The shift to virtual shopping by global consumers has accelerated during the pandemic, and the growth of e-commerce is showing no signs of slowing down. As we see restrictions lifting around the world, and physical retail stores opening back up, there is new confidence for virtual shoppers to go back into stores. But global Technical Consumer Goods (TCG) shopping behavior has transformed forever, with consumers that have spent the last 18 months shopping virtually, now demanding multichannel ways to explore and buy TCG products and services. Brands that understand this and use innovative ways to reach, market, and sell to consumers will have an edge over their competitors.

Europe, APAC, LATAM, and North America have experienced a rapid surge in virtual shopping due to the pandemic. And according to the GfK: MDA Global Trend Report, e-commerce grew by 30.6% from January to May 2021. And this is up by 44% in 2020. US retail e-commerce sales are expected to increase 13.7% in 2021 to reach a whopping $908.73 billion by the end of the year.

The virtual shopper is changing too. Since we’ve had to rely more on virtual services the demographic has broadened beyond Gen Z and Millennials. “It’s not just the younger tech-savvy generations who are relying on virtual shopping for goods and services – the older generations are engaged in this narrative too,” says Proximity Insight CEO Cathy McCabe.

Who is the Virtual Shopper?

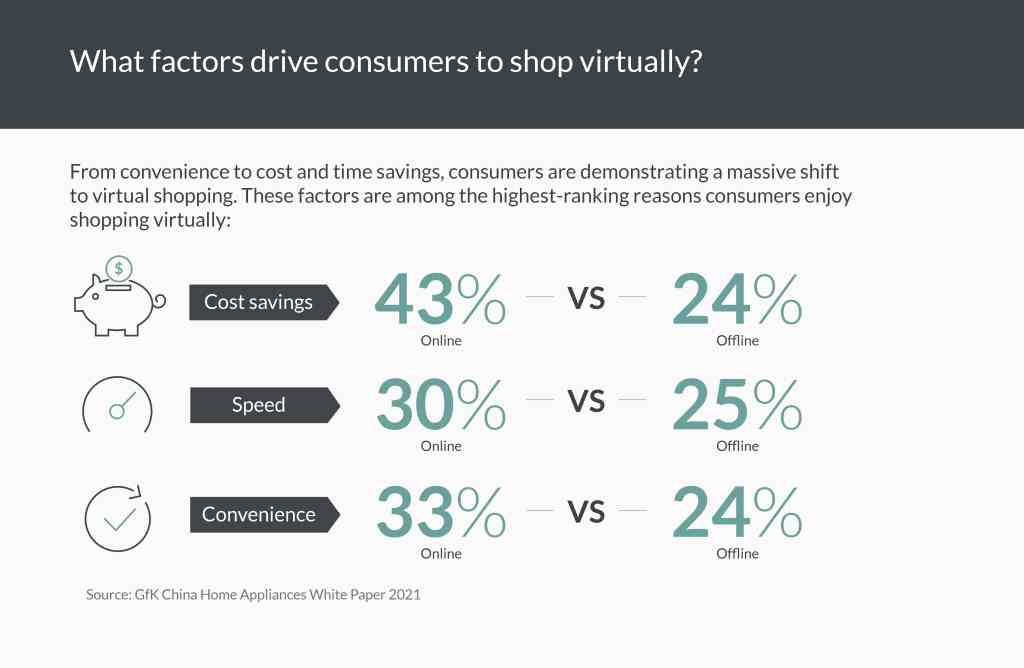

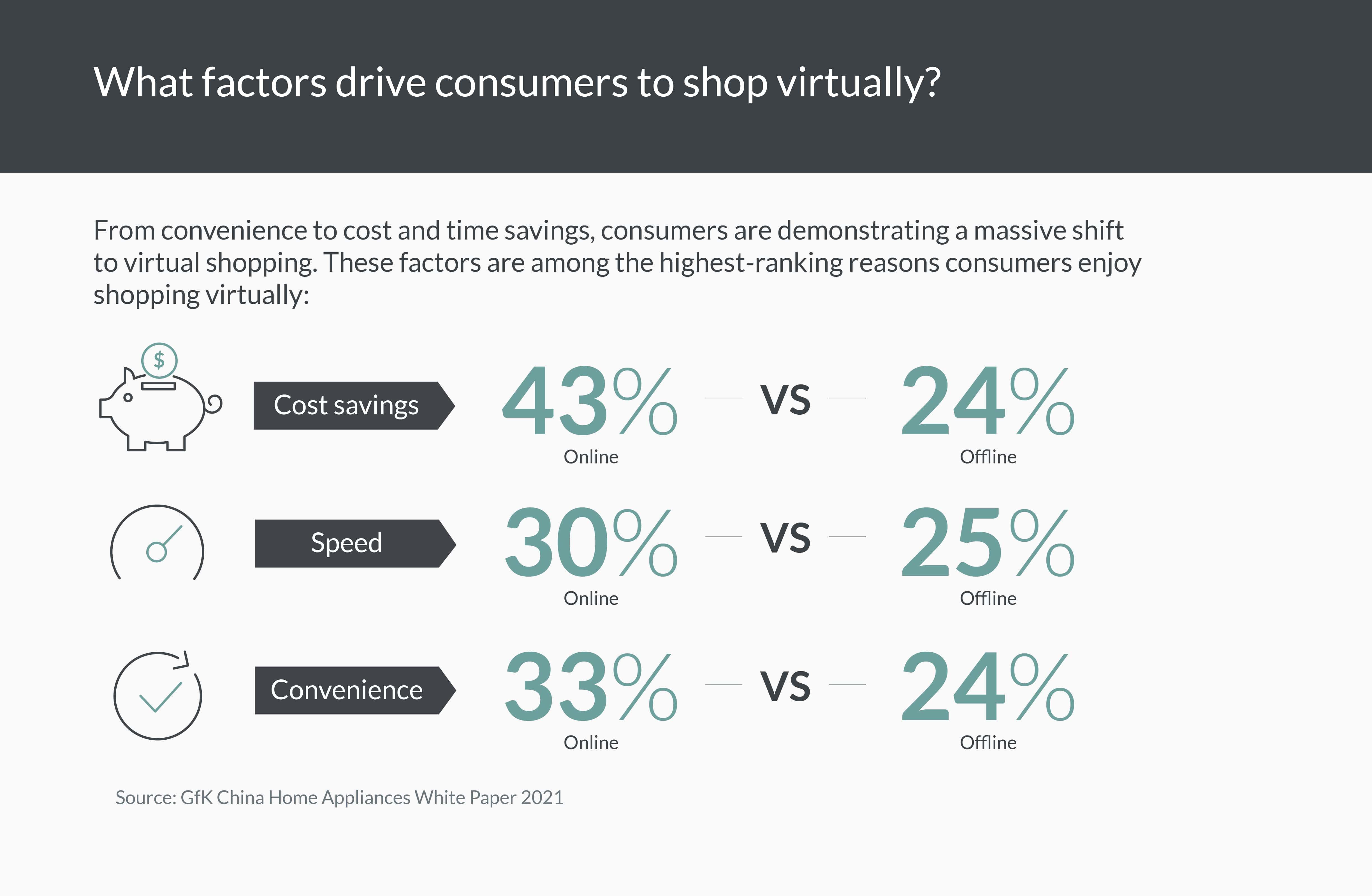

The behavior of the virtual shopper has transformed as traditional retail models are unable to keep up with their needs. According to GfK’s Global Consumer Life report, 40% of global consumers believe that price is the most important factor in purchasing decisions. Aside from price, GfK China Home Appliances White Paper reveals convenience and speed also remain top priorities for shopping online – regardless of age group, and on a global scale. And the experience of having instant access to purchased products is an aspect that is more highly valued in-store. But online shopping is stepping up with innovative ways to deliver overnight, same day, or even in as little as 10 minutes.

Virtual shoppers are a group of consumers who value easy and seamless experiences and this is paramount to winning their spend. GfK’s Global Consumer Life report shows that 40% of consumers are prepared to pay more for products that make their lives easier. And in China, technology affects consumers’ purchasing decisions with 48.2% of Chinese Gen Z agreeing with this statement, compared to 43.4% of Millennials, 38.7% of Gen X, and 31.4% of Boomers. Regardless of their age, Chinese and Korean consumers are also more inclined to turn to online sources when making a purchase.

