GfK global research shows Canada scoring below average in considering “hot-button” items such as sugar, fat

While Canadians have been hearing the “good word” about healthy eating for decades, GfK research suggests that this raised awareness is not always leading to smart food choices.

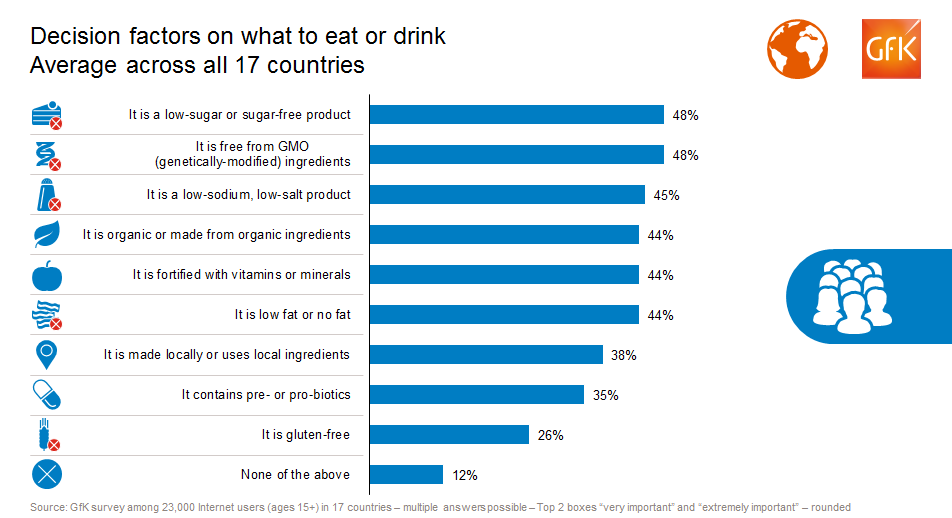

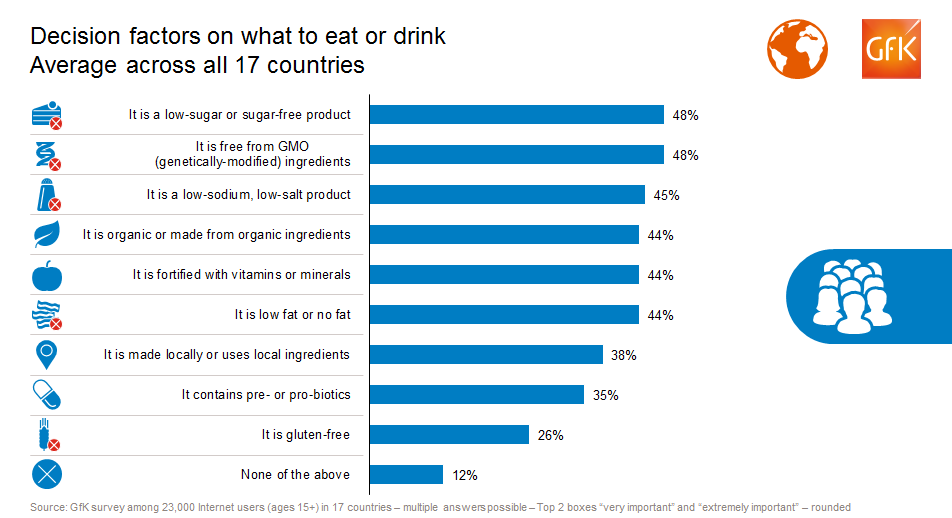

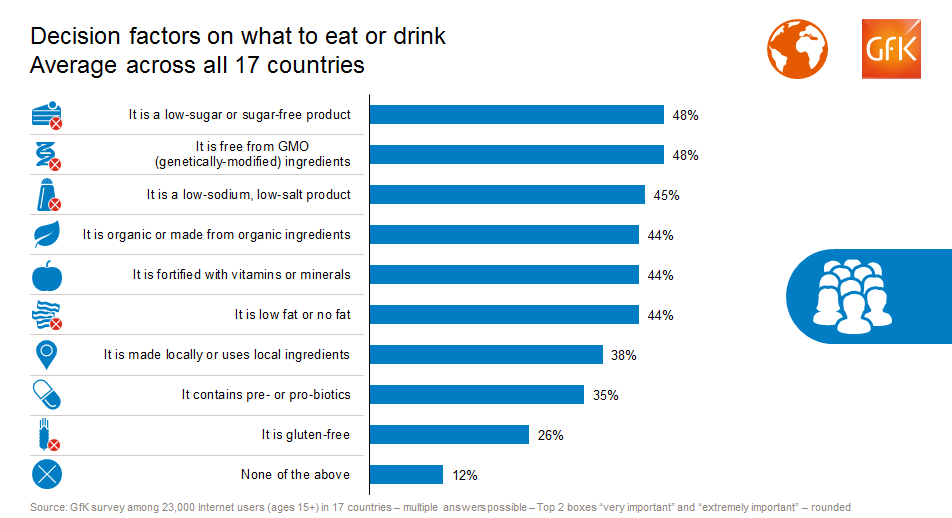

GfK asked 23,000 consumers online in 17 countries how important certain factors are, from a given list, when deciding what to eat or drink. For the top six factors, Canadian scores ranked 5 to 18 percentage points below the global averages.

For example, nearly half (48%) of consumers worldwide report that products being low-sugar or sugar-free is “extremely” or “very” important to them, compared to 43% in Canada. Globally, 48% also cited “GMO-free” –lacking genetically modified (GMO) ingredients – as another important factor in food and drink choices; in Canada, the level was just 37%.

The study revealed similar discrepancies between global and Canadian scores for low-salt or low-sodium (45% worldwide, versus 37% in Canada), vitamins or minerals (44% versus 30%), and low-fat or no-fat (44% versus 35%).

The “organic” designation, which has drawn so much focus at higher-end supermarkets and health-focused restaurants, was a factor for only one-fourth (26%) of Canadians – almost half the global average of 44%.

Age groups vary in focus on healthy ingredients

In Canada, the most selective food and drink shoppers often come from different age groups, depending on the category. Those age 60 and above, for example, are most likely to opt for low-sugar or sugar-free items (50%) and low-sodium or low-salt (43%). But 20 to 29 year olds lead in organic (32% — tied with the teen group here) and pre- or probiotics (27%).

The mixed impact of gender

In Canada, women were more likely than men to take some key food and drink factors into account when making eating choices, scoring 7 percentage points higher in low-sugar and sugar-free (47% versus 40%) and 5 points higher for local ingredients and local sourcing (38% versus 33%). But men led women in low-salt and low-sodium (40% versus 34%) and organic (31% versus 22%). Globally, however, gender was essentially a non-factor, with men and women scoring almost the same throughout.

