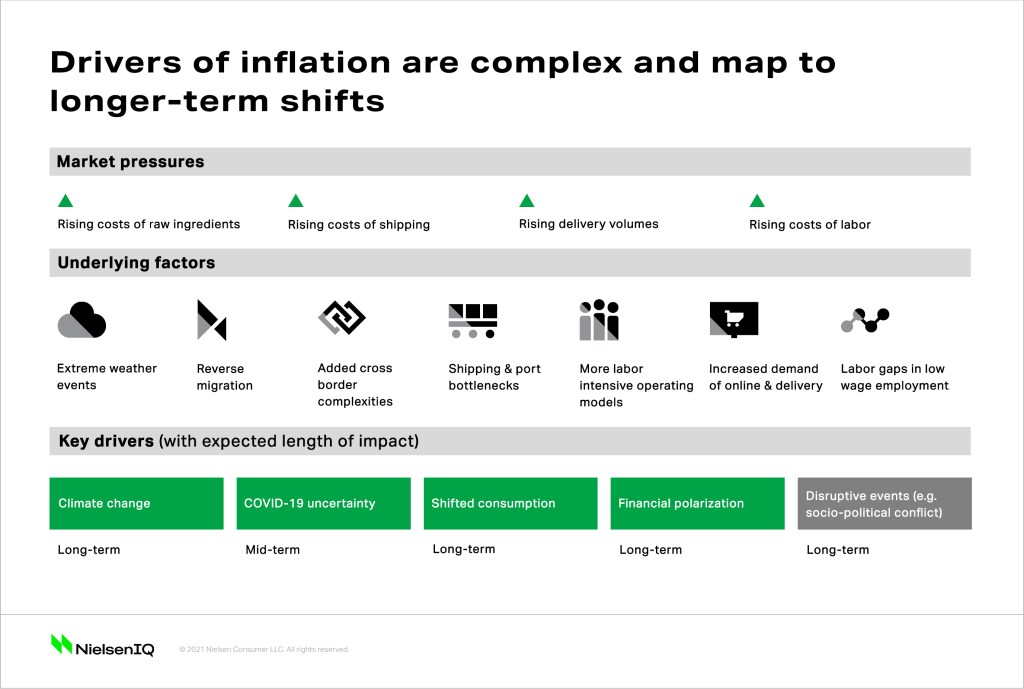

The 2021 NielsenIQ Global Inflation and Pricing analysis uncovers 3 inflation horizons for organizations to navigate: rising market pressures, mounting underlying factors, and enduring key drivers. Through the lens of these inflation horizons, the NielsenIQ Global Inflation and Pricing analysis will address 5 key considerations that every global manufacturer and retailer must think about to help mitigate their business model risks in the short-, medium-, and long-term future.

1. Underlying forces of inflationary pressure are likely to remain or grow long term

While labor shortages, shipping costs, and raw ingredient prices have been assigned most of the blame for recent global price increases, these factors alone do not reveal the full picture. In taking a deeper dive into the current landscape, there are several underlying forces that collectively suggest inflationary impacts are likely to remain in the mid- to longer-term future.

Some key factors to watch include:

- Extreme weather events

- Increased demand for home delivery

- Oil price increases

- Transportation infrastructure bottlenecks

- Reverse migration

- Labor-intensive processes

- Taxes associated with environmental and regulatory issues

- An exodus away from higher exposure and low wage jobs

- And, an overall increased demand in goods and services

Without question, recent rising inflation has exposed fragilities in both supply chains and value chains. International supply chains have been especially strained during the present cycle, which has exacerbated their more fragile frameworks versus localized supply structures. In the months ahead, the speed at which supply will catch up to demand will vary, while the many underlying market pressures will continue to show volatility and the current inflationary cycle will remain elevated for the foreseeable future.

2. Tackling ongoing inflationary pressures requires different strategies across short-, mid- and long-term horizons

The short-, mid-, and long-term horizons all have different priorities and challenges and require very different approaches and skill sets. Companies currently grappling with short-term pricing strategies should also take the opportunity to assess their value chain and think about longer-term value chain challenges.

For example, while supply chain pressures are causing stress today, factors like climate change, labor laws, and corporate responsibility will increasingly pressure industry value chains in the mid- and long term. Recognizing these various challenges in a time-horizon framework will be critically important to gaining clarity on how to proceed. Organizations can relieve pressure points by setting clear strategies around:

- Pricing, promotion, and communications in the short term.

- Portfolio architecture and communications in the mid-term.

- Value chain changes and evolved business models in the long term.

3. Short-term pricing decisions will be critical in the current hypersensitive consumer landscape

The polarization of the consumer landscape has been accelerated by the global pandemic and the lingering impacts of unemployment, income loss, and changed consumer mindsets, making the current inflationary cycle a poorly timed complication. A key finding from the most recent comparable event—the global financial crisis (GFC) of 2008/2009—is that the employment rate took 10 years to return to pre-GFC levels. Though any comparison is inexact, the recent bounce-back in some markets ought to be viewed with this example in mind.

