Five consumer groups have been split by an economic divide

After COVID-19’s first year caused disruption at unprecedented scale, NielsenIQ identified four consumer groups based on the pandemic economic impact on their financial security and associated spending patterns. Fast forward to 2022, as the dust settles consumers situations and spending ability has evolved and shifted. Our latest NielsenIQ study identifies five new cohorts, their unique rebound mindsets, and the shopping habits that we anticipate from them in 2022.

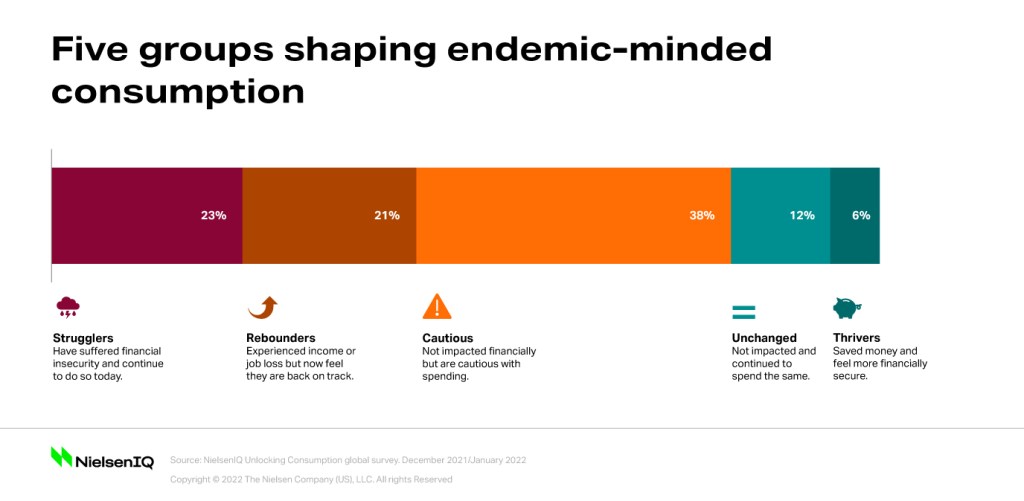

Our study looks at consumers within five separate groups, each shaped by their unique circumstances and approach to endemic living:

- 23% are Strugglers – Experienced financial insecurity during COVID-19, which continues today.

- 21% are Rebounders – Experienced financial insecurity during COVID-19 but are back on track today.

- 38% are Cautious – No impact on financial security but remain cautious with spending.

- 12% are Unchanged – No impact on security and continued to spend normally.

- 6% are Thrivers – Saved money during COVID-19 and feel more financially secure than prior to the onset of the pandemic.

These segments demonstrate that 82% of global respondents (namely, those identified within the cohorts of Strugglers, Rebounders, and the Cautious) are cost-conscious consumers who are altering their buying and consumption patterns.