Based on a global overview the Boomer generation has been the newest addition to the e-commerce sphere. In 2020, only 26% of Boomer virtual shoppers reported confidence with new digital experiences, but that has risen to 36% this year. This increase was driven by the health risks associated with in-store shopping, but their online spend has, for the most part, been on basic necessities and FMCG goods. Interestingly, brands need to be aware that ƒsustainability is a top priority for this shopper and Opinium’s survey found 78% of Boomers believe they have a personal responsibility to deal with the climate crisis.

Meanwhile, Gen X virtual shoppers are more experimental and willing to try new products. According to eMarketer, 86% of Gen X consumers said they would try a new brand if offered a coupon or discount online. However, brand loyalty also remains a top priority for this generation making them prime targets for the luxury market. The survey also confirmed 70% of US respondents and 30% from other English-speaking countries remain faithful to their regular brand purchases.

Contrastingly Millennials and Gen Z have limited brand loyalty compared to their predecessors. According to a report by McKinsey, 44% of Millennial and Gen Z consumers have tried a new brand, compared to 35% of Boomers. Virtual shoppers from these generations tend to be more inclined to switch brands because of value and quality. They are also more heavily influenced by social media trends and rely on influencers to gain valuable information.

According to GfK: China Driving the Future of Consumption, China is at the forefront of this global change and is forecast to account for 56% of all global online retail sales by the end of the year. And this is expected to balloon to 63% by 2020. A growing spirit of nationalism is one of the factors driving this growth in China and other regions around the world, as consumers seek to support their countries’ economies. Research in GfK’s China Home Appliances Whitepaper 2021 found that 70% of Chinese consumers said they would be more likely to choose and support domestic brands. GfK’s Global Consumer Life data also supports this, as 31% of consumers believe where and how a product is made is important to them. Overall these consumers are driven by trust, novelty, and quality, alongside convenience. This shift to virtual shopping is a global phenomenon with both the US and Europe showing substantial gains. In Spain, 88% of consumers confirmed that their shopping habits changed, and online shopping in the US is expected to reach $1 trillion by 2022.

Driven by COVID lockdown restrictions and expanding access to the internet, LATAM has emerged with as many as 7.3 million Brazilians making purchases via the internet for the first time in 2020, providing a new market for brands to tap into. Growth in online sales was forecast at 19% – but was dwarfed by an actual 63% increase, which was five times the growth registered in 2019.

How has the pandemic accelerated the desire for virtual shopping?

As bricks-and-mortar retail outlets temporarily closed and stay-in-place orders kept consumers at home, deliveries boomed. DPD delivered 1.9 billion parcels worldwide in 2020 – an increase of half a billion compared to 2019. It has led to shoppers being more accustomed to the ease of e-commerce, and they now demand retailers adopt quicker delivery models, in fact, 88% of consumers will pay for same-day delivery. Across Europe, the main areas of e-commerce development are focused on flash delivery services, which are quickly expanding.

COVID-19 has had a huge impact on the retail industry – from staff shortages to flagship locations shutting down – operations have been severely limited. As a result, retailers had to quickly adapt to new modes of operating, while implementing technologies that could create a unique customer experience at home. Digital technologies that bring the virtual shopper experience to life, such as 3D, AR, and VR are proving to be very successful with 61% of consumers saying they prefer retailers with AR experiences. The richness of these virtual experiences is giving customers what they want and driving high conversion rates.

Throughout 2021, as restrictions eased, new online consumer behaviors and the desire for more convenience, have continued the shift towards virtual shopping. GfK’s China Home Appliances White Paper found 33% of global consumers purchase products online for this very reason.

Contact anxiety will be a long-standing COVID-19 legacy and social distancing measures will continue, but it’s clear that health, safety, demand for convenience, and richer virtual shopping experiences are now top priorities for consumers.

