Over the past decade, China’s birth rate has declined from 13.03‰ in 2013 to 6.39‰ in 2023.

As a sector closely tied to people’s daily lives, Chinese maternal and infant industry is facing challenges in finding new growth points. Where are the emerging growth opportunities in the maternal and infant market?

As the new generation mothers Generation Z mothers are entering the golden period for marriage and childbearing. This new generation of mothers will bring in unprecedented changes to, the consumption demands and media engagement habits that will impact of the baby market are undergoing unprecedented changes in China. Brands must act now to accurately capture market dynamics and the ever-changing consumer sentiments.

—— Bryce Zhu, China Customer Success Consulting, Baby Industry Leader

Rebounding China baby market

In 2024, the national birth population reached 9.54 million, an increase of 520,000 compared to 2023, marking the first rise since 2017.

From the perspective of the mother-and-baby consumption cycle, an increase in the birth rate in a given year will drive consumption in the following year and even the third year. With the short-term rebound in the number of newborns, the mother-and-baby market will enter a new consumption cycle in the coming years.

The perfect mix of an omnichannel play

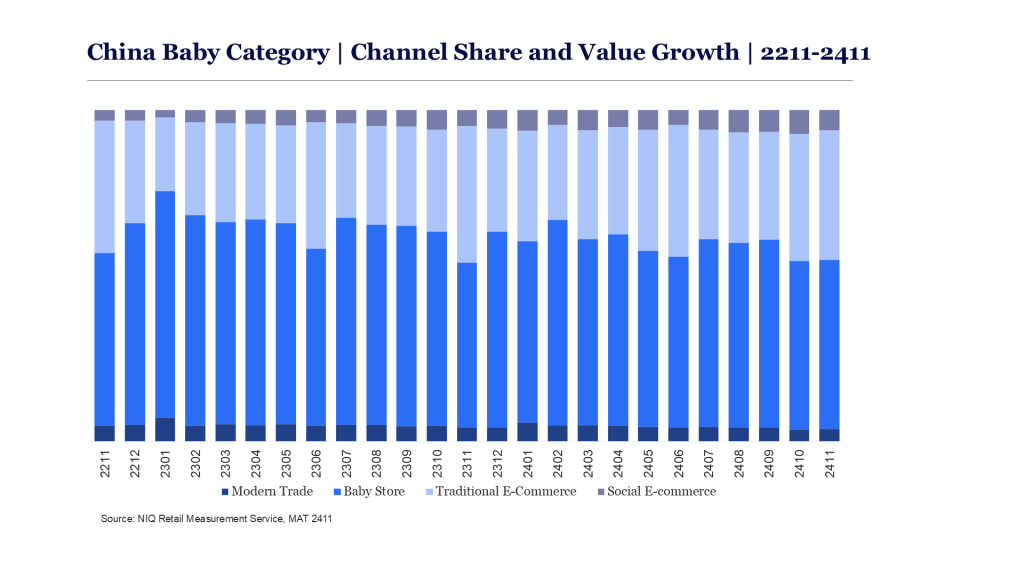

In the post-pandemic era, China’s maternal and infant market is entering a new period of accelerated online-offline integration, with a flourishing general e-commerce and social commerce in a multi-channel landscape.

Undoubtedly, offline maternity and baby stores remain the cornerstone of sales in this category, with nearly 60% of maternal and infant product sales coming from offline channels.

