Niche needs are more universal than we think

When we look at the major trends like clean beauty, multicultural, age-inclusive and gender-neutral, the common thread is that they are social-led, targeted, focused on niche needs, and offer specialized and/or personalized products to meet the needs of diverse consumers.

North America is a tapestry of race and ethnicities with many of the non-white population groups historically undercounted in the 2020 U.S. census.1 As media outlet NPR explains, “People’s identities rarely fall neatly into boxes,”2 a fact that applies to ethnic composition and gender. Celebrity beauty lines like Machine Gun Kelly’s Un/DN LQR and Harry Styles’ Pleasing dismantle gender conforming bias within beauty. These breaking-bias themes helped foster a very strong rebound in 2021 in total beauty with $88.7B in total beauty sales across omnichannel, according to NielsenIQ Omnishopper.

Online stores paved the way for choice and empowerment, making up 29% of total 2021 sales, a 2% increase from 2020. This beauty growth is increasingly being driven by indie brands, which often have the eyes and ears of trendsetting members of Gen Z and Millennials.

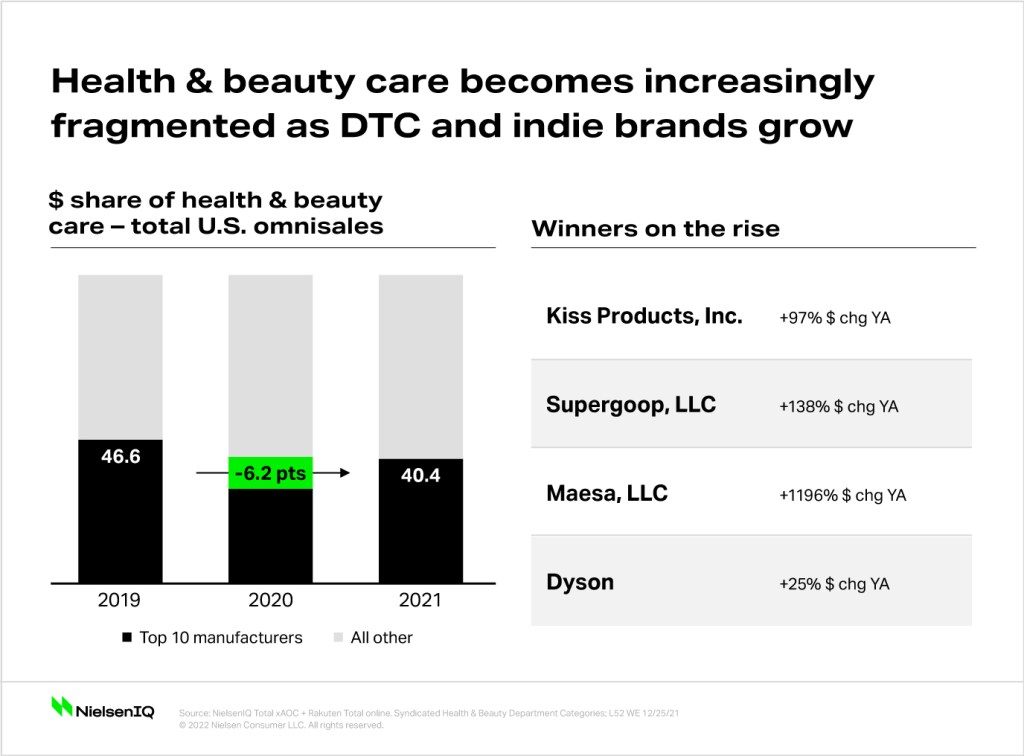

In fact, the top 10 major beauty manufacturers have collectively lost over 6 points of omnisales share over the past two years. Indie and direct-to-consumer (DTC) beauty brands like Supergoop clean sunscreen have risen in their share by +138%. There are other shakeups in the industry with brand incubator Maesa growing products like Kristen Ess Hair and Drew Barrymore’s FLOWER Beauty, while retailer private labels earned +1196% dollar change compared to 2020 and tech trailblazer Dyson earning 25% year-over-year through their innovative hair tools.

