For most brands, customer loyalty has been one of the casualties of the cost-of-living crisis. However, for some fast-moving consumer goods (FMCG) categories, channels and products, customers are proving sticky despite low consumer confidence. Understanding why will help businesses adjust their marketing tactics to appeal to shoppers and preserve brand loyalty during 2023 and beyond.

Here are six strategies that have emerged from GfK consumer research in 15 European countries during 2022, including our Behavior Change Surveys in April and November.

Empathize through action

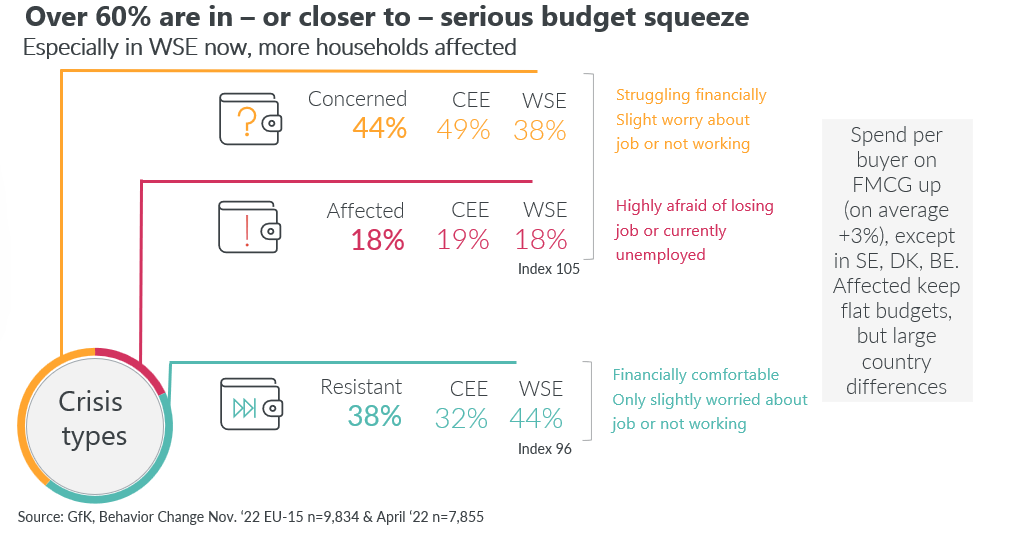

Households across Europe are feeling the squeeze, with more than six in 10 people struggling financially and either out of work or worried about job security. Almost three-quarters are routinely saving energy at home by turning down temperatures, taking shorter showers and using household appliances less. For 55% of people, saving money wherever they can, including on daily staples, is not a choice but an imperative.

When it comes to FMCG, impulse shopping or buying more than necessary are things of the past for many. One of the top coping strategies for struggling households is to plan recipes according to a budget (this was one of the least popular options for comfortable households). And, when asked about their intentions for the future, consumers are also planning to cut down, or cut out, alcoholic drinks, confectionary, cosmetics, frozen food, and meat and fish.

These coping strategies are expected to intensify over 2023 while inflation remains high. Brands that recognize this and can address the negatives of austerity through positive messaging have an opportunity to increase consumer loyalty by helping their consumers cut spending where possible. For example, washing detergent that performs well at low temperatures or meals that requires a shorter cooking time can help households save energy.

The need to cut food waste is another consumer coping strategy that brands can turn to their advantage. Danish grocery retailers are jumping on this trend by suggesting recipes for fridge leftovers, selling ‘surprise bags’ of surplus stock, and offering odd-shaped vegetables at affordable prices.

Through marketing strategies based on empathy and providing meaningful solutions to real-life needs, companies can gain trust and loyalty, while giving consumers a reason to keep a brand in their basket.

Persevere with premiumization

Private labels were the FMCG winners in 2022, contributing 70% of growth in the market, especially in the dairy and food segments, though not in beverages. This reverses a trend seen during the pandemic when brands wielded more power than private labels.

