Inflation is impacting

back–to-school shopping

Without question, inflation is influencing how families are approaching back-to-school shopping.

In a new NielsenIQ survey, 47% of parents of school aged kids (6-17 years old) stated that inflation is largely impacting how much they will spend on school supplies this year.

In fact, close to 20% of consumers surveyed stated that they will not be purchasing everything on this year’s school supply list. Of this subset of consumers, 48% stated that items are just too expensive to afford/purchase. Meanwhile, 17% of parents noted that the limited availability of products on shelves and online as a core reason to not purchase everything on their school supply list.

School supply spending budgets are higher than last year

Due to the expectation of higher prices, 47% of parents plan on spending more this year on school supplies than last year, 44% of parents are expecting to spend about the same amount as last year, and 9% of parents are expecting to spend less than last year.

When it comes to school supply budgets

Typical school supply lists include items such as clothing, shoes, personal care/beauty supplies, paper notebooks, pens, pencils, glue, desk and locker supplies, snacks, food for lunch, and bottled beverages. For some students, this list could include technology such as calculators, laptops, and tablets.

As a result, surveyed parents indicated that

- 15% are budgeting to spend less than $100

- 32% are budgeting to spend in the range of $100 – $199

- 25% are budgeting to spend in the range of $200 – $200

- 12% are budgeting to spend in the range of $300 – $399 this year on school supplies

- 5% are budgeting to spend in the range of $400 – $499

- 11% are budgeting to spend more than $500 this year on school supplies

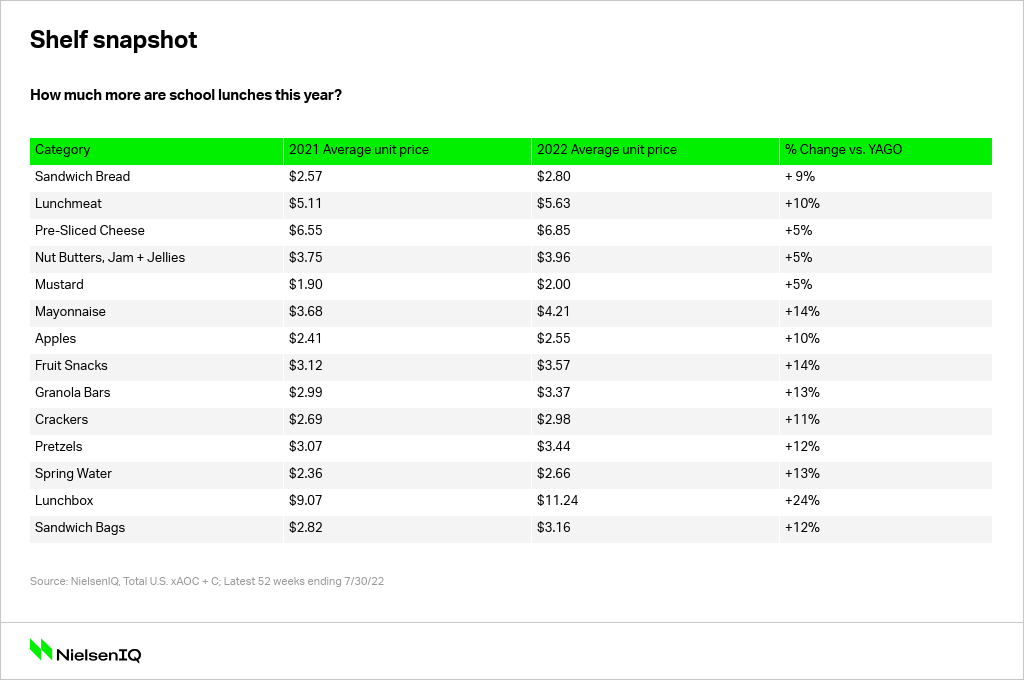

Prices of standard school supplies have increased on average by 10% over the past year

Compared to 2021 school supply prices, the cost to stock up on supplies this year has increased on average by 10%.

Parents are not procrastinating

The back-to-school shopping season is off to a strong start. In our survey, 88% of parents indicated they have either finished or are currently shopping for this year’s school supply list. Only 12% of parents noted that they have not started their back-to-school shopping yet.

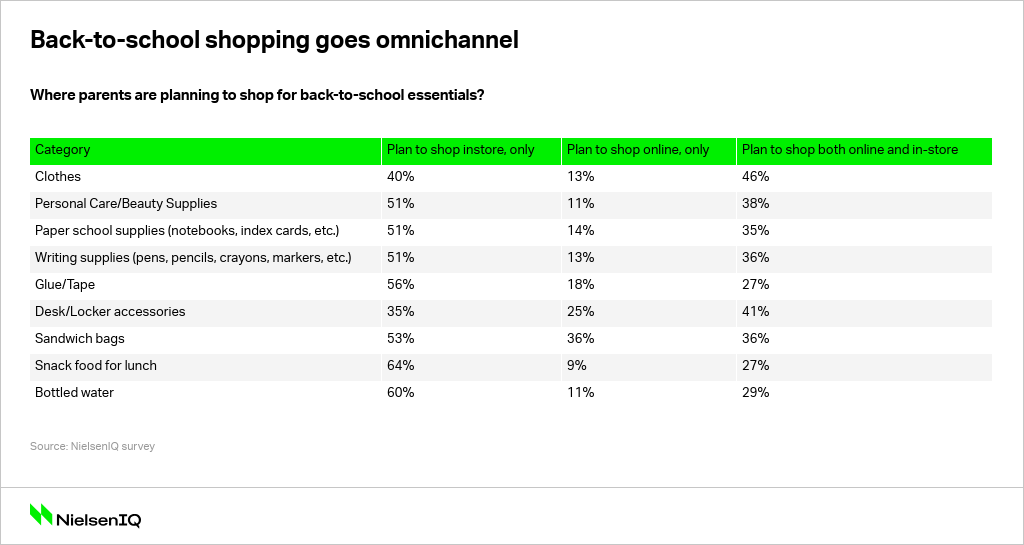

Back-to-school shopping has gone hybrid

For a growing number of back-to-school categories, parents are leaning into retail options that stretch across online and in-store shopping. It’s interesting to note that 51% of parents stated that they leaned into Amazon Prime Day, July’s blockbuster shopping holiday, to meet their