While brands are being pulled in all directions over the cost-of-living crisis, many households are hunkering down for a hard winter in the expectation that high inflation is here to stay.

You can’t blame them. A year ago, the International Monetary Fund expected global prices to ease during 2022 with raw material shortages and sky-high energy costs settling down as the pandemic recovery calmed. Then came the war in Ukraine. Russia’s invasion in February inflamed supply and demand imbalances and inflation soared to its highest seen in decades.

By October, IMF forecasters expected global inflation for 2022 to average out at 8.8%, more than double its January projection. They expect the rate to fall slightly next year, reaching 4.1% by 2024, but admit the outlook is uncertain, and disillusioned consumers will take some convincing to regain confidence.

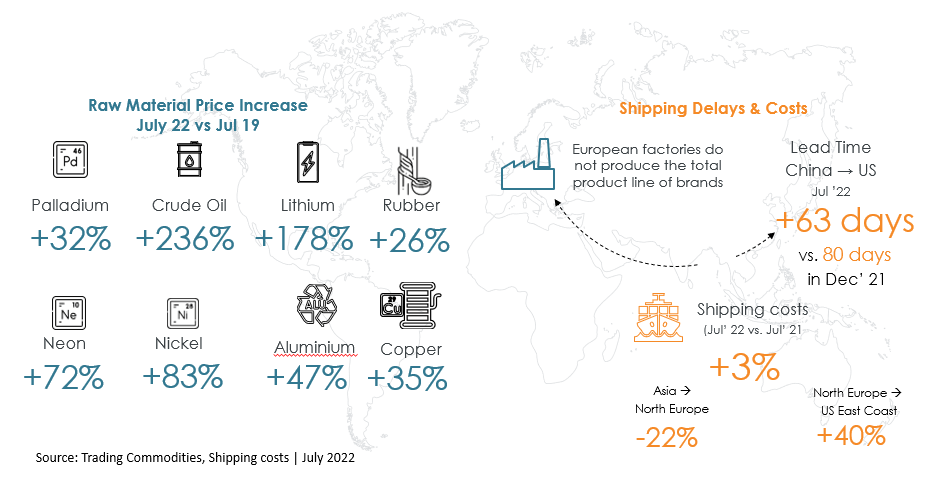

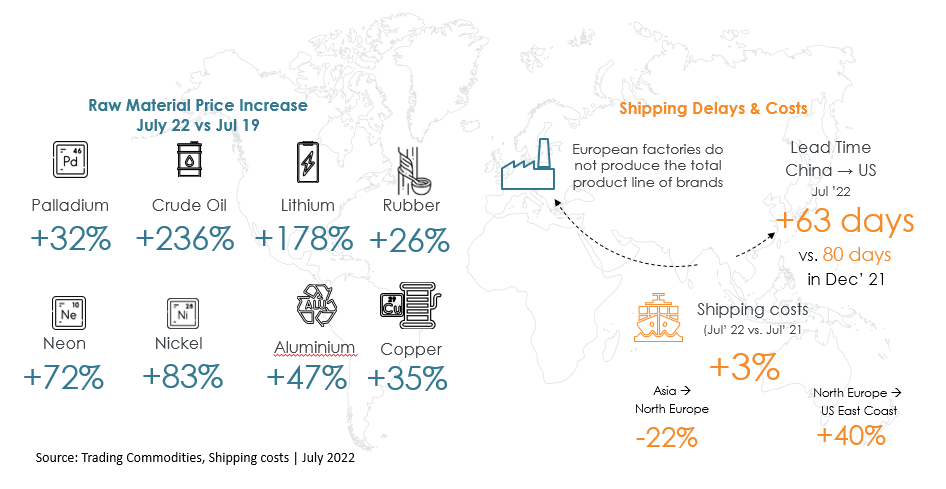

Supply chain disruption and high prices for raw materials persist in 2022, piling pressure on brands. The cost of aluminum, palladium and copper fell in the year to August 2022, but crude oil shot up by 34% and lithium by a staggering 434%, driven by increased demand from the electric car industry. Although shipping costs are now decreasing steadily, they remain elevated compared with previous years and the threat of disruption, for example due to the Covid-related lockdowns in China, is still present.

The knock-on effects of these price hikes are not fully reflected in the market, says Jutta Langer, GfK’s Vice President of gfkconsult. “Yet we are hearing both from industry and retailers that quite a number of negotiations are taking place and there are more price rises to come.”

For manufacturers and retailers accustomed to planning three-to-five years ahead, the future has an unnerving number of forks in the road. Should they pass on higher production costs to consumers and try to secure margins or cut prices hard to tempt hesitant consumers to reopen their wallets?

Here we look at three ways for brands to stay focused on sustainable growth during this uncertain inflationary environment.

Stay focused on what’s sacred to the consumer

When values and life experience are under threat due to financial hardship, brands need to move with their consumers, echoing their priorities and motivations. It’s important to position yourself as a brand that understands and can help people through the crisis.

This doesn’t necessarily mean cutting prices, says Madalina Carstea, Head of Global Sales, Brand and Marketing Intelligence at GfK. “People are looking for things to give them joy, positive energy and hope,” she says. “They will gravitate towards brands that make them feel good and offer them small ways to pamper themselves. There is still a space for brand loyalty and affordable indulgences.”