Virtual shopping: An opportunity for brands

As VR and AR become mainstream, smart brands are taking the opportunity to connect with consumers via XR (the name for both VR and AR) – a market forecast to be worth about $1tn by 2030. Ikea’s Studio Play app is a great example. The app allows consumers to virtually put items of furniture in their own homes to see how it looks before they purchase. It’s simple to navigate, does not require additional equipment, and allows users to share. Ikea’s e-commerce performance saw a boost jumping 45% to account for 15% of total retail sales.

When it comes to e-commerce, convenience is king. Flink, an instant grocery delivery service that promises to deliver groceries in 10 minutes saw significant growth during the pandemic. In just six months, from a start in Berlin, Flink has grown to 24 cities across Germany, France, and The Netherlands. Understanding the needs of their customers and solving the biggest pain of delivery services; the time it takes to get delivered, this innovative company has since attracted $240 million in capital from investors. Services like Flink experienced a lockdown boom due to safety being a priority for Boomers, who preferred to shop online for necessities.

Finding the balance between technology and humanity is also needed in this space and having a personalized approach is the way to do it. Brands can use algorithms to gain previous purchasers’ information or get users to connect social media profiles to their apps, to gauge their interests. For example, clienteling tools like Hero connect to brands’ websites and message store-staff by chat or video tools and offer suggestions to sales associates to help secure sales. Hero’s data found virtual shoppers spend up to 70% more online when they can have a personalized experience. The app offers new revenue streams, such as link clicks or talking to associates instantly – providing multiple routes to gain revenue and incorporate software.

However, with highly personalized approaches comes the risk of data privacy breaches due to consumers giving out their information to brands and their data partners without knowing how much they are revealing. “There is a transactional decision people make when they shop online because they are aware of exposing some of their data. But it becomes problematic because brands, retailers, and other data partners know way more about shoppers than they are aware of, so retailers and brands need to be careful about how much they expose and how they communicate to shoppers,” says Beier, adding that in Asia, this customized approach is welcomed. “Our data points showed that in Asia there is much more willingness to share personal data,” he says, “and more reluctance in Europe or the US.”

Buying online: Where they purchase and what they buy

Consumers believe the best retailers and brands can now deliver better experiences online rather than physically in-store for an optimal connected shopping experience. This is reflected in the fact that virtual shoppers are relying more on influencers, live-format videos, AR, and branded communities when making purchase decisions.

Retailers should capitalize on the TCG market now. GfK’s China Home Appliances White Paper states the global market value of technology products is $799 billion. For virtual shoppers in Europe, according to GfK’s Coronavirus Recovery Pilot, demand for consumer electronics has risen by 30%. In comparison, the Chinese market saw an increase of 34.2% and the US increased by 12%.

When trying to sell consumer electronics online, it’s the brand’s responsibility to ensure consumers truly understand the purpose of the product by providing clear information. Beier says: “More durable purchases [like consumer electronics] involve a lot more information seeking and searching – there’s a bigger purchase risk here. We found around 75% of the time people are using online resources to compare these devices.” And where consumers used to physically visit stores to see and touch products and then go away and search online for the best deal, they are now looking for the same experience but in a virtual environment. So brands that create a virtual see and touch experience will win consumers over.

Shoppable live-streamed content like QVC is not new, but the adoption of live-stream content has been spurred by consumer demand during COVID-19. It is an interactive way to learn about brands’ product offerings and connect with like-minded individuals. For example, Caast is a live e-commerce specialist who integrates into e-commerce product pages and sales associates create videos demonstrating how to use products. Caast is seeing conversation rates rise by as much as 200-500% on the day live-streamed shows take place. In the consumer electronics space, the platform works with the likes of Dyson, Philips, and Samsung who create videos on how to use their products and have flash sales as well.

