Across Europe’s four major markets of France, Germany, Italy and the UK, people’s focus on sustainability is again on the up.

Even more importantly: in these countries, over two-thirds of people who say they are intending to make a sustainable major purchase over the coming 12 months, also say they are willing to pay a higher price for it.

This is a lucrative audience for consumer tech & durables (T&D) manufacturers and retailers, as we forecast that eco-active shoppers will be spending $700 billion globally on T&D by 2030.

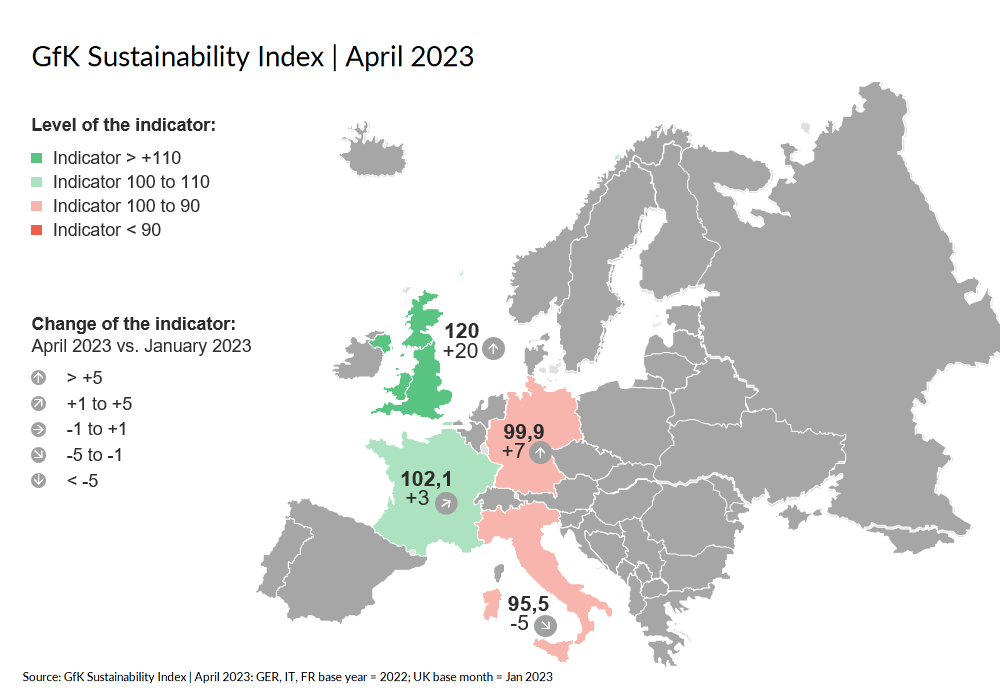

Shopper focus on sustainability is increasing as consumer sentiment stabilizes

As consumers adjust to their new economic landscape, their desire to take sustainability into account when making purchases is again increasing.

Compared to January this year, the UK, Germany and France have all seen increases in people’s sustainability index rating, with the UK in particular jumping +20 points. This makes the UK the strongest growing country of the four, in terms of overall Sustainability Index rating.

Only Italy saw a decrease, with consumers still very much focused on the continued higher cost of everyday living.

