Brands implementing a direct-to-consumer (DTC) strategy have significantly disrupted both the consumer packaged goods (CPG) and the consumer technology & durables (T&D) industries. Already, DTC sales account for around 1 in 7 e-commerce dollars globally and this is expected to grow rapidly. The benefits to manufacturers are clear and 2024 brings fresh opportunity for retailers too, as successful DTC brands surge out of ‘digital only’ and increasingly look for opportunities to expand their reach.

Consumers and DTC

Our latest consumer research* shows that the following factors are much more important when buying direct from a brand, compared to when buying from a retailer: after sales support, knowledgeable staff, and detailed product information. [*gfknewron consumer; all tracked product groups across: BE, BR, DE, ES, FR, GB, IN, IT, JP, NL, RU]

With consumers becoming increasingly price sensitive, some DTC brands have focused on pricing, with offers such as ‘best price’ guarantees when buying direct from them or subscription commerce tied to loyalty discounts.

Added to that is an “exclusivity” focus: the attraction of early access to new products launched by brands via their own channels before they become available in retail stores, enticing consumers to buy from brands directly.

Brands and DTC

DTC has been around for many years, but gained more prominence recently, driven by the surge in digitization during the covid period. In the same way that ecommerce became a high priority for businesses during covid, DTC also gained momentum as a way to connect directly with consumers.

For manufacturers, selling direct to consumers is attractive for reasons such as being able to shape a consistent end-to-end brand experience, with sole control including the point of sales and after sales experience. Also of value is the opportunity to collect zero-party data – i.e. direct from the consumer – to better understand their preferences, purchase intentions, and personal contexts at a time when they are focused purely on that one brand’s products or services.

Retailers and DTC

As additional touchpoints for consumers continue to complicate the shopping journey and competition increases, direct sales by brands – particularly those offering competitive prices or early access to new launches – are an area being watched closely by many retailers.

