The cost-of-living crisis is leading consumers to shop more cautiously. Amid a broad-based drop in consumer spending, sales across product segments and key markets are declining, with only limited signs of a lipstick effect offering hope. But while the challenging economic environment is expected to continue, there are more optimistic signs in the technology and durables (T&D) sector, where high-performance products are continuing to outperform their categories. To offset stagnant sales in other categories, how can businesses leverage high-performance products to drive growth and where should they focus innovation in the future?

Premiumization slows

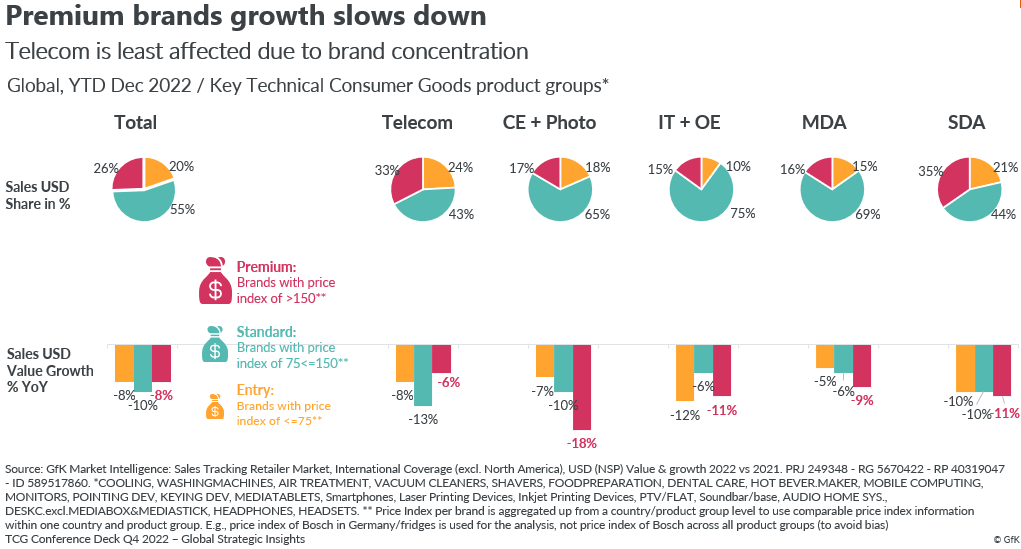

Premiumization has been a long time trend and has been a major driver of growth for the T&D sector as consumers sought out larger, faster or better-equipped devices when making new purchases. But with the cost-of-living crisis forcing consumers to review their shopping habits, the value of premium brand’s product sales in 2022 has fallen – down from growth of 32% in 2021 to a contraction of 8% in 2022.

Across almost all segments in the T&D sector, premiumization has slowed. While telecom has fared relatively better, premium brands have recorded significant contractions in other segments, notably consumer electronics and photo sector, and major domestic appliances (MDA). In consumer electronics and photo sectors, premium sales contracted 18% in 2022, with entry-level brands falling only 7%. In the SDA sector, premium sales in 2022 dropped 11% whereas both standard and entry brands saw sales decrease 10%.

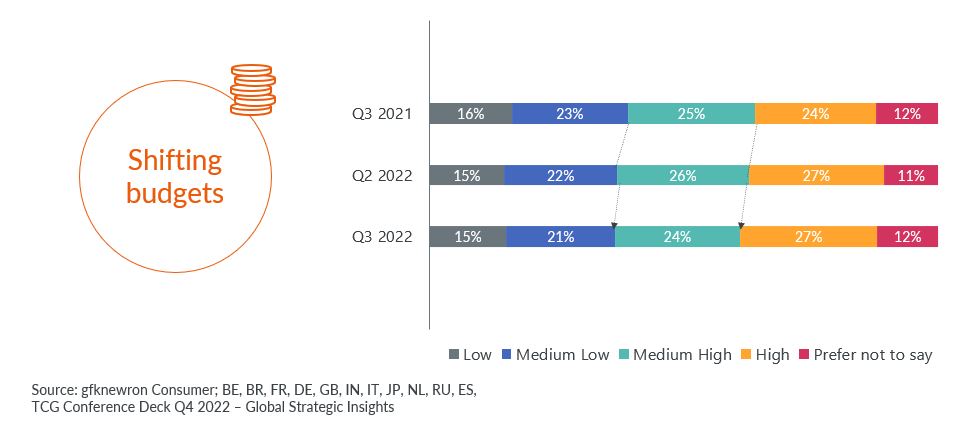

With less disposable income, many consumers are turning away from larger purchases and opting to shop for brands with a lower price positioning. The share of tech and durables purchases by low and medium-low-income buyers has fallen from 39% in Q3 2021 to 36% in Q3 2022. Meanwhile, high-income buyers were responsible for 27% of purchases in Q3 2022, up from 24% in Q3 2021. This has led to price polarization, with demand for lower-priced products driven by budgeteering consumers while higher-income buyers are providing support for premium products. And with high-income buyers now responsible for a larger proportion of spending, it’s even more important to understand what they are looking for and how to engage with this market.

