The effect of price increases in 2021

NielsenIQ Retail Measurement Service (RMS) data analysis shows that 83% of categories across six markets in Asia Pacific (Australia, China, India, Malaysia, Philippines, and Singapore) in 2021 had increased prices compared to 2019. Of these categories, 25% had price increases of over 10%. So, what was the impact of these price increases?

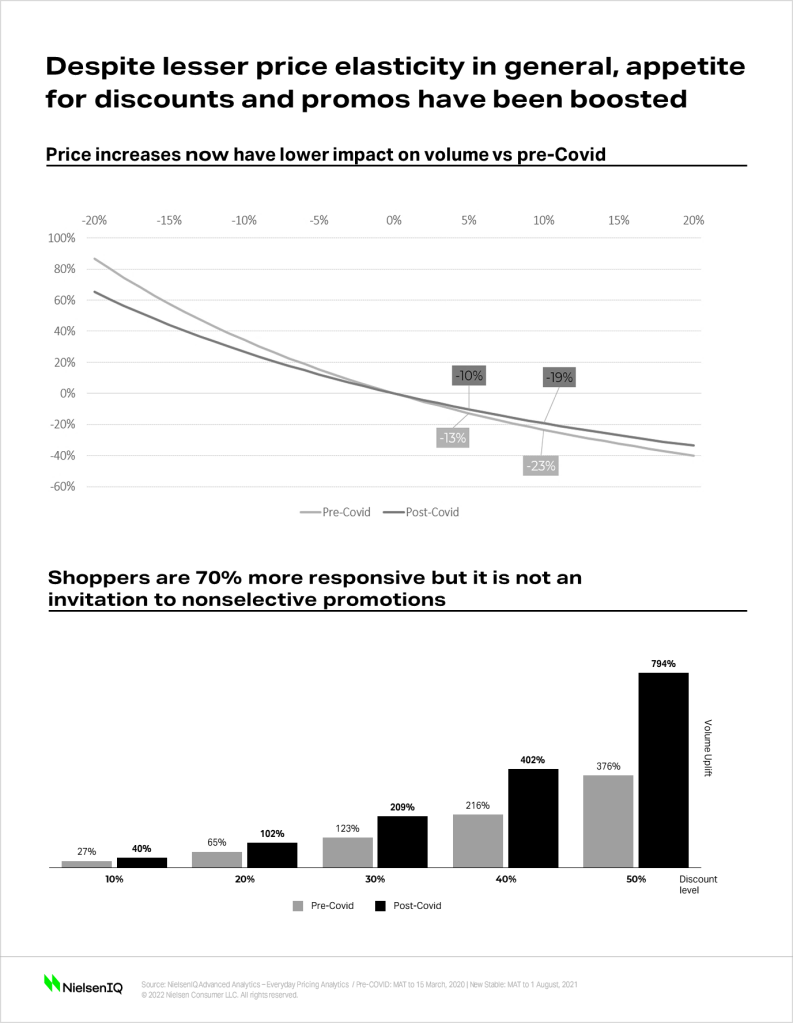

Through NielsenIQ’s Everyday Analytics* data, we found that price increases in 2021 had a lower impact on volume. For example, before Covid, if a product increased its price by 10%, there was an expected 23% reduction in volume. However, in 2021 this volume decline is to the tune of 19%—highlighting those consumers who were less impacted by price increases. The reason for the lower-than-expected decline can be attributed to the robust growth of FMCG and to consumers’ willingness to open their wallets for goods with less noticeable price changes.

At the same time, consumers are deal crazy! Although NielsenIQ notes a 70% increase in responsiveness to promotions, we recommend making a data-based decision of whether brands should promote more frequently or less frequently and consider how promotions need to vary by market or even by brands or items. One size does not fit all when it comes to promotions.

The shift in 2022

The picture is slightly different now from what we saw at the end of 2021. With the recent constraints on the supply chain and rising costs of raw goods and materials, there has been a further rise in the cost of goods. This year consumers are paying attention.

Today, manufacturers are dealing with rising production costs, be it the increasing costs of raw materials or the costs of shipment. These costs then get transferred to the market to sustain profitability, but this makes it challenging to maintain volumes and remain competitive.

To hurdle this challenge, driving efficiencies is critical. You need to ensure that your product is available in the right stores and channels, at the right price point.

Identify the Golden Stores (20% of stores that sell 80% of your products), optimize assortment to ensure that you have the right products in-store, understand how it varies by channel, and optimize your price and promotions.

NielsenIQ Everyday Analytics data in 2021 shows that while 37% of products were sold on promotion in Asia Pacific, there were wastages because over 51% of these sales would have happened even without a discount. By optimizing promotions using Everyday Analytics, brands can enjoy 3.3% extra growth in the region.

Focus on premium

Beyond promotions, how else can one drive category growth? Premiumization can be a source of growth, particularly for markets that are on a rebound like Singapore, Australia, and Taiwan. In these countries FMCG sales are growing compared to 2020 as well as 2019.

Conversely, struggling markets like Thailand and Vietnam are seeing a decline in premium. As brands start to think of premiumization, affordability should also be a consideration and the justification of why consumers should trade up must be solid.

*NielsenIQ Everyday Analytics (EDA) enables clients to maximize everyday pricing and build better promotions by leveraging NielsenIQ’s Revenue Management Optimization platform and automated models, creating profitable and scalable strategies.