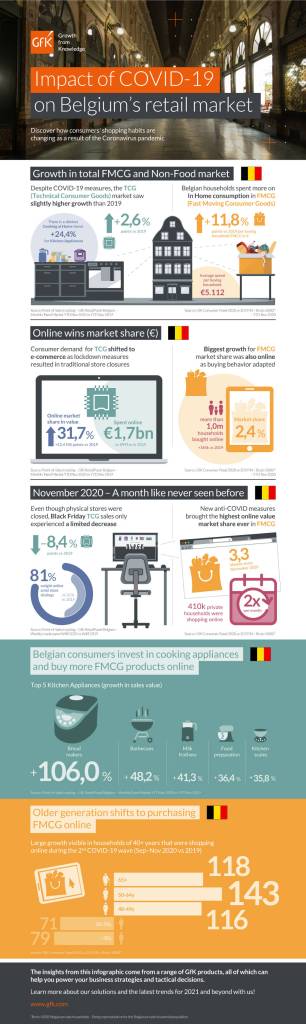

The virus that shut down the world: 2020, a year like no other. To wrap up this incredible year our experts have summarized the most remarkable trends in the retail market. Have a look at the infographic and discover how consumers’ shopping habits are changing as a result of the Coronavirus pandemic:

The infographic below contains the main trends and lessons observed in the Belgium’s retail market.

The rise and shine of E-commerce

Let’s first reflect on the start of 2019 when nobody could ever imagine that a virus would change our lives so drastically. In the first weeks of 2019 only 23,3% of consumer spending on technical products (eg. vacuum cleaners, hair straighteners ) was online. This means that still 75% of consumers were purchasing in-store instead of online.

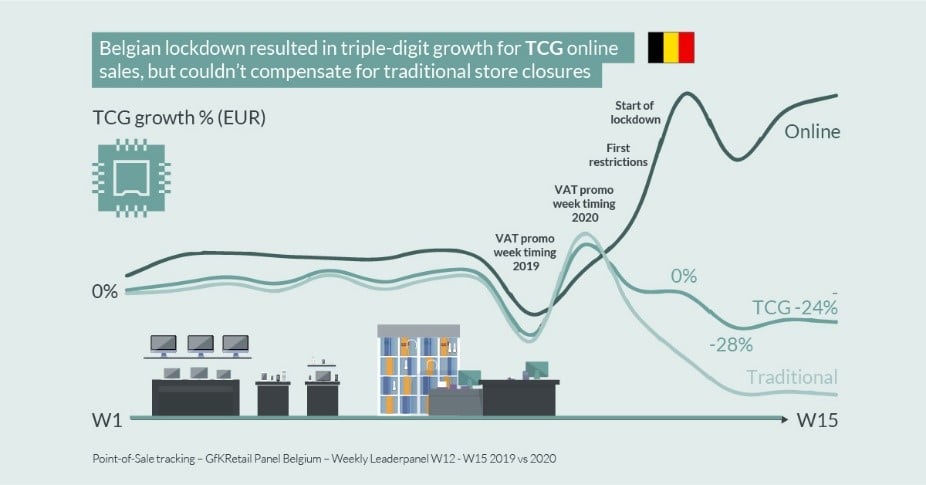

And then one year later, COVID-19 impacted the shopping behavior in Belgium tremendously. While traditional stores had to close their doors because of the lockdown measures, consumers demand for Tech & Durable goods shifted drastically to e-commerce.

In week 15 of 2020, the data from GfK Market Intelligence: Sales Tracking shows an online share of 85% in the Technical Consumer Goods (TCG) market. This resulted in triple-digit growth in online sales of Technical Consumer Goods as shown the image below. An extraordinary trend that we haven’t seen before. Eventhough the online share explodes and online sales boom, in-store losses cannot be compensated and the total TCG market decreases to -24% in week 15 of 2020 compared to last year.

Working from home boosts online sales of technical goods

The corona virus impacted not only the way we were shopping. It also influenced our way of working. Offices were closed and people were all forced to organise their working situation at home. Office IT products were sold like never before due to people investing lots of money in creating a pleasant home office. This resulted in booming sales of products that contribute to a more convenient home office. The top 5 categories sold in the first 15 weeks of 2020: Monitors (+237%), MFD (+148%), Mobile Computing (+86%), Communication Devices (+79%) and Headsets (+79%).

