FMCG retailers and manufacturers also had to quickly adapt to supply chain challenges, government regulations, and changes in consumers’ priorities. Although the long-tail impact of economic slowdown will continue into 2021, the success of the FMCG industry depends on how retailers and manufacturers address evolving behavior and shifts in the retail landscape by leveraging best-selling “golden store” locations, e-commerce, assortment, and promotions.

Consumables are king

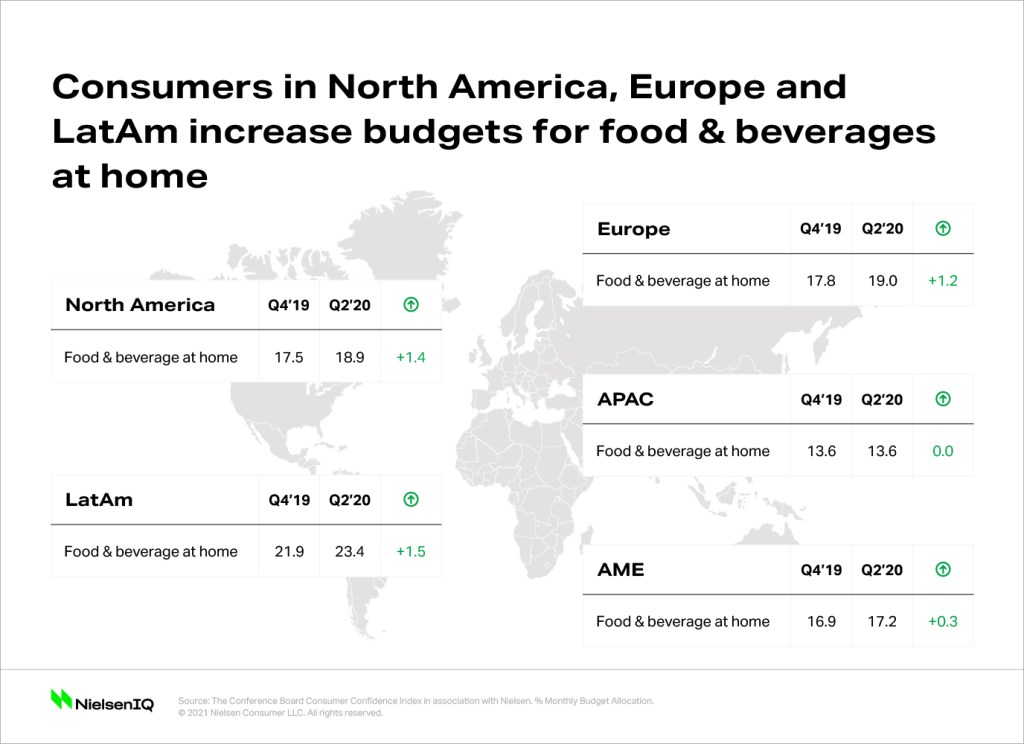

Lessons learned: The closure of restaurants and shelter-in-place regulations led to an increase in in-home consumption. Food and beverage categories, particularly perishables, saw strong growth as consumers in North America, Latin America, and Europe increased their monthly budget allocation for in-home food and beverages.

Opportunities ahead: We expect the need for in-home consumption to continue in the first half of 2021. To win in-store:

- Manufacturers should optimize product distribution to ensure their availability in the most-demanded categories.

- Manufacturers should forecast category evolution to quantify the impact of their sales and adapt their inventory to consumer behavior.

- Retailers should ensure that they have the right products in the right stores and distribution centers, based on the new shifts in purchase patterns.

- Manufacturers and retailers should work together to focus on consumables to drive store traffic, basket size, profits, share, and loyalty.

Rationalize your assortment and optimize your portfolio

Lessons learned: The pandemic gave rise to two distinct shoppers: constrained shoppers (those financially impacted by the pandemic) and insulated shoppers (those who experienced no financial impact). These two groups have distinct priorities and shopping behaviours, and they each gravitate toward different types of products and SKUs.

Due to health and safety concerns, both groups are shopping at physical stores less often, and when they do, they come more prepared and they spend less time in store than before the pandemic. While they make fewer trips, they buy more products each trip to meet their consumption needs.

Opportunities ahead: Given that one-third of global consumers have been financially impacted by the pandemic and unemployment spiked in many parts of the world, we expect belt-tightening to persist in 2021. Shoppers will also likely remain cautious about the risk of infection when shopping in public places, as the vaccine slowly begins to become available. To win:

- Manufacturers should rationalize their assortment to address the needs of constrained wallets as well as the increase in in-home consumption.

