Current situation

On top of this, three additional forces pose further challenges for manufacturers and retailers. Rising raw material costs, energy prices and the resulting inflationary pressure add further complexities to supply chain.

This new environment plays a direct impact on pricing strategies and will bring changes in buyer behaviour. Manufacturers and retailers will be faced with the difficult task of sustaining demand while managing pressure on margins. How can you prepare for these challenges?

Knowing the elasticity of demand reduces uncertainty when increasing prices.

Price is the foundation of any product or service. It positions us in the market, defines the value for our customers and clearly determines our profit and loss account.

Knowing the elasticity of the items or skus that make up our portfolio is a must if we want to maximise margins. It is still surprising that we talk about ‘Revenue growth management’ or “Revenue optimization” without considering the concept of elasticity in the setting of assortments.

Do we know which products in our assortment are most reactive to a price increase? And more importantly, do we know which products are less reactive or margin-protective and could therefore sustain a larger increase without impacting our volume as much?

The British market is sensitive to price changes, although each product plays its own game.

If we look at what happened in the British market in the past, there was a significant and widespread increase in the elasticity to changes in regular price. However, in this current pandemic crisis, elasticities have remained stable worldwide in general and in Britain in particular.

Specifically, the average elasticity of the British market was -1.7%, which means a moderate-high elasticity.

But each benchmark plays a different role, and in this average, we find 32% of benchmarks with high elasticity, therefore much more reactive to increases than those with moderate or low elasticity.

Although the fact that the average has remained reasonably consistent does not mean that there have been no variations in the categories, and above all that there are large differences depending on the category and the role of each product within the category.

In situations such as rising commodity prices, knowing the role of each benchmark and its elasticity will allow us to make better decisions.

Optimize your Revenue

Take control of your price and promotion strategy. Contact us and master the rules of the pricing game.

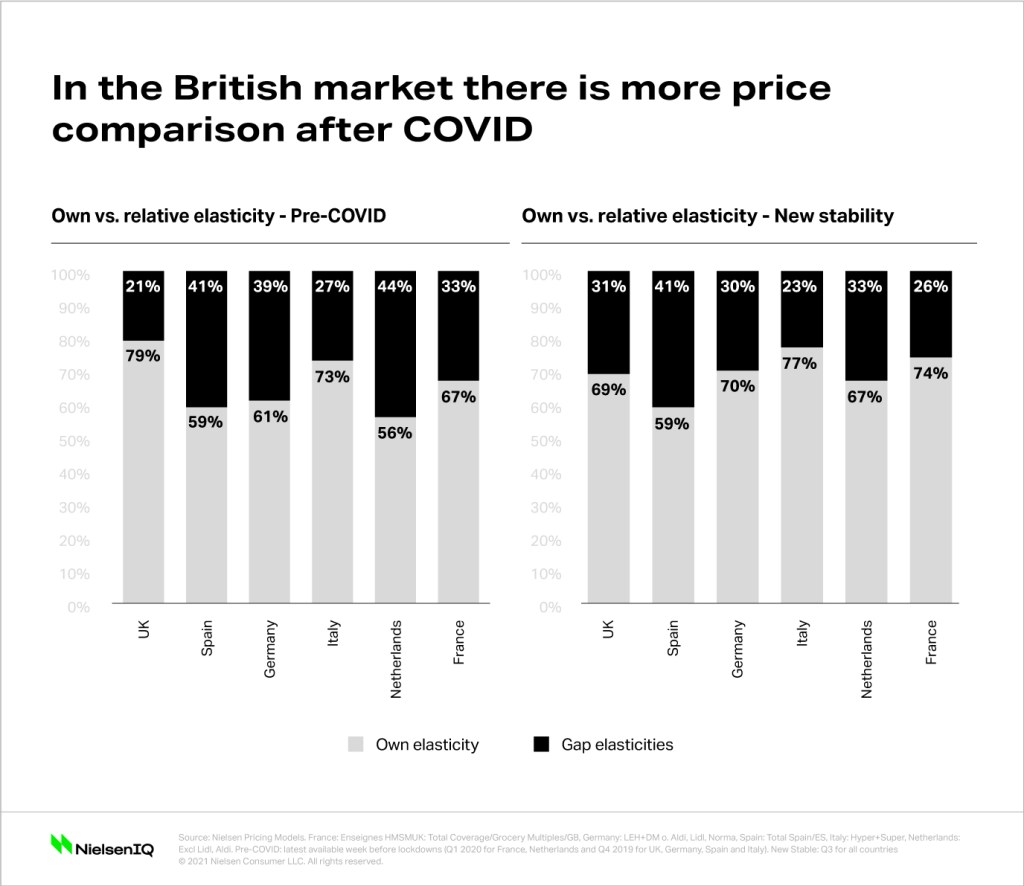

British shoppers are comparing more in the New stability

Once the concept of elasticity has been incorporated, the next step is to break it down into the impact that the price itself can have on volume and the impact that comes from the comparison or gap with other references and brands (both within the portfolio and with the competition). We call the former own or internal and the latter external or relative.

We can see that in the New stability more than 30% of the elasticity in the British market is explained by the comparison or gap with other references. Although, UK is one of the countries with the lower weight of the relative price component.

In times of generalised price increases, the decomposition of elasticity is key, because it is the sensitivity to the competitive gap that will mark our greater or lesser fall in volume. Despite the fact that there are categories with high elasticity, buyers will not stop buying certain products en masse, but will adjust between the different alternatives. Hence, there will be a trade-off between brands-formats or more promotional purchases.

For example, if we analyse some of the FMCG categories, their position changes when we focus on this relative aspect. Milk, yoghurts, ice cream and detergents are categories with a large comparison or gap component in their elasticity.

More than ever in inflationary situations it is necessary to know who you are competing against on the shelf. Learning from previous, we know that multipack formats are relevant for households that need economies of scale in their consumption. Maintaining a consistent range whilst avoiding cannibalisation between formats is possible through the relative elasticity coefficient. This will make for optimal performance of our shelf prices.

When or how? Strategies to apply in inflationary economies

In the current situation, two opposing forces are converging on the price variable. In less than six months we have gone from talking about a reduction due to the latent economic crisis to a rise due to pressure on operating costs. Is it possible to combine both strategies? When should we act?

To the first question the answer is yes. To the second question, all operators will have to implement this increase in the end, so the timing is relevant. What is really crucial is not when to apply it, but how to apply it, i.e. on which products and in what way. That is to say, on which products and in what way: which products can assume higher increases because they have lower elasticities, and on the contrary, on which products should I contain the tariff price increase a little more because they are very elastic?

In short, these are the steps to define a correct pricing strategy:

- Identify the price elasticity of the entire assortment. Key is the definition of price movements based on the sensitivity of each item, increasing the least elastic and decreasing the most elastic items.

- Define the ideal price gap for the items, for which it is key to identify the cross-price elasticity between own and competitors’ portfolios.

- And finally, simulate the impact of the price adjustment, validating the potential of the strategy before executing it in the market and anticipating the reactions of the competition.

“Contrary to what we might think, Covid-19 decreased price sensitivity for some categories, so the basis for applying rate increases is different for each category”, said Alex MacGregor, NielsenIQ Advanced Analytics Director UK & Ireland.

“The process should start by measuring the risks and opportunities that the price change will have on the entire assortment, and then identify the price that will allow the proposed objectives to be achieved. Not forgetting that any price increase should be combined with other actions (such as innovation or communication, for example) and compensatory actions such as promotions. In this new environment, manufacturers and retailers will have to act with depth of analysis, agility and adaptability”, he concludes.