This article was developed by Tech & Durables industry experts Ines Haaga and Sohjin Baek of the GfK Global Strategic Insights Team.

Set against a backdrop of rising prices, shrinking markets, and changing consumer behavior, it sounds a contradiction to suggest that a premiumization strategy offers growth potential in today’s challenging environment. However, we at GfK we have identified that the current rise in the appeal of higher-priced tech and durable products amongst premium buyers will persist throughout 2022.

In previous articles, we covered how brands can embrace premium and how premiumization can save consumer tech and durables. In this blog, we examine the drivers and the products already benefitting from the trend. We profile high spec premium buyers, and share how to realize the opportunity they present in your business. So read on to discover if your business could maximize the power of premium.

What’s driving the shift to premium?

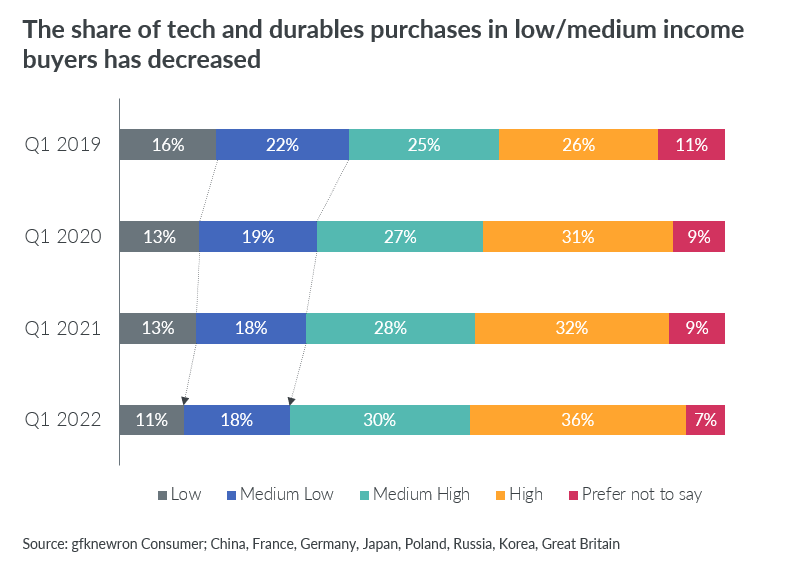

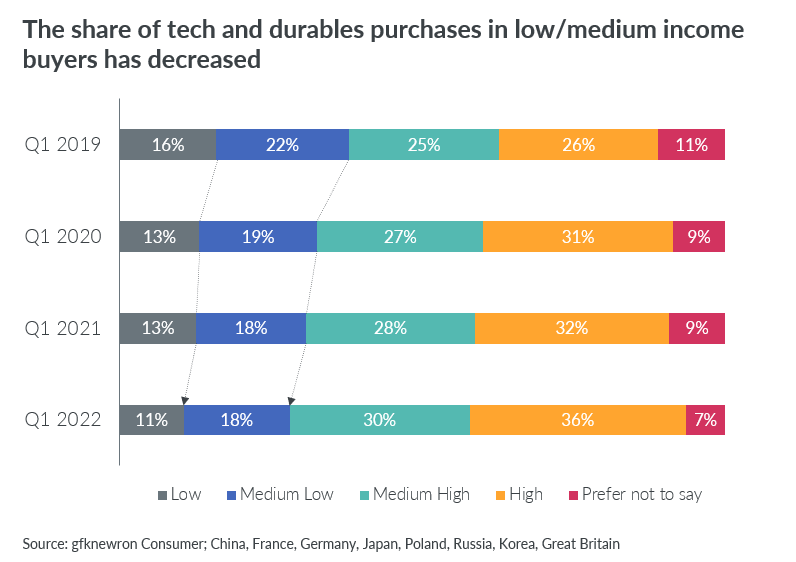

Firstly, household budgets are increasingly limited, and the share of purchases has changed. Between Q1 2019 and Q1 2022, the share of low and medium-income buyers in Tech and Durables declined from 38% in Q1 2019 to 29% in Q1 2022. Over the same period, high-income buyers grew their share from 26% to 36%.

