Future outlook strengthens with five-point jump for personal finances and four-point jump for UK economy

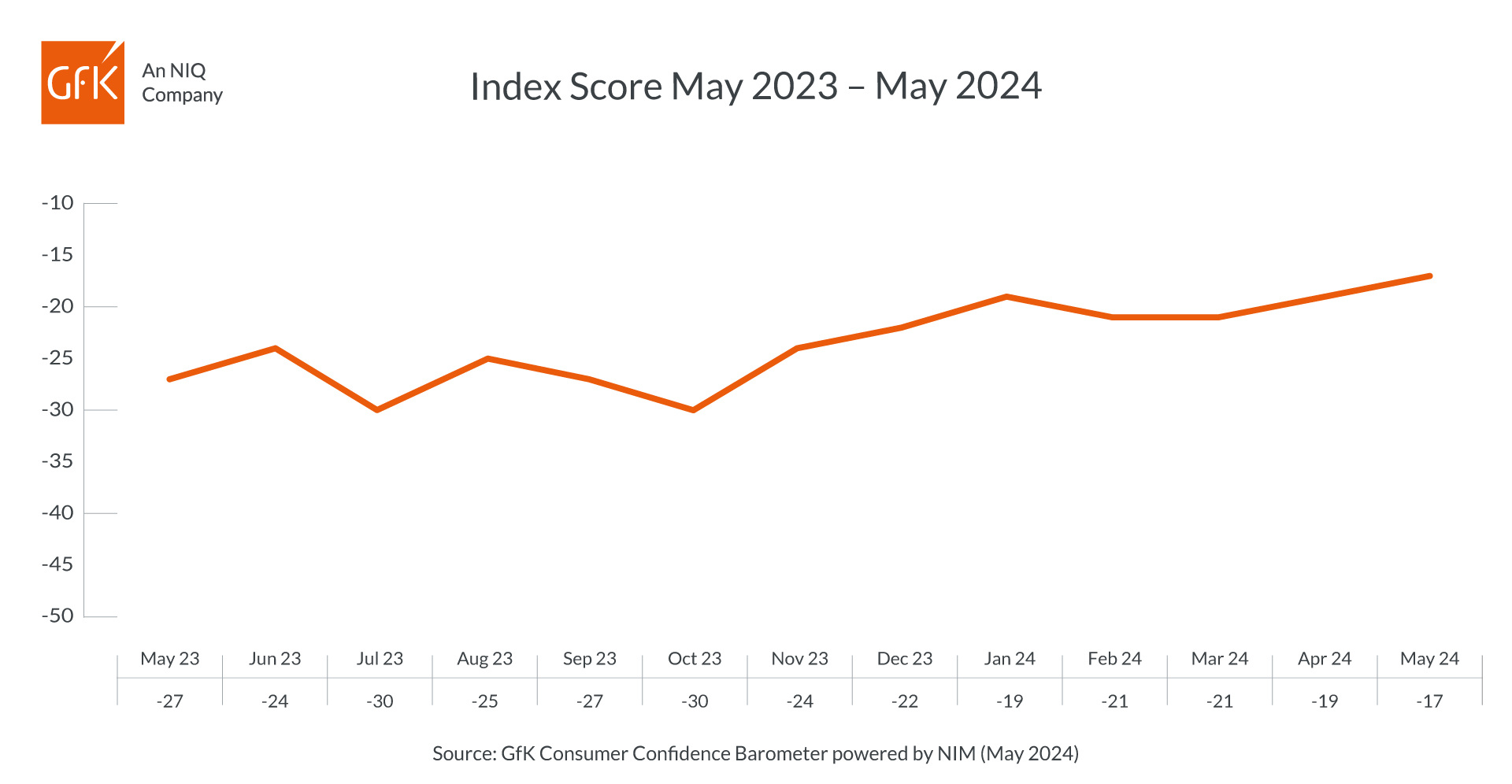

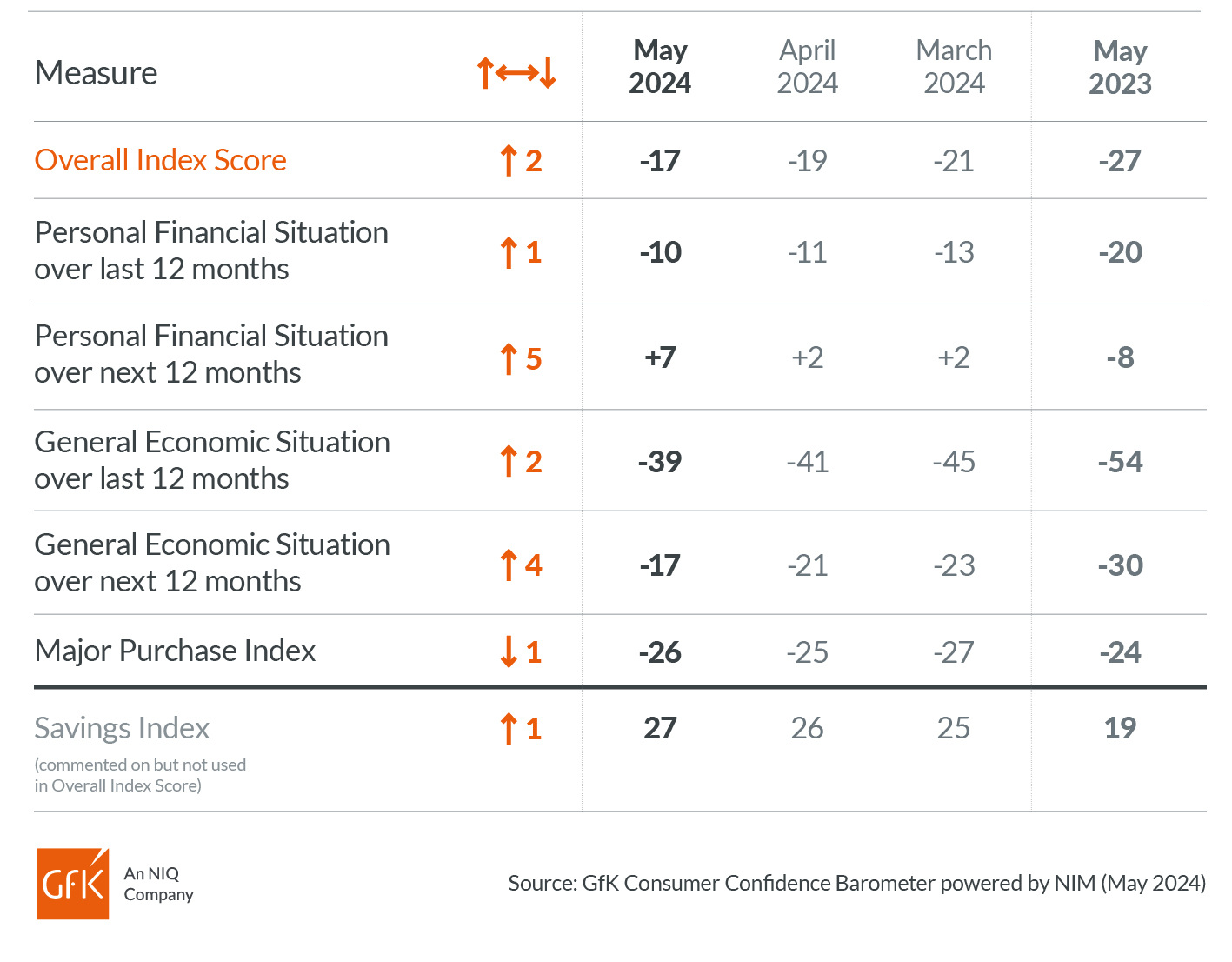

GfK’s long-running Consumer Confidence Index increased two points to -17 in May. Four measures were up and one was down in comparison to last month’s announcement.

Joe Staton, Client Strategy Director GfK, says: “There was another strong showing for the UK Consumer Confidence Index this month, driven by a jump in the outlook for our personal finances (up five) and a boost for our view on the wider economy in the coming year (up four). The only negative in May is the slight dip in our major purchase measure (down one point to -26), reinforcing the fact that the cost-of-living crisis is still a day-to-day reality for all of us. However, with the latest drop in headline inflation and the prospect of interest rate cuts in due course, the trend is certainly positive after a long period of stasis which has seen the Overall Index Score stuck in the doldrums. All in all, consumers are clearly sensing that conditions are improving. This good result anticipates further growth in confidence in the months to come.”

UK Consumer Confidence Measures – May 2024

The Overall Index Score increased two points to -17 in May. Four measures were up and one was down in comparison to last month’s announcement.

Personal Financial Situation

The index measuring changes in personal finances during the last year is up one point at -10; this is ten points better than May 2023.

The forecast for personal finances over the next 12 months is up five points at +7, which is 15 points higher than this time last year.

General Economic Situation

The measure for the general economic situation of the country during the last 12 months is up two points at -39; this is 15 points higher than in May 2023.

Expectations for the general economic situation over the next 12 months have increased by four points to -17; this is 13 points better than May 2023.

Major Purchase Index

The Major Purchase Index is down one point to -26; this is two points lower than this month last year.

Savings Index

The Savings Index has increased one point to +27 in May; this is eight points higher than this time last year.

——————————————-

Measuring 50 Years of Consumer Confidence

January 2024 marked 50 years of the UK Consumer Confidence Barometer. There is no other consumer research project with the longevity, rigour and reliability of the Consumer Confidence Barometer. Each month since January 1974, this study has provided insight into how UK consumers feel about their personal finances and the wider economy, as well as the outlook for the next 12 months. Through the winter of discontent, the Falklands War, economic boom and bust, the Brexit vote, and most recently the coronavirus pandemic, CCB has seen many highs and lows over five decades.

