Escalating levels of inflation are already having a significant impact on both businesses and households globally, as the price of food, fuel and transport rise. That makes it critical for consumer technology and durables brands to emphasize how they can deliver value worth splashing out on.

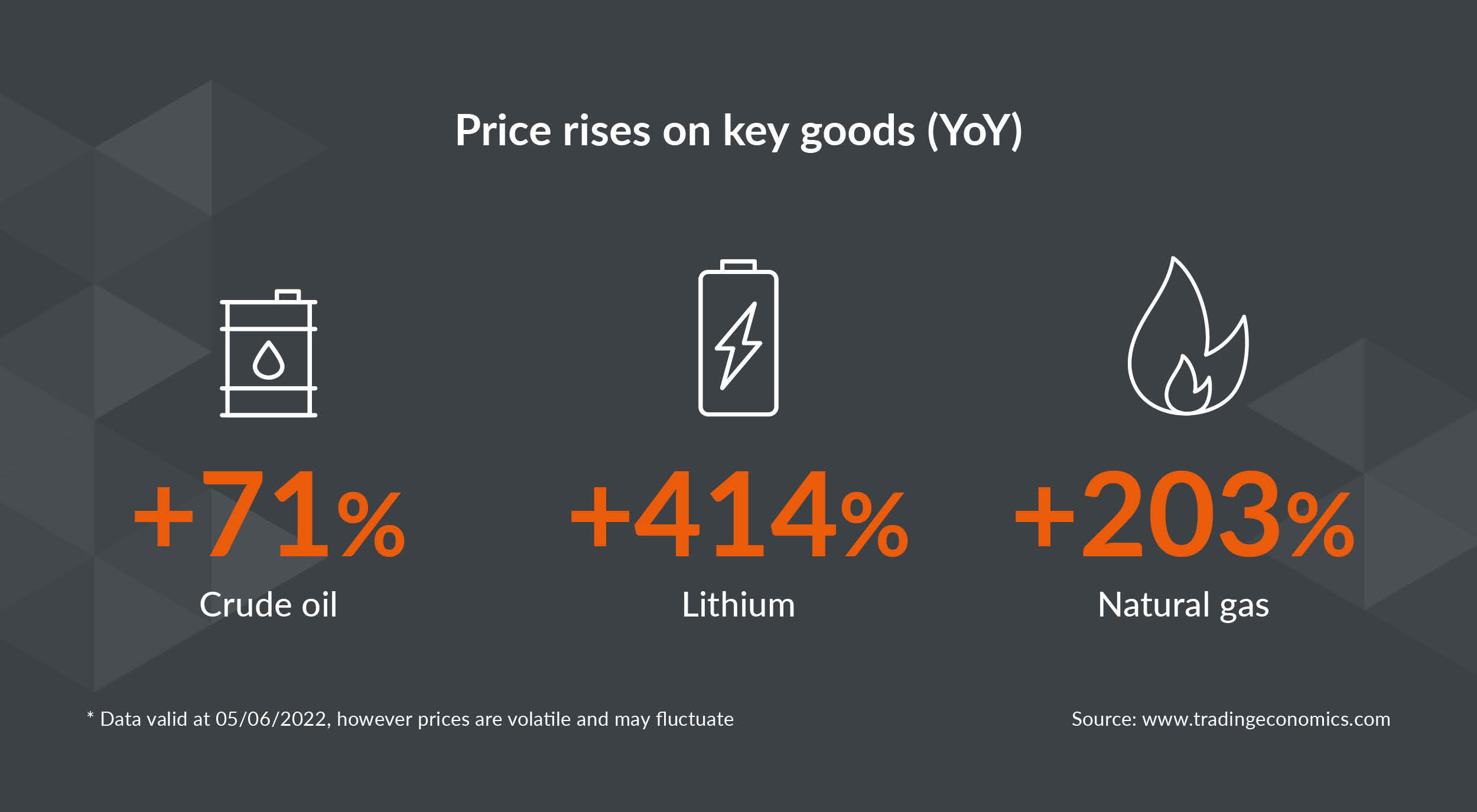

Though in many global markets the rate of economic recovery post-Covid-19 had been largely stable, that rebound is beginning to lose momentum. That’s in part thanks to the scale of inflationary pressures weighing in on both global supply chains and consumer households. From shortages of food, fuel and raw materials to ongoing logistics disruption and the conflict in Ukraine, a perfect storm of challenges have seen the world’s post-pandemic recovery slow.

