Experts weigh in on omnichannel strategies

U.S. households are making more frequent shopping trips to maintain their pantries. However, the nature of those trips is evolving, continuing an omnichannel shift that was underway even before the disruption caused by the Covid pandemic.

Experts from Conagra Brands, Post Consumer Brands, Reynolds Consumer Products, and NIQ traded insights about these changes in a discussion at last month’s Consumer 360® Conference in a session titled “The Evolution of Shopping Trips.”

As the panelists made clear, the need for consumer brands to track and continually adjust omnichannel strategies is here to stay.

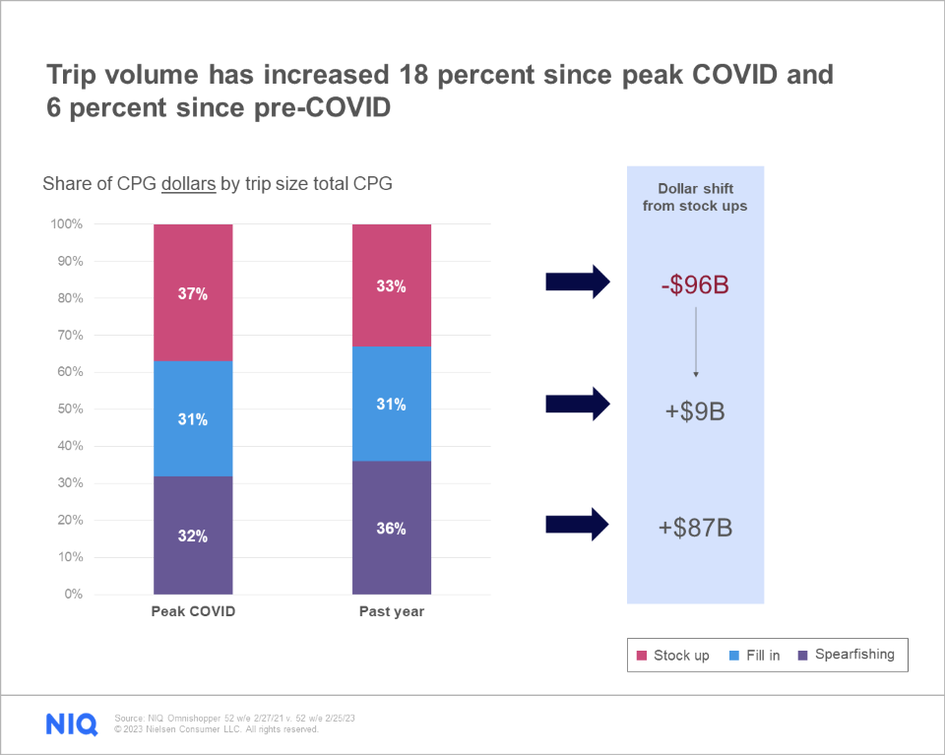

“Shopping trip frequency is up 18% since Covid peaked, and also up more than 6% since the year before Covid.”

