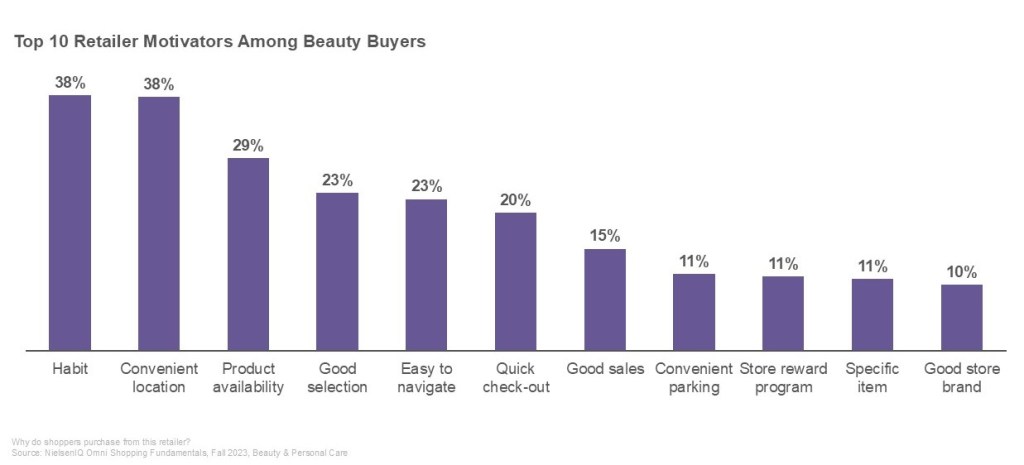

What Drives Channel and Retailer Purchasing

In the past few years, the retail marketplace has been faced with a number of challenges. Consumers have been hit hard, from the COVID-19 pandemic to inflationary pressures to global conflicts. Yet, the key drivers for where Beauty and Personal Care consumers shop have remained relatively steady. Above all else, 38% of these shoppers say that Habit and a Convenient location are their most important motivators.1 A further 29% are motivated by product availability and 23% by a good selection of products.1 Despite external pressures, consumers continue to prioritize ease and reliability when choosing where to shop for beauty and personal care products, reinforcing the importance of familiarity and accessibility in the retail experience.

Equally interesting, the pre-shop and point-of-purchase influencers for Beauty and Personal Care consumers are also pretty much the same today as they were before COVID. The biggest pre-shop influencer was replenish need, according to 36% of consumers.2 For point-of-purchase influencers, comparing product prices (23%), product descriptions (17%), and deals (16%) have the most significant impact on purchase.2 This highlights how the overall Beauty and Personal Care category has managed to maintain relative stability during turbulent times, and many brands are capitalizing on these trends by relying on intelligent pricing strategies and the need to replenish.

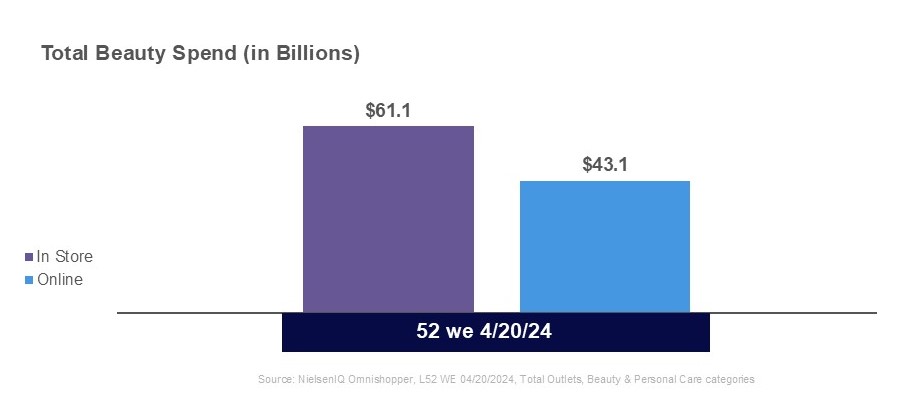

Channel Performance: In-Store vs. Online

In recent years, the beauty retail landscape has seen a significant shift in channel performance, with both in-store and online experiences playing critical roles in consumer purchasing behavior. As more consumers embrace eCommerce and omnichannel shopping, Online sales are getting closer and closer to In Store levels ( $43 B vs $61B ).3 Even more impressive is the year-over-year growth of online sales. Online sales saw a 10.4% growth in Unit sales and a 14.5% increase in dollar sales.3 Online growth actually outperforms In Store in all categories except for in the Beauty Specialty channel.4

Still, while online shopping has grown rapidly in recent years, brick-and-mortar stores remain a vital part of the beauty shopping journey. Beauty shoppers still make the majority of their trips In Store, 34x per year vs. 16x per year Online.3 Understanding the differences in consumer preferences, shopping trends, and category performance across these channels is essential for brands and retailers looking to optimize their strategies.

