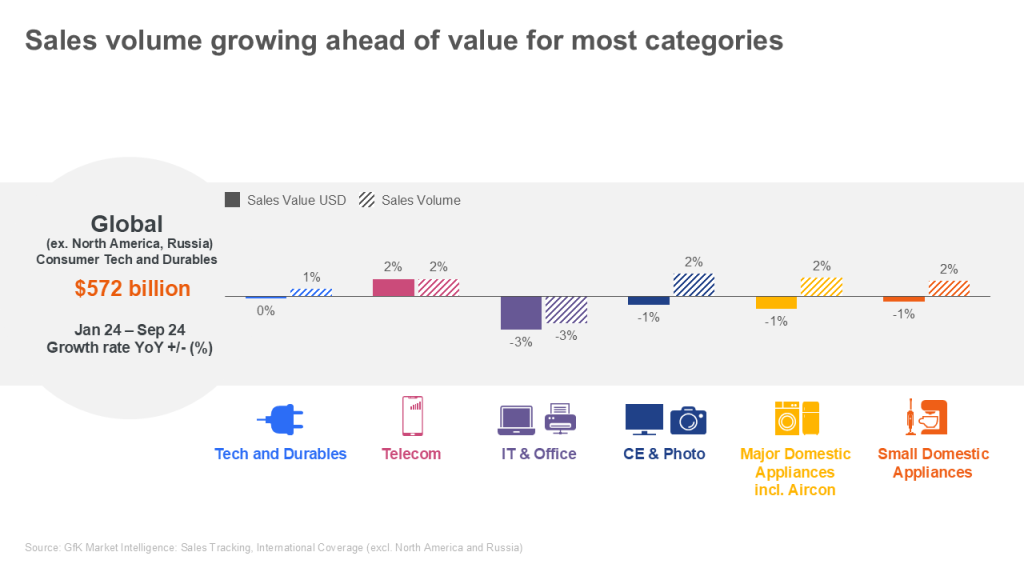

Sales Radar: Volume Outpaces Value

Revenue growth has remained flat year-on-year, whilst sales volumes grew by 0.5% from January to September in 2024, indicating steady demand for tech and durables. Despite the cost-of-living crisis and inflation, tech and durable goods prices (outside the U.S.) have dropped by an average of 5% in USD since 2021, and over 25% when adjusted for inflation. Contrast this to the compounding effect of inflation on wider Consumer Packaged Goods prices (e.g. groceries) – these are up by 17%.

Volume continues to grow faster than value in many tech and durables categories, highlighting downward pressure on price and negatively affecting retailer and manufacturer margins. This has all been compounded by a strong U.S. dollar, cautious consumer spending, and intense competition.

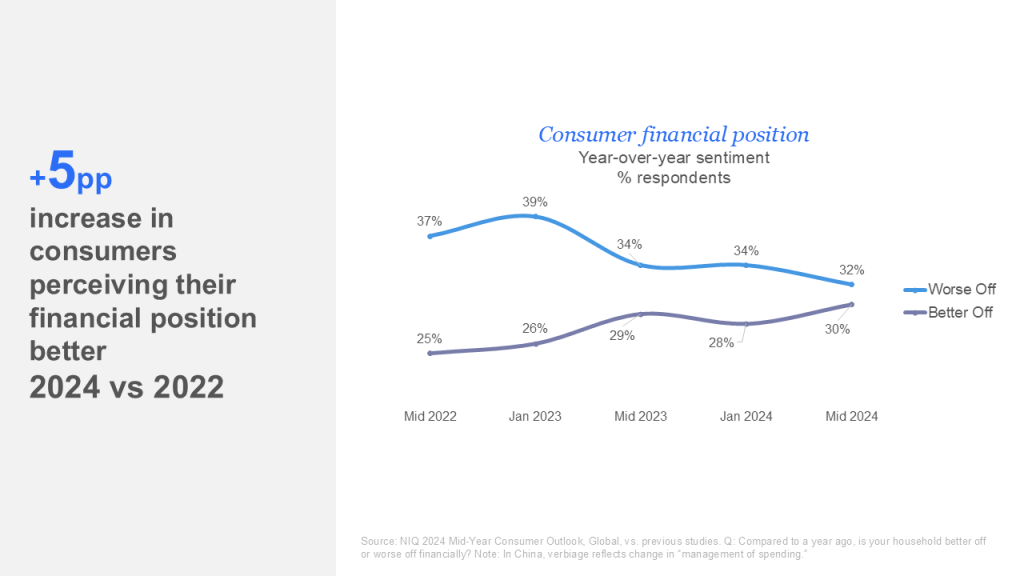

The Mood Has Shifted: Embracing the Intentional Consumer

With inflation rates easing, the consumer mood has shifted. 30% of consumers feel better about their finances compared to 25% in 2022, and optimism varies by region and income class. There is still a higher percentage of people, almost a third, who continue to feel worse off. Perception is usually reality, which means that whilst spending is becoming less cautious overall, consumers remain conscious of prices and look for genuine, tangible value in their purchases.

