A shifting retail media landscape

The rapid evolution of retail media has motivated brand marketers to adopt business activities that did not exist even a few years ago.

They are moving ad dollars into retail media networks from their traditional media budgets. They are also shifting some marketing funds formerly earmarked for trade promotions. They are wrestling with the complexity of buying and evaluating retail media investments across multiple RMNs.

New research from Coresight Research, commissioned by NIQ, sheds light on the perspective of today’s CPG ad buyers as they pursue relevant audiences and consider the value and results of new types of marketing campaigns. Findings from the research report were presented during a recent webinar hosted by Progressive Grocer titled “A CPG’s Perspective on Retail Media and Personalization.”

Speakers included:

- Xavier Facon, Global Head of Retail Media & SVP of Retail Product at NIQ

- Steve Winnick, Senior Analyst at Coresight Research

- Moderator – Gina Acosta, Editor in Chief at Progressive Grocer

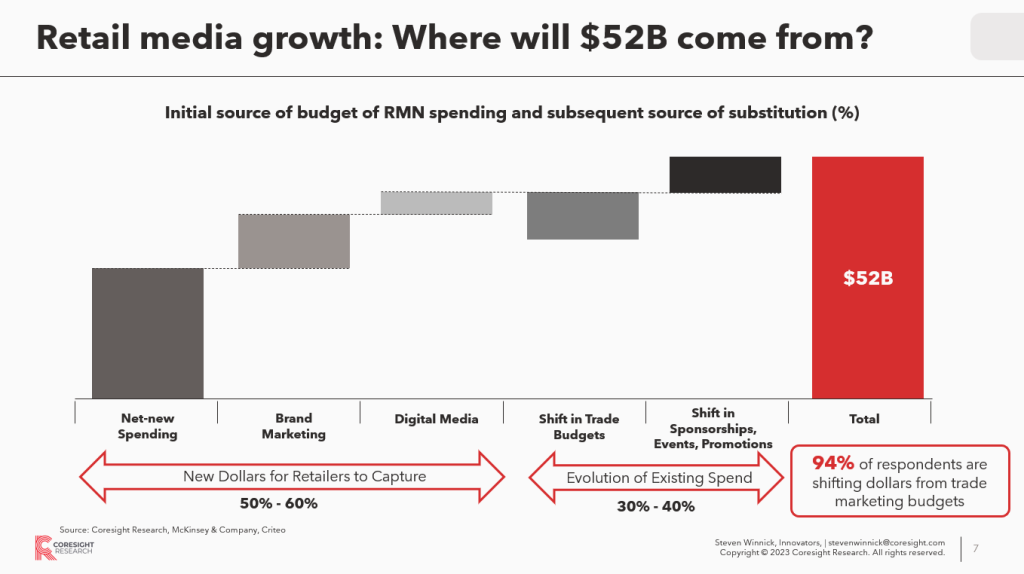

With U.S. retail media spending approaching an estimated $52B in 2023, ad buyers face daily decisions about which channels to invest in, what advertising and promotional techniques to use, how much to spend, and where to source the budgets to pay for campaigns. Meanwhile, retail media networks (RMNs) scramble to keep their channels relevant, data-driven, accessible and competitive in value.

Partnerships and collaboration are key, especially appropriate sharing of data in the context of a self-service planning process that enables brands to accurately assess the value gained from their retail media advertising investments.

The research findings have implications that will be of critical importance to partners on both sides of the trading table.

A touchy topic: New versus repurposed spending

Among the most sensitive issues for retailers who have made the investment to establish retail media platforms has been the expectation of incremental, “alternative” revenues that should result. The reality, according to the research, is more mixed.

“We’re seeing, based on our research and some in-depth interviews, about 30 to 40 percent of these dollars are coming from existing spending with retailers,” said Steven Winnick, senior analyst at Coresight Research. “About 94 percent of ad buyers said they would be shifting at least one dollar from trade marketing funds to RMN programs.”

This means not all retail media income is being transferred from traditional media channel budgets such as television, print, and cable TV advertising. But the overall picture still favors retailers.

“Brands are making big bets in this space, with one-fifth of marketing budgets planned on retail media networks,” Winnick said. “The majority of this growth is being funded by incremental dollars, which is a good sign.”