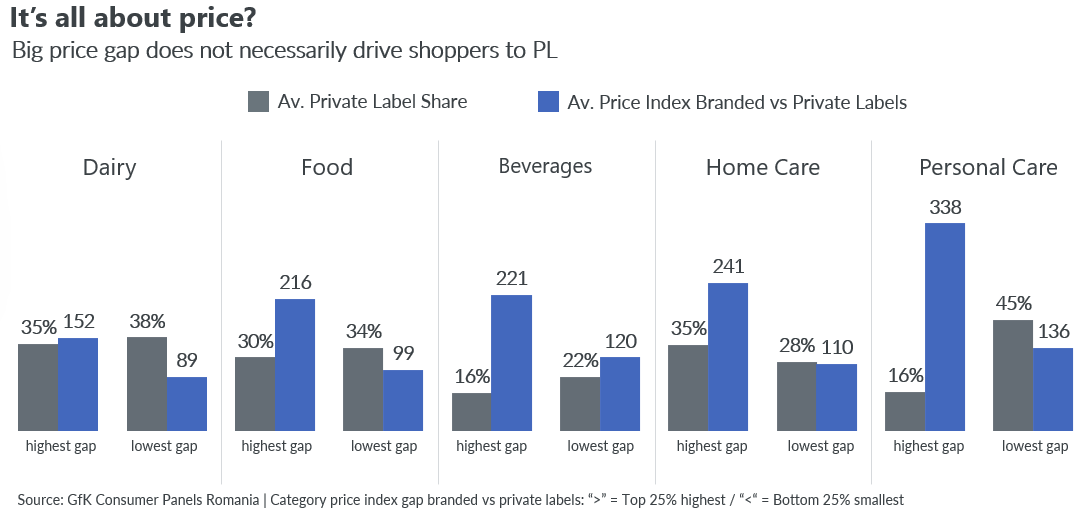

To prevent an exodus to private labels, it might be tempting to discount prices to drive volumes. However, this might not be the best sales strategy. The chart below from Romania shows that price discrepancy is not always the clinching factor where private labels dominate. For exmample, in categories like beverages where private labels are less than half the average price of branded labels, private labels hold only 16% of the market. Where there is less of a price gap, private labels actually have more market share. The same goes for personal care products, showing that price is not everything even in these cost-conscious times. Value is the priority, and brands that can deliver on innovation and perceived quality can maintain trust and dominate the market, even at higher prices.

Our findings also show that, although loyalty decreased for seven out of 10 brands in 2022, some categories preserved brand loyalty better than others. People were more likely to stick with their favorite brand of toothpaste, shampoo and coffee, for example, than milk, yogurt or ice cream.

To understand this, one needs to consider the investment that companies have made in developing their products over the years. It is essential that marketers keep delivering on the basics of product, price, and trust, to drive sales volumes. However, to build a premium product that can withstand competition from private labels, brands need to bring additional value, offering superiority in terms of purpose-driven products, undeniable product excellence and uniqueness.

Brand premium is what gives power brands such as Pepsi, Apple, Microsoft, Starbucks and BMW their advantage. Decades of investment have paid off for these brands, with consumers willing to pay more even though disposable incomes are squeezed. Retaining and building the value of your product should still be a priority. That way, when the crisis ends and the premiumization trend returns, your product will be ready to reap the rewards.

Avoid broad-based discounting

Even when facing a crisis, brands need to maintain a consumer-centric strategy. Identify what shoppers want from your products and give it to them at a price they are happy to pay – without devaluing your brand or making it unprofitable.

