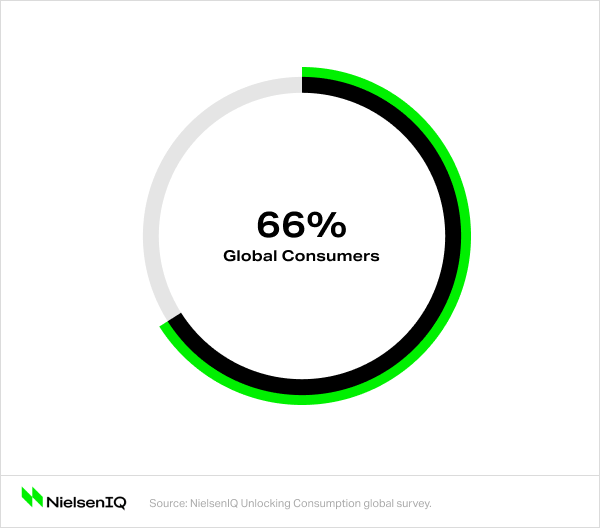

Nearly two-thirds of global consumers said they have changed how they buy categories and brands.

Consumers—and consumption behavior—are unpredictable

The moments your customers choose to consume your product (or products in your category) are inherently unpredictable in the best of times. The sheer global reach and duration of the COVID-19 pandemic have forced consumers to shift or abandon even their most ingrained habits.

Most importantly, the pandemic has either shifted or created entirely new contexts of consumption behavior. Chances are, your coffee routine is different when you have a commute compared with when your commute is from your bedroom to your home office. Think back to the holidays. No matter what you were celebrating, your menu differed drastically with fewer in-person guests.

These shifting consumer contexts are at the heart of better understanding consumption of your product. It’s one thing to know that in-home alcohol sales were up 31% during the pandemic. It’s another to know what in-home situations are driving consumption of prepared cocktails, for which sales grew almost 30% in 2020. Unlocking the many variables that make up the “why” behind that consumption moment can inform your growth strategy.

Cost-conscious consumption in the new normal

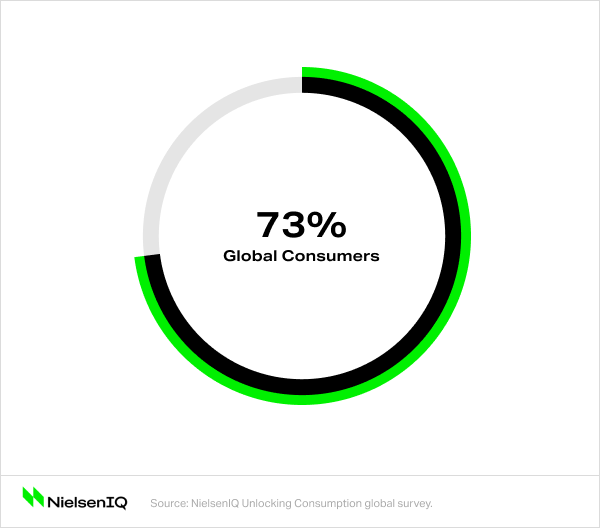

The consumption contexts brought on by COVID-19 are driven largely by economic impact and upheaval. Nearly three-quarters of consumers (73%) are cost-consciously altering their consumption and buying patterns, according to our research.

Nearly three-quarters of global consumers are cost-consciously altering their consumption and buying habits

Consumers are employing new coping mechanisms to make these pattern changes: 46% say they buy products solely based on promotions, irrespective of brand, and 45% say they always seek private-label/store brands to save money. Clearly, consumption patterns have shifted as heads of households deal with the economic consequences of the pandemic.

Yet, it’s important to understand these trends at a deeper level, because consumers are not exclusively price conscious. If 73% of consumers are watching their spend more closely, a certain percentage are spending as freely as they were pre-pandemic. On top of that, 55% of consumers say they are brand loyal, and will only change brands if prices increase. Unlocking the motivation of consumers who have money to spend (or those who are willing to spend limited funds on your brand) is key to driving growth in an economically unsure market.

Understand your consumption moments

Gaining a contextual understanding of who, what, where, when, and with whom your customers consume your product calls for a qualitative research method that adds a new dimension to the retail and panel data you already rely on.

Our Consumption Moments solution gives you the insight you need to grow by collecting in-the-moment information on the context behind consumption of your product. Consumption behavior is collected in real time, which eliminates consumer error caused when respondents are forced to remember consumption after the fact. Our solution also provides data you can trust via a system that auto-populates brand-level information from our global barcode database.

With our Consumption Moments solution, you can be the expert on your product at a level deeper than purchase behavior, with the information you need to design a road map for growth.