In an age of 24/7 connectivity and unparalleled access to information, consumers have the ability and freedom to seek out products and services that meet very specific needs and desires. And when it comes to food in the fast-moving consumer goods (FMCG) space, those needs are rooted in product transparency.

Generally speaking, consumers are seeking transparency around three key product attributes: sustainability, processing claims (e.g., organic, natural) and ingredients. Interest in each of these three areas varies, but sales among products that focus on each of them are on the rise.

Strength in sustainability

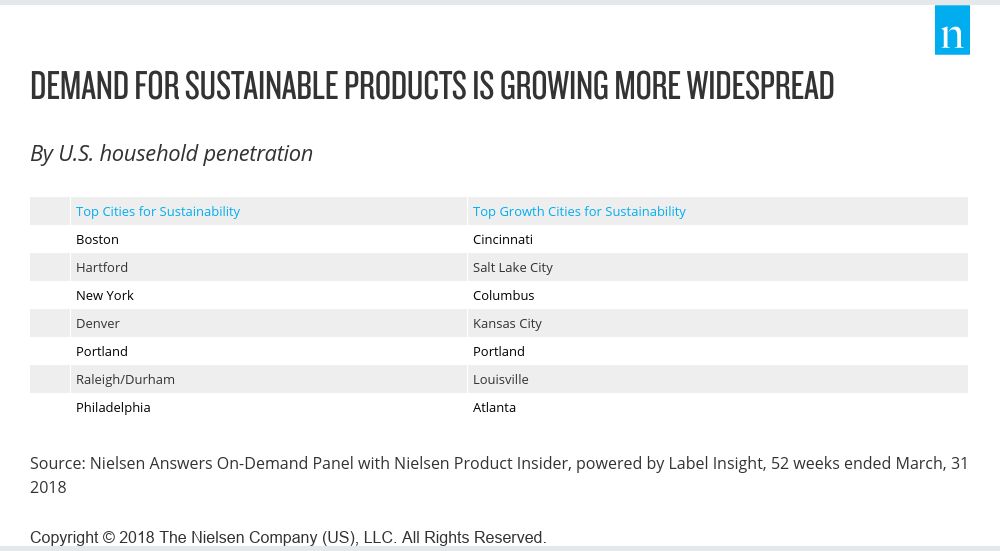

Across the U.S., household interest in sustainable products is on the rise. According to data from NielsenIQ and NielsenIQ Product Insider, 64% of U.S. households buy sustainable products, which is up four percentage points from a year ago.

In the retail space, the highest sales growth, according to data from NielsenIQ Product Insider, is coming from products that tout sustainable farming and social responsibility, at 14% and 8%, respectively. Products touting sustainable resource management are seeing sales growth of 6% and sales of sustainable seafood are up 3%.

So who is today’s sustainable shopper? Notably, they’re online. In fact, shoppers with a lifestyle of health and sustainability are 67% more likely to be digitally engaged than the average U.S. consumer. Drilling down further, sustainable product shoppers are 22% more likely to shop on a handheld device, 12% more likely to use handheld devices in stores and are 11% more likely to shop online than in store. They’re also affluent with families, as they’re 66% more likely to have children under 6 and 47% more likely to live in households with incomes of more than $150,000.

While not every consumer is a sustainable shopper, overall consumer interest in sustainability is growing. According to NielsenIQ’s 2017 global survey on sustainability, 68% of Americans believe it’s important that companies implement programs that improve the environment. With that sentiment in mind, 67% said they are prioritizing healthy or socially conscious food purchases this year, while almost half of Americans (48%) said they will change their consumption habits to reduce their impact on the environment.

Consumers want to know where their food comes from

The old adage “you are what you eat” has likely never meant more to consumers than it does today. Notably, NielsenIQ’s 2017 global sustainability survey found that 67% of consumers want to know everything that goes into the food they buy. Drilling down further, 46% of Americans say that claims on food products have a direct influence on their purchase decisions.

46% of Americans say that claims on food products have a direct influence on their purchase decisions