China is most selective on what to eat, drink

In eight out of the nine decision factors researched, China tops the list for having the highest percentage placing importance on that item when deciding what to eat or drink. The scrutiny is likely driven by the typically higher concerns over food safety in the market. The exception is for locally produced products, where Italy takes the lead. Other nations consistently placing in the top 3 were Brazil and Mexico.

The greatest difference between China and other nations is seen when it comes to preference for pre- or probiotic products. Here, China is 21 percentage points ahead of the next closest country with over half of its online population placing high importance on this factor. Canada did not place in the top 5 for any of the factors or ingredients studied.

Download GfK’s complimentary report on “factors when deciding what to eat and drink” to see key demographic data for each of the 17 countries included in this survey.

GfK combines these self-reported insights with data from areas such as point of sales tracking, consumer panels and geo-marketing to help clients successfully target high-potential audiences both globally and within specific countries.

About the study

The survey question asked, “When deciding which food or beverage product to eat or drink, how important are the following in making your decision?”, with options listed as It is organic or made from organic ingredients; It is made locally or uses local ingredients; It is a low-sugar or sugar-free product; It is low fat or no fat; It is a low-sodium, low-salt product; It is fortified with vitamins or minerals; It contains pre- or probiotics; It is free from GMO (genetically-modified) ingredients; It is gluten-free.

GfK interviewed 23,000 consumers online in 17 countries in the summer 2017. Data are weighted to reflect the demographic composition of the online population aged 15+ in each market. The global average given in this release is weighted, based on the size of each country proportional to the other countries.

Countries included are Argentina, Australia, Belgium, Brazil, Canada, China, France, Germany, Italy, Japan, Mexico, Netherlands, Russia, South Korea, Spain, UK and USA