Xavier Facon, Global Head Retail Media and SVP of Retail Product at NIQ, noted that retailers sometimes see their brand-new retail media networks grow very fast at the onset, after which growth slows.

“It can quickly get to a point where brands—who are spending on many retail media networks—are not going to bring too many new dollars into the pot,” he said.

“Brands are unlikely to invest more until the retailer can properly explain what the impact is, what the efficacy is, what the performance is. It is super challenging to do that with simple, basic campaign KPIs like ROAS (return on ad spend). That doesn’t tell the whole story.”

The Coresight survey found that 73 percent of advertisers expect to spend more on RMNs over the next 12 months, Winnick said. “We’re seeing no sign of slowing down on the demand side.”

Facon observed that the competition to earn retail media spending comes down to three elements – price, inventory and data.

“The price of the media is set by the market by and large. Inventory is defined by how many channels and ad formats you can offer to access the shoppers. Then, how many shoppers have you identified and how good is your behavioral understanding – your first-party data?”

Price, inventory and data. If you bring these three things together, you can command your fair share of advertising dollars.

— Xavier Facon, Global Head of Retail Media & SVP of Retail Product at NIQ

He emphasized that it is also essential to “take friction out of the process” to the extent possible. “If you are not a company that is easy to do business with, if it’s not automated, it’s not self-service, it’s not transparent, then obviously there is going to be fewer campaigns running. This may be the biggest impact on your overall revenue.”

Attractive margins, not a “tax”

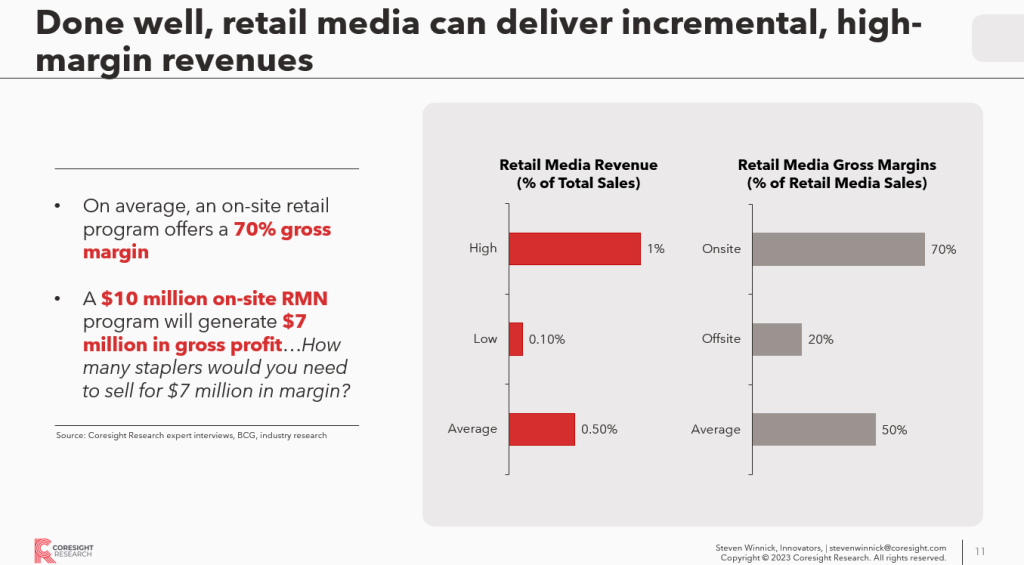

For retailers a major attraction of retail media networks has been the favorable margins that come with selling advertising, a purely digital product. Winnick shared some topline findings from the research study:

“Just to show you what the margins can look like, on average we are seeing retail media can represent about one percent of topline revenues, with a gross margin average of about 50 percent. To put this into perspective, a $10 million on-site media program can generate about $7 million to the bottom line,” he said.

“This is quite significant. To put that into perspective for a retailer in the audience right now, that’s the equivalent of about $40 million in product sales at a 20 percent margin.”

Brands are spending willingly on retail media for the most part, Winnick said, overturning what he called the myth that retail media amounts to a “spend tax” from endemic brands.

“In the survey we found that just 28 percent of ad buyers cite the investment as a cost of doing business, which we think is very low. And in two years we see that going down to 18 percent.”

