Indonesian consumers are more cautious with their spending

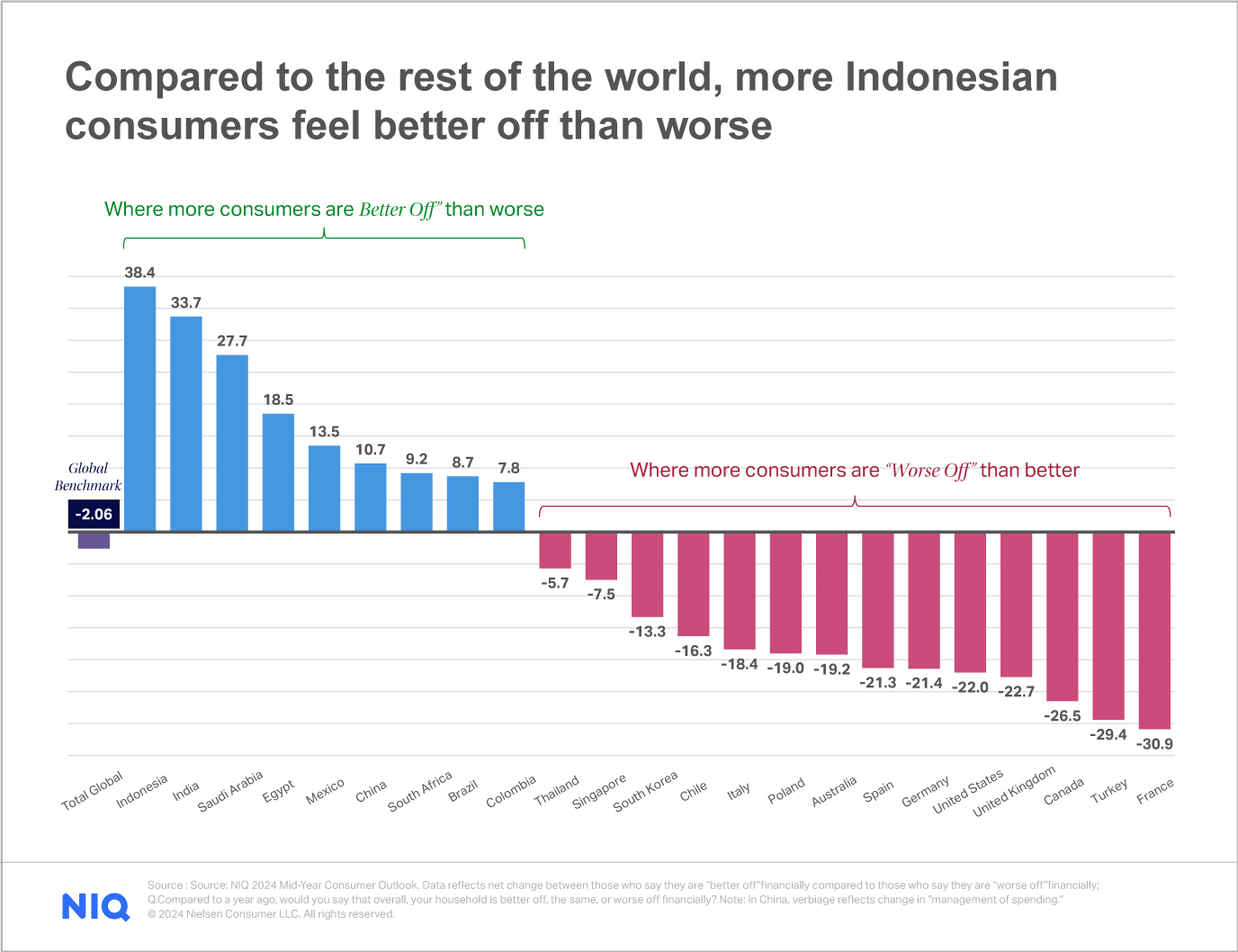

According to the Mid-Year Consumer Outlook: Guide to 2025 report, consumers in Indonesia are continuing to purchase products and services they need despite price increases. However, consumers are now more cautious, more experimental, and more selective about brands. Consumers are also remaining optimistic about Indonesia’s economic conditions. Compared to other countries in the world, the study found that more Indonesian consumers feel better than worse at 38.4% compared to consumers in other countries and globally at -2.6%.

This is based on the outlook for Indonesia’s economic growth, which is estimated to be stable until 2025 according to BPS data. GDP is estimated to grow from 5.1% in 2024 to 5.2% in 2025. This economic growth is dominated primarily by household consumption at 54.5%. Inflation has also decreased, but not in the food, beverage, cigarette, personal care, and other service sectors.

Despite this, the level of confidence among Indonesian consumers is not as optimistic as before, namely after the post-pandemic or during the recovery period. Rising food prices and the threat of economic decline continue to be the main factors weighing on consumers’ minds, so they are more careful and more strategic in using their money. In fact, this concern has triggered 83% of consumers to actively seek additional income outside their main job and 23% said they would increase their debt to meet their needs and maintain their current lifestyle.

Driven by necessity, Indonesian consumers will continue to spend their money on fast-moving consumer goods (FMCG) despite price increases. However, they are now more experimental to get more and better experiences from the products they buy. In addition, they are also more selective about their choice of brands.

Key findings from Indonesian consumers:

- Consumer confidence in Indonesia has declined , with the percentage of those saving and feeling financially secure dropping from 26% in mid-2023 to just 13% in mid-2024. Meanwhile, the proportion of consumers becoming more cautious in their spending increased from 34% in 2023 to 41% in 2024. This caution is driven by concerns over personal well-being, happiness, and job security.

