The temperature check: How consumers grocery shop online today

NielsenIQ’s latest global survey takes a temperature check on consumers’ online grocery shopping behaviors and attitudes. The survey found that online shopping is most prevalent in parts of East and South Asia, and the Middle East. Among those who buy groceries, 96% of Chinese grocery shoppers buy groceries online. They are followed by grocery shoppers in India (93%), South Korea (89%), and from the Middle East, purchasers from the Kingdom of Saudi Arabia (77%).

The survey, which was conducted in Q2 2022 among 11,000 consumers in 12 countries around the world, also revealed that more consumers are buying their groceries online compared to six months ago. This increase is most prevalent among consumers in India, with 75% of those who ever buy online say they are now doing more of their grocery shopping online. Surveyed consumers in China (55%) and Brazil (50%) state the same claim.

The mood of consumers

The temperature check reveals that increased adoption of online grocery shopping is linked to a growing price-consciousness among consumers.

Consumers across the globe expect to see a rise in the cost of goods and services in the next six months, but their outlooks vary by region. Consumers in six out of the 12 countries surveyed (Chile, South Africa, Brazil, Kingdom of Saudi Arabia, China, and India) feel optimistic that their lives or personal financial situations will improve in the same period. Feeling pessimistic are most of the consumers surveyed in the United Kingdom, Poland, Germany, and France. Consumers in South Korea and the United States of America are split.

However, regardless of whether these consumers are optimistic or pessimistic, they are all keeping a watchful eye on spending.

How consumers will shop in the next six months

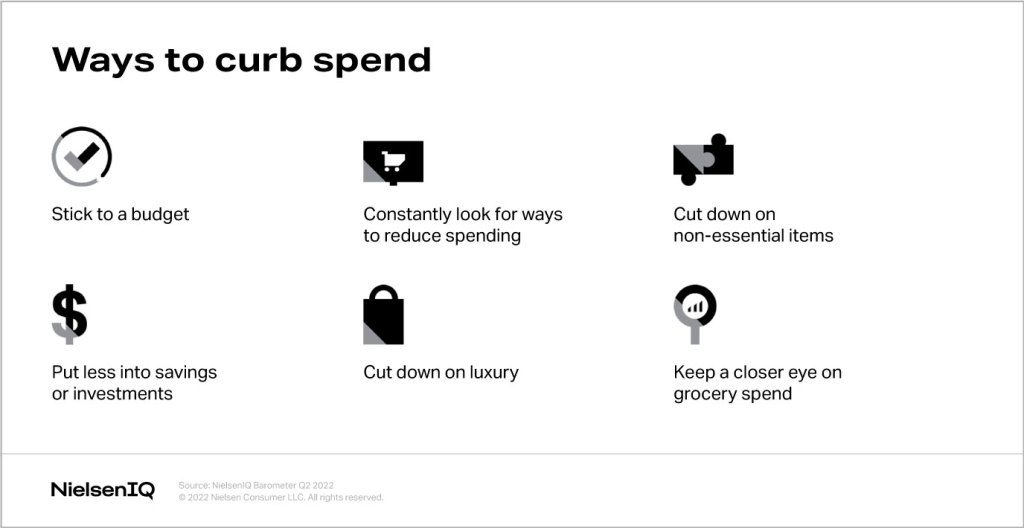

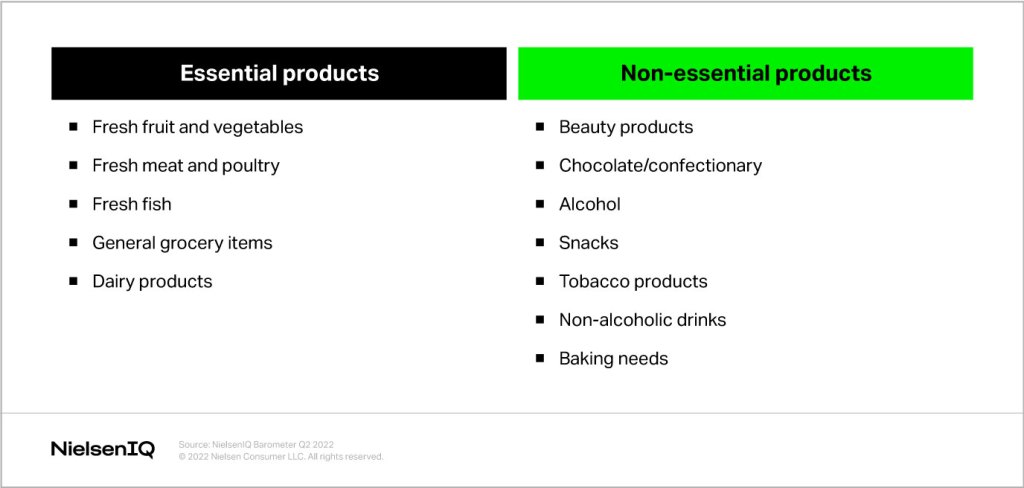

Generally, grocery purchasers have been watching their spending more closely over the past six months, but many say they’re still spending more due to increasing prices. As they keep a tight watch on spend, consumers are prioritizing basic food and grocery items over items that they view as non-essential.

At the height of COVID-19 lockdowns, concerns for convenience, safety, and product accessibility for mobility constrained consumers provided the impetus for online shopping’s extraordinary growth, but rising prices will likely push more consumers to shop online.

The same global survey shows that providing good deals and promotions, value for money, and low prices are considerations among consumers when deciding where to shop for groceries. Consumers have come to equate these considerations with online shopping.

In countries like South Korea, aside from these considerations, the availability of online grocery shopping is also important when deciding where to shop for groceries.

Online resources as aid to better grocery planning

Now that consumers are more conscious of their grocery spending, they also report using online resources to compare prices before deciding where to shop, research products or brands before deciding what to buy, and check supermarkets’ websites before grocery shopping. In India and China, live streaming updates or the latest posts on digital platforms from social influencers also impact grocery shopping choices.

What’s next for e-commerce?

The rising number of consumers adopting online shopping isn’t simply a COVID-related fluke. As inflation continues to rise around the world, e-commerce is yet coming to the rescue of consumers who are still recovering from pandemic-related financial challenges and feeling the effects of rising prices.

Today’s consumers are relying on the online world to help them plan, seek more value for their money, and access products that cater to their saving tactics.

Source: NielsenIQ Barometer Q2 2022