- For constrained shoppers, introduce economy products and pack sizes to meet the need for affordability; for insulated shoppers, introduce value-for-money and family size packs to meet in-home consumption needs.

- Optimize product distribution, with the most efficient visibility within the store.

- Manage your out-of-stock and distribution issues quickly and efficiently. When not addressed properly, these factors can be the main barriers to success.

Know your golden stores

Lessons learned: Store closures and travel limitations led consumers to visit stores they hadn’t shopped at previously. Globally, consumers who shopped at a store they’d never shopped at before grew from 39% in May 2020 to 45% in September 2020.

As working from home has become the new normal for many, consumers have replaced or eliminated shopping trips close to the workplace and near commuter stations with trips to stores in residential areas. This has changed the concentration, or number of stores, that account for 80% of FMCG sales, often referred to as “golden stores.”

Opportunities ahead: Location is a key determinant of growth, and to win:

- Manufacturers and retailers should identify their new golden stores.

- Maximise in-store activation across your golden stores.

- Adjust distribution and sales strategies in relation to new stores and new customers.

- Retailers should review their real estate strategy based on new shopping locations.

Promotions matter… when done right

Lessons learned: In North America and Europe, the increase in in-home consumption sparked FMCG growth in the second and third quarters of 2020. At the same time, promotional levels declined, with sales on promotions reaching four-year lows in markets such as the U.S., Spain, Germany, Italy and France in Q2 2020.

Despite strong FMCG growth in the U.S., NielsenIQ research showed that a whopping $US5.9 billion in sales were lost as a result of decreased trade promotion and a loss in trade promotion effectiveness this year compared with last year. Grocery experienced the greatest loss, given that it is by far the largest department, but household care, dairy and general merchandise also lost about $US700 million in potential sales. Imagine the incremental growth manufacturers and retailers would have seen if the right promotion activities were maintained?

In Asia-Pacific, Latin America, and the Middle East and Africa regions, FMCG growth declined or remained flat in the second and third quarters of 2020. In Asia, markets with strong modern trade and e-commerce presence (China, Taiwan, Singapore, Korea) were able to thrive compared with markets reliant on traditional trade (India, Indonesia, Thailand, Vietnam), owing to their ability to better cater to consumers during periods of lockdown.

Opportunities ahead: Based on the pandemic’s impact on consumers’ finances as well as their shifting preferences, there is an opportunity for manufacturers and retailers to use price and promotions in the right way to drive incremental revenue. To win:

- Don’t ignore promotions. Retailers and manufacturers should also align on the role of promotions and how to develop mutually beneficial consumer incentives.

- Win shopper loyalty, drive revenue growth and protect ROI by placing promotional investments in the right categories and channels, using the right promotional mechanics, and executing them at the right time.

- Design promotions that appeal to consumers’ needs and behavior—increase promotions on products that are shelf-stable and can be inventoried.

Prepare for life after the pandemic

Lessons learned: As a result of the pandemic, FMCG consumers are even more concerned about health, wellness and hygiene. The sale of consumables grew as consumers spent more time at home, and spent less money on out-of-home consumption. They also became more accustomed to shopping online.

Opportunities ahead: As the first doses of the vaccine are administered and the effects of the pandemic abate, the question remains if retailers and manufacturers will be agile enough to respond to changes in consumers’ priorities and shopper behavior. Will they leverage promotions, lower prices, and optimize their assortment in the right stores to maintain demand and drive revenue growth?

To win:

- Rationalize your assortment to create shelf space for products and novelty innovations that meet consumers’ increased need for hygiene, health, and immunity attributes. Insulated consumers will also seek products that offer indulgence, comfort, and fun.

- Brick-and-mortar retailers should explore how they can use the latest analytical models to create promotions that effectively compete against e-tailers.

- If they haven’t already, brick-and-mortar retailers should develop strategies to cater to the omnichannel shopper.

The insights in this article have been derived from:

Methodology

- NielsenIQ Answers On Demand (AOD), September 2020 vs 2019

- NielsenIQ Store-Level Retail Measurement Services Data, March-August 2020 vs 2019

- NielsenIQ Shopper In The New Normal, May 2020 and September 2020

- NielsenIQ Quarter By Numbers, Q3 2020