A ‘budget or bust’ mentality

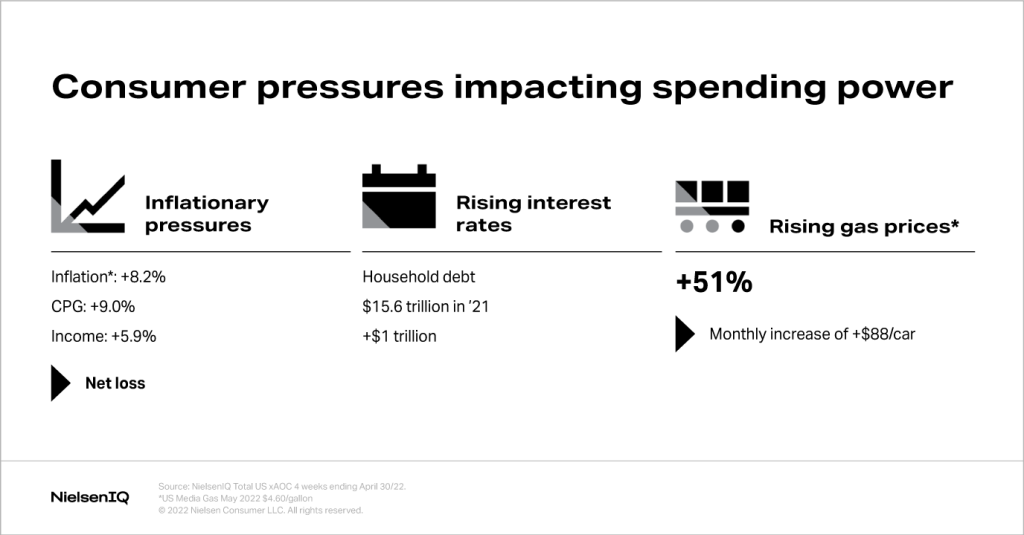

With a host of external economic factors affecting disposable consumer spend, many beauty consumers are planning to buy fewer products than in past months. They are also shopping online or closer to home to drive less and save on gas.

Findings from Nielsen IQ’s US Homescan panel views survey in May 2022 revealed consumer concerns about rising prices and showed that they are likely to spend less as a reaction.

When asked if they would be concerned if there were price rises to everyday items within the next 12 months, 97% said yes. And when asked if they would buy fewer beauty and personal care products if prices were to rise over the next 6 months, 38% of shoppers said they would buy less, 5% said they wouldn’t buy any at all, 2% said they would buy more, and 56% said it wouldn’t impact their spending.

The survey also revealed that Beauty and Personal Care consumers were more likely to decrease their spending compared to the overall panel, and that Fragrance and Hand, Body, and Lotion shoppers were the most concerned of all.

Beauty consumer ‘belt-tightening’ strategies

As of May 2022, NielsenIQ research indicated that many beauty consumers were already using the following money-saving strategies:

- 51% stock up when a product is on sale

- 41% use coupons

- 38% seek out stores with lower prices

- 37% are buying store brands

- 33% travel less to save on gas

- 29% only buy essentials

- 27% only buy items on sale

- 26% only buy less expensive name brand products

- 25% buy less expensive alternatives

- 25% shop with retailers that offer loyalty points

These consumer money-saving strategies give brands and retailers some insights on how to stay ahead of the curve when it comes to pricing, promotions and discounts.