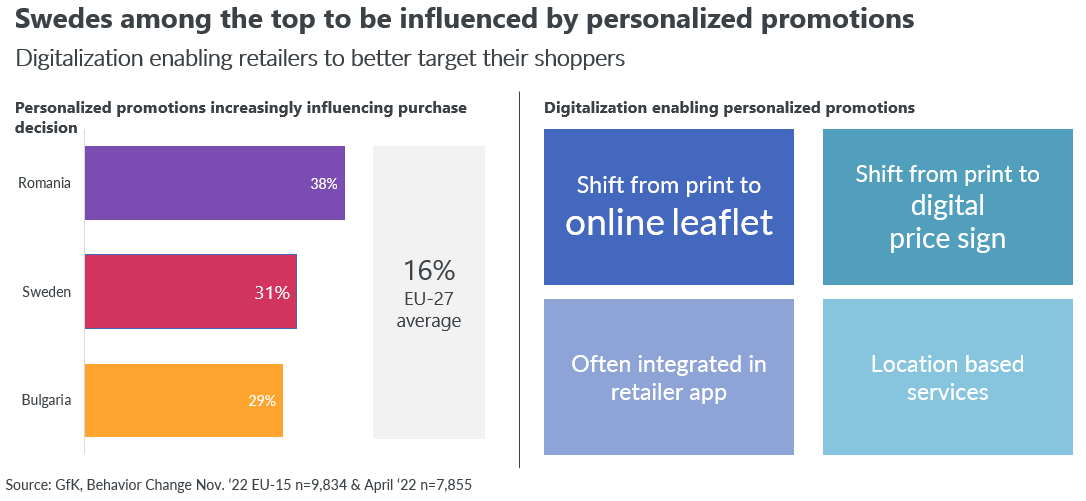

If price reduction is the only option to grab consumers’ attention and drive volumes, then do it through personalized promotions that clearly frame the change as a one-off personalized offer. Digital loyalty schemes, price signs and leaflets targeted at individuals are on the rise in the EU, influencing 16% of purchase decisions in the bloc last year and resonating particularly strongly with struggling households.

Personalized promotions have become the norm for grocery retailers in Sweden, where 90% of the population have at least one loyalty card through which they can secure cheaper prices on items they often buy or receive personalized product suggestions. Consumers in Romania and Bulgaria are also attracted by personalized promotions, which influenced 38% and 29% (respectively) of purchase decisions in 2022.

Be where the shopper is

When consumers choose which stores to visit, the presence of well-known brands is not the priority it once was. Factors such as self-checkouts, loyalty cards, attractive promotions and proximity have become more important.

Online, however, brands big and small are still thriving, especially e-grocery and category specialists.

In terms of the categories that consumers intend to buy online in the coming months, we see the most potential in the home care and personal care categories, followed by staple foods, pet supplies and alcoholic beverages. Given that struggling households have signaled their intentions to cut back on cosmetics and alcoholic drinks, this makes the online channel a vital way for brands to establish touchpoints with potential shoppers.

Delivery costs, however, are increasingly a dealbreaker for online shoppers, so brands and retailers should avoid adding to the cost of the overall basket by charging for delivery.

Stay true to your brand strategy

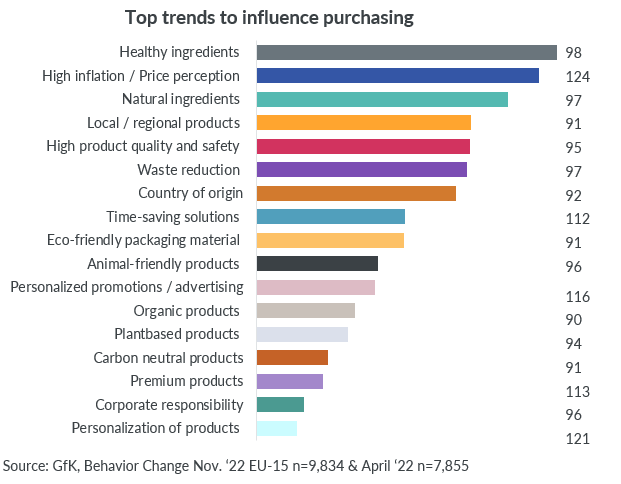

To override consumer cautiousness, it is important to understand what shoppers care about beyond the cost of living and incorporate it into your brand strategy.

Healthy and natural ingredients remain top priorities, even for struggling households. And healthy product claims are diversifying beyond the usual suspects of ‘no artificial ingredients’ and ‘low sugar’ to include additional factors such as ‘rich in protein’, ‘lactose-free’, ‘gluten-free’ or highlighting the presence of specific nutrients. Around 4% of Europeans now live a vegan lifestyle, 9% are lactose-intolerant and 11% have diabetes, so brands that cater to these needs can expect demand for their products to continue.

Corporate responsibility, carbon neutrality, and plant-based and organic products may have slipped down the list of trends influencing purchasing, but it would be a mistake for brands to take their eyes off eco-conscious consumers. Some 23% of European consumers fall into this ‘eco-active’ segment and they tend to include the financially comfortable consumers who are more willing to pay premium prices now. The segment is also expected to grow considerably in the coming years.

Lead from the heart

The fastest-growing trend in Western Europe in 2022 was ‘belonging’, reflecting a growing desire, especially among Gen Z and Millennials, to feel part of a wider community driving positive change. Cash-strapped consumers may be making cost-conscious choices right now, but even in uncertain times, brands have everything to gain from connecting with consumers on an emotional level through positive and inclusive messaging. A strong understanding of your consumers is critical to ensure your brand purpose is aligned with the values that matter to them.

Find out how GfK Growth Architect can help you develop a consumer-centric strategy, or speak to us about building a strong and resilient brand with GfK Brand Architect.

![]()