A deep analysis of the current state of automotive and aftermarket sales, together with the major trends impacting the industry – from the macroeconomic landscape to consumers’ economic pressures, and the latest areas of innovation-led transformation that are unlocking pockets of growth.

Last year saw consumers around the world buying 68 million new cars, a significant jump in year-on-year growth that brings the industry closer to the pre-pandemic benchmark of 73 million bought in 2019. For 2024, the general view is that sales will reach around 70 million.

This year’s more muted growth forecast is due to much of the pent-up demand from the low-production years of 2020-2022 having now mostly been satisfied, along with the ongoing economic challenges faced by consumers across different regions.

For example, APAC is a high-potential region with very low car penetration. Last year, sales of new cars there grew by +9%, according to Statista, but expectation for this year runs at just +2%, largely due to low performance forecast for China.

For this year, then, Europe looks to be the region offering greatest growth opportunities, followed by North America – but, even in these two markets, the rate of growth for new car sales is depressed.

- Second hand car sales and automotive aftermarket – 2024 opportunities

Globally, we expect to see 36.2 million used car sales this year, just up from 35.9 million in 2023.

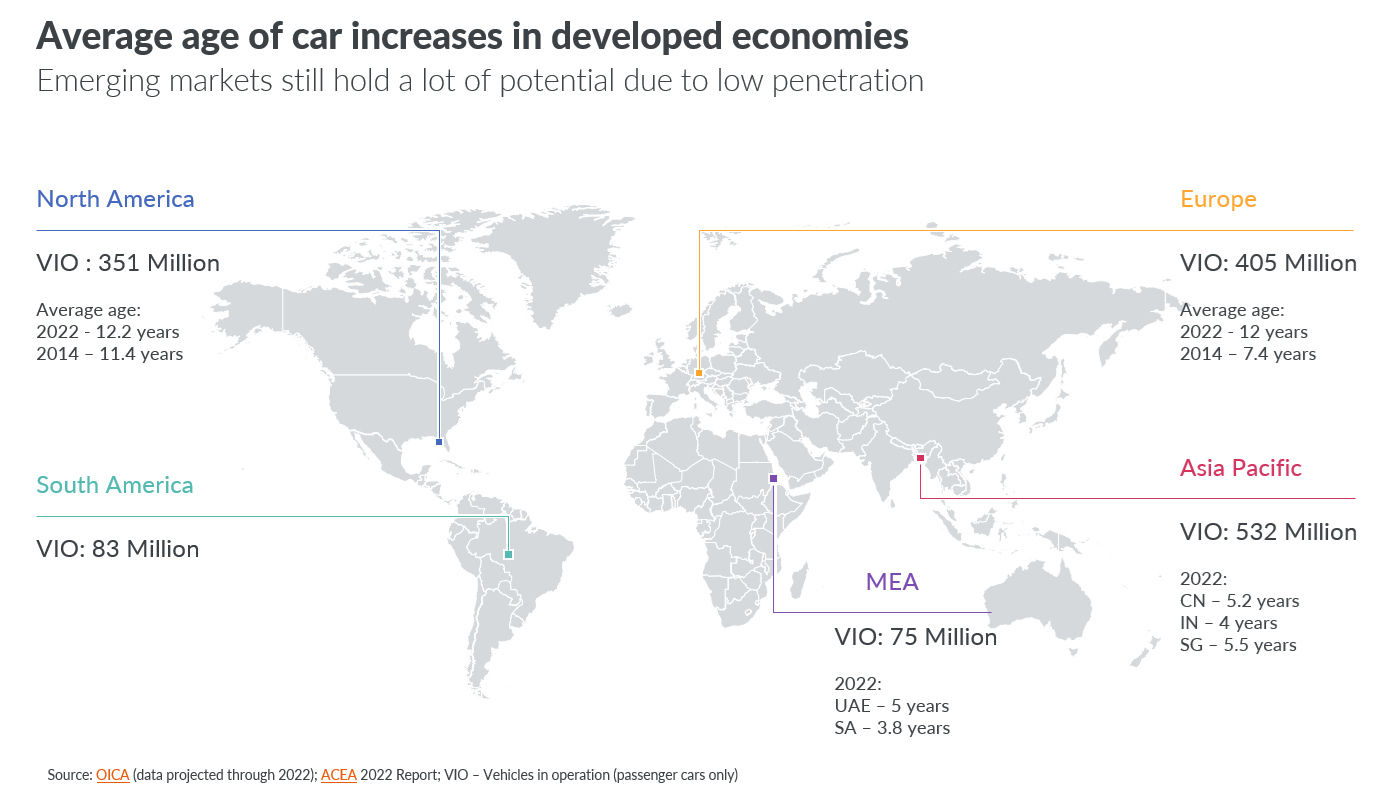

In Europe and North America, the average age of cars in operation has increased from 7.4 years old (Europe) and 11.4 years old (USA) ten years ago to 12 years old now. This is according to latest data from OICA, the International Organization of Motor Vehicle Manufacturers.

With over 750 million passenger cars in operation on those two continents, we expect to see increasing demand for aftermarket products as the maintenance requirements of these older cars grows.