Chinese short video social platform Kuaishou is a great example of an app leveraging the power of community effectively. The app’s algorithm focuses more on the accounts users follow than their number of followers. These self-appointed Key Opinion Leaders (KOLs) are impactful to Gen Z’s purchasing power because they can influence their decisions with recommendations. In the year to November 2020, the Kuaishou grew eight-fold to $51.55bn which demonstrates the power of its community. And across the generations, GfK’s Chinese Home Appliances White Paper identified 29% of Gen Z are influenced by social media influencers compared to 25.7% of millennials, 11.9% of Gen X, and 9.4% of Boomers. Virtual Shoppers of all ages are also incredibly connected to their social media platforms, GfK’s Consumer Life Global data suggests 60% of global consumers visit social media websites multiple times a day.

Social selling has proven to be a great way to attract new customers. TikTok shopping, for example, experienced a 553% increase in the last 12 months. As 74% of global shoppers are now more inclined to shop via social media than pre-pandemic. The app successfully introduced Spark Ads which allows brands to pay to boost a creator’s organic User Generated Content (UGC). And a recent report by Stackla confirms 56% of shoppers this is consistent in other markets including the UK, Australia, and America.

There are however anomalies to this trend to virtual shopping – and where the other generations are moving more online, according to an A.T. Kearney survey, 73% of Gen Z like to discover new products in retail stores. From a global perspective, GfK’s Consumer Life Global data states 42% of consumers believe the look, feel, and smell of a product is important to them. So it’s important for brands to create a hybrid multichannel approach that intertwines the digital and physical. AR is a great way to create a seamless brand experience by delivering memorable activations. For Gucci and The North Face’s pop-ups, the brands created collectible virtual merchandise for Pokémon Go avatars. According to the brands’ data, this activation ensured the collection sold out within a day.

Online retailers like Amazon are meeting consumer demand for a more holistic shopping experience by entering into partnerships with brick-and-mortar stores. Their collaboration with Kohl’s allows virtual shoppers to return items on-site providing more convenience for Amazon shoppers and bringing more people into the store. With the desire to go back into stores when purchasing FMCG goods, e-commerce growth is starting to stall. The online experience for buying these types of products doesn’t present enough advantages to consumers.

What lies ahead for the virtual shopper?

Innovative virtual shopping experiences tap into consumers’ desire for a personal connection online. For example, Yahoo Ryot Lab has created a web-based AR activation, which is due to launch, where AR codes are embedded in the physical tags of clothing that will unleash a hologram of the designer to converse with fans. This is something that could be adapted to tech brands to explain the functionality and inspiration behind products.

A true understanding of how to merge the digital and physical worlds will be vital to success, as the desire for going back to stores is on the rise. Customers want to shop wherever and whenever they are. “Fluidity is the key word here and we’ve seen a real rise from retail partners across brick-and-mortar and their digital worlds. The virtual shopper wants to toggle whatever shopping modality is convenient for them at that moment,” says Beier. This demand for shopping innovation also applies to deliveries as consumers yearn for convenience. All-in-one apps that allow customers to manage their deliveries across different stores are filling a customer’s need. Route, an app that tracks deliveries from partnered merchants, has a Gmail extension that links to all of the users’ other orders. The app lays out all of the customer’s orders on the map with immediate access to its status changes.

Blockchain is a powerful tool for combatting e-comm data privacy issues as it offers smart solutions to cyber threats and financial security concerns. “As we find new ways to make e-commerce interesting for younger generations, blockchain technology will take over this space. Brands who explore this shift with blockchain will reap the benefits early on,” says McCabe.

Ultimately virtual shopping is now a must-have to attract customers that have a ‘try before you buy’ mentality. The experience must not only be accessible and social, but brands should avoid gimmicks and keep a functional focus. This can be curated by leveraging their consumer niche on social platforms such as TikTok, a leader when it comes to e-commerce success. Finally, AR is becoming a fast favorite with virtual shoppers as it creates both a convenient and customized experience, blending the best of all the worlds of the modern shopper.

Stay on top of virtual shopping trends

FAQs

What is virtual shopping?

Virtual reality retail experiences allow customers to experience, interact and then purchase products from within a VR experience.

How do virtual dressing rooms enhance online shopping?

Virtual dressing rooms allow consumers to see themselves in an outfit, makeup or even hairstyle. Being able to visualize size, style and fit eliminate questions in the consumers’ mind allowing them to reach a purchase decision. It also decreases returns as shoppers can try on items without touching them.