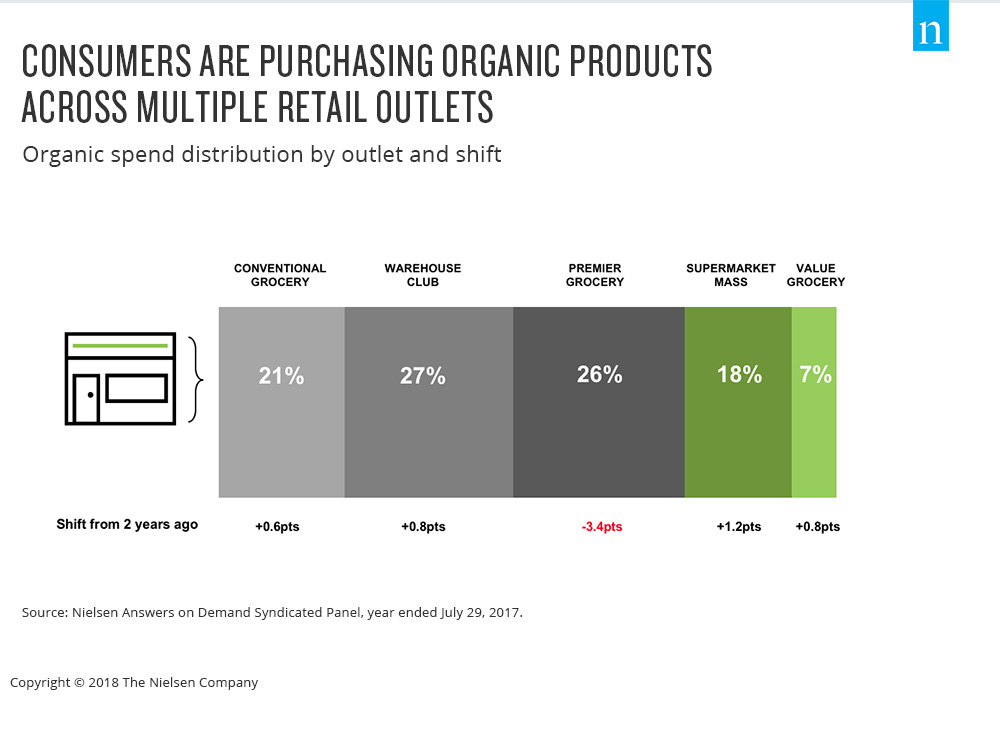

And as we’ve reported, a few key marketing claims continue to fuel sales growth. “Organic,” “natural,” and “free from” are prime examples. And with health and wellness driving notable FMCG sales growth (as well as private label growth) in recent years, it’s no surprise that we’ve seen double-digit organic sales growth for the last five years. And as a result, organic products are no longer confined to premier and specialty grocers. In fact, the premier grocery channel has lost 3.4% share of organic spend over the past two years, and the warehouse/club channel now leads in total share of organic spend.

Ingredients are everything

But claims aren’t the only elements that consumers are reviewing on product packaging. Walk through any store and you’ll see it: the flip. That’s what happens when consumers come across products that are unfamiliar to them but are interested in possibly buying them: they turn the package over and read the ingredients.

There are varied reasons why consumers don’t base their decisions on the marketing claims on the front of the products they consider. One of the key reasons is that Americans don’t necessarily believe marketing claims, and the claims that Americans believe are those that have no regulation to back them, such as “natural.” This term is also one that doesn’t have a universally accepted definition. According to NielsenIQ’s 2017 global sustainability survey, only 15% of Americans trust “all natural” marketing claims. Comparatively, 18% never trust these claims, while 67% say they sometimes trust them. At the opposite end of the trust spectrum are claims that are backed by the FDA, such as “low sodium,” “heart healthy,” and “low sugar.”

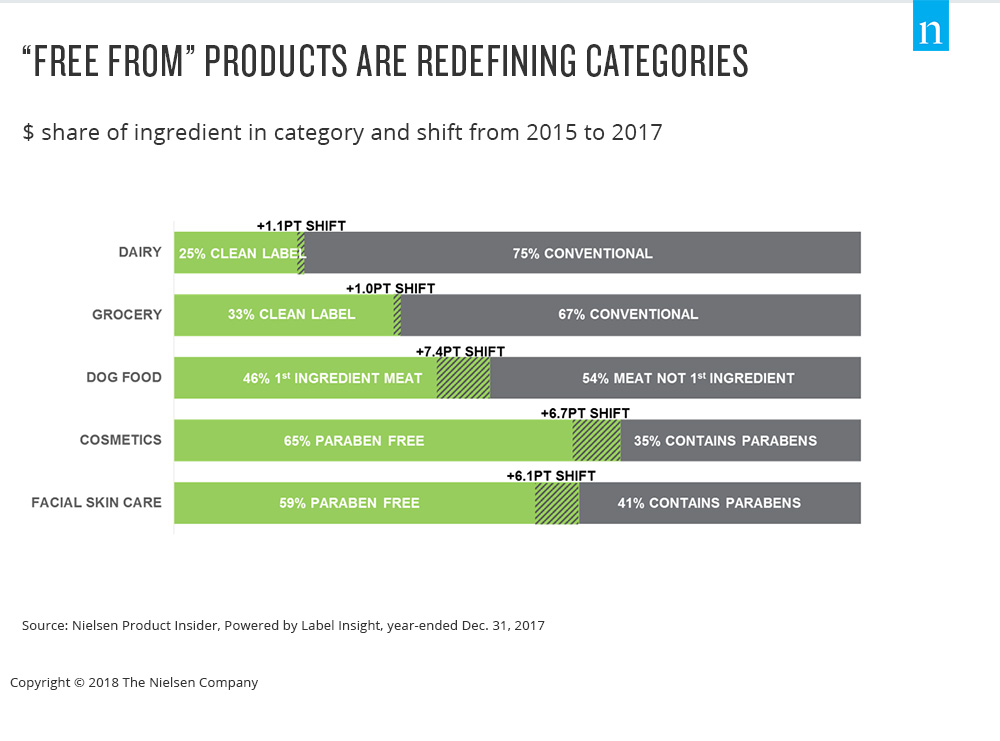

The shift toward ingredient-driven growth is well underway, yet it’s not just something we’re seeing in the food and beverage space. And as we’ve reported previously, consumers are often looking to see what’s not in certain products rather than what ingredients are actually included. Consumers’ shift toward clean-label products, or those that don’t include certain undesirable ingredients, can be seen across store aisles. Twenty-five percent of U.S. dairy products fall into this realm, and 1.1% share shifted toward clean label dairy between 2015 and 2017. While the increase seems small, it equates to almost $1 billion in sales.

So which growth drivers will deliver the strongest performance going forward? As with any category or market, access to information and abundant choice mute the ability to appease everyone with one strategy. There are some over-arching approaches, however.

About half of Americans say that claims influence their at-shelf decisions. So to engage these shoppers, it will be imperative that brands and retailers ensure that on-pack claims are the ones that are meaningful and ones that consumers will trust.

For shoppers looking for specific ingredients, it will be crucial to understand their true purchasing impact. If one in three shoppers is following a specific diet, for example, your product offerings will need to be properly aligned to encourage purchase behavior.

And lastly, shoppers don’t just want to show concern for the well-being of their family. They want to improve the world around them, and one way they are doing that is by aligning their purchasing with their personal beliefs. Sustainability isn’t a fad, and shoppers are increasingly demanding it from the companies in which they buy products and services.