Consumers demand dialogue

Nowadays, we are no stranger to Instagram comment clapbacks and Twitter trending topics dictating news cycles. Consumers want products that go beyond “made for you” marketing speak.

They want:

- The convenience and flexibility they get from Amazon customer service guarantees

- Companies to practice what they preach with complete transparency, like we saw with the viral 15% pledge, which calls on retailers to devote 15% of shelf space to Black-owned businesses 3

- Products and where they shop to allow them to fully express themselves

Brands such as Curology, a skincare brand devoted to customized skincare, help customers take the guesswork out of treating skincare-woes. Forget looking within—soME is a skincare company that uses a blend of ingredients combined with a consumer’s own platelet rich plasma. DTC brands are looking to solve and treat problems from an entirely new perspective.

Tech isn’t limited to Silicon Valley

Technology helps enable customer personalization. Interactive online quizzes aid haircare brands like Function of Beauty and Prose have thrown out the cookie-cutter approach to consumer issues with algorithm-powered product solutions that beauty shoppers love.

Function of Beauty’s in-store launch in 2021 was extraordinarily successful. These quizzes also provide a direct line to the consumer with no need to confine product innovation to a focus group.

Luxury house Yves Saint Laurent rethought how they offer a personalized tech-enabled approach with an at-home lipstick tech tool that helps the customer get a custom shade from whatever sparks their fancy. Artificial intelligence is not limited to robots or the sci-fi genre—it is a beauty industry tool too.

A real social-led celebratory moment: Black-owned beauty

The heightened support for diversity gave the beauty industry pause with a true reckoning. Sharon Chuter of Uoma Beauty had companies publish the number of their POC employees compared to total organization as a pulse check of diversity and inclusion with Pull Up or Shut Up.4 As mentioned previously, a viral IG post ushered Sephora’s pledge of 15% shelf space for black-owned brands 5.

To answer the consumer’s call for change, retailers have reassessed their assortment to include black-owned businesses to ensure the long-neglected backbone of beauty retail was visible and available to the masses. Melanin skincare company Urban Skin Rx sold $9.6M across mass retailers. TPH, founded by Taraji P. Henson of Empire TV-acclaim, redefines how consumers take care of their scalp and hair health and took home $8.6M this past year. This is a true testament to how social-led movements can lead to change in the industry.

Remember, sound travels better with your ear to the ground

Consumers have endless choices so it’s important that brands and retailers stay relevant and speak to the consumer directly. There’s major opportunity in using deep learning to glean insights into the consumer psyche; after all, we have entire teams devoted to analysis. As a society, we’ve have seen the power of authenticity and support for what was formerly known as “niche” or a mere section of the beauty aisle.

Corporations cannot cave into social media pressures for a quick soundbite; diversity and inclusion is not a goal, it is a practice. Brands and retailers need to ensure each shopper is treated like an individual, not just a number.

Source:

1 Bureau, US Census. “Census Bureau Releases Estimates of Undercount and Overcount in the 2020 Census.” Census.gov, 10 Mar. 2022, https://www.census.gov/newsroom/press-releases/2022/2020-census-estimates-of-undercount-and-overcount.html.

2 Escobar, Natalie, and Leah Donnella. “Who Are We? We’re Finding out Together.” NPR, NPR, 31 Mar. 2020, https://www.npr.org/sections/codeswitch/2020/03/31/823881121/who-are-we-were-finding-out-together.

3 “15 Percent Pledge.” 15 Percent Pledge, https://15percentpledge.org/.

4 Hou, Kathleen. “The Beauty Executive Asking Companies to ‘Pull up or Shut up’.” The Cut, The Cut, 17 June 2020, https://www.thecut.com/2020/06/interview-with-sharon-chuter-creator-of-pull-up-or-shut-up.html.

5 Kosik, Alison. “Sephora Will Dedicate 15% of Shelf Space for Black-Owned Brands.” CNN, Cable News Network, 10 June 2020, https://www.cnn.com/2020/06/10/business/sephora-15-percent-pledge/index.html.