Kenneth Cassar

VP, Omni Industry Leader

Shopping Trip Frequency is up 18% since Covid peaked

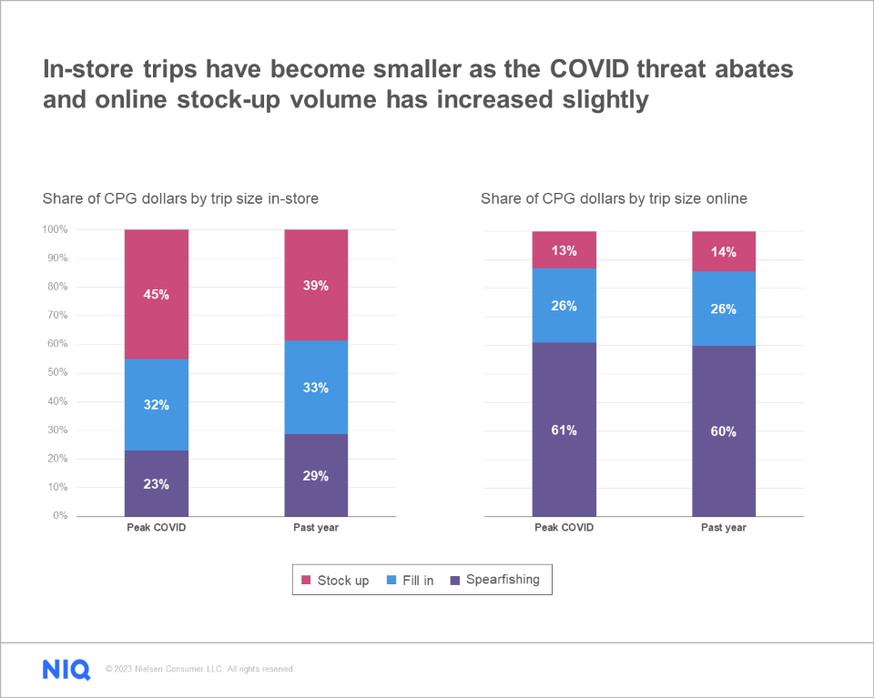

The nature and purpose of many of those trips have changed, however. Shoppers are patronizing twice as many banners today versus a decade ago. NIQ Omnishopper and Homescan data document an ongoing shift from stock-up trips for consumer-packaged goods (CPG) to more frequent smaller trips, amounting to $100 billion in sales shift since peak Covid, according to Cassar. The smallest “spearfishing” trips of 1 – 3 items now account for 58% of all shopping trips.

CPG sees stock-up trips increase simultaneously reducing in importance

“NIQ research defines stock-up trips to mean baskets of 12 or more items,” Cassar noted. Stock-up sales online continue to increase, now accounting for 11% of all stock-up dollar sales. At the same time, one-fourth of non-stock-up trips are now conducted online.

For many online shoppers, minimum order sizes and delivery fees have influenced more stock-up orders. A key exception is Amazon.com, where 72% of consumer-packaged goods shopping trips are spearfishing trips, compared with just 13% of trips in brick-and-mortar grocery stores.

Cassar observed that while stock-up trips still account for a significant portion of CPG sales, their importance is declining somewhat across all departments. Over the 52 weeks with reporting ending on February 25, 2023, the dollar volume of omnichannel stock-up trips reduced by 5 points to 33%.

“For a while post-Covid, shoppers continued to replenish their back-up in the pantry.” When inflation hit, price points influenced some shoppers to shift to smaller-sized packages in some channels and larger sizes in others.”

Greg Davis

VP, Category Management

CPG manufacturers enact different strategies depending on categories

These trends have implications for CPG manufacturers as they consider how their product sales may be impacted by changing consumer behaviors. The strategic responses could be very different for the brands represented on the panel, depending on their categories.

“I would love to think breakfast cereal is a primary shopper mission, but in reality, it is not,” said Geoff Zahn, Associate Director of Insights and Strategy, Post Consumer Brands. “So stock-up trips are the heart and soul for us at Post.”

Greg Davis, VP, Category Management, Insights & Analytics, Reynolds Consumer Products, concurred. “Stock-up is very important for us too. We sell essential items that are kept in household pantries every day.”

“With its broad variety of 105 brands, each with different trip behaviors, Conagra Brands is constantly adjusting packages and strategies,” said Bob Nolan, Senior Vice President, Demand Science.

“It has been changing more over the last five years than my entire career. It is really about adapting faster.”

Bob Nolan

Senior Vice President, Demand Science.

The panelists explored how recent inflation has had varying impacts on trips. Davis observed that lower-income shoppers may be more motivated by price point in the present era, while shoppers with more means may look for higher unit value.

“You need the right images and information for display online too. Don’t start with an item selling in one way and then stop thinking. You’ve got to move beyond that.”

Bob Nolan

Senior Vice President, Demand Science.

Omnichannel trip behavior influences the product portfolio

Clear insights about omnichannel trip behavior can have an important influence on the product portfolio. Nolan offered an example: “Conagra’s Slim Jim meat snacks are 50% impulse purchases. This is perfect for convenience stores or the front checkout lanes in supermarkets. But online, a pantry pack works much better.”

Reynolds’ line of foils, pans, and wraps are “products you cook with,” said Davis. Often, shoppers seek them out with clear intentions, such as for holidays, when bundling can be an effective way to merchandise, both in-store and online.

Nolan noted that “Conagra views online channel as a meal solution selling opportunity. In-store, it can be hard because of temperature differences among the items. But online, we can offer bundles versus individual products.”

“Cereal is a lot less functional,” said Zahn. “Product variety is key. Our Malt-o-Meal brand, sold in bags, is a match made in heaven at Walmart. As a manufacturer, we over-index with them as a result.”

He added “that its’ cereals are packed in 25-ounce up to 60-ounce bags, which tells a great value story on store shelves, but presents a particular challenge when it comes to merchandising them online, where larger and smaller packs can look indistinguishable. We need creative images for the web store to educate shoppers about the value at a glance.”

Nolan concurred about the need for product packaging to tell a coherent story across all channels. “You need the right images and information for display online too. Don’t start with an item selling in one way and then stop thinking. You’ve got to move beyond that.”

Omnichannel Trips Insights at NIQ

Today’s shoppers are changing constantly, as each household formulates their best trips solutions to meet their budgetary and consumption needs in an era of rising CPG prices. Brands and retailers need precise data more than ever to inform decisions and present a great value story to shoppers. NIQ experts can help.