The highest value of the Overall Index Score – the headline score – was in January 1978, when it reached +21. It reached +16 twice in 1979 (first in July and again in September). The lowest score recorded was -49 in September 2022, and other lows include -39 in July 2008, during the global financial crisis, and a score of – 35 in March 1990, in the lead-up to the 1990/1991 recession. The largest monthly increase was in May 1993 when the headline score jumped 12 points. There have been seven monthly drops of 10 or more since the survey started, with the largest by far happening during the coronavirus crisis when it dropped 25 points from -9 in mid-March 2020 to -34 at the end of March.

If you’d like the 50th-anniversary consumer confidence report, click here to download.

Notes to editor

Please source all information to GfK.

Press contact: For further details or to arrange an interview, please contact Greenfields Communications:

Stuart Ridsdale E: stuart@greenfieldscommunications.com T +44 (0)7790 951229

Lucy Green E: lucy@greenfieldscommunications.com T +44 (0) 7817 698366

About the survey

- The UK Consumer Confidence Barometer is conducted by GfK.

- This month’s survey was conducted among a sample of 2,009 individuals aged 16+ in the UK.

- Quotas are imposed on age, sex, region and social class to ensure the final sample is representative of the UK population.

- Interviewing was conducted between May 1st and May 15th.

- The figures contained within the Consumer Confidence Barometer have an estimated margin of error of +/-2%.

- The Overall Index Score is calculated using underlying data that runs to two decimal points.

- The press release dates for the remainder of 2024 are: June 21st; July 19th; August 23rd; September 20th; October 25th; November 22nd and December 13th.

- Any published material requires a reference to GfK e.g., ‘Research carried out by GfK.’

- This study has been running since 1974. Back data is available from 2006.

- The table below is an overview of the questions asked to obtain the individual index measures:

|

Personal Financial Situation (Q1/Q2) |

This index is based on the following questions to consumers: ‘How has the financial situation of your household changed over the last 12 months?’ ‘How do you expect the financial position of your household to change over the next 12 months?’ (a lot better – a little better – stay(ed) the same – a little worse – a lot worse) |

|

General Economic Situation (Q3/Q4) |

This index is based on the following questions to consumers: ‘How do you think the general economic situation in this country has changed over the last 12 months?’ ‘How do you expect the general economic situation in this country to develop over the next 12 months?’ (a lot better – a little better – stay(ed) the same – a little worse – a lot worse) |

|

Major Purchase Index (Q8) |

This index is based on the following question to consumers: ‘In view of the general economic situation, do you think now is the right time for people to make major purchases such as furniture or electrical goods?’ (right time – neither right nor wrong time – wrong time) |

|

Savings (Q10) |

This index is based on the following question to consumers: ‘In view of the general economic situation do you think now is?’ (a very good time to save – a fairly good time to save – not a good time to save – a very bad time to save) (Commented on but not included in the Index Score) |

About the GfK Consumer Confidence Barometer powered by NIM

There is no other consumer research project with the longevity, rigor, and reliability of GfK’s Consumer Confidence Barometer (CCB). Each month since January 1974, it has provided a snapshot of how UK consumers feel about the crucial economic topics today and their outlook for the next 12 months. It has provided insight into the UK’s thinking through boom and bust, the Brexit vote, and most recently the coronavirus pandemic. Since October 2023, GfK has been cooperating with the Nuremberg Institute for Market Decisions (NIM), GfK’s not-for-profit founder, on the Consumer Confidence Barometer. The aim of the cooperation is to provide even more in-depth analysis of the reasons behind shifts in consumer confidence. GfK’s high-quality survey methodology and rigorous processes have not changed so there is no impact on the CCB dataset and trends. This is the background to the sourcing in the release, ‘GfK Consumer Confidence Barometer powered by NIM’.

About GfK

For over 89 years, we have earned the trust of our clients around the world by solving critical questions in their decision-making process. We fuel their growth by providing a complete understanding of their consumers’ buying behavior, and the dynamics impacting their markets, brands and media trends. In 2023, GfK combined with NIQ, bringing together two industry leaders with unparalleled global reach. With a holistic retail read and the most comprehensive consumer insights – delivered with advanced analytics through state-of-the-art platforms – GfK drives “Growth from Knowledge”. For more information, visit www.gfk.com or follow www.twitter.com/GfK.

Nuremberg Institute for Market Decisions (NIM)

The Nuremberg Institute for Market Decisions (NIM) is a non-profit research institute at the interface of academia and practice. NIM examines how consumer decisions change due to new technology, societal trends or the application of behavioral science, and what the resulting micro- and macroeconomic impacts are for the market and for society as a whole. A better understanding of consumer decisions and their impacts helps society, businesses, politics, and consumers make better decisions with regard to “prosperity for all” in the sense of the social-ecological market system. The Nuremberg Institute for Market Decisions is the founder of GfK. For more information, visit www.nim.org/en