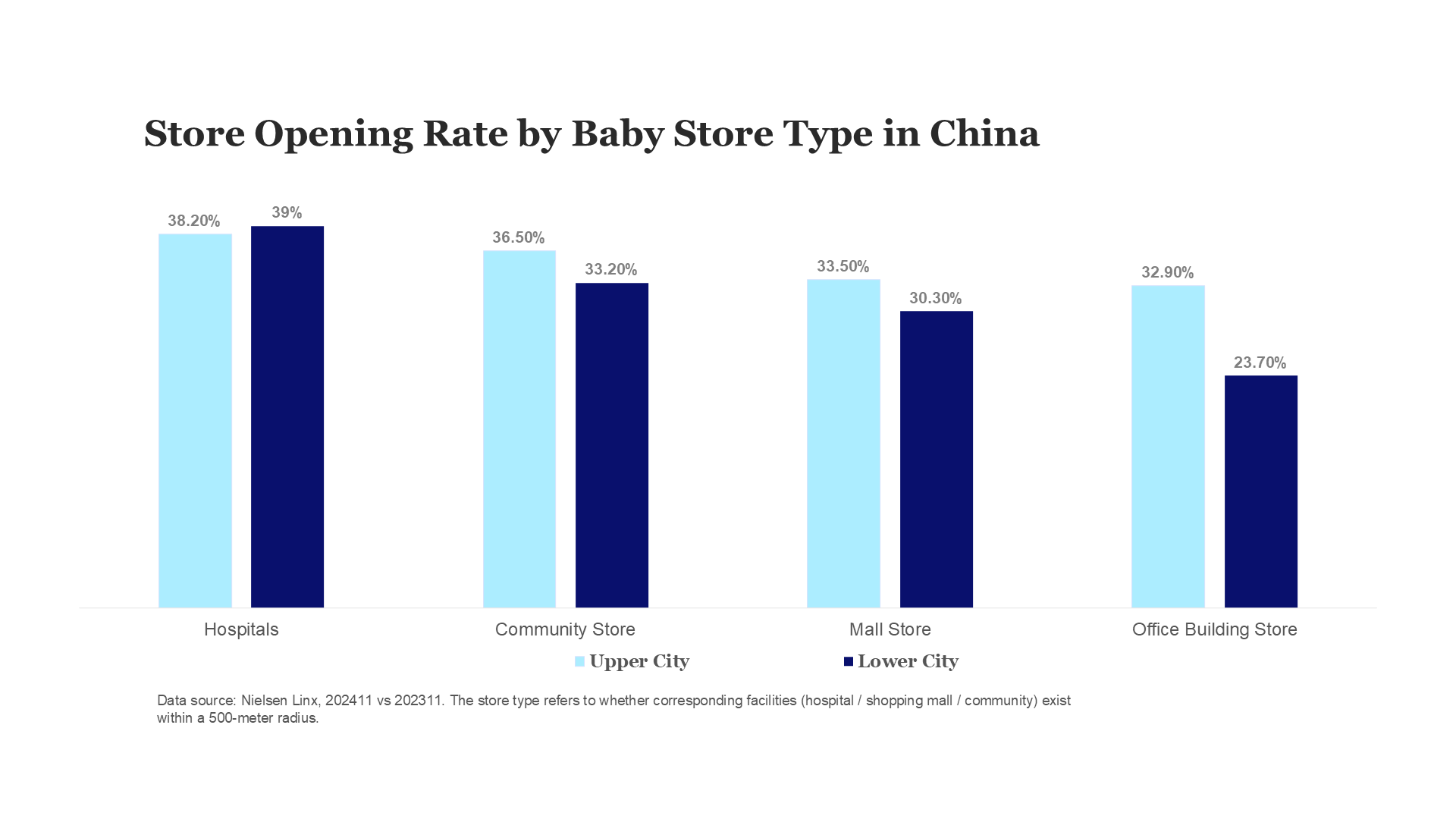

China baby stores: Higher opening rate near hospitals

In the past year, the opening & closing rates of maternity and baby stores have remained high. We have found that stores located near hospitals have the highest opening rates, followed by community stores and those in shopping malls.

It is worth noting that in upper cities, maternity and baby stores around office buildings also maintain a high opening rate. This is closely related to the urban planning and layout of upper tier cities, as well as the working, commuting, and shopping habits of mothers.