So as those with more limited budgets delay or even avoid buying, better-off premium buyers achieve a bigger share of sales. Those with lower incomes may also be impacted by the reduction in the number of entry-level items for sale, as driven by supply chain shortages, manufacturers have concentrated on producing higher priced-items offering better margins.

In addition, consumer preferences are driving the potential of premium. Our 2021 Consumer Life study has shown that more than one-third (37%) of consumers agree ‘it is important to indulge myself on a regular basis’. This may be another motivation of premium buyers for upgrading to higher-priced, feature-rich premium products.

Meet the ‘High Spec Premium’ buyer

Feature rich and well-known brands are important criteria in helping High Spec Premium buyers make purchase decisions. Based on gfknewron Consumer analysis, consumers can be classified into seven audience groups, with High Spec Premium buyers representing 15% of all consumers in Europe. This group values well-known prestige brands as well as product features. Almost all (95%) agree with the statement “I want a feature-rich device from a brand I know well. If that means paying more, then so be it!”

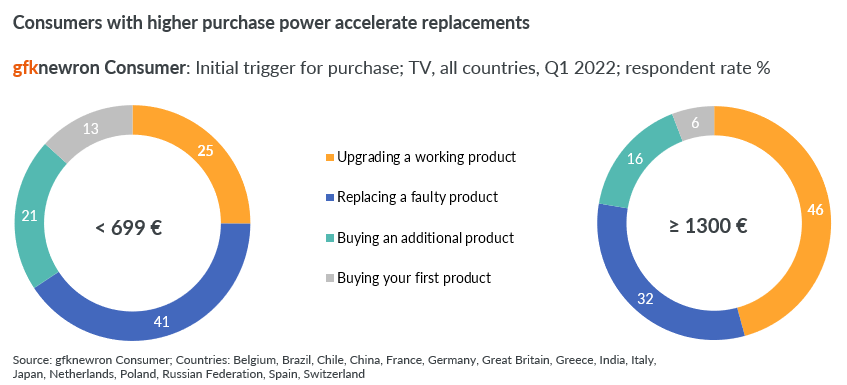

For these premium buyers, pricing is less likely to be an important consideration factor. There are numerous factors that appeal to High Spec Premium buyers, including whether it is sustainable or smart, perhaps it helps make life simpler, or offers an upgraded, enhanced experience. Upgrades are an important driver, and in fact analysis of TV sales between Q1 2019 and Q1 2022 shows that ‘upgrading a working product’ is on a growth trajectory as a reason to buy (up from 29% to 34% by Q1 2022), while ‘replacing a faulty product’ has remained flat during the time period.

The premium price opportunity: Driving revenue and margin

Sales at the higher-end have been growing since April 2018. The latest analysis shows that the 5% of unit sales at the top end price point accounted for 26% of revenue from May 2021 to April 2022, making them both efficient and effective. So higher-priced products offer a better profit margin too. Where resources are limited, it’s logical to focus on the more expensive, higher-return items. This trend is happening in key categories including flat TVs, smartphones, mobile PCs, monitors, washing machines, and vacuum cleaners. Here sales are increasing in double-digits, while at the lower price point, sales have plateaued or are in decline.

Analysis of consumers who bought a flat-screen TV reveals that those shopping in the low- to mid-level price point of €699 or less are purchasing specifically to replace an item. In comparison, those – premium buyers – spending €1300 or more are replacing a working product. This suggests that these consumers are buying to indulge their desire for better features, or to indulge themselves, or a combination of both. Analysis of consumers buying higher-priced vacuum cleaners indicates a further link, this time between high levels of consumer confidence and spending.

So, while some consumers are feeling the squeeze of rising prices and are cutting their expenditures in the TCG category, this is not the case for all. There is still a significant proportion of shoppers who are attracted by feature-rich products from well-known prestige brands, and who can afford to buy them to satisfy their need for self-indulgence. This suggests there is a genuine opportunity to maximize the potential of premium if you understand what will appeal to High Spec premium buyers.