Tempering that potential revenue pot for aftermarket sales, however, is the fact that, once their cars reach 5 or 6 years’ old, people become less inclined to splash out on their maintenance, and more likely to choose budget-friendly rather than premium parts.

In Asia Pacific and the Middle East, we see a different picture and set of opportunities. In these regions, the average age of cars sits at around 4 to 5 years old. With a rising middle class across much of these regions, and relatively low car penetration, this presents potential for a spike in new car sales from consumers wishing to enhance their standard of living and display their increased wealth.

Additionally, the fact that people here are exchanging their cars after only 4 or 5 years presents opportunity for the second-hand car market. Not only is it able to offer younger, higher quality cars which should drive strong sales potential, but we expect a boost to after-market sales too, as rising middle-class buyers who may not have felt able to afford a new car look to enhance their second-hand purchase with premium parts, tires, and car chemicals.

- Automotive aftermarket sales showing continued growth

The global automotive aftermarket is continuing to grow with sales revenue up +4% last year, reaching $71 billion. This is on top of a +3% growth already seen in 2022 versus 2021.

Tires, which account for three in every four dollars spent on aftermarket purchases, grew +4% compared to 2022 revenue, while car chemicals (15% of aftermarket revenue) were up +6% and spare parts up +10%.

This growth is driven in part by an increase in premium purchases across segments – but that is not the only factor.

Over the last couple of years, we’ve seen polarization between value and volume growth, as the average price of items soared, driven by worldwide high inflation and increased costs in manufacture and delivery. That gap is now closing as prices start to stabilize, although at high levels.

