The Asia Pacific region presents new opportunities for fast-moving consumer goods (FMCG) businesses, but there are also complexities that companies need to consider when operating in the region.

With the lingering threat of COVID-19 and its variants, supply chain challenges, rising costs of raw materials, and geopolitical uncertainties, can we still expect a promising outlook for the FMCG industry in Asia Pacific in 2022?

In short, yes. In fact, NielsenIQ’s latest Retail Measurement Services (RMS) data shows that overall, there is 5.9% sales growth in 2021 compared to 2019 (pre-COVID). This growth is reflected in 9 of the 14 markets across the region. By the end of 2021, Australia, the Chinese Mainland, India, Indonesia, Malaysia, New Zealand, Singapore, South Korea, and Taiwan were all showing signs of rebound.

Optimism is high among FMCG CEOs

NielsenIQ’s latest CEO Outlook Survey, conducted across FMCG manufacturers and retailers in Asia Pacific, found that optimism is on the rise. Among those surveyed, 63% of the CEOs said that they are expecting growth of 5 to 15% for the industry and 69% for their company, respectively. This is a significant change in sentiment among these top leaders—in 2021, only 41% expected 5-15% growth for the industry and 53% for their organization.

Similarly, those who expected flat growth for the industry declined from 35% in 2021 to 25% in 2022. Likewise, 18% of CEOs foresaw flat growth for their companies in 2021, while just 13% reported the same sentiment this year. Forty-four percent of CEOs also confirmed that Asia Pacific has become more important to their global business.

Rising cost pressures

In 2022, the rising costs of raw goods and materials is the number one factor that Asia Pacific’s FMCG CEOs believe will have a significant impact on their businesses. With ongoing regional and global pressures, particularly supply chain issues, the emerging energy crisis, and various other uncertainties in the market, this will be a persistent issue.

Understandably, COVID-19 continues to be a top concern because of the threats of new variants and additional rounds of health and safety restrictions. When it comes to running their businesses, the CEOs also list inflation, inconsistent supply of raw materials, impact of higher prices to market share, higher employee turnover, and increased competition as top concerns.

We are still seeing divergence in consumer behavior and spending habits, especially among the constrained consumers that have been affected by the economic conditions of the last 12 months. The CEOs recognized this as a top concern along with how consumers would react to higher prices of goods resulting from the rising cost of raw materials.

Talent is key

With unpredictable demand, many FMCG companies are investing heavily to improve internal efficiencies. Like last year, digital transformations are top of mind.

One notable change this year is how CEOs regard people development. In 2021, only 20% of CEOs saw talent development as a priority. Now, nearly 30% plan to spend more time and effort on talent development to maximize outcomes for their businesses.

This change indicates more widespread recognition that quality of talent is crucial for successfully navigating the complexities and fast–evolving environment in Asia Pacific.

Renewed emphasis on demand generation

Driving demand through marketing and engagement is another focus area for CEOs in the Asia Pacific region this year, in addition to securing supply chains and navigating ongoing distribution disruptions. In 2022, CEOs are focused on rebuilding consumer confidence and engagement with the right messaging, particularly around new innovations, across the marketing funnel.

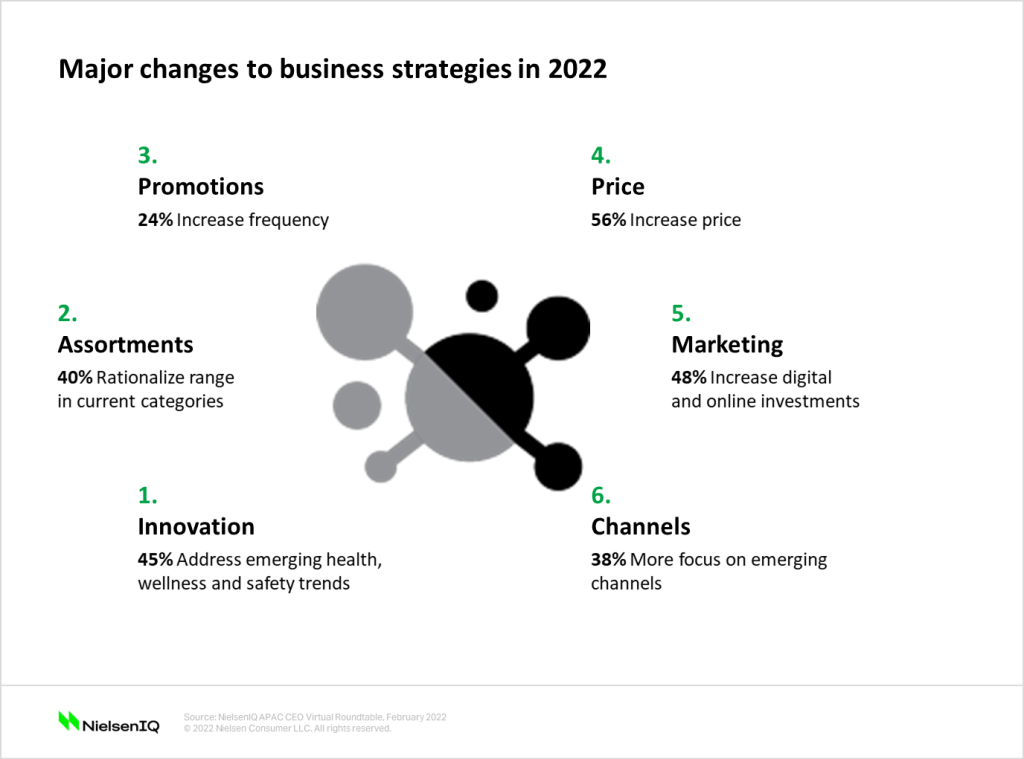

We also asked the CEOs about the major changes to their business strategies in the areas of innovation, channels, marketing, assortment, promotions, and price. Their answers revealed a mix of focus areas, that were consistent with data trends from NielsenIQ’s RMS, Consumer Panel, and E-commerce solutions.

For instance, in terms of innovation, 45% of CEOs identified addressing emerging health and wellness trends as a major change. In a recent NielsenIQ global health and wellness study, more than half of respondents in Asia Pacific said that they are proactive about their health. This growing emphasis on health is also reflected in our RMS data, which reveals substantial growth for the over the counter (OTC) and health supplements category with an 18.5% increase in 2021 versus 2019, and 16.1% growth in 2021 compared to 2020.

The chart below outlines the changes that the CEOs have identified:

While there is still uncertainty in Asia Pacific due to a variety of factors, the outlook from the region’s FMCG leaders is largely positive, and the numbers reflect their optimism.