Community group buying reshuffling

Since 2020, community group buying has been on the fast development track due to the pandemic, but its growth slowed down in 2021.

Community group buying is referred to as another form of e-commerce where a minimum number of consumers buy goods and services at reduced prices. Also known as collective buying, the concept of group buying works like cooperatives, where many people buy from a merchant.

As the authority tightened control on community group buying, some of the community start-ups are facing growing pressure while established e-commerce giants continue to rise and solidify their client base.

The latest research on community group buying shows that the cooperation concentration rate for small offline retail stores and e-commerce giants’ community group buying platforms has reached 87% in December 2020. In the meantime, the cooperation concentration rate for earlier platforms has dropped from 39% in June 2021 to 13% in December 2021.

How is community group buying affect conventional retail?

Community group buying, as a form of retail, has fresh players from e-commerce platforms instead of traditional retail giants. Internet giants are now moving to attracting traffic and appealing to users.

Conventional Internet traffic has peaked, while short videos and other social e-commerce platforms take traffic away. Conventional e-commerce players must find ways to defend their centralized traffic and drive home advantages on customer stickiness. Under this circumstance, community group buying was favored because of its frequent interaction with users.

Community group buying business is different from conventional retail market. However, they are both built on traffic (the customer groups for a retail store and a community group buying group leader stay the same), as follows:

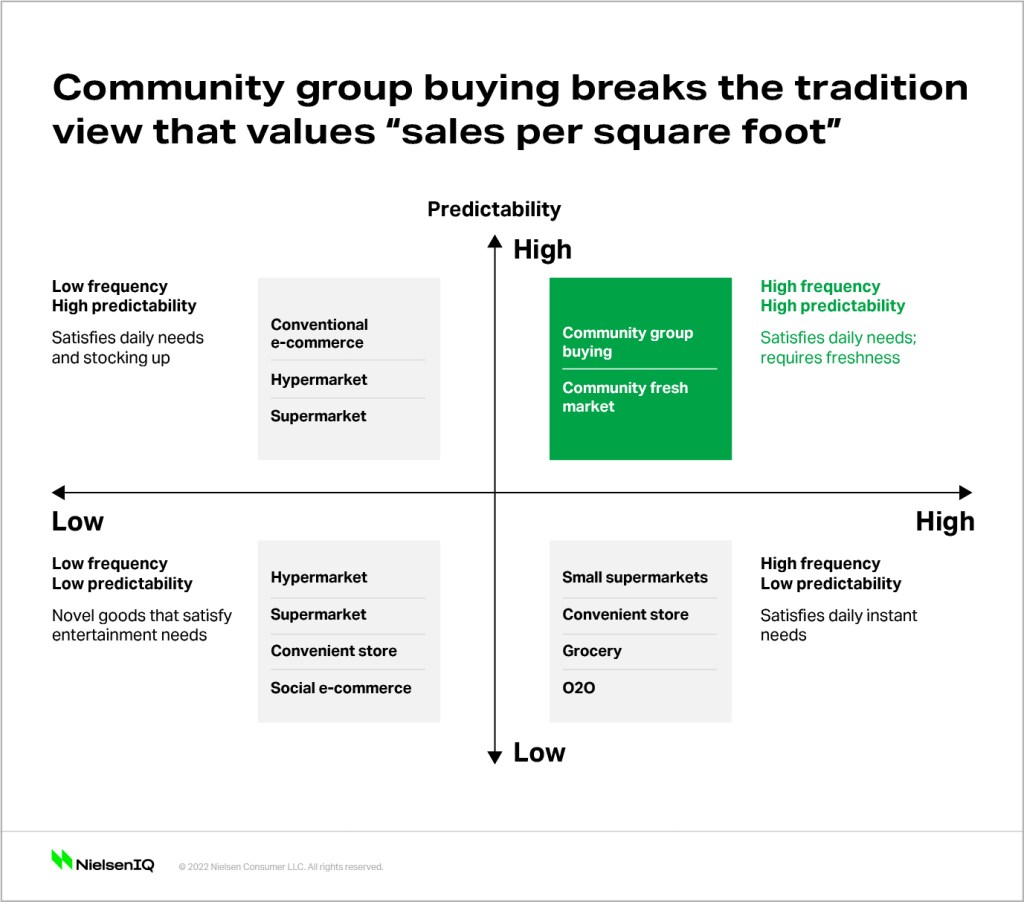

- Conventional retailer values “sales per square foot.” The more goods the better; the more goods per capita the better, satisfying as many customers’ needs as possible. Differentiated goods, attractive promotion, and display in store push consumers to make impulse purchases. “Sales per square foot” is the key to success.

- Community group buying employs a different logic, which favors the more limited goods the better and the less difference, the better. The more predictability the better; the more frequent the better. Pre-sale reduces loss as group buying brings larger scale, and picking up reduces fulfillment expenses. Supply chain efficiency becomes the key to success.

When these two styles come together, the biggest impact from community group buying is that it satisfies the high- frequency needs of consumers, therefore making it less necessary to shop at conventional retail stores. Ultimately, this makes it less likely for consumers to make unplanned purchases, breaking the traditional view that values “sales per square foot.” This has affected the profits of traditional retailers. What e-commerce players value is the contribution to traffic and user stickiness from community group buying. They are running platforms, and they can subsidize community group buying with profits from the whole platform. As a result, Internet giants do not necessarily destroy conventional retail.

Will community group buying replace conventional retail?

NielsenIQ study found the answer might be no. Community group buying will face the following challenges in the future:

- Other industries wait to fill in the market. The target group of community group buying are price-sensitive consumers. It is not accepted by both consumers and policies to unreasonably raise the price, causing an infinite loop. Grocery stores, small supermarkets, and other competitors will take their market share as soon as community group buying is no longer cheap.

- Each consumption need is filled with industries. Community group buying is not replacing every shopping scenario. Profitable markets with high prices have high entering barriers. It is fundamental for community group buying to enhance supply chain efficiency to succeed.

- Existing retailers innovate accordingly. Retailers start to innovate on operation model. For example, community fresh markets and warehouse clubs have an impact on community group buying under certain circumstances.

Some inspirations for FMCG manufacturers from community group buying

Community group buying business is different from conventional retail market. For consumer goods manufacturers, it is important to combine the traits of community group buying with those of retail.

- NielsenIQ suggests piloted investment. Community group buying has entered a new reshuffling period, and it is unlikely to have explosive growth in recent days, which makes it unsuitable for substantial amounts of investment. However, community group buying is developing at different paces in different regions. Brands may choose regions where community group buying is developing fast to pilot, aiming to accumulate operation experience.

- Define strategic objectives while customizing product mix including price and promotion strategies. Group purchase is currently aiming to capture traffic and user engagement services for internet giants. Therefore, community group buying is more inclined to sell the core products, which are the high-frequency and highly planned products among the manufacturer’s product portfolios. The mandatory lessons are to define whether to focus on volume or profit to manage the relative balance of core items in different retail channels.

- Reach lower–

- Combine different channels to cover all consumption scenarios. Community group buying has a limited role in the retail market and will eventually fit with other retail channels. While developing community group buying, brands need to pay attention to the characteristics of different channels and constantly build their brand awareness. It is also essential to develop new products to satisfy consumer needs under different shopping and consumption scenarios.