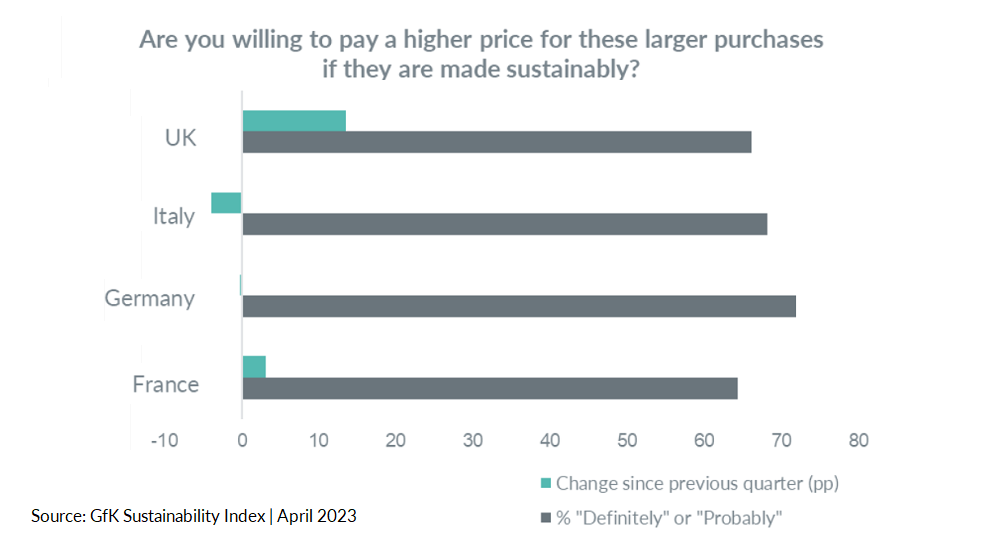

Willingness to pay more

All four countries are seeing encouraging percentages for the number of people who are willing to pay a higher price for their intended major purchase, if it is produced in a sustainable way.

Looking at country level:

- Germany is slightly ahead of the others for those willing to pay more

- but it is in the UK that we again see the strongest increase in numbers, since the previous quarter, followed by France.

- Italy was the only country showing a slight decline in numbers, triggered by the persistence of high cost of living concerns, in particular for everyday purchases.

Brands must focus on trust issues, and balancing consumers’ conflicting interest

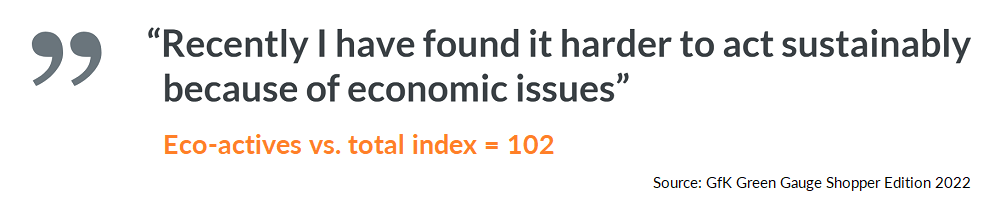

Right now, the majority of consumers are balancing their eco-aspirations against the increased strain on their wallets from the heightened cost of everyday living. Even “eco-active” shoppers, who are highly concerned about the environment and taking direct actions to reduce their waste, are struggling to balance the current increase in cost of living with their desire to act and shop sustainably:

Manufacturers and retailers can focus their strategy around two key areas that can help encourage shoppers’ eco-spending intentions:

- Trust in eco-credentials. In Germany, only 20% believe the claims that companies make about their environmentally friendly activities. To break through this scepticism of ‘greenwashing’, sustainability can’t be an afterthought; it needs to be integrated into each aspect of a product. Brands must communicate the way in which sustainability is baked into their products’ DNA. A full-spectrum eco-focus that includes not just the product’s packaging, raw materials, recyclability, but also the distance it’s travelled and how, it’s increased repair-ability and durability, it’s reduced consumption of energy or water, the welfare of the company workforce, and the company’s championship of major causes.

- “Affordable premium”. For big-ticket purchases in particular, consumers are operating within a budget, but are likely to seek out the highest value replacements they can afford within that. Consumer tech & durables manufacturers and retailers can help drive interest in ‘affordable premium’ range products by clear marketing that highlights the additional functions, features and ‘product lifetime value’ savings that the small extra outlay will deliver to these shoppers – including critical 360’ eco-credentials such as energy use, materials, location of manufacture, durability and repair-ability.

Get this right and the potential for cornering this growing area of consumer spending is huge:

“There is a gap in the market for a tech manufacturer that is committed to a truly 100% sustainable product. This could mean an innovation that isn’t even feasible with traditional materials or production methods.”

– Madalina Carstea, Head of Global Sales, Brand & Marketing Intelligence, GfK

Continue to explore how environmental concerns are influencing consumer attitudes and buying behaviors:

![Understanding your audience: The power of segmentation in retail [podcast]](https://nielseniq.com/wp-content/uploads/sites/4/2025/07/Podcast-Understanding_your_audience-The_power_of_segmentation_in_retail-mirrored.jpg?w=1024)