How brands and retailers can maximize margins in a turbulent Golden Quarter

With dented consumer confidence threatening to tarnish the Golden Quarter of 2022, brands and retailers will need to use every tool, insight and lever to maximize margins.

Global sales of consumer goods are down by 6%, and sales value is down by 5.5% on 2021 for the year to date, as a result of macroeconomic crises that will continue to impact sales as we enter peak season.

But it doesn’t have to be a bleak midwinter. “There are business growth opportunities in crisis,” according to Jutta Langer, Vice President of Consulting at GfK. “And those brands that are open to reassessing their strategy to ensure that it is optimized for this fast-moving consumer goods (FMCG) environment will be those that win.”

Global uncertainty dampens demand and confidence

Consumer confidence continues to be knocked by interlinked crises that have driven up energy prices and living costs – the bumpy pandemic recovery, the war in Ukraine, shortages of labor and raw materials, and geopolitical tensions between the US and China.

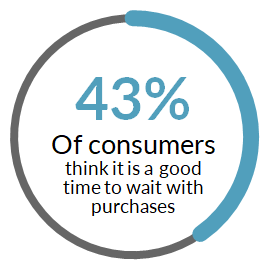

Against this backdrop, 43% of global consumers feel now is a better time to wait than to buy, up 3.4 percentage points on 2020 when the world was grappling with Covid-19.

Source: GfK Consumer Life 2022

The Golden Quarter will be more unpredictable and challenging this year

Peak season events such as Black Friday and Singles’ Day in China will present business opportunities for retailers to clear overstock they have built up due to supply chain disruptions. However, sales activity is likely to be less frenzied than pre-pandemic, judging by the muted response to Amazon Prime Day in July.

Michael McLaughlin, GfK’s Vice President of Retail, says, “We expect to see a good range of offers, but with price cuts less deep than in regular Black Friday years. Mid-market brands or mid-range products could struggle as cost-conscious consumers focus on entry-level products while affluent consumers continue to purchase premium goods, polarizing the market.”

The Fifa World Cup might bring short-term gains in Q4, but wary retailers will remember from previous tournaments that the event will likely only pull forward future demand.

It’s a conundrum for the industry, especially as some inflationary pressures are not yet factored into prices. Retailers are hesitant to pass these on to budget-conscious consumers, nor are they likely to find their suppliers willing to sacrifice margins.

“The industry is being squeezed from both sides,” says Langer. “Reduced demand is affecting the top line while cost increases are impacting the bottom line. Companies need to determine whether their priority is securing the top or the bottom line, with some difficult months ahead.”

Brands and retailers need to harness cross-functional expertise

Now more than ever, brands need to tap into the breadth of insight and perspectives within their organization to undertake comprehensive scenario planning and build strategies that will be salient in different local contexts.

According to Langer, “We’re seeing the biggest success from brands that bring together cross-functional expertise, both from inside the company as well as outside experts, to consider their strategy from all perspectives,” she says. “This lets them gain a view on how they are engaging with consumers across different touch points to create a coherent brand image.”

Brand opportunities as price-sensitive consumers look for the real deal

Media reports have sometimes questioned the credibility of peak season discounting events such as Black Friday. This year, retailers need to strengthen their messaging to convince consumers they’re delivering genuine value.

Due to polarization, ‘value’ will mean different things to different groups depending on their vulnerability to the economic climate, so consumer segmentation will be important in order to strike a chord with buyers. Last year’s segmentation model will no longer work.

“Retailers will need to offer carefully curated deals that consumers believe are authentic and resonate with them,” says McLaughlin.

The sustainability opportunity

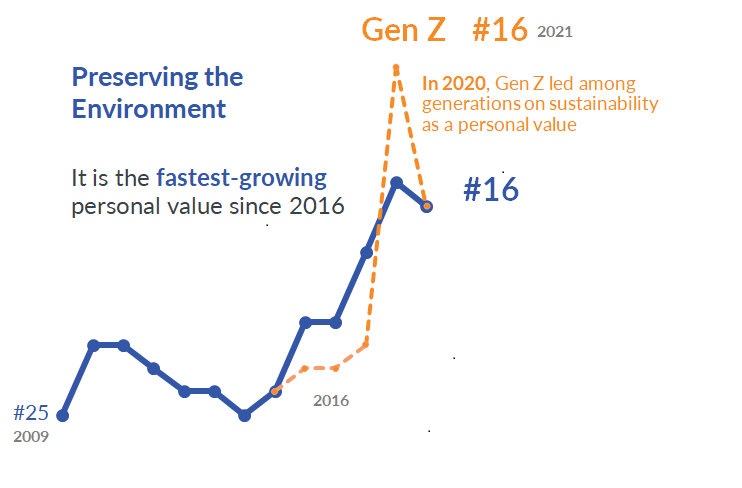

Sustainability remains a growing priority for both cost-conscious and affluent consumers of all ages. Preserving the environment was the fastest growing value for global consumers between 2016 and 2021, and by 2030 half the world’s population will be ‘eco-actives’ – people who invest energy and money in buying sustainably.