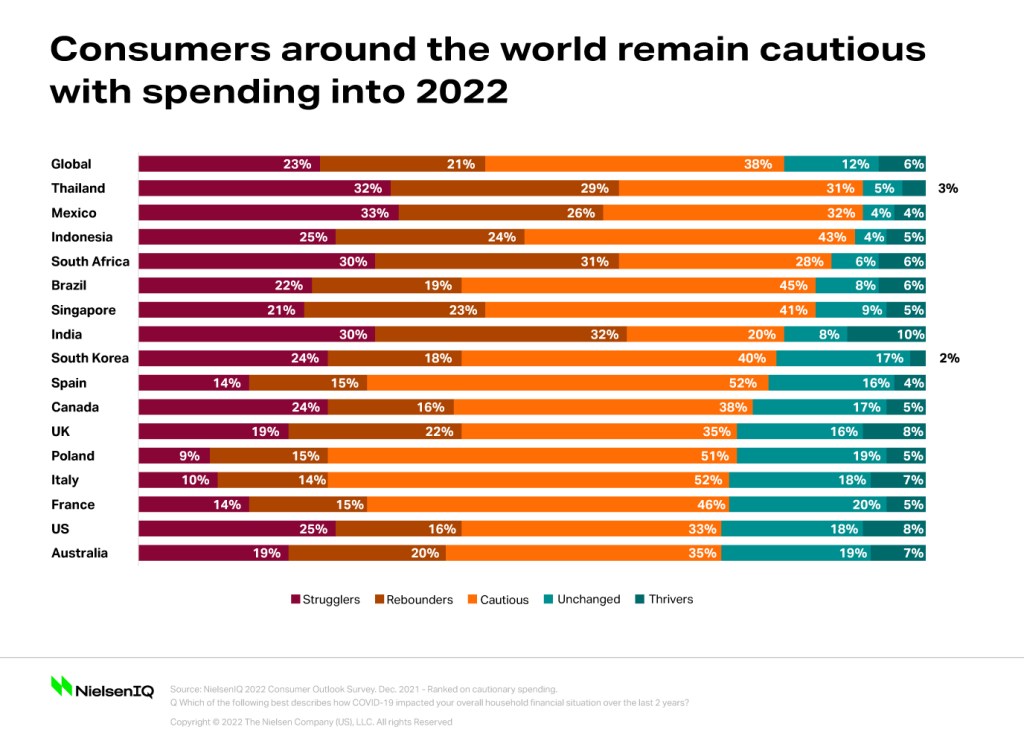

Willingness to spend varies by country

Many developing and emerging markets have higher numbers of consumers who are demonstrating cautionary spending. Among the countries surveyed, Thailand (92%), Mexico (92%), Indonesia (91%), South Africa (88%) and Brazil (86%) had the highest numbers of consumers carefully considering their purchases. Developed markets, who have largely benefited from stronger governmental support programs show the lowest levels of caution – lead by Australia (74%), the United States (74%), and France (75%).

What quickly becomes obvious in the study is that even in the most confident markets, roughly three-fourths of consumers are exhibiting caution in spending. Massive opportunities exist for brands to offer options that tap into the needs of this cautious spending mindset.

Readjusted retail realities

Huge surges in online shopping were seen during the onset of the pandemic, and those habits have taken hold for many. Nearly half (49%) of global consumers say they are omni shoppers—regularly shopping across both offline and online channels to do their regular grocery shopping. 42%, however, say they shop exclusively offline, at outlets like supermarkets or local traditional independent stores, while 9% are online loyalists and say they no longer regularly visit physical grocery stores.

“With rising prices, essential vs discretionary items are being re-evaluated and value trade-offs and compromises are the new norm,” said Nicole Corbett, Director, Global Thought Leadership, NielsenIQ. “Retailers and brands cannot assume past pricing and promotional strategies are relevant in today’s world. These changing retail dynamics are playing out against a backdrop of new consumer priorities and needs and preferences that are very different from 2019.”

