities are plentiful in this space, and successful marketers are deliberately searching for them.

Great brands are built on fantastic products and experiences. Exceptional delivery in the appropriate moment — both of practical value and an intangible connection — secures your product as an indispensable part of an inflation-pressed consumer’s life.

#5 Think long

Brands need to think long, and short — efficiently, and effectively balancing performance and brand-building efforts to deliver immediate returns and long-term growth. As a marketer, you need a consumer-centric strategy that ensures you win high-value segments by inspiring consumers to DO MORE with your brand, by purchasing, advocating, and reviewing. Meanwhile, you also need to reach the broader market and inspire them to THINK MORE about your brand, by forming relevant brand associations and seeding demand space cues.

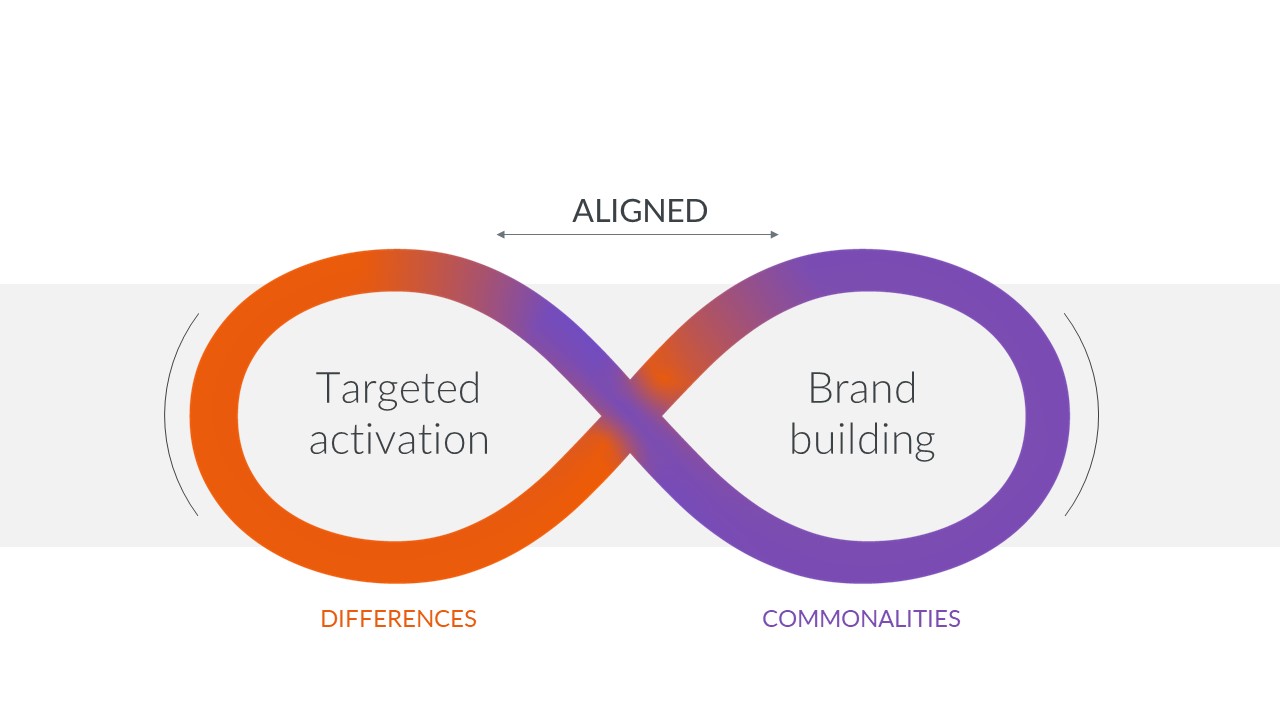

To achieve this, you need to change the way you view the consumer landscape: targeted activation and brand building need different types of insights, but these still need to be aligned. Consumer research or segmentation traditionally focuses on highlighting differences. This helps to design targeted, benefit-focused, short-term activation. But to drive long-term impact on the market, you need to increase your reach by understanding what unites segments, not divides them.

Targeted activation for short-term growth focuses on the differences between segments, while longer-term brand building activities leverage their similarities. Working coherently together, you can achieve optimal, scalable and sustainable growth for your brand.

A broad reaching, long-term strategy needs to encompass two strategic avenues: upscaling targeting activities to increase reach and future growth, and the cultivation of brand connection.

Rationally linking your brand with broader demand entry points

Broadening your brand’s reach from the center to the periphery helps you win consumers’ future purchases by creating clear associations to a wider space of relevant demand entry points. This is the new marketing model adopted by Coca-Cola, who aims to drive profitable long-term growth for its entire portfolio of brands in this way. CEO James Quincey explains that their “new marketing model is focused on adding and retaining consumers. And we’re doing this through an ecosystem of experiences that link consumption occasions with consumer passion points.”

Emotionally linking your brand with unifying human truth

This entails discovering themes that consumers across all segments and communities value, so you can build your brand on messages that deliver a net-positive impact across the market. Insights gained from this process will help you build a brand famous for its purpose and values, by aligning your brand’s ‘Why’ with where consumers see value, to generate a higher brand worth. Our GfK Brand Architect research shows that whilst Brand Purpose and Brand Values have lower impact on driving market sales volumes for brands, they do have an impact on justifying a Brand Premium.

Increasing brand premium by investing in brand building is a strategy Coca-Cola has adopted: driving concrete worth in all consumer wallets, with the objective of securing revenue growth amidst the crisis. Chief Financial Officer John Murphy said the decision to increase spend was made to “create more value” for Coca-Cola’s brands, and to “continue to earn the respect of price points.” GfK Market Intelligence data from 2008 proves this strategy in the Consumer Technology and Durables sector: our sales data showed that price premium goods grew at the cost of standard-priced goods, both during and after that financial crisis.

Get the clarity and direction you need to make scalable growth decisions

We’ve designed Growth Architect to deliver the evidence and insights marketers need to make bold decisions and reveal scalable growth opportunities — ensuring you uncover, size and prioritize them effectively.

Join our experts at an on-demand webinar where they share ways for hacking growth to help define your consumer-led growth strategy and emerge stronger during the turbulent economic times:

![]()