Fast growth of social e-commerce

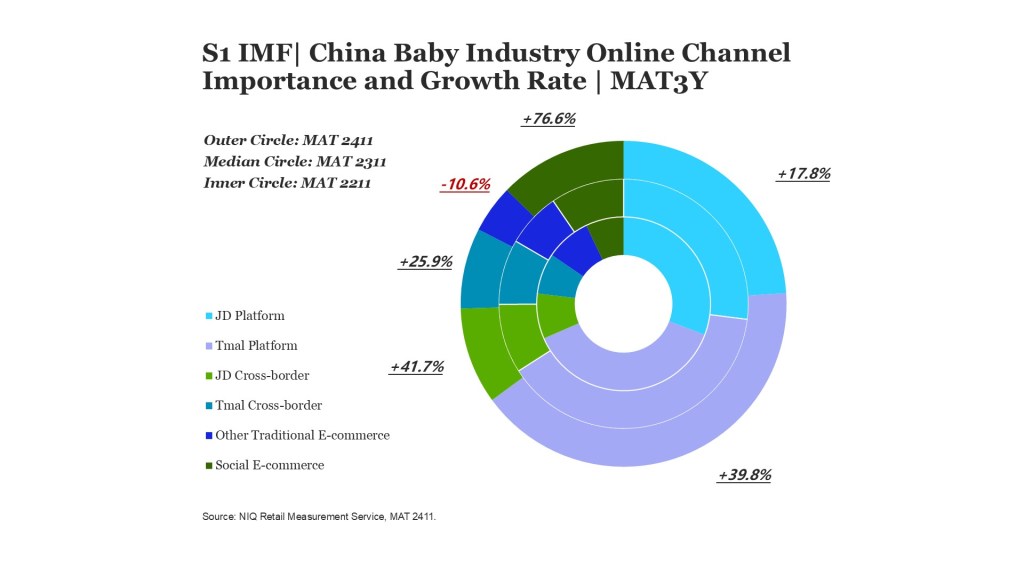

Research shows that Chinese consumers have a much higher tendency to purchase maternal and baby products through online channels, especially via content e-commerce, compared to the Asia-Pacific region.

The experimentation across different online channels continues: Comprehensive e-commerce platforms like JD and Tmall still dominate in sales share, with the importance of maternal and baby products on Tmall increasing for three consecutive years, reaching nearly 40% of sales share in 2024. Meanwhile, content e-commerce is rapidly expanding, with a growth rate of 76%.

