Retailers sell more than merchandise: Monetizing customer loyalty program data

The retail marketplace is competitive, so much so that retailers look outside of physical stores for strategies to grow their businesses. A popular tactic: monetizing their customer loyalty data through collaboration programs with their supplier partners.

Customer loyalty program data — voluntary demographic and shopping behavior information — is collected from customers when they use their loyalty card for purchases at a store. Customers receive incentives like exclusive offers, discounts, and rewards; in exchange, retailers gain critical insights into how they shop to better engage with them. Retailers use this information with the goal of understanding how to increase their share of wallet (the percentage of dollars spent at a retailer versus the percentage they spend elsewhere) with their customers.

Collaboration programs between retailer and supplier start with the retailer. Many retailers choose to partner with third-party data providers like NielsenIQ to establish an exclusive data and insights environment that suppliers can subscribe to. Suppliers can use this enriched dataset to:

- Optimize trade and marketing budgets

- Target specific customer groups with personalized offers

- Understand who drove category trends

- See how competitive brands interact and switch with each other

- Assess cross category purchase behavior

- Measure product trial and repeats, and more.

For suppliers, the investment they make in these programs increases their potential for sales growth thanks to a better understanding of their customers with that retailer and shows the retailer a stronger commitment to the partnership.

The information used in retailer-supplier collaborations can vary. Most engagements involve supply chain and customer insights. Best-in-class consumer intelligence companies offer insights that reflect the holistic relationship between retailer and supplier including assortment, pricing, personalization, and retail media. When retail-supplier business decisions leverage customer-level data, NielsenIQ considers it to be in-scope for collaboration programs.

Launching a collaboration program is no easy task. Retailers that take on this endeavor in-house usually prepare for a time intensive and expensive journey. Many opt to partner with a global analytics leader like NielsenIQ, that will deliver a comprehensive, easy-to-use, modern platform within weeks, and jointly highlight the value to suppliers and encourage investment into the collaboration program. This is often the more efficient path in terms of time, resourcing, and cost.

NielsenIQ organizes first-party data into five modular workstreams that help drive sales for categories and brands

Once the raw data is onboarded, validated, and configured, it is transformed into intuitive dashboards, reports, and ad hoc modules. At NielsenIQ, our collaboration platform offers solutions to address five core business needs:

Supply Chain Analytics

In the 2023 Store Choice Drivers study conducted by NielsenIQ, shoppers said product availability is the most important attribute that a retailer can possess.* This emphasizes the importance of supply chain analytics and the impact it can have on customer satisfaction. Supply Chain Analytics enables retailers to share daily sales and inventory data with suppliers to reduce out-of-stocks and optimize inventory levels at store and distribution center level. Supply chain data can explain store sales trends and help ensure product availability in the right place at the right time. Examples of capabilities in this module will allow you to:

- Assure on-shelf availability and predict out-of-stock.

- Prevent disruptions with dynamic retail and location data to identify risk areas before they become lost sales.

- Manage supplier compliance and get ahead with out-of-stock predictions, scorecards, and replenishment schedules.

Category and Customer Analytics

Category and Customer Analytics leverage retail customer data to align customer profiles and shopping behavior to items, categories, and brands. Retailers access both total store sales and customer identified sales drivers to understand the cause behind the sales trends. Examples of capabilities in this module will allow you to:

- Analyze brand trends segmented based on new, lost, retained customers, or decouple the sales volume by gains, loss, and switching across brands.

- Observe category and brand affinities, basket composition, and cross purchase activity to tailor personalized or mass offers.

- Monitor new product launches to understand which retailer persona or demographic the new product skews towards.

- Identify the most loyal customers and understand their buying behavior to ensure their satisfaction.

Assortment and Promotion Analytics

Assortment analytics help retailers and suppliers maximize their sales by assessing the true value of each item to the category. Examples of capabilities in this module will allow you to:

- Know the incrementality of an item to the category before making delisting decisions.

- Explore the customer decision trees to derive what attributes are most important to customers when shopping in a particular category.

- Leverage built-in predictive analytics to forecast the monetary impact of planogram changes.

Promotion analytics help retailers and suppliers augment their sales and margin by ranking the effectiveness (incremental lift and margin) of every promotion. Examples of capabilities in this module will allow you to:

- Find out how effective promotions were to the target audience, the overall sales lift, and the halo effect they had in other parts of the store.

- Look at the customer base to see if the promotion influenced customers to try a brand for the first time, brought customers back to the brand, made the current brand base more loyal, or caused customers to switch.

- Collaborate with suppliers to boost growth, profit margins, and improve promotional strategy for better promotional ROI.

Personalized Offer Management

Personalized Offer Management provides a simple workflow for retailers and suppliers to collaborate and send personalized offers to their customers. Examples of capabilities in this module will allow you to:

- Leverage the simple workflow for retailers and suppliers to collaborate and send personalized offers to their customers.

- Send offers that reward customers for what they already purchased, stretch them to stock up, try new products and explore new categories.

- Collaborate with supplier partners to leverage the personalization workflow.

- Build customer segments using the artificial intelligence-derived target audiences or design customer groups from scratch.

- Create offers and store them in the offer bank to include in campaigns.

- Establish rules and guidelines for the promotional campaign.

- Measure the results in a single platform with the same dataset so everyone is on the same page.

Retail Media Intelligence

Retail Media Intelligence helps retailers launch their retail media network with an end-to-end solution for data management, automated activation, and measurement and attribution. For retailers, this high margin revenue stream has potential to be very lucrative and for brand advertisers it makes retail media a compelling new channel. Examples of capabilities in this module will allow you to:

- Connect media impressions easily with customer purchases to close the loop and measure return on advertising spend (ROAS).

- Build customer segments, establish an offer bank, set rules for the offer, and measure the outcome.

- Optimize offer selection by customer based on scoring to ensure the most relevant offers.

- Empower suppliers to measure the impact of media spend and content for improved promotions across all channels.

Collaboration in Action

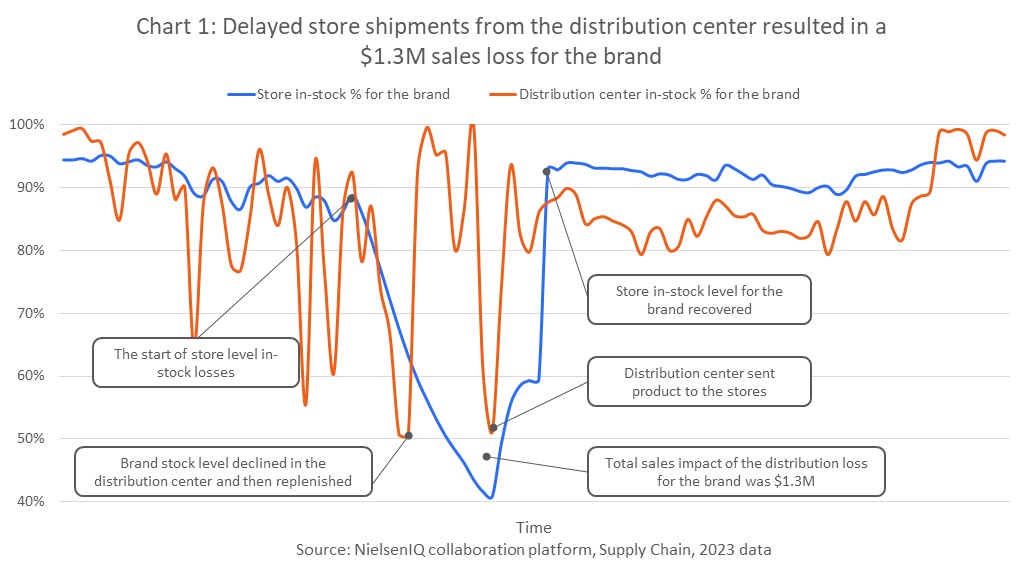

Example #1: Supply Chain Analytics revealed a disruption in a retailer’s regional distribution center that explained the $1.3M sales loss for a leading cosmetic brand. As a result, an investigation was conducted, and the issue was resolved.

A cosmetics category review revealed that sales trends for the retailer compared to the market diverged significantly in the recent timeframe. Sales grew in the market, declined at the retailer and a top brand in the category was responsible for most of the sales losses.

Several brand drivers were evaluated, and distribution factors were identified as the primary cause of the sales decline. Users leveraged the collaboration platform and were able to go beyond market distribution indicators like average number of items and sales velocity to perform a deep dive into the supply chain data.

As a result, the in-store stock level percentage (blue) in a key state compared to the in-stock percentages in their supporting distribution centers (orange) illustrated brand items were in the distribution center and not making it to the stores. The impact of the distribution loss in stores over those few weeks represents $1.3M in lost sales for the brand. The retailer investigated and corrected the issue and brand items were soon back in stores. This is an example of how supplier partners can sound the alarms to retailers on critical issues impacting sales performance that are independent of market influence.

Example #2: Improved personalization management helped a retailer increase engagement with a targeted customer segment that resulted in an increase of +23% in store visits and +20% in sales growth for this segment.

The loyalty program performance metrics for a large drug store had remained steady for years and the retail marketing team looked to NielsenIQ to help them to elevate their program by expanding to digital channels and increasing program engagement among customers. Additionally, they desired more granular control of their personalized campaigns and prompt insights into their customers, buying habits, and motivators, across any channel.

NielsenIQ leveraged its collaboration platform to deliver a plan to help them achieve their objectives. Upon launch, the NielsenIQ team worked alongside the category managers to help them with customer segmentation, set up offer banks, establish campaign guardrails, and share promotional outcomes internally and with suppliers, all within a single platform. The team’s support plus a highly intuitive platform allowed the retail team to be mostly autonomous within weeks.

As a result, their suppliers saw favorable results from the more effective personalization campaigns and increased their promotional trade spend at the retailer. The targeted retail customer segment became more engaged as evident by the +23% increase in store visits, +20% increased sales, and 2x return on investment with discounts (for every $1 on discount, they spent $2).

In Summary

Collaboration programs are a great strategy for retailers to improve business performance, increase brand awareness, have better engagement with customers, and share insights with supplier partners. If done well, retailers can expect to see share of wallet growth with customers and incremental revenue from supplier partners.

NielsenIQ is the preferred collaboration partner by multiple international retailers that want to start a collaboration program or improve the one that is in place. NielsenIQ provides retailers with renowned client service support, and a collaboration platform with efficient workflows and best-in-class analytics. If you are seeking to maximize the value of your customer data, then contact NielsenIQ for a free consultation meeting to learn more about what is available and how we can drive growth for your organization.

Visit the NIQ Activate page for more details on how the collaboration platform takes you from data to insights to activation.

Sources

*For more information, visit the Store Choice Drivers page to learn more about what attributes are important to shoppers when choosing a retailer and how store banners rank.

Learn more about NIQ Activate

One collaborative platform powering retailers and brands to go from data to insights to activation.

About the author

Dharshaun Turner, Associate Director

Dharshaun is a customer and shopper insights consultant with over nine years at NielsenIQ. He has worked with some of the largest US retailers and manufacturers helping them with category and customer strategies using insights from first- and third-party data sources. Dharshaun supports the NielsenIQ Retail Strategy business that includes retail collaboration.