- Despite a decline in FMCG spending, food spending, particularly among lower-income groups, increased slightly from 26.5% in 2023 to 27.3% in 2024.

Factors driving Indonesian consumer purchases:

- For technology needs, 71% of consumers are willing to pay IDR 9-10 million for premium, long-lasting products, as they prefer to replace their devices every three years or more.

- In the FMCG sector, consumers are increasingly experimental in their purchases to enhance their experience. Nearly half of consumers purchase more than five product categories for cooking, 50.1% buy more than two for snacking, and 22.8% buy more than three for beauty.

- Although more experimental, consumers are becoming more selective about the brands they choose. With more brand options and frequent promotions available, they can control their shopping baskets by sacrificing certain brands in various categories.

The impact of

experimental and selective shopping behavior, towards 2025:

- The top 5 brand positions are under pressure, with leading brands in categories like cereal, cooking milk, and cooking oil experiencing consistent declines. Cereal brands dropped from 85% in 2022 to 83% in 2024, cooking milk brands from 93% to 89%, and cooking oil from 50% to 42%.

- Indonesian consumers are willing to pay more for comfort and convenience, with 58% spending extra for special moments, 64% opting for at-home experiences to save on dining and entertainment, and 57% preferring easy-to-use product formats.

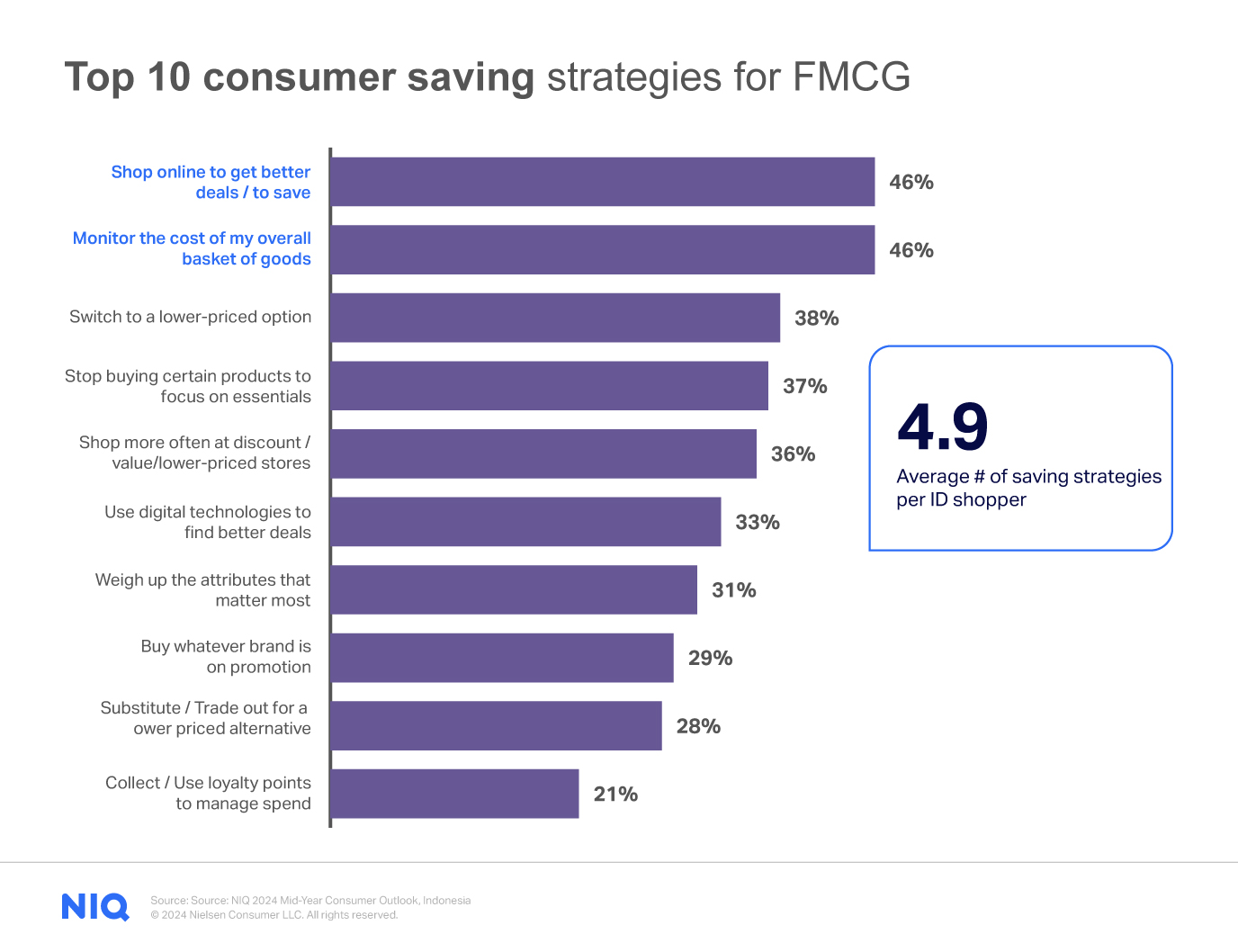

- To save on FMCG shopping, 46% of consumers find online shopping helpful for better deals and also take control of their shopping carts. Additionally, 38% switch to cheaper products, and 36% buy more discounted items.

Start making data-driven decisions

Ready to transform your strategy with actionable insights? Dive into our comprehensive report and gain the clarity you need to make smarter, more impactful decisions. Download it today and empower your team with expert analysis and data that drive success.