Clean and Sustainable looks different across Lifestages

Gen Z is particularly influenced by values such as animal welfare and environmental responsibility. They prefer products that are cruelty-free, reef-safe, and come from brands that demonstrate social responsibility, such as B-Corps or fairtrade practices.

Clean beauty is also a strong motivator for Gen Z, with a preference for products free from harmful ingredients like aluminum, sulfates, and parabens. Millennials share similar values but place slightly less emphasis on these factors.

In contrast, Gen X and Boomers prioritize practical considerations. For Gen X, reduced packaging matters. For Boomers, health and need states like cardiovascular health influence purchases.

For a deeper dive into how factors like social media influence, community engagement, and celebrity drive purchasing decisions across generations, get your full report here.

Channel Headwinds: Challenges Impacting the Market

As the beauty industry continues to evolve, it faces several headwinds that are impacting channel performance and reshaping the retail landscape. One of the biggest issues is the decline in direct-to-consumer (DTC) sales. DTC sales have struggled across Pure Play (online-only brands) and Mult-level Marketing (MLM). MLM is the primary cause of absolute dollar decline, seeing a -25.3% drop in sales YoY.5 Facial skin care, cosmetics, and hair care are most heavily impacted by the loss.5

In Store, Drug Beauty sales are also lagging behind due to a few challenges. Drugstores that did well during COVID-19 are seeing a drop in foot traffic and declining prescriptions, with some stores closing their pharmacies entirely. Many stores are also actively locking up products to prevent theft, making the shopping experience more difficult. This is all contributing to a -1.1% drop in In Store dollar sales YoY.2

Channel Tailwinds: Opportunities for Growth

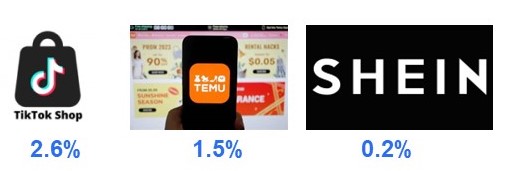

Despite the challenges facing the beauty industry, there are several tailwinds driving opportunities for growth across various retail channels. One big area of growth is the rise of social selling apps like TikTok Shop, Temu, and Shein. Though a relatively new concept, the apps have managed to carve out a 6.2% market share in Online Beauty.6 The rise of these apps is further driven by rapid discounting and the adoption by Gen Z and Millennial shoppers. In fact, 56% of users say that TikTok ads have led them to discover new brands and products.7

Another area of promise comes in the form of AR and AI Beauty innovations. These tools have a range of uses, including allowing consumers to virtually try on makeup, get personalized tutorials, or even detect skin concerns. As brands and retailers continue to develop and utilize new technologies to break down education barriers, more consumers are likely to seek out Beauty and Personal Care products online.

Finally, the Beauty and Personal Care market is further being bolstered by Department Stores adopting new competitive strategies. Many are focusing their efforts on selling niche and exclusive products or offering new services that set them apart from the pack.8 Others are focusing on their location to provide unique experiences for their customers.9 While some are focusing more on loyalty programs and promotions to bridge the gap. Regardless of the strategy used, it’s clear that these stores aren’t going away anytime soon.

Want to learn more about the Role of Channel in Beauty?

In our NIQ: Role of Channel in Beauty report, we delve deeper into the trends seen here as well as shifting consumer behaviors, the future outlook of the Beauty and Personal Care market, and more.

You can also check out NIQ’s Beauty Inner Circle for insights on the health and beauty vertical, our latest research, and more.

Sources:

1 – NielsenIQ Omni Shopping Fundamentals, Fall 2023, Beauty & Personal Care

2 – NielsenIQ Omni Shopping Fundamentals, Fall 2023, Beauty & Personal Care

3 – NielsenIQ Omnishopper, L52 WE 04/20/2024, Total Outlets, Beauty & Personal Care categories

4 – NielsenIQ Omnishopper, L52 WE 04/20/2024, Total Avail Retailers (OMNI), Beauty & Personal Care; Beauty Specialty= Ulta/Sephora/Sally + In Store Beauty, DTC Beauty= Online Beauty Supply X Ulta/Sephora/Sally)

5 – NielsenIQ Rakuten ecommerce total US 12 months ending 6/30/2024 vs YA

6 – Foxintelligence E-receipt Consumer Panel YTD week ending 7/7/2024

7 – TikTok Marketing Science Global Retail Path To Purchase conducted by Material, August 2021