“Sustainability could be a trump card for retailers this year,” comments McLaughlin. “Consumers are shopping for purpose as well as products, so spotlighting sustainability in product descriptions and advertising could help products stand out.”

Source: GfK Consumer Life Global Green Gauge Report

One major business opportunity is to address a lack of awareness about environmentally responsible brands and reassure consumers wary of ‘greenwashing’ – inflated sustainability claims. 71% of consumers say it is important that companies take environmentally friendly actions, but only 19% can name an FMCG brand that is eco-friendly, and just 25% of them trust company claims about environmental practices.

Brands that can address this trust gap by emphasizing sustainability in product descriptions and promotional messages, or offering refurbished goods alongside regular products, stand to make gains.

Opportunity: markets are responding differently across regions

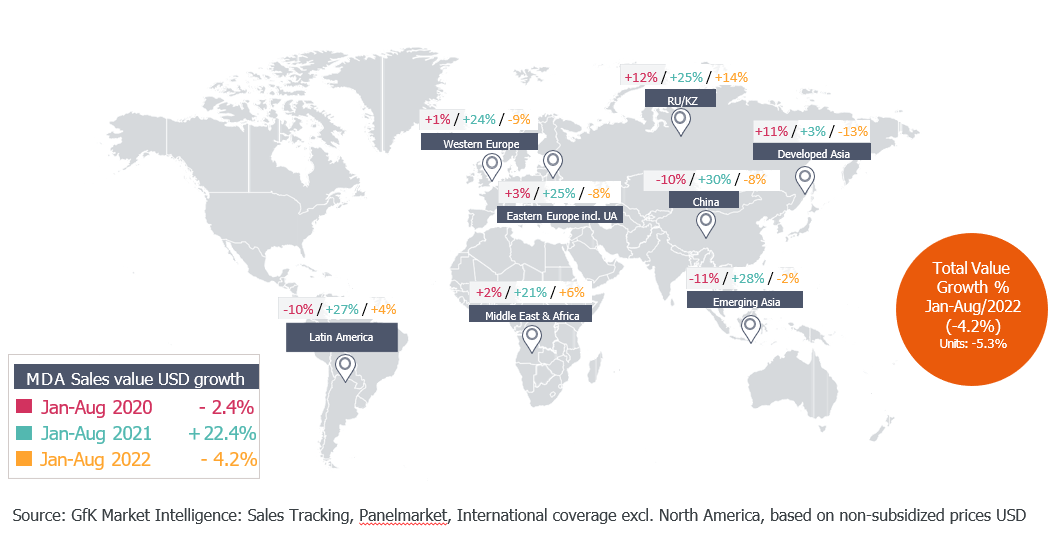

Demand deceleration has not been uniform across the globe. Q1 2022 sales growth slowed much more dramatically in developed markets compared with emerging Asia, Latin America and the Middle East and Africa.

For brands, this means no single solution or strategy that will work everywhere, but there is a business opportunity to spread risk and secure margins by pulling on different levers of growth in different regions. In high penetration markets, innovation can help drive growth and maximize profits. In emerging markets, powerful messaging matched by insight into changing consumer behavior will become the critical factors.

Conclusion

Although the Golden Quarter of 2022 looks challenging for the FMCG environment, pockets of opportunity exist. Emphasis on sustainability and long-term value will give brands and retailers an edge, while insight into regional variation will help identify resilient markets and develop successful strategies for different locations and scenarios.

Harnessing data, insight and cross-functional expertise will be more important than ever as the picture will change from month to month, and even week to week. This will help retailers connect the dots to develop bespoke and robust strategies to navigate uncertainty.

“In these times of uncertainty, people are looking for direction,” says Langer. “We are seeing changing consumer behavior as people re-evaluate their circumstances in the changing landscape. There are business opportunities here for brands and retailers to maximize profits, and potential gains for the top and bottom line.”

Find out how gfkconsult can help you develop winning strategies.

![]()