After two years of Covid cancel culture, people will not give up easily on their holidays and other travel plans. German consumers, in particular, prize travel and would rather spend less on the weekly food shop than sacrifice a family holiday. So, it’s essential to understand what is motivating the purchase decisions of different consumer segments in different geographic regions. Using tools such as GfK’s Growth Architect to understand your target groups and what they value will help you shape a better value proposition that justifies premiumization.

The premiumization trend has been one of the big stories of the pandemic and our research shows that it is on pause rather than in decline in the face of inflationary pressure. Average e-commerce prices in the first half of 2022, for example, remained on par with H2 2021 despite a sharp drop in sales volumes over the same period.

However, brands now need to justify their prices more than ever, says Langer. “A lot of premiumization is cost-driven not value-driven,” she says. “Brands that pursue this model during a cost-of-living crisis risk coming across as tone deaf.” Companies need to conduct pricing studies to understand consumer motivations, find out what’s sacred to them and which products can withstand premiumization. “Remind them there’s a reason they pay a premium for your brand,” says Langer. “If you stop reminding them, they’re going to go for the cheaper option.”

Stay focused on assortment optimization

High energy costs and raw material prices may be a universal problem for manufacturers, but the way consumers are impacted varies greatly depending on their personal circumstances and where they live in the world. In some countries, government intervention has softened the blow of rising energy bills. While consumers on lower incomes are cutting back on non-essential items and delaying purchase decisions of technical consumer goods, a tranche of affluent customers remains unaffected by the cost-of-living crisis. Brands can capitalize on this polarization by optimizing their assortment strategies to cater to different types of customer. Rather than trying to achieve personalization, they can save money by using growth architecture that look for meaningful commonalities.

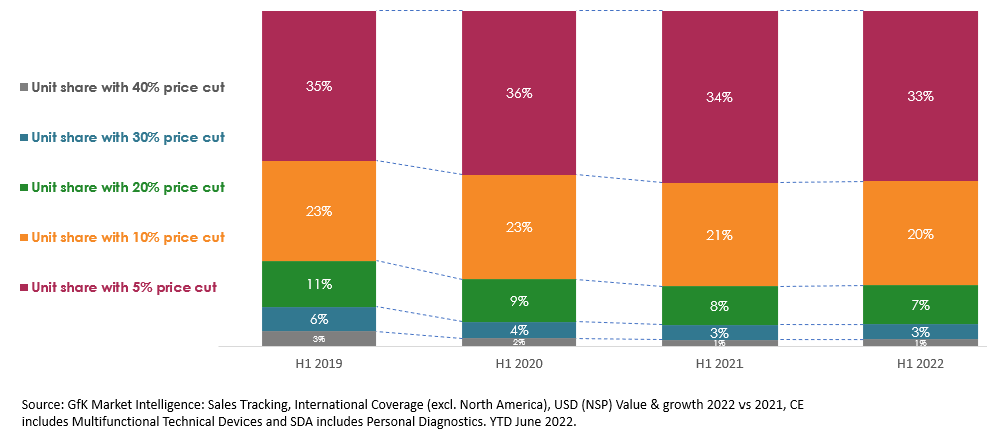

The households hardest hit by rising living costs will be looking for genuine discounts this year, yet our research shows that brands are not offering such generous e-commerce promotions as in pre-pandemic times. In the first half of 2019, a fifth of discounted online technical goods had price cuts of 20% or more. By H1 2022, however, only 11% came with such generous promotions. Lower discounts of 10% or less have been the norm since 2021. However, strategic use of promotions will be essential this year in order to stimulate demand in the face of dramatic deceleration. Due to the heavy pressure to clear inventories, we expect to see strong Black Friday discounting, for example, on TVs, cordless vacuum cleaner handsticks and lower-priced IT products, which have all experienced particularly weak demand this year.

Stay focused on sustainability

With less incentive for consumers to simply ‘do the right thing’, brands might be tempted to put the climate crisis agenda on hold to focus on short-term concerns. This is risky, however, because pressure from major regulators such as the European Commission continues to mount, and consumers will add to the rallying cry for sustainable products once the economy bounces back.

Instead of changing course, brands should be explicit about how sustainable products can help consumers can make day-to-day or long-term cost savings, for example through durability, repairability, energy efficiency or lower absolute energy consumption over the lifecycle of the product.

Are you maximizing opportunities to sell refurbished products? This could be a cost-effective way to help shoppers save money while addressing the circular economy principles gaining traction with both consumers and regulators.

Stay focused on long-term strategic thinking

It’s natural in times of uncertainty to focus on firefighting, reacting to current shocks rather than proactively planning for the future. However, our research from past crises shows that brands that maintain their long-term vision in times of turbulence and continue to invest in innovation are much better placed to bounce back when the crisis recedes. In our analysis, brands winning in market share clearly outperformed in bringing new products to market, hence demonstrating strength in innovation to consumers.

Brands will need to fine-tune their business plans every quarter to stay abreast of the shifting consumer landscape. But they should also stay focused on where they are going and why, aligning their actions with their brand strategy. Instead of completely ditching the three-to-five-year plan, brands need to get comfortable with uncertainty through greater scenario planning, focusing on flex and resilience rather than trying to prepare for all possible outcomes.

Juggling prudence and ambition, pressure from consumers, HQ and stakeholders, brand professionals will need to provide strong evidence to back up their strategies. Above all, they should stay focused on knowledge investment, leveraging the power of accurate real-time data and market insights to align the strategies of different departments and ensure the brand speaks with one voice.

![]()