- Car tire trends: growth shifting to emerging economies

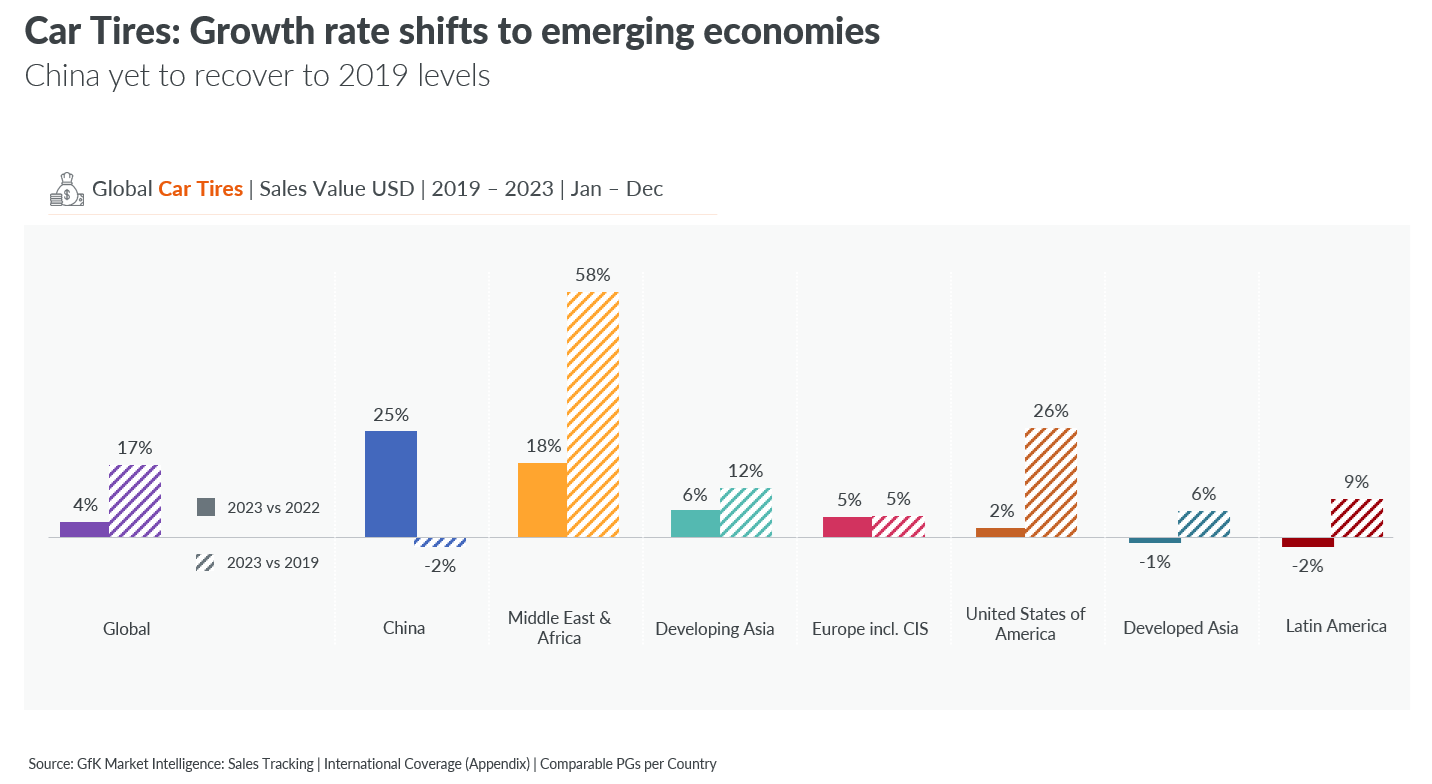

From a regional share perspective, Europe and US are the biggest regions in revenue within the automotive aftermarket industry. Looking at their sales of car tires last year, both markets continue to grow steadily, although at a slower rate than before, with 2023 delivering +5% growth in Europe and +2% in US.

The two fastest growing regions for car tires are China and the Middle East and Africa. China recorded an amazing +25% growth, year on year, with potential to grow still further this year, as the market has not yet recovered to its pre-pandemic 2019 levels. The Middle East & Africa region is also one of the high potential growth markets, continuing to register strong growth year on year.

Developing Asia was just ahead of Europe in terms of growth – standing at +6%, while the Developed Asia and LATAM regions both showed a slight decline in revenue. These last two markets have strong headwinds, however, due to the high growth rates witnessed in 2022 setting challenging baselines.