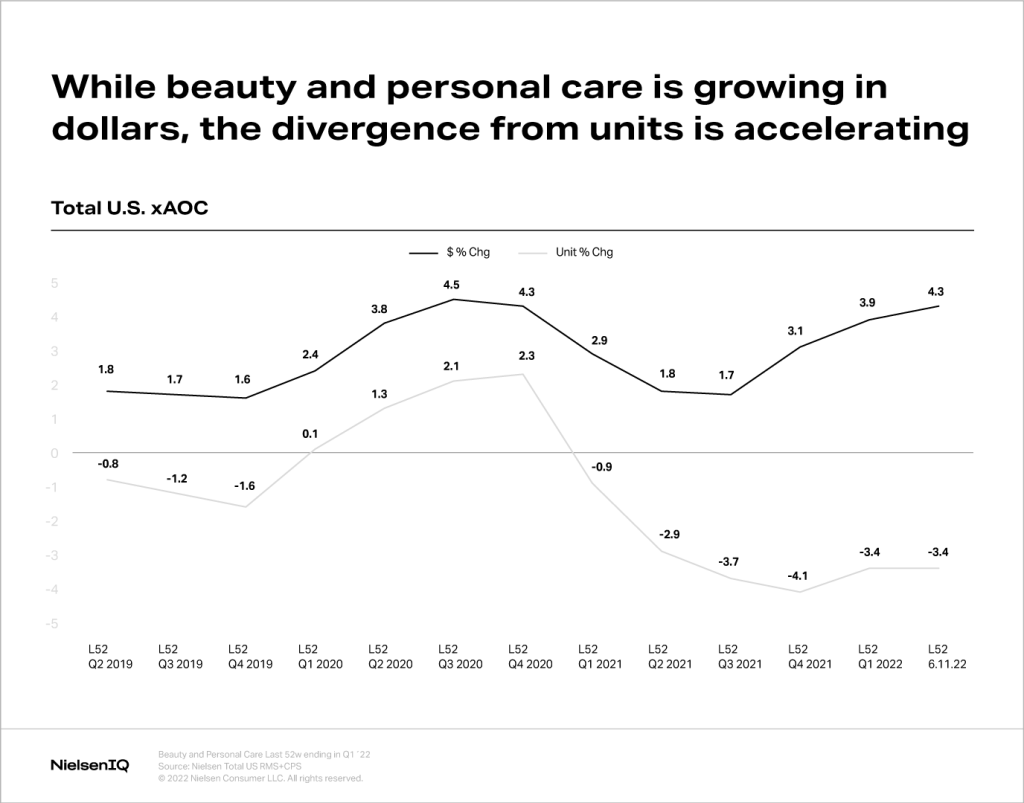

Beauty is increasingly prestige

The value of the total beauty industry is currently growing in dollars, but NielsenIQ data shows that unit sales are down. The divergence between these two factors is accelerating, and this pattern has been triggered by more than just rising inflation.

In fact, this gap is being driven by other category dynamics; notably, premiumization of the industry. It seems that more consumers have been “upgrading” their product purchases: opting for more exclusive or innovative options, prestige formulations, special ingredients, limited editions or added extras. The shift toward premiumization increased the overall product price point.

Although prices are indeed rising due to inflation, the premiumization of the overall beauty and personal care category has also affected price points.

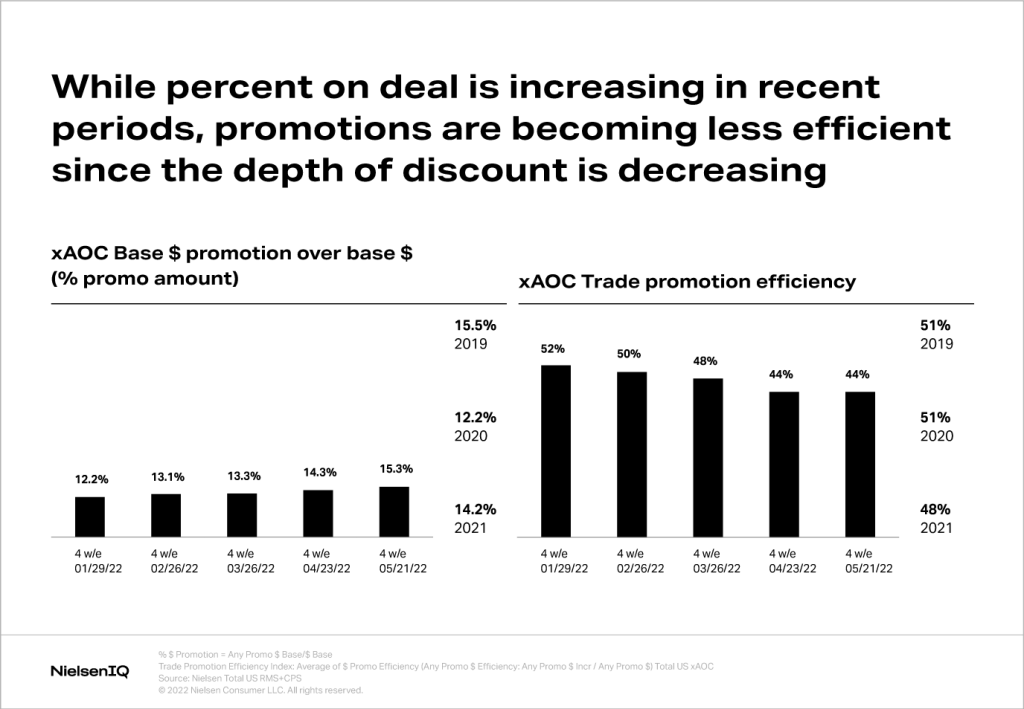

Promotions aren’t what they used to be

In a bid to survive this increasingly competitive market, more beauty and personal care brands and retailers are offering promotions on their products. As the overall levels of promotions are rising, NielsenIQ data shows that they are becoming less efficient due to a decrease in the depth of discount offered.

Brands and retailers can no longer rely on their old techniques for promotions and price cuts. They will need to explore innovative new ways to stand out from the crowd in this increasingly premium landscape.