Asia reaches full-scale generational e-commerce adoption

As we stand at the end of the beginning of e-commerce in Asia, new data is emerging on the evolving omnishopper—someone who shops both online and in-store.

While nearly two-thirds (66%) of consumers globally reported making changes with their shopping behaviors in the past year, according to NielsenIQ insights, the pandemic ushered a massive spike in older consumers’ online grocery spending. The big question that remains to be seen is whether they revert to their former purchasing patterns and forgo their reliance on e-commerce to keep their refrigerators and pantries stocked post-pandemic.

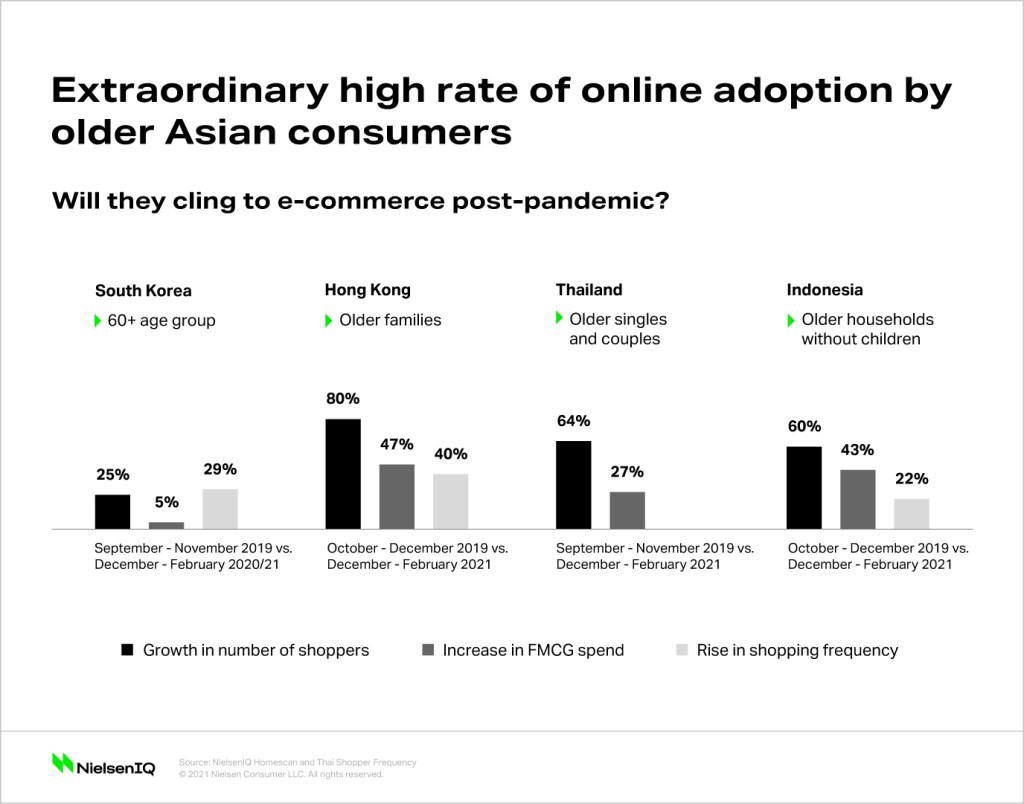

Globally, Asia dominates the e-commerce universe, accounting for over 50% of all retail sales. However, NielsenIQ’s consumer panel data across a number of Asian markets—including pre-COVID sales compared with the latest three months of data in four core markets that are at various rates of e-commerce maturity—confirms an extraordinarily high rate of online adoption among older consumers.

In South Korea, for example, roughly 60% of the population presently purchase FMCG online. However, online buying in the 60+ age group increased a staggering 25% from September-November 2019 through to December-February 2020/21. Not only did the number of online buyers in this age group increase—they also increased their FMCG spending during this time by 5% and shopped more frequently, increasing their shopping trips by a whopping 29%.

In Hong Kong, we saw similar numbers but at an even more dramatic rate, with the number of older families which transitioned their shopping to online increasing by 80% from October-December 2019 vs. December-February 2021. This group also increased their frequency of shopping online by 40%, which in turn nearly doubled their overall online FMCG purchases with a 47% increase.

In developing markets such as Thailand, the trend was similar, with older singles and couples who shopped online for FMCG increasing by 64% alongside a 27% spike in spending from September-November 2019 vs. December-February 2021. In Indonesia, a similar trend was also detected among predominantly older households without children, whose online shopping increased by a massive 60% from October-December 2019 vs. December-February 2021. This group spent 43% more when they shopped online during the same period and increased their digital shopping frequency by 22%.

The significance of older omnishoppers

Older online shoppers have long been viewed as the last barrier to full scale generational e-commerce adoption. The pandemic precipitated a forced change for the mature consumer group, whose overall experience with e-commerce has primed them to continue.

It’s important to remember that this isn’t a one-or-the-other scenario, as consumers will continue to shop in traditional retail formats. However, the rate of new online shopping adoptees will continue to erode the share of the spending pie for brick and mortar retailers, which will need to be prepared to further innovate or risk losing an even larger slice.

Traditional retailers committed to retaining many of these shoppers must embrace the retail revolution and provide valuable, seamless omnishopper experiences. While retail incumbents hold the advantage of having a trusted legacy relationship with their longtime shoppers, they have a stellar opportunity to further solidify the bond in the online world as well. They can also accelerate their omni offerings by leveraging their loyalty programs with customized offerings to different consumer groups while consistently communicating offerings that are proven to draw foot traffic and clicks, both in-store and online.

Accurate, daily, e-commerce insights

Are you looking for e-commerce insights to drive your digital business decisions? Look no further. Discover how you can get granular e-commerce sales and shelf performance.

Furthermore, with the older demographic becoming increasingly more comfortable with online purchasing, brands would be wise to consider how their marketing approaches align with this group to further enhance their comfort levels. As opposed to a one-size-fits-all mindset that targets all online shoppers as a collective, digital merchants can enhance older shoppers’ online journeys—and in the process cultivate stronger loyalty—with dedicated content and resources.

While the rampant penetration of older online adopters during the pandemic will likely subside somewhat, there is a huge opportunity for greater sustained digital adoption moving forward for several important reasons: Primarily, these countries have huge older populations. Second, older e-commerce adopters were exposed to the convenience that online shopping and delivery offer throughout COVID. Finally, older Asians may continue to buy certain products online post-pandemic, such as big or bulky products that make more sense to have them delivered.

At the precipice of a new frontier for e-commerce, the next chapter of omnichannel evolution in Asia resides in a deeper understanding among retail buyers and sellers of the ever-changing consumer behaviors and preferences. To that end, e-tailers’ and omni players’ needs for accurate and reliable data and precision decisions have never been more urgent in order to court, win, and keep the highly valuable 60+ shopper demographic.

This article originally appeared in Inside Retail Asia.

Lorem Ipsum…

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Duis felis arcu, pulvinar a ipsum vel, elementum pharetra massa…