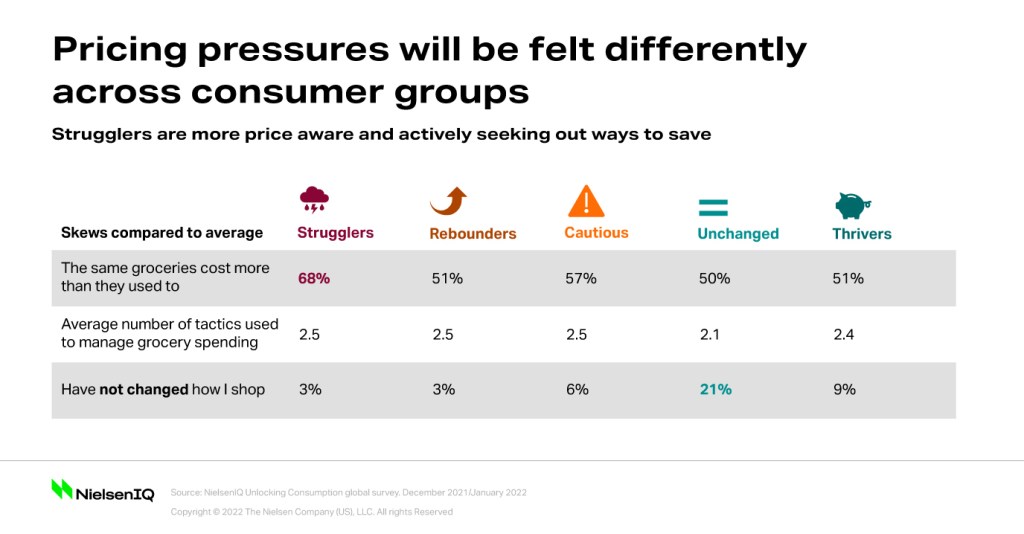

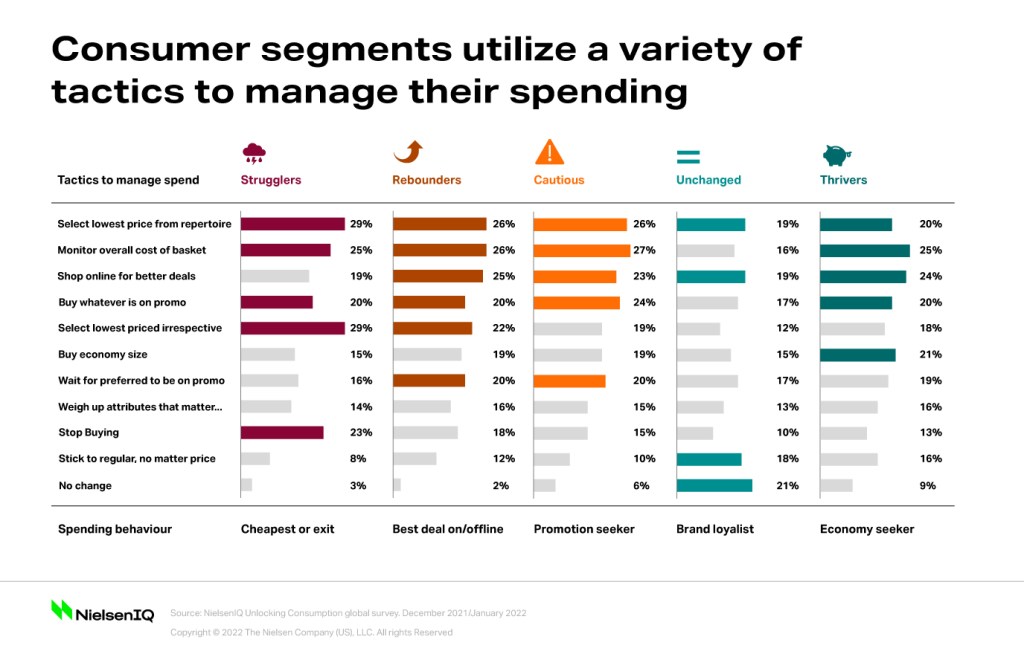

The nuances of how their shopping habits are shifting has become integral to connecting with these new consumer segments. Strugglers and Rebounders show behaviors that indicate they have no margin for spending error, compared to more secure groups. They are likely to pantry stock to avoid out-of-stocks and to shop in physical stores because they can’t rely on online shopping. Only 3% of Strugglers say they haven’t changed their shopping behaviors, compared to 21% of the Unchanged cohort.

The tactics being employed across groups when attempting to manage spending are as unique as the segments themselves. Strugglers are likely to select whatever the cheapest replacement is or stop buying completely, while the Unchanged segment are more likely to remain loyal to brands and purchase their regular products, regardless of price increases.

Make your assortment strategy work for you

While assortment is getting harder, your competitors are looking for every edge. Stay ahead with proactive strategy and solutions to simplify the complexity of the changing retail and manufacturing landscape.

Each of these groups display a unique growth opportunity that has been shaped by how their financial security has endured the pandemic and their moving on mindsets. To connect with each, focus on the areas of opportunity that resonate most with their needs:

- Strugglers – The most economical offer will hold appeal but will appreciate brands who can bring excitement or relieve daily pressures.

- Rebounders – Recovering from financial insecurity they remain cost-conscious. They will attempt to embrace the advantages of their at-home lifestyles, including online shopping.

- Cautious – This group has the ability to spend but will need more convincing than before the pandemic. They carefully weigh the pros and cons of purchases more heavily and will look for new values and attributes that are important to them. While still prioritizing affordable prices, brands and retailers that emphasize the details that matter most – fresh produce, environmental credentials, hygiene, and safety benefits – will convince them to spend.

- Unchanged – Consumers who have been insulated from COVID-19 financial stresses are the most likely to say they are loyal to their regular brands, regardless of price. Earn their loyalty by catering to their desire to make healthier lifestyle choices.

- Thrivers – Though a smaller pool of consumers, this group has the ability to spend disproportionately on products, brands and experiences than they did pre-pandemic. Be sure that your offerings align with their growing focus on health and wellness, environmental credentials, and social responsibility.

The future impact of today’s economic divide

Consumers’ first-hand experiences from the pandemic have fundamentally changed their future outlook. While 30% of global respondents say they have a totally different set of priorities than they had in 2019, the cohorts whose financial circumstances have pivoted the most – Strugglers, Rebounders, and Thrivers – anticipate dramatically new buying habits. While it is important to understand present consumer mindsets, companies should be planning today for how these segments might evolve tomorrow, given the unpredictable nature of the future.

If COVID-19 takes the endemic path that many are projecting, and economies start to rebound Strugglers may return to the workforce and their improved financial situation may enable them to share more common characteristics with Rebounders. Similarly, the Cautious cohort could start to relax their cost-conscious mindsets and exhibit the habits of the Unchanged consumer. But in a scenario where more serious variants, geopolitical events, or macroeconomic pressures throw havoc on societies – leading to new mandates, disruptions and uncertainty – we could see the reverse occur, where more consumers are financially impacted and cautiousness across the board escalates to fracture this economic divide even more.

As we enter a new endemic-minded phase, companies need to understand that consumer growth is now polarized. Businesses must reinvent their portfolios and forge new strategies to navigate the new needs, priorities, and preferences of this divided consumer landscape.

Stay ahead by staying in the loop

Don’t miss the latest NIQ intelligence—get The IQ Brief in your inbox.

By clicking on sign up, you agree to our privacy statement and terms of use.