High-performance products are boosting sales

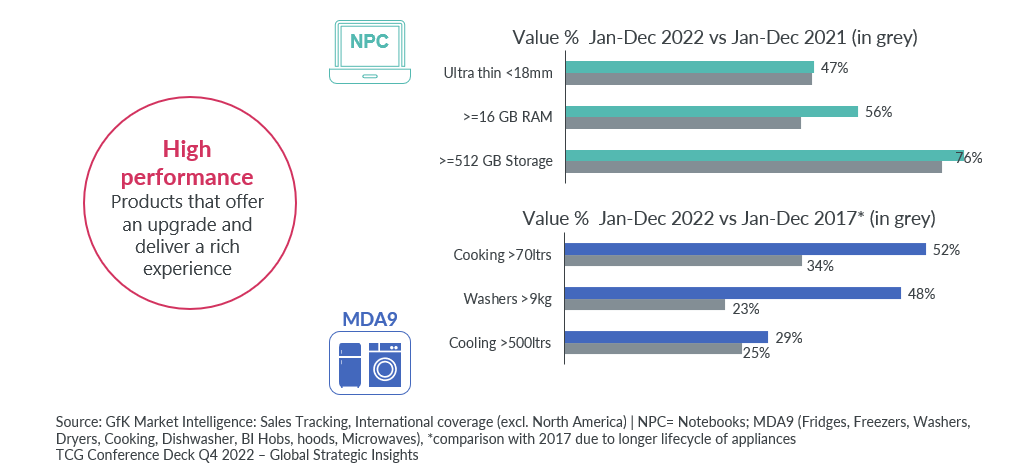

Our research shows that the consumers continuing to purchase tech and durable products are choosing to shop for high-performance products that offer an upgrade or deliver a richer experience. These high-performance products are outpacing their categories, highlighting pockets of opportunity for future tech market growth.

This effect can be seen in the notebook PC segment, where products such as 16 GB RAM and 512 GB storage devices have performed very strongly against the year before, now occupying a share of 56% and 76% respectively in 2022. Similarly, higher-capacity household goods, such as cooking devices, washing machines and fridge-freezers, have also grown in market share considerably.

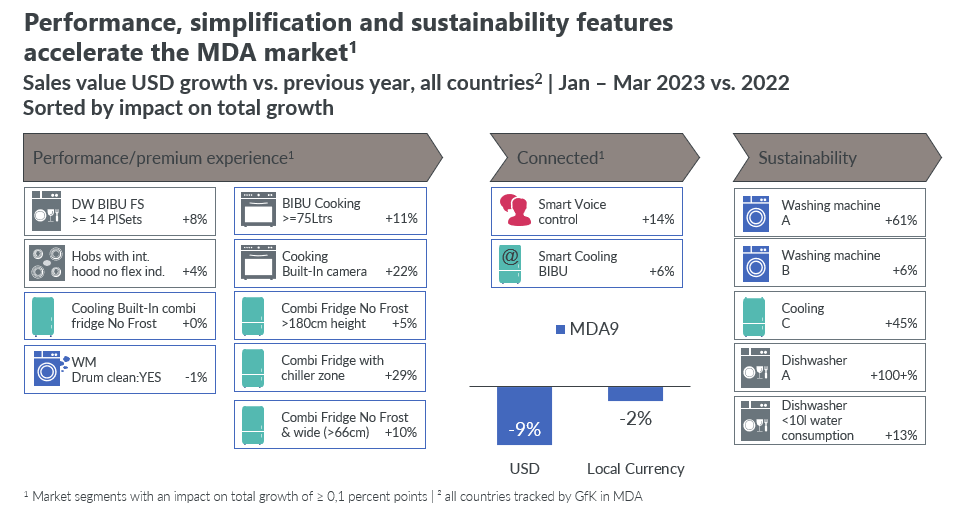

In addition to higher capacity products, high-performance features, smart connectivity and more sustainable options are increasingly popular with consumers. Growing demand for self-cleaning washing machines and hobs with integrated features demonstrates that consumers with bigger budgets are prepared to pay more for convenience as well as capacity. Meanwhile, connected devices, such as those that incorporate voice control or fridges with smart cooling features have also significantly outperformed their categories. There was a 14% increase in the sales value of smart voice control appliances in the first three months of 2023, when compared to the previous year. Consumers also have a wider range of sustainability-related features to choose between, including reduced water consumption and smart features for more efficient energy usage. The strong performance of these products provides more evidence that consumers’ increasing eco-consciousness is translating into purchasing decisions.

Understanding the features consumers will pay more for

By understanding these trends, brands can adjust messaging and promotions to help drive demand for their products. Emphasizing the lifestyle or convenience benefits of multi-functional or smart devices will appeal to the high-income consumers who are insulated from the immediate impacts of cost-of-living pressures.

While many consumers are shopping more cautiously, high-performance products are still in high demand, providing some much-needed optimism for the T&D sector. Businesses looking to boost sales and capture changing consumer behavior should pay particular attention to products that improve performance, provide a richer experience or offer enhanced sustainability as potential drivers of tech industry growth.

Performance-enhancing features are continuing to sell strongly and may offer a valuable source of growth for businesses. Speak to gfkconsult today to understand how high-performance products can drive business performance.