Price, product and brand

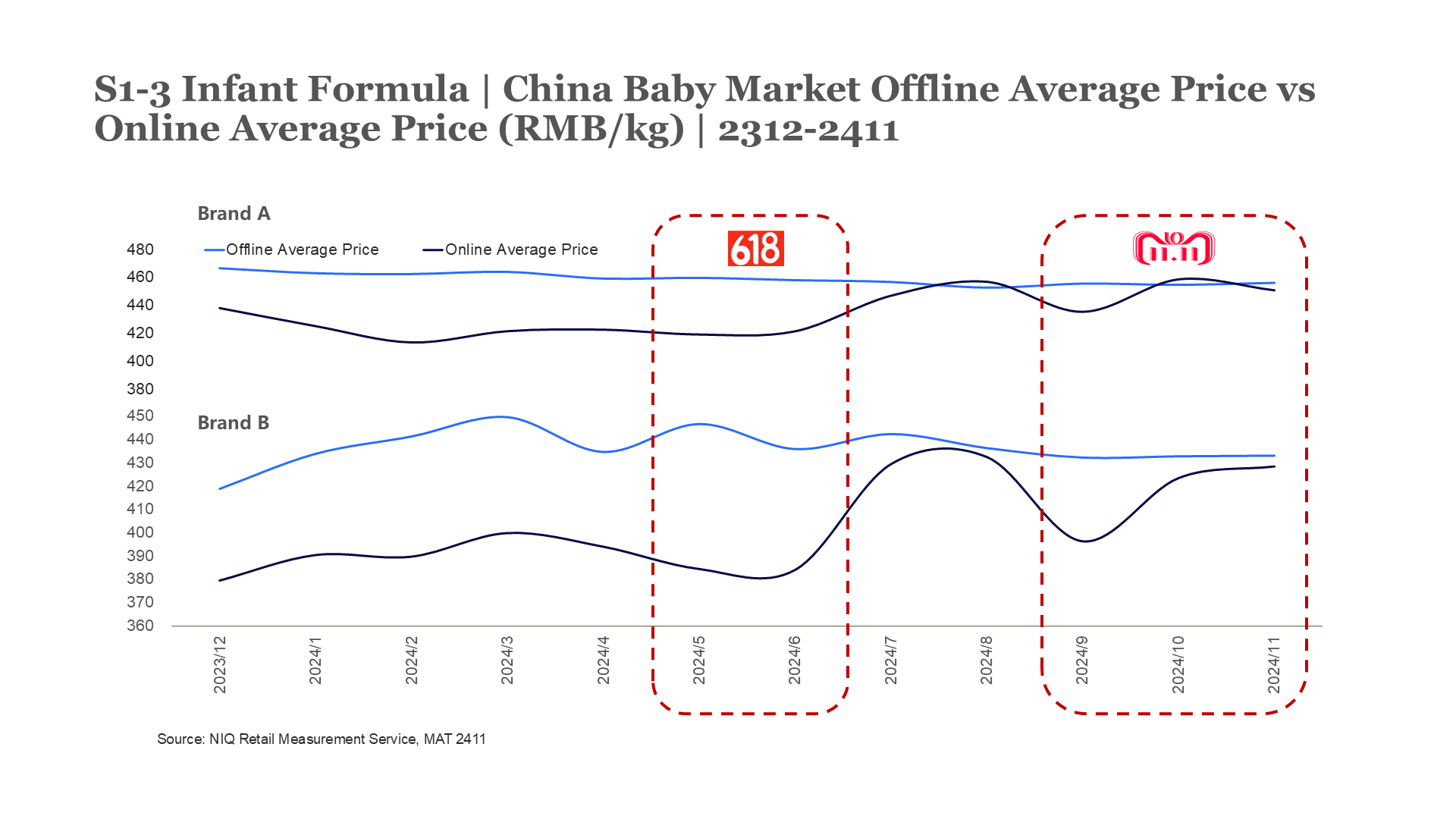

Chinese infant and maternity manufacturers are actively promoting price parity between online and offline channels, making non-price factors even more important.

Brands are striving to differentiate based on non-price factors such as product variety and global product resources. Infant and maternity brands should focus on the future and adopt a long-term strategy of emphasizes strengthening product capabilities and building brand power.

How has China baby product landscape evolved?

Amidst a declining consumption wave, China’s baby market is witnessing an upward trend in consumption in the mother and baby products, especially for products like infant formula.

The emergence of “ultra-premium” infant formula has created new growth opportunities in the market. At the same time, for consumables and disposable products like baby diapers, we see both the “ultra-premium” and “budget” products gaining popularity among consumers.

Different manufacturers have adopted differentiated strategies: leading mainstream companies tend to produce ultra-premium products, while platforms like Douyin (TikTok in China) and white-label manufacturers focus on affordable options.

A new chapter: Chinese infant formula industry

- New Ingredient: Leading manufacturers have successively announced the launch of HMO infant formula, and it’s expected to maintain its popularity in 2025 and 2026.

- New Concept: From the initial DHR 1.0 to the 2.0 version of milk fat globule membrane and phospholipids, parents who are already on the starting line will continue to purchase these concept products in the coming years.

- Baby water milk: Baby water milk is a new product category in China and is priced relatively high, and it has achieved considerable sales in markets such as the United States and Japan. Brands targeting ultra-high-end consumer groups can leverage its combination of high nutrition and convenience to fill the market gap in baby formula.

- Special formula milk powder: Specially formulated powders for infants under 1 year old, designed to address allergic symptoms, will continue to penetrate the market, particularly in lower-tier cities in China.

A new chapter: “Ultimate Safety” baby diapers

Today, baby diapers have evolved from a single function to multiple functions—ranging from roll packaging and fabric to an increased focus on the addition of skincare and antibacterial ingredients in the diaper. Recent products aim to provide more care for babies. In the future, diapers will pursue “ultimate safety,” further strengthening the control over material safety.

What to expect?

Times are good for long-term thinkers. Brand owners not only need to ride through the cycles but also need to adopt a cautious and forward-looking perspective to understand the deepening needs of Chinese consumers.

By staying one step ahead, anticipating your consumers’ potential needs, and deploying emerging products that can stand out in the market, you will be able to transcend time and remain resilient through the different cycles.

Download report

2025 China Baby Market Report: Decode Cycles, Traverse Cycles

Navigate the business cycle, Contact us

Contact NIQ expert to unlock the potential of business growth