Tech products have always trended towards better and advanced specs, thanks to consumers’ inexhaustible appetite for speed and performance, combined with evolving component technology from the industry side. Mobile personal computers (PCs) are complex tech products with various components working simultaneously to deliver computing processing, and so stand at the centre of this “fast and advanced” spec evolution.

In particular, RAM (Random Access Memory – providing data storage for processing power) is one of the prominent specifications within mobile PCs that is being constantly improved and advanced over time. Currently, 47% of all global sales of mobile PCs are for models with 16GB RAM. Of course, these higher spec products come with a higher price tag. The global (excluding North America) average price of 16GB models sold last year was 239 USD higher per device than for 8GB models. The attraction for retailers to encourage consumers to choose the higher end models is clear.

Some markets, though, are slower in their consumer take-up of 16GB mobile PCs than others. So how do retailers in these markets encourage their target audiences to trade-up?

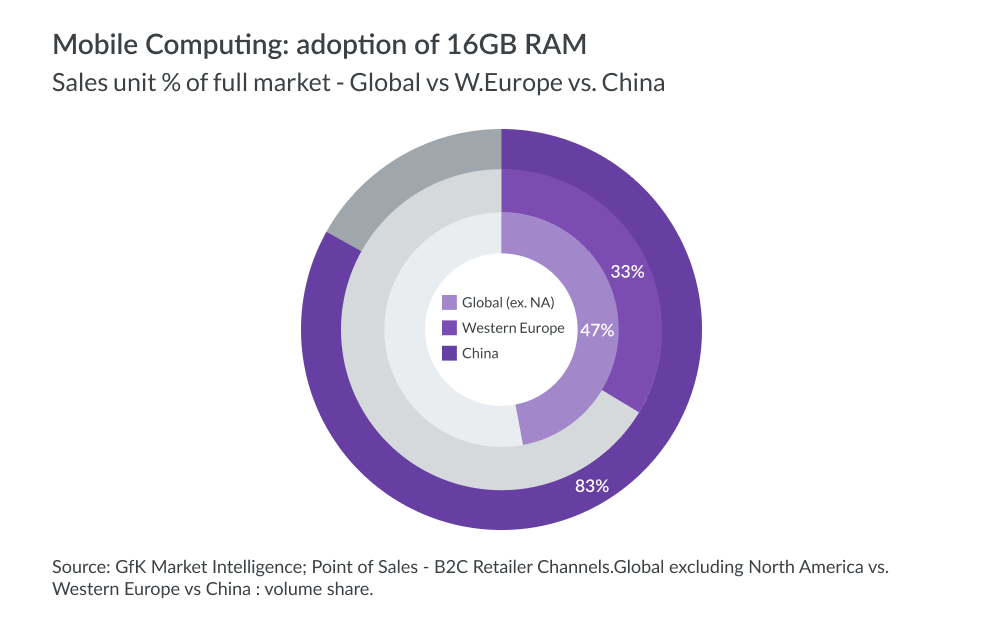

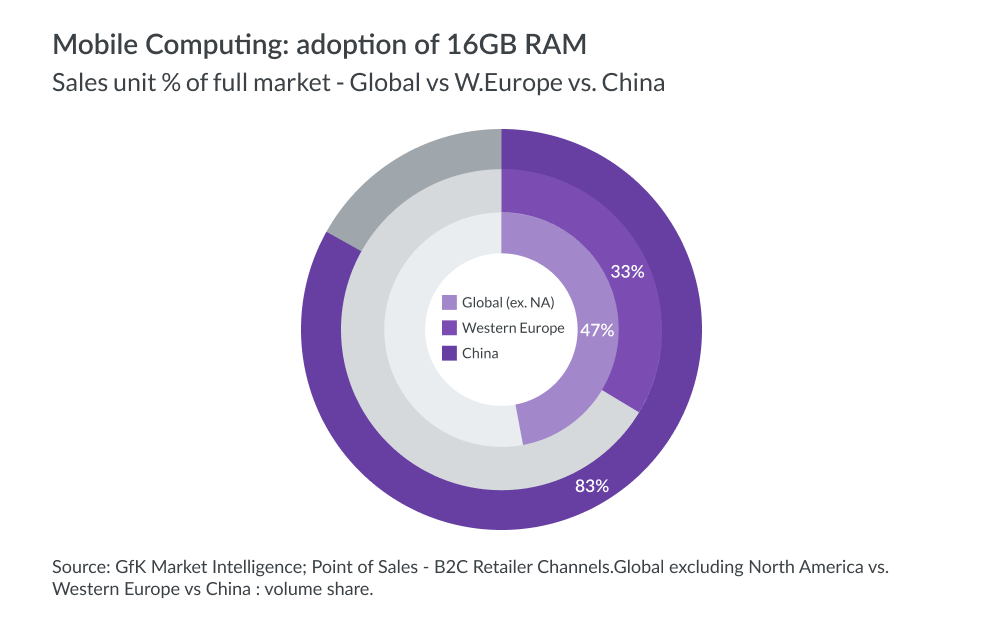

Regional uptake of 16GB RAM

Globally, the adoption of 16GB RAM mobile PC stands at 47%, which means that overall transition to these higher-end models is still taking place. However, in China, the transition is pretty much complete, with 83% of all mobile PC purchases being for 16GB models.

Compare that with Western Europe, where 8GB RAM configuration is still the norm – accounting for almost half of current sales, while 16GB RAM at present holds only a third.

While consumers in Western Europe are the slowest to trade up to higher spec mobile PCs, they are not wholly alone. Consumers in Eastern Europe and Developed Asia are also relatively slow to transition, with share of sales standing at 43% and 44% respectively.

So why is China so far ahead?

Much of this is cultural. Chinese consumers have always shown higher-than-average affinity for high-spec products. For example, their transition to 512GB SSD storage can be considered as completed (63% of sales volume), and their adoption of 1TB SSD has already started (30% sales volume).

Given that other regions are still going through transition to 512GB SSD, this shows how far Chinese consumers are ahead of others in being early adopters of high spec devices.

What can retailers selling into the slower markets bring across?

In markets with less tech-focused consumers, retailers need to work harder on crafting marketing messages that bring out highly relevant benefits that the higher spec devices deliver.

Success here depends on tailoring the message for each specific target group. That means having a lazer-focus on the specific needs, pain points, aspirations and lifestyles of each different group – and therefore understanding what will trigger them into buying a higher spec model.

It additionally means understanding the price premium that they will accept in return for those benefits, versus the point at which the price outweighs the extra value, in the eyes of that audience.

Understand more about this fascinating area, and how we help our clients unlock the maximum revenue for their portfolios across markets.