The IMF has downgraded its global growth forecast as a result, to 3.6% in both 2022 and 2023, with elevated levels of inflation expected to persist. In the United States and some European countries, it has already reached its highest level in more than 40 years. This is filtering through into consumer technology and durables, with a global price increase of 23% as of February 2022 (compared with January 2020).

For business decision makers, that has significant implications for their own bottom line of course. While in 2021, we saw strong global growth of 12.2% across the sector, in 2022, GfK forecasts this will slow to 2% thanks to myriad market pressures. This forecast is very likely to be revised further downwards at the next iteration in May.

But it’s crucial that neither brands nor retailers forget the direct impact these pressures also have on their end consumers. In many markets, household bills for food, fuel and transport are rising steadily, leaving a serious dent in the financial confidence of many. In fact, GfK research shows that only 34% of consumers believe their economic situation will improve 12 months from now, compared to 41% in 2019. It has therefore never been more important to stay up to date with exactly how this is impacting consumer behavior, using platforms such as GfK’s own gfknewron.

That’s because this lack of confidence is likely to have a direct impact on the decisions these same consumers make on what, when and how they buy products in consumer technology and durables. They’ll take a more considered approach. Shop around. Look for those products and retailers that recognize their challenges and offer them genuine value. For more on exactly how this uncertainty is influencing consumers, take a look at our recent blog post here.

How can brands and retailers ensure they deliver value?

1. Pair premiumization with good value

To start with, adopting a market positioning that offers consumers clear value for money isn’t the preserve of lower or mid-level brands. In fact, when asked their top five reasons for choosing premium brands, consumers said ‘offering good value for money’ was one of the key drivers. This idea of value can be multidimensional too. Sustainability, for example, is an opportunity for brands of all tiers to add clear value for consumers – to read more about the topic, take a look at our blog here. All which demonstrates how important it is for brands at every price level to carefully consider how they’re delivering clear and demonstrable value to consumers. For more on the opportunities in premiumization take a look at our blog here.

2. Elevate multifunctionality in product design

Those products that can deliver multiple use cases in one are already a key area of growth in consumer technology and durables. Mini ovens have traditionally been seen as low tier products, for example. But by integrating the option for air-frying or humidifying steam into the same device, many brands have significantly elevated the appeal. In fact, these examples of multifunctional products have seen an astronomical growth in sales of 534% and more than 1,000% respectively. This trend will only gain pace as value moves up the list of consumer priorities.

3. Position convenience as a clear USP

In the second half of 2021, many categories within consumer technology and durables began to see a deceleration in demand. But in small domestic appliances (SDAs) this was far less pronounced. In fact, despite strong growth in 2021 (7%), it achieved a 23% increase in value sales from 2019 to 2021. That’s in part thanks to a strong performance by devices that had convenience as a core selling point, such as hot drinks machines or food preparation tools. For time-poor consumers, this is a key way to add value.

4. Cater to the connected consumer

Connected devices are already an emerging area of interest in consumer technology and durables. By allowing users to tap into the internet of things (IoT) via wearables that are connected to a range of other household devices, from scales to mattresses or sports equipment, they add a whole new dimension to the functionality of a product. This in turn gives them an added sense of value versus the competition.

Elevate value and support consumers through inflation challenges

The impact of inflationary pressures on both businesses and households isn’t about to end anytime soon. For business decision makers in consumer technology and durables, that makes it critical to demonstrate a sense of added value across their product portfolio in order to secure loyalty and mitigate deceleration against a challenging backdrop for both them and their customers.

Learn more about strategies and solutions that can help you navigate through the uncertainty of an already volatile market.

Most of the data in this report has been collected from GfK Market Intelligence, GfK Consumer Life Global, gfknewron Predict and GfK Market Intelligence: Sales Tracking.

![]()