Increase in online shopping amongst older generation

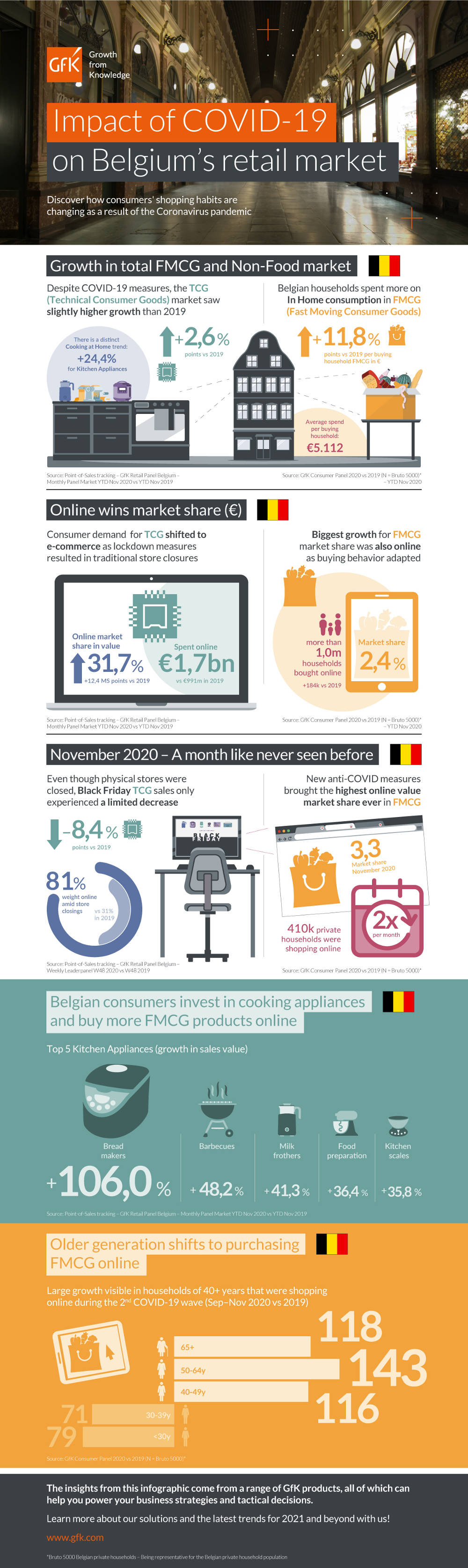

The rise and shine of the e-commerce market is also visible in the FMCG market. In 2020, 1,041 mio Households (November 2020 YTD) were buying their groceries online. And while a growing number of the younger households already moved towards e-commerce in the first COVID-19 wave, the households of 40+ years joined this growing online shopper group in the 2nd COVID-19 wave (Sep – Nov 2020 vs 2019).

In November 2020, the belgian market was confronted with a closure of the non essential stores. Consumers massively moved towards online which resulted in an online sales increase of 3,3%. This is the highest market share ever reached within the Fast Moving Consumer Goods market.

Cooking at home becomes major trend

Also Cooking at Home and Home-made food is back in fashion! This is not strange knowing that Belgians were advised to stay at home as much as possible and COVID measures didn’t allow them to go to a bar, restaurant or club. When looking at Point-of-Sales Tracking data, this trend resulted in a +24,4% sales growth (in value) of kitchen appliances.

Curious what top 5 products were sold in 2020? Have a look at the infographic!

How will the FMCG & TCG market evolve in 2021?

Will the Belgian consumer keep on spending their money online? Will they invest more in their homes? What will they start buying next? What new trends will emerge when measures continue? GfK offers a wide range of GfK products that provide a deep understanding of the market and that can help you power your business strategies and tactical decisions.

The used data comes from various GfK solutions

GfK Market Intelligence: Sales Tracking that helps you to measure your market share and brand performance in the Technical Consumer Goods market, and benchmark it against your competition. We have built the world’s largest retail panel, and track products and deliver insights based on actual sales data from both retailer and reseller. And with our Performance Pulse app you can access these insights on-the-go.

Our extensive FMCG research is rooted in GfK’s Consumer Panel. This research includes purchase data of a representative sample of private households that scan all their purchases of Fast Moving Consumer Goods on a continuous basis. It also covers the full picture of the different retailers selling the FMCG category.

Next to this, the performance of brands and retailers can be evaluated and supplemented with shopper segmentations, data from our tracking tools, why-to-buy studies and other advanced analytics that helps you to get a complete view of your customer and market potential.

Interested?

Talk to our experts and learn what GfK can do to help you grow your business:

- Karina De Cock (karina.de.cock@gfk.com) – Retail Account Director – Fast Moving Consumer Goods

- Muriel Pessinet (muriel.pessinet@gfk.com) – Retail Intelligence Lead – Technical Consumer Goods