What is the “Buy Canadian” movement

The “Buy Canadian” movement is a growing consumer-led shift toward prioritizing domestically made products over imported alternatives—especially those from the U.S. Sparked by political tensions, trade disputes, and rising tariffs, the movement reflects a broader desire among Canadians to support their local economy, protect domestic jobs, and assert national pride through their purchasing decisions. And this movement isn’t anything to scoff at.

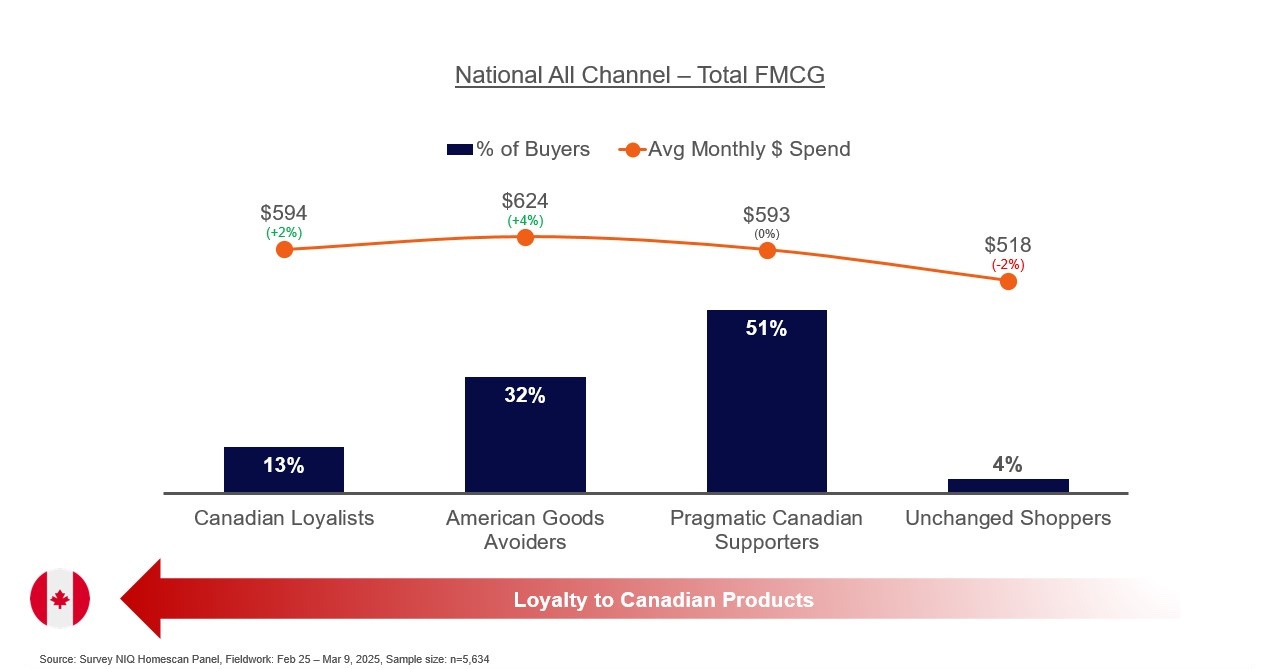

A new NIQ study reveals that nearly half of Canadian consumers are taking a stand. From boycotting U.S.-made goods to choosing Canadian products even when they’re not the easiest or cheapest option, shoppers are putting their wallets where their values are. This sentiment is influencing everything from food and beverage categories to household goods, prompting both retailers and manufacturers to rethink their positioning in a climate where Canadian-made has become a competitive advantage.

How “Buy Canadian” is Reshaping the Market

“Buy Canadian” may be more than just talk. This behavioral shift is starting to show up in self-reported shopping preferences—particularly in categories like beer, BBQ sauce, sugar substitutes, and low-alcohol beverages—areas that are important to Canadian Loyalists. Meanwhile, U.S. brands are seeing heightened risk as 45% of consumers are either Canadian Loyalists or American Good Avoiders. This is especially true in categories like wine, backache treatments, and processed cheese spreads, particularly among American Goods Avoiders, who are more likely to live in Quebec and skews older. This group has the highest average monthly spend of all which presents significant risk to U.S. products.

One takeaway that is fascinating is how this movement transcends traditional demographics. Canadian Loyalists tend to be middle-aged, lower income, and live in the Prairies. American Goods Avoiders skew 55+ and are more likely to live in Quebec.

But across regions and income levels, while the sentiment is consistent, there is still a bit of a say/do gap. Many buyers are claiming they will boycott, but when push comes to shove, will they actually shell out the extra money given all the cost pressures right now?

*Canadian Buyers Defined:

- American Good Avoiders: I will boycott U.S.-made products and refuse to purchase them, regardless of availability or price

- Canadian Loyalists: I will only buy Canadian-made alternatives and will go without if a Canadian option isn’t available.

- Pragmatic Canadian Supporters: I will prefer Canadian-made products whenever possible but will still buy U.S. products if they remain my best option

- Unchanged: I will continue buying U.S.-made products as usual, without making any changes