Bigger brands losing share to budget brands

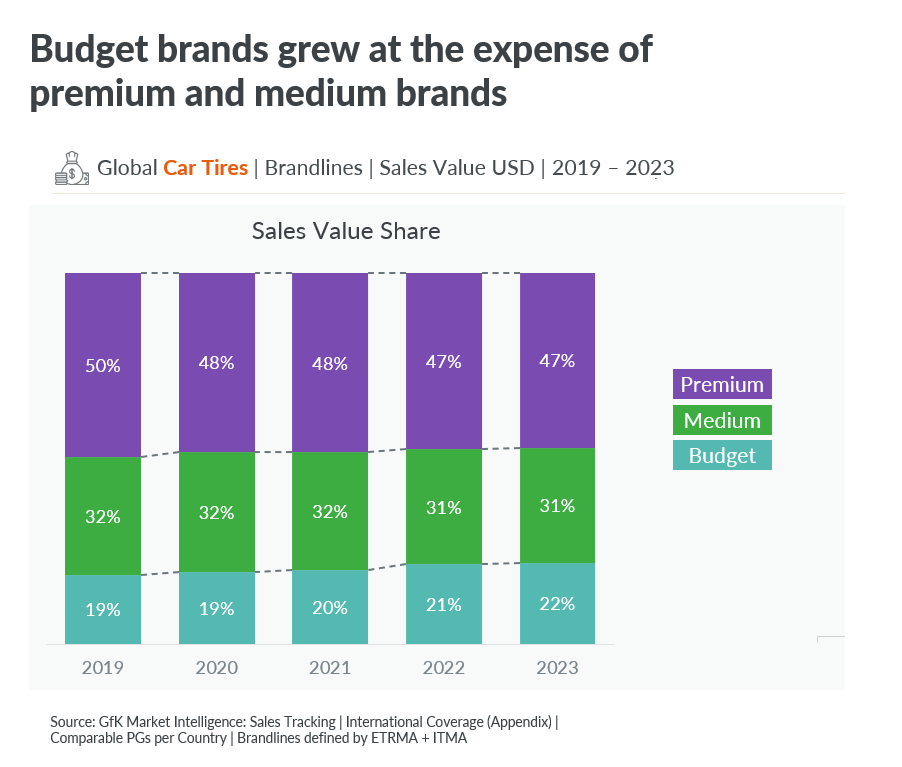

Globally, the unit share of car tires sold by smaller brands has increased from 29% to 33%. It is fair to assume that this is driven by consumers shifting to lower priced brands as their household budgets were squeezed last year.

Given the significant difference in the price between premium, medium or budget brand tires, budget options remain a very economical choice for the consumers – especially as the average cost of budget brand tires decreased very slightly last year, while medium and premium brand tires rose.

This expansion of budget brands in terms of market share is not confined to lower price segments. Budget brands are also offering more and more SKUs even in higher-end tire segments, but at better prices than the big brands. For example – tires with 18-inch-plus rims cost an average 137 US dollars for a budget brand, versus 237 dollars for a premium brand.

Regional variations in growth of budget brand tires

Globally, tire sales for budget brands grew +6% last year, while premium and medium brands saw around 3% growth. However, there are regional variations in this trend.

In Europe, medium brands saw the strongest growth, followed by budget brands, and with premium brands showing considerably weaker performance. This circles back to the trend we see of European drivers keeping their cars longer and being less inclined to spend money on premium parts once they pass 5 or 6 years old.

LATAM, budget brands grew a huge +19%, while premium declined by -7% and medium brands also saw significant decline. This polarization in sales is also visible in the MEA and APAC regions, where premium and budget both grew more than medium brands.

In the US market, however, we are seeing clear premiumization, thanks to two key factors. The first is an economy that is doing better, and the second is the import restrictions placed on (generally cheaper) Chinese brands due to the geopolitical situation between the two countries.