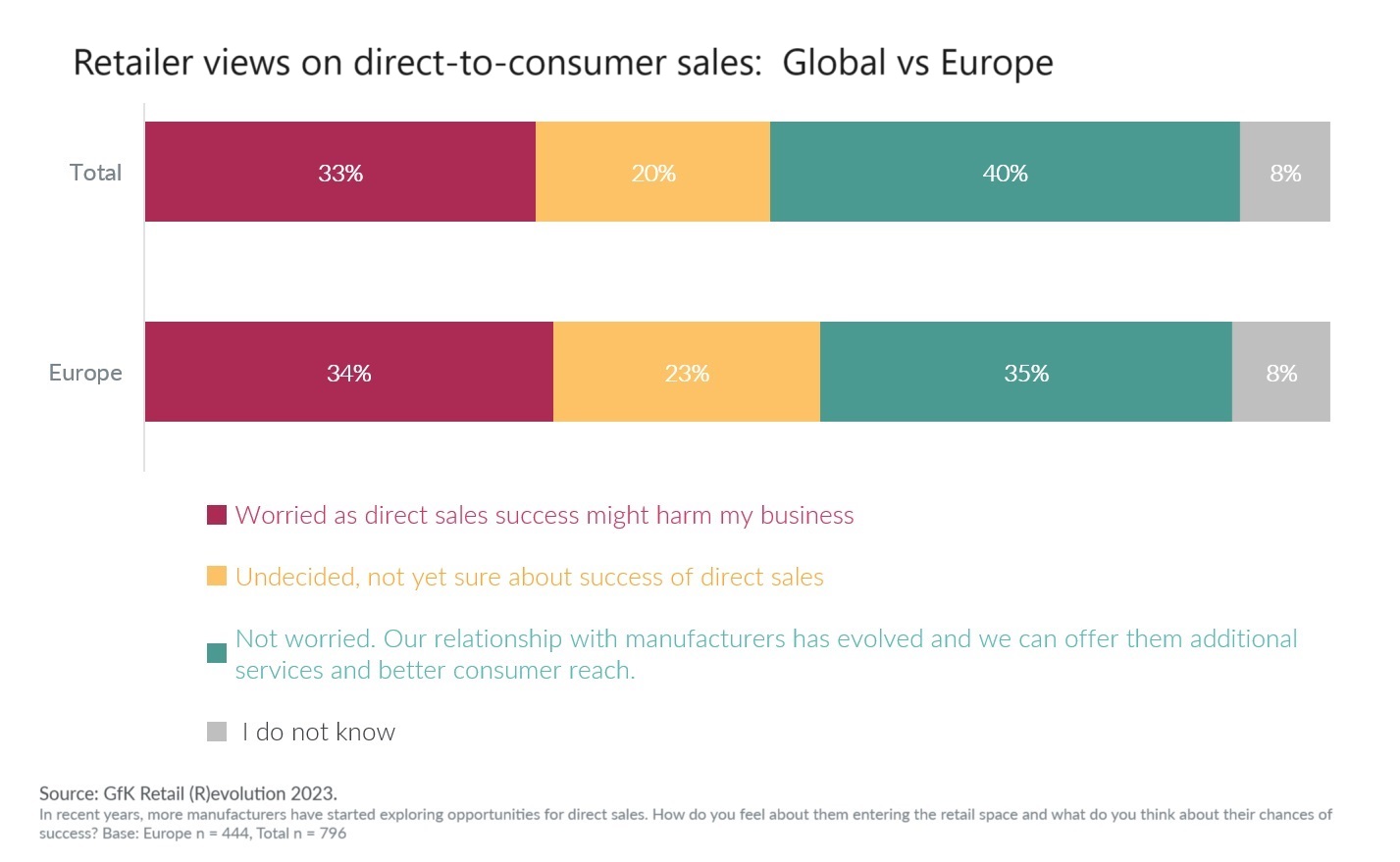

However, retailers’ level of concern is mixed.

For example, in Europe, our latest research shows that 34% of retailers are worried that direct sales might harm their business but, on the other side of the scale, 35% are not worried. 23% are at present undecided.

Retailers see opportunity in their ability to offer manufacturers additional services and better consumer reach than they could otherwise achieve.