According to GfK’s global Consumer Life study, 46% of global consumers still cite price as the most important factor in their purchasing decisions, up from 45% a year ago. This is also accompanied by an openness for trying new and lower-cost products. This means that brand loyalty is under increasing pressure, with 37% of consumers opting for lower-cost brands to save money, fostering demand for affordable premium products that offer high quality without the premium price.

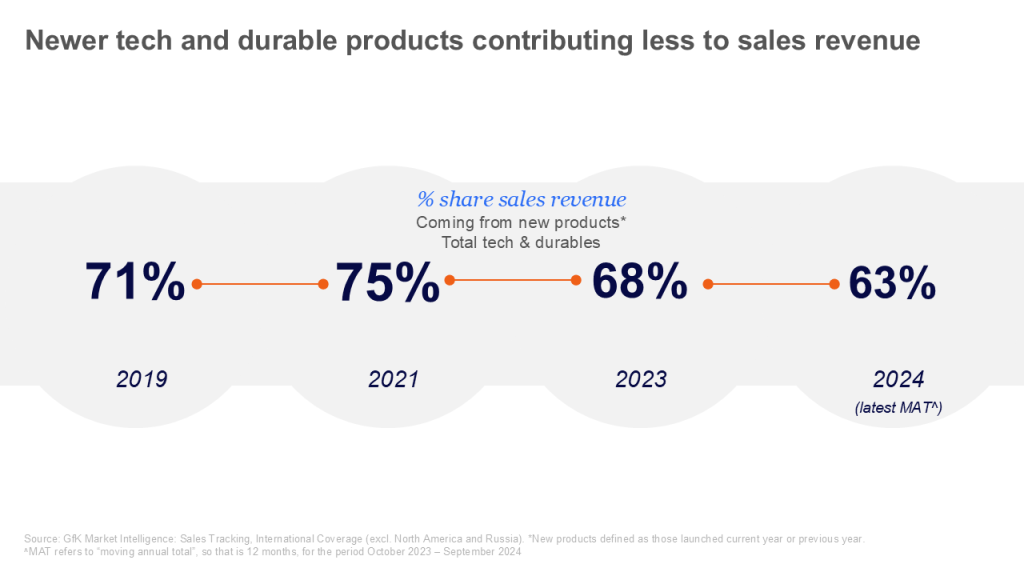

Unlocking Product Replacement: Making An Impact Where It Counts

The tech and durables markets are now saturated, with many consumers having already equipped their homes for work, study, and entertainment during the stay-at-home lockdowns. The success of new products has stagnated. Currently, 63% of sales revenue comes from products launched within the past two years, a drop from 75% in 2021. This shift in new product success as well as the shift in consumer mindset since the pandemic underscores the need for brands to refresh interest through strategic upgrades and new launches.

Market-redefining innovations occur only every 5 to 10 years in tech and durables. In the meantime, growth must be driven by capitalizing on natural product replacement cycles and effectively communicating the value of incremental improvements.

Our consumer survey data¹ shows that 50% of consumers replace faulty products, nearly a quarter upgrade still-functional items, and only 13% are first-time buyers. With the average product age around 5 years— coinciding with the timeline since lockdown purchases, a significant upgrade cycle could occur in 2025 for certain product segments. For instance, Microsoft’s end of Windows 10 support in October 2025 is likely to prompt PC upgrades.

To unlock replacement demand, brands need a nuanced understanding of regional replacement cycles, influenced by factors such as cultural attitudes, disposable income, and openness to innovation. While disruptive innovations drive market expansion, these are few and far between. Incremental upgrades, however, hold immense potential and should be marketed effectively, emphasizing how they enhance everyday use and elevate the consumer experience.

¹ Source: gfknewron consumer. Global coverage. Timeframe: July 23-Jun 24.

Outlook 2025: A New Era of Intentional Spending

Regardless of market uncertainties, 2025 will usher in a renewed focus on innovation, driven by advancements like AI and a growing demand for upgrades to pandemic-era purchases. With fewer disruptive product launches, brands must ask: How will our innovations make a meaningful impact? Consumers now prioritize clear use cases, tangible value, and experiences that justify a purchase. In 2025, success will depend on thoughtful differentiation and targeted innovations that resonate with today’s intentional consumer.

Want to know more about the strategies that can support your success in 2025?

Leverage the power of our solutions, actionable insights, and data-driven decision-making to stay ahead in the competitive retail landscape. Connect with an expert today and uncover how to turn challenges into opportunities for sustainable growth.