Endemic brands increasingly perceive the merit in their retail advertising investments. When they can be shown to deliver both advertising value and incremental conversions in the stores, this is regarded as a sound return.

Brands spend across multiple RMNs

The research confirms that advertisers continue to diversify their spending across multiple RMNs. “According to our survey, they are splitting their spending across an average of six,” Winnick said. “Obviously, capabilities, scale, and sophistication are critical to deliver the audiences and retain those dollars.”

Spreading campaigns across multiple RMNs may help a brand reach more of its desired audience, but it also adds considerable intricacy. Brands are willing to invest the effort, but their bandwidth is limited. Many are frustrated by gaps in most present retail media offerings.

Among these gaps are a lack of collaboration, cited by 62 percent of respondents, and a lack of reporting standardization across retailers, cited by 52 percent of brands.

Retailers that don’t already command a vast audience scale like the top 5 largest players will need draw upon their special attributes to compete for a piece of the action, Facon advised. “Some retailers have a very unique identity and are reaching certain segments of the shoppers that otherwise are hard to reach.”

He added, “In grocery, for instance, you may have a retailer that has a strong loyalty program who is very much thinking about how to sell media by objective. They can look at the opportunities to identify transactions, with an understanding of people’s purchase behavior, their buy cycles. If you build a media network that is very retail customer-oriented you can easily get more than your fair share.”

This also presents opportunities for smaller, scrappier retailers who can present a unique audience proposition, he added. “They can go into hyper-targeted, always-on campaigns that target the shopper at the right times in the purchase cycle and build a story.”

Keys to unlock advertiser spend

Survey respondents regard collaboration and transparency to be the “gold standard” which can differentiate a retail media network from the pack.

“Fostering this trust will create a real opportunity,” Winnick shared. “Retailers need to ensure attribution metrics are clear, channel specific and easy to understand. We see a huge opportunity to align and provide a unified experience in this way.”

Facon urged retailers and ad planners to consider that certain campaign strategies and business goals “should not be addressed with just one marketing tactic like retail media, but with a variety of tactics, including digital offers or mass promotions or pricing changes or even supply chain optimization.”

Real-time data-sharing and insights can support the ability to bring all those considerations together around a set of set of retail analytics and sales drivers.

“The brand companies cannot dream of doing this because they don’t have the data the retailers have,” Facon noted. “That’s where we come back to how the retailer can provide capabilities to help them. What’s interesting is that you don’t become so focused on the basic campaign metric. You focus on the numbers you see in the analytics. On true collaboration.“

Other “keys” identified in the research that can unlock advertiser spend include:

- Real-time data sharing and insights

- Promotional tools and “optionality”

- Partnering to accelerate growth

- Industry standardization

Overwhelmingly 97% of advertisers said “yes” to a desire for real-time data sharing. They are willing to pay a premium, willing to invest in RMNs that can provide this.

— Steven Winnick, Senior Analyst at Coresight Research

This finding may signal a significant present gap, Facon observed. “If I put myself in the side of the media network, I’d be concerned about what that number says.”

Real-time should be paired with telling the whole story, delivering the full view. All the metrics that matter, including customer and sales data. Use these to optimize the next campaign, and sometimes even to adjust within the campaign.

“This must occur within the retailers’ domain,” Facon insisted. “If you are asking a third party to create sales attribution reports showing true incrementality, those studies are not real-time.”

Meaningful steps that retailers can take to build trust among brand advertisers include offering a shared collaboration platform to enable real-time communication and data sharing. The survey revealed that less than one-quarter of retailers share data and analysis with brand advertisers in real time during ad campaigns.

Coresight Research emphasized that a lack of standardization in RMNs has created an inefficient, costly and frustrating experience for ad buyers. Working in collaboration with McKinsey and the Interactive Advertising Bureau, they estimate that as much as $5 billion to $15 billion in incremental value would be unlocked by pursuing this effort.

Is the industry experiencing a convergence of personalized offers and retail media advertising? Facon said he believes so and that it is a good thing.

“I love that it’s happening. Shoppers want better value exchange for participating in loyalty programs. Putting incentives in the ads is good for the brand and the customer, also for the retailer at end of day.”

Want to learn more?

Read our research report for in-depth details: “The U.S. Retail Media Market: Understanding the Ad Buyer’s Perspective in CPG.”