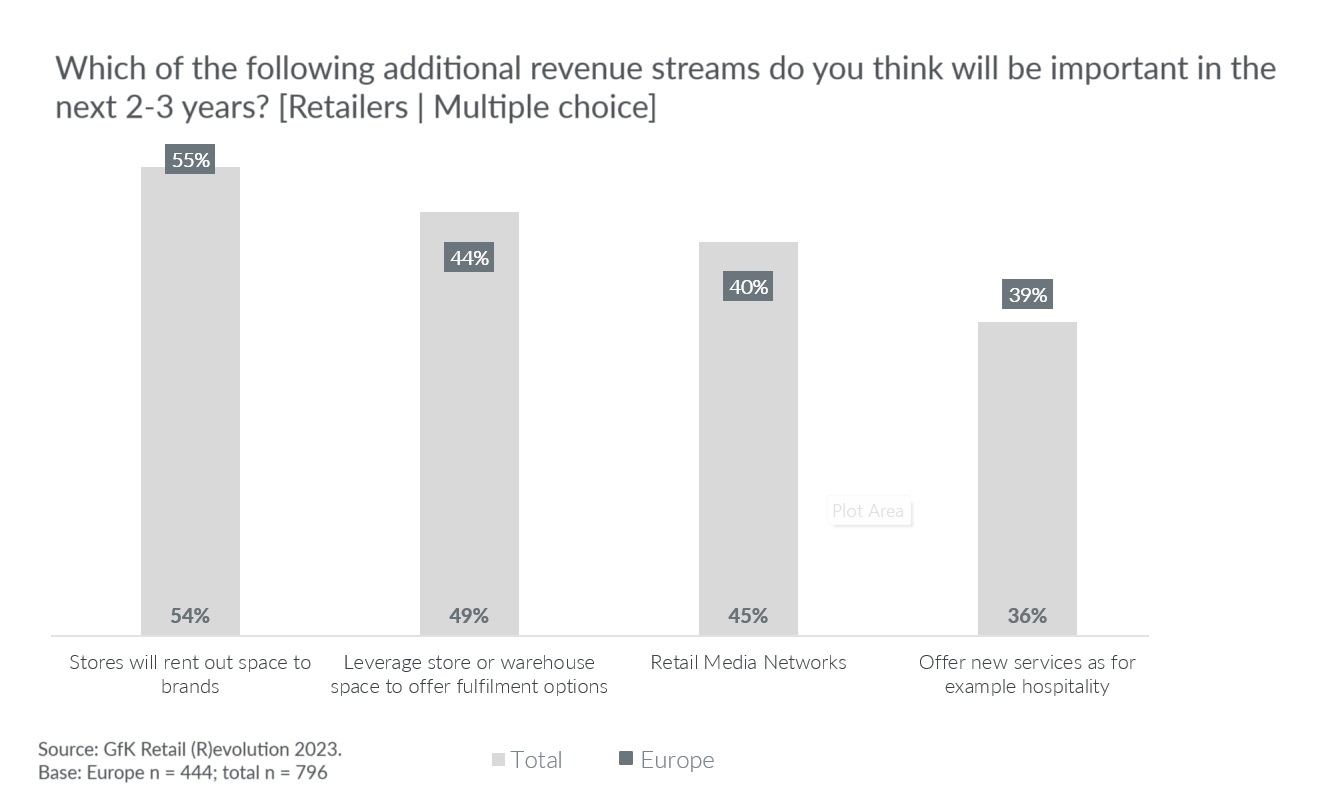

Such retailers are increasingly devising strategies to offer more to manufacturers and continue to be an integral partner for them.

For example, online retailers and intermediaries can offer manufacturers a dedicated brand page within their site, with no limit on how many partnerships they can host, or even offer warehousing or shipping solutions.

In the case of traditional retail, brands must understand that traditional retail continues to hold lion’s share of T&D market sales and so cannot be ignored, if those brands wish to grow. Physical retailers have already started offering dedicated kiosks or interactive displays within their stores where manufacturers can deliver the all-important “brand experience” or product testing where shoppers can handle products ahead of purchase.

The evolving DTC journey – collaboration key to growth in 2024

Direct sales, though presently in infancy stage, will continue to grow, tapping into consumers’ desire for value, personalization, sustainability, and immersive shopping experiences. However, the digital-first mindset that is at the heart of direct selling can only take a brand so far, even with the growing popularity of channels such as social commerce.

The rate of DTC take-up means that some successful brands in this area have encountered challenges in areas such as sustainable scaling and logistics, while competition from increasing numbers of DTC brands is putting pressure on maintaining customer loyalty.

Consumers no longer differentiate between online and offline shopping experiences. DTC brands will have to consider creating ecosystems via partnerships or collaboration to expand to the offline space for growth. At the same time, the dominance of traditional retail will continue this year too, So brands could gain and expand their reach by partnering with established retailers who can connect them with target audiences both online and via a physical presence.

Continue to explore the 2024 trends for brand success

Major retail formats in 2024:

- Omnichannel Retail – offers seamless shopping experience across all online and offline touchpoints.

- Mobile Commerce – shops specifically tailored to mobile devices where the complete purchase including check-out and payment is done on mobile.

- Internet Market Place – online platforms offering infrastructure and services to other retailers or brands to sell directly to consumers.

- Shopping Experience Store – offers heightened & immersive shopping experiences to consumers (e.g., Smart home, Gaming, Audio, etc.).

- Buy Online and Pick up in Store (BOPIS) – offers shoppers the convenience to purchase products via online channel and pick up the product from a local store.

- Social Commerce – shops within social media platforms, where the consumer can shop, check-out and pay without leaving the platform. This format may also include livestreaming events to promote and sell products often in collaboration with influencers and celebrities.

- Localization – small neighbourhood stores catering to the communities they are in.

![Understanding your audience: The power of segmentation in retail [podcast]](https://nielseniq.com/wp-content/uploads/sites/4/2025/07/Podcast-Understanding_your_audience-The_power_of_segmentation_in_retail-mirrored.jpg?w=1024)