The unemployment rates are given further context when looking specifically at the type of unemployment that has already occurred. Data from the OECD across multiple markets highlights that job losses have the greatest impact on lesser-paid low- and medium-skilled workers. For these people, the loss of income even for a short time is likely to have lasting effects on their financial situation, regardless of whether or not they regained employment. The key takeaway here is that rising employment rates may disguise the residual pressure on bank accounts and consumer mindsets, both of which must be considered.

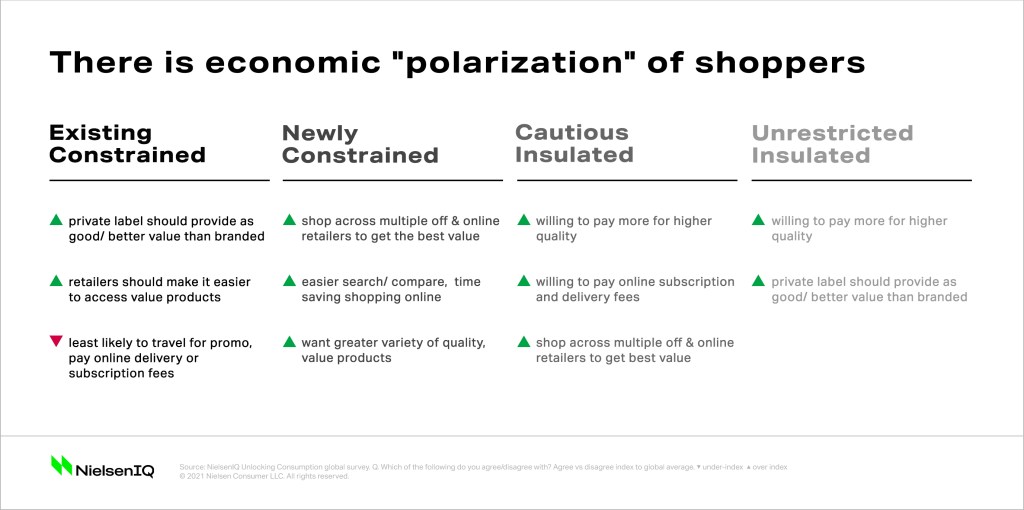

NielsenIQ has been tracking consumer sentiment over the last 12 months by segmenting consumer groups based on household financial capability, employment confidence, and spending patterns. During this time, NielsenIQ detected a polarized landscape of two consumer segments—one of which has been adversely impacted and another which has remained constant or fared better financially.

Global data across 17 markets revealed 4 segments of pandemic impacted consumers in vastly different situations and modes of spending.

All 4 consumer segments have redirected spending from normal pre-pandemic out-of-home consumption to in-home consumption through the course of the pandemic (benefitting several categories), but now a few key questions remain when it comes to inflation and pricing:

- Will value-sensitive constrained consumers be willing to take on price rises, or will they tradeoff between categories and products?

- Will insulated consumers pay a premium for products with compelling benefits or features?

- Are price elasticities influenced by the consumer experiences of the last 18 months?

These questions will help establish if a product has “pricing power,” or if they’re merely a starting point, as companies must remain vigilant in the current hypersensitive consumer environment.

4. Mid-term strategies require reconfiguring current capabilities

Many organizations will be limited to what they can achieve within a mid-term timeframe given the complexities they are dealing with today. The most effective strategies to that end would be to work with current value chains and capabilities, as well as to adjust product, brand, and portfolio architecture and consumer engagement.

Some organizations are better positioned than others to integrate elements of long-term strategies, but a potentially more productive and achievable path to pursue includes:

- Evolving the product and brand offerings to more relevant price points for consumers across the price spectrum.

- Change pack size and product formulation to remain at key price points.

