Social selling has taken off in China but has yet to catch on across the rest of the world. That could be about to change in a big way. While brands outside China have been comparatively slow to pick up on the trend, the country’s experience provides clear evidence of the value that social selling can generate. It also gives brands insight into what strategies do well on social platforms and the reasons why.

For brands looking to capture the huge potential market opportunity social selling offers, the priority is first understanding how it differs from more established processes – and how to adapt strategies accordingly.

What is social selling?

Many brands use social media to build a stronger and more visible brand profile across the channels where customers spend their free time. The social media presence of companies has tended, therefore, to be solely the concern of marketing teams.

But social media channels can be leveraged by sales teams too to interact directly with potential buyers in a much more targeted way. This is what social selling is all about. It allows brands to better identify and listen to their target audience, before engaging them in a way that focuses on relationship and credibility building. It can be easy to forget just how huge this potential audience is too. There are currently around 4.7 billion active social media users around the world – 59% of whom spend over two hours and 29 minutes on their chosen platforms a day.

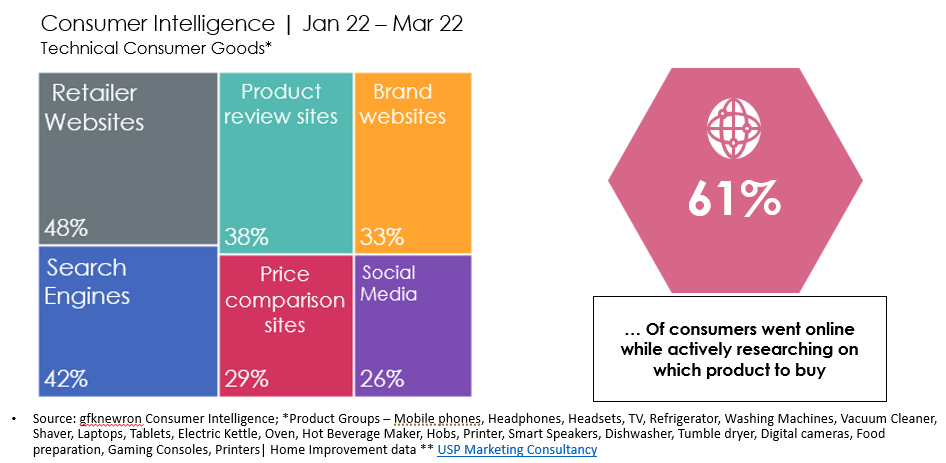

Social selling looks to form and maintain connections over time. This means it can seem less intense for consumers than more traditional, sales-focused approaches. This may be more appealing to consumers in a period of increased market uncertainty where high inflation is leading many households to withhold purchases of big-ticket items. Social media is also an important tool for brand and product research with 26% of consumers researching technical consumer goods online utilizing those channels.

A big hit with Chinese consumers

The Chinese market has seen an acceleration in social selling in recent years. The country has a huge active social media population – with Tencent’s multifunctional social media platform WeChat boasting over 1.2 billion users. Like many other economies, China was severely impacted by the Covid-19 pandemic. Consumers quickly shifted to making more purchases online. This can be seen in the expansion of the share of Consumer tech and durable goods purchases being made online, rising from 36% in 2019 to 47% in 2022.

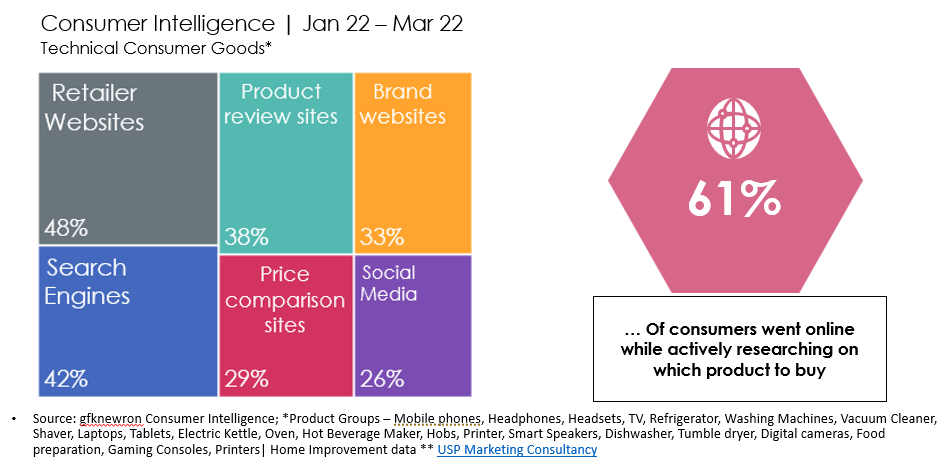

Since 2020, the number of sales being made through social selling in China has grown significantly. For male electric shavers, for example, 3.2% of online sales came from social selling in 2020. By 2022, that will have jumped to 14.8%. Consumers are now using both online e-commerce sites like JD.com as well as social platforms such as TikTok. In 2021, social commerce across the country’s social channels generated $363 billion in value for brands. While this still represents 13% of total e-commerce sales, it is also triple the amount that took place in 2018.

The scale of the social selling opportunity for brands in China is evident when you look at the reach of the country’s influencers. In October 2020, popular influencer Viya livestreamed on Alibaba’s Taobao platform (where viewers can watch as well as purchase products) to an audience of over 149 million people. That’s more than the entire population of Russia. The result? The audience spent 4.8 billion yuan ($719 million) on products that Viya promoted.

Lessons for brands

China’s success in setting social media market trends has not gone unnoticed. Platforms around the world are looking to create the kind of engagement that Viya and Alibaba have produced and are introducing a range of new features to try and capitalize. Amazon first introduced a feature to allow livestreaming in order to promote products and, in 2020, began allowing content creators to earn commission on sales they help facilitate. The partnership announcement between Shopify and TikTok that allows merchants to deploy video ads directly onto the platform is an indication of things to come in social media trends.

For brands looking to maximize selling through social media opportunities, the first priority is to choose the right networks. From there, the task becomes identifying your audience, listening to them and beginning to build engagement. The choice of network will depend on both the audience you are targeting and your intended approach to social media selling. While Instagram may be the best choice for B2C retail in certain countries, LinkedIn is considered by many to be the right platform for B2B retail. The Linkedin Social Selling Index (SSI) tool, for example, enables brands to measure how well they are using their accounts for social selling by assigning them a score out of 100. This Linkedin SSI Score is based on their performance in four criteria: establishing a professional brand, finding the right people, engaging with insights, and building relationships.

An untapped opportunity

2022 has been marked by a slowdown in sales across many product segments as continued market uncertainty and high inflation force households to more carefully consider their purchasing behavior. For retailers and brands looking to continue to drive sales, the example of China shows that social selling has huge potential. Not only are consumers spending significant amounts of time on social media, but they are increasingly using it to research products as well. Social selling offers brands the chance to turn this research into sales.

Being a first mover requires high-quality data and strong strategies. gfkconsult can help with both.

![]()