- Engine oils trends

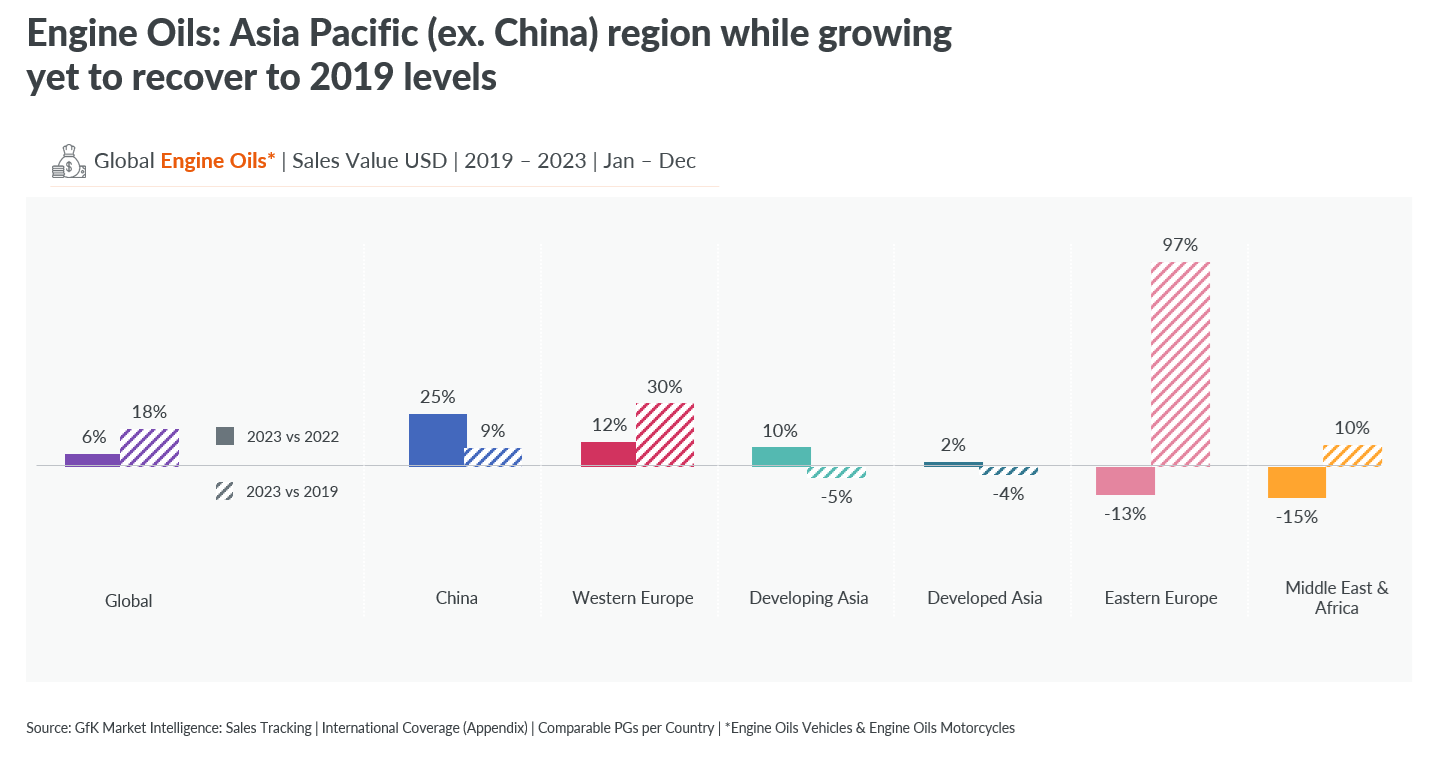

Global revenue from sales of engine oils for both motorcycles and cars grew +6% last year, led by China (+25%), Western Europe (+12%) and Developing Asia (+10%). Eastern Europe and Middle East and Africa both showed declining revenue for engine oils.

In the Middle East and Africa, the decline also represents the high baseline from last year, as well as the currency volatility (in local currency, growth there is positive), and the ambition of some countries in this region to have much higher focus on E-mobility.

An additional factor impacting these regions includes the local evolution of mobility, with cheaper options such as “ride hailing” being particularly popular in areas such as Southeast Asia and India.

Budget buying carries through into engine oils.

Smaller brands have considerably increased their share of both revenue and volume of engine oil sales, growing from 42% market value in 2022 to 48% now. So, while the total category sales revenue has increased, those gains are mostly being seen in the long tail, or brands with smaller market shares compared to the market leaders.

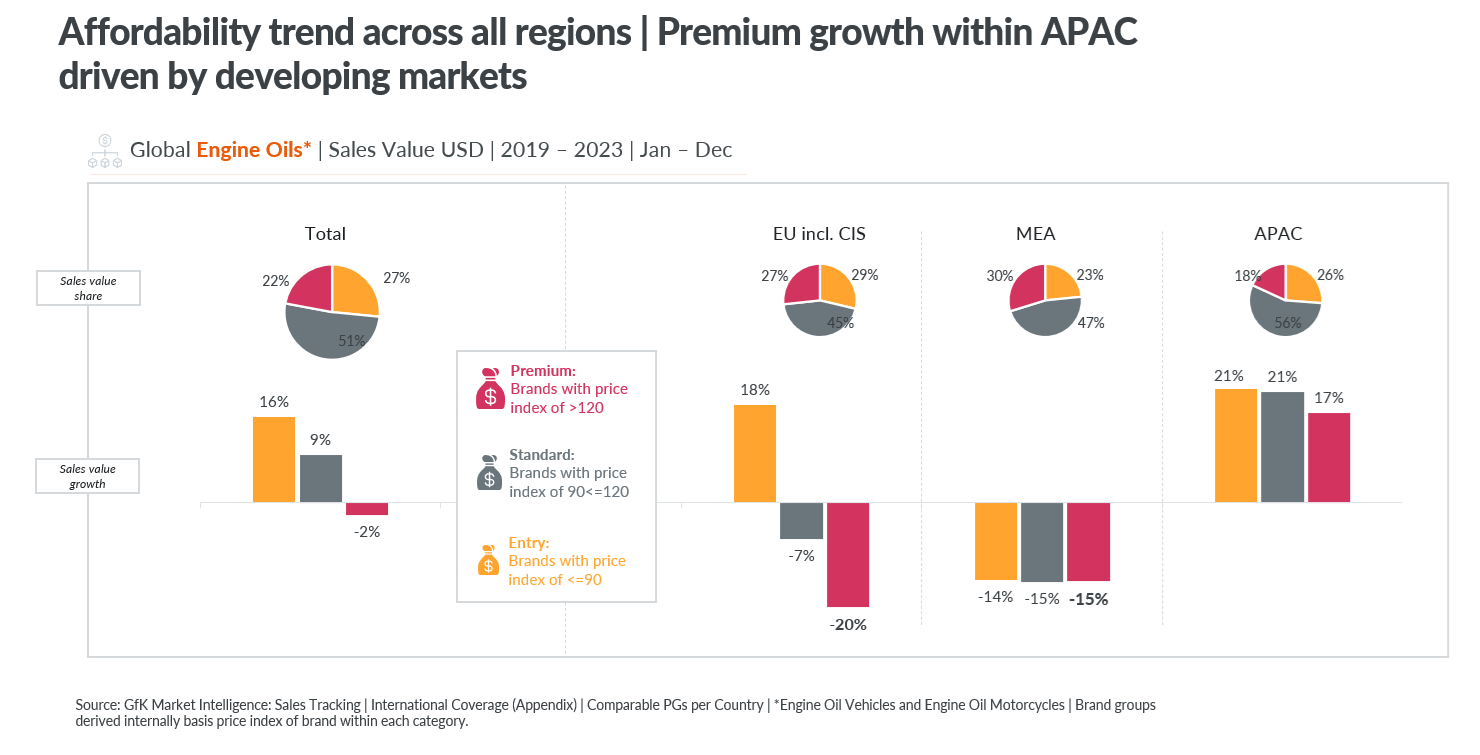

Globally, engine oils saw a +16% increase in the sales value of entry brands compared to +9% of standard brands, while premium brand sales declined by -2%. That affordability trend is seen across all regions. with the entry-level brands doing much better than the rest.

APAC is the only region showing positive growth for engine oils, and this is driven by the developing markets such as Developed Asia, where budget brands were the only section that grew.

Our forecast is that this trend with continue through 2024, with consumers looking for affordable options for all maintenance products – especially as they keep their cars longer in markets such as Europe and the USA. The opportunity for market leading brands comes when consumers purchase a new car or face a significant issue with the current product they have used.

- Automotive innovation outlook

For the automotive industry, like others, there are three forces that drive innovation: consumer demand, legislation / regulation, and manufacturer push.

Over the last couple of years, we have seen automotive innovation focusing on 6 themes:

- Safety

- Convenience

- Performance

- Design

- Sustainability

- Business models.

Looking at the technologies that will influence or enable innovations in the automotive industry, AI is still the buzz word. Immersive technology is enabling enhancements in consumer experience and changing the way consumers interact with their cars. The Internet of Things, for example, is being integrated into vehicle technology to drive transformation across design, manufacturing, operations and maintenance, while cloud computing is enabling automakers to remotely monitor vehicle performance and predict maintenance needs.

Electric vehicles also continue to grow in both the consumer and commercial spheres. In 2021, EVs accounted for 12% of all sales in 2021, rising to 21% in 2023 and are expected to hit 25% this year. Three markets dominate these sales – China (over 50% of share of global sales last year), Europe and the US – with other countries tailing quite far behind. From a consumer perspective, EVs are more of an aspirational or status symbol product, with the key attraction being less about their eco-positioning and more about the level of tech incorporated in these cars that enables them to do more than just drive. This focus means we are seeing traditional tech brands becoming increasingly interested and influential in the automotive sector.

The future of mobility, then, will be connected, autonomous, shared and electric. It will, however, take a long time to reach that future, due to challenges such as market readiness, slow implementation to become mainstream, and high production costs leading to high selling prices.

To optimize the success of their innovation strategy, manufacturers must maintain a laser-sharp tracking of their audiences, and align precisely with their evolving lifestyles, needs, aspirations and barriers.

Want to know more?