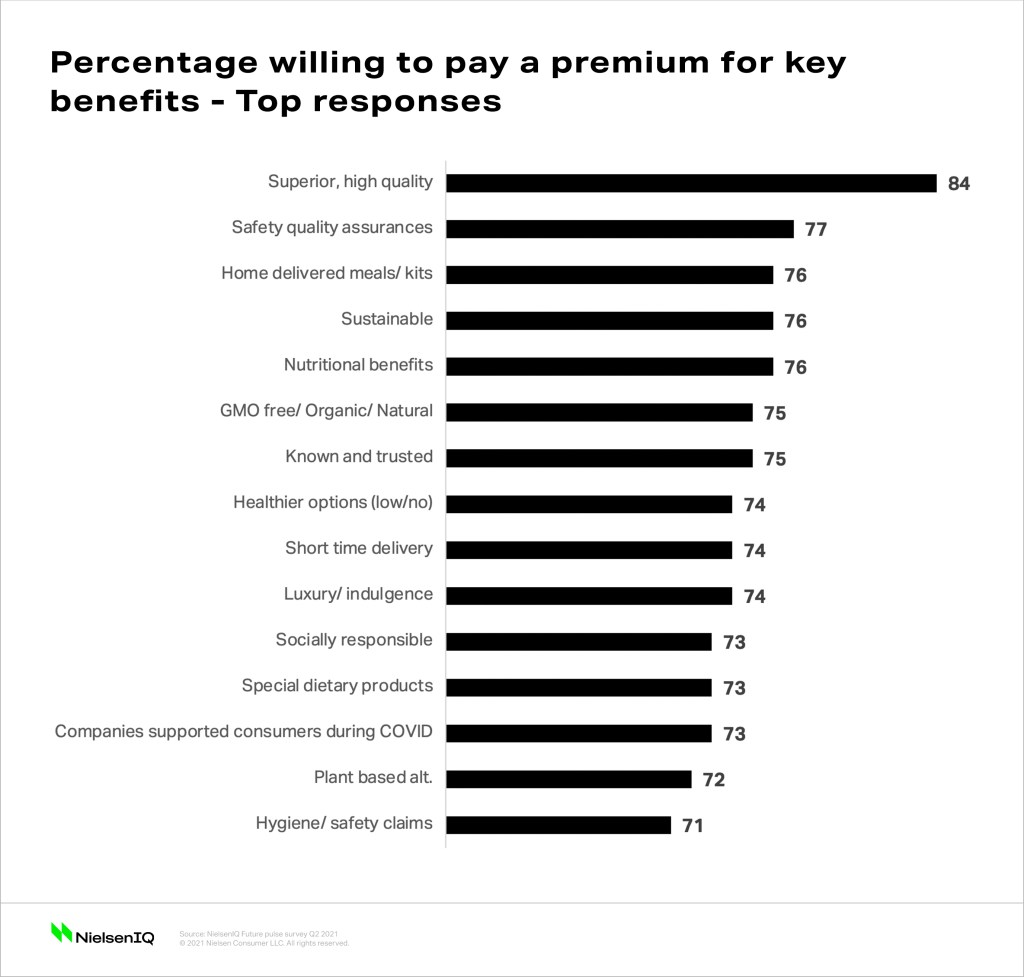

- Focus on and communicate key product benefits that consumers are more willing to pay for.

Many brands fail to communicate the benefits of the products that their consumers are seeking out. But what sorts of benefits are consumers looking for? More importantly, which benefits are they more willing to pay a price premium for?

A recent NielsenIQ global survey asked that very question, and the top responses illustrate a range of consistent responses seen in the past, such as quality and safety assurances. There were also requirements for hygiene, health, and wellness benefits along with time and convenience factors in addition to elements of sustainability and socially responsible credentials.

Although there are always inconsistencies around what consumers say and what consumers do when it comes to these responses, the intention behind the survey data is simple: Consumers value these attributes; In addition, brands that can demonstrate, connect, and communicate the benefits and credentials of their products have a better chance of justifying consumers’ spending decisions.

5. Long-term strategies will focus on tackling the issues causing value chain increases

Organizations that are not actively seeking ways to take cost out of their value chain are in danger of being left behind. In previous eras, a strategy of high volume and scale based on cheap labor and transportation has worked, but the recent issues might signal that we’ve reached a tipping point. Many organizations will have to make dramatic adaptations and tackle some of the issues called out previously, as the base contributors to rising inflation like climate change, shortage of labor, and scarcity of raw ingredients escalate.

A 2020 World Economic Forum survey of global business leaders asked about their intentions to modify the composition of the value chain by reducing labor costs through technology and automation.

A review of emerging strategies, technologies, and business models suggests that a variety of options are being explored and utilized—from the basic to far more sophisticated approaches that seem closer to science fiction. Some of the solutions that remain, or have previously been, on the periphery of organizational thinking, are likely to become realistic and relevant as time goes by and challenges become more acute.

Some long-term changes to value chains and business models are:

- Localizing product assortments and shortening supply chains.

- Diversifying suppliers to different regions to mitigate impacts from weather events and climate change.

- Reformulating products to cut down or eliminate scarce/expensive ingredients, or ingredients that will be taxed at higher rates moving forward.

- Sourcing products from vertical farms to reduce transportation costs.

- Leaning into plant-based alternatives in assortments to keep price alternatives for meal solutions.

- Automation and robotics in production facilities, warehousing, and distribution.

- Finding alternate and lab-based solutions for ingredients.

- Unmanned stores utilizing the latest technology.

Conclusions

Continued challenges with the underlying contributors to the current inflationary climate are expected to linger, and in some cases will intensify before a resumption to traditional inflationary trends. The amplified issues due to COVID-19—both in logistics and consumer sensitivity—mean that the next 3-6 months will be a critical time to have a clear understanding and set of tactics in place for price and promotional plans.

The current challenges further underscore the need for companies to recognize the need to engage in mid- and long-term strategies as well, including portfolio architecture and value chain restructuring.

Stay ahead by staying in the loop

Don’t miss the latest NIQ intelligence—get The IQ Brief in your inbox.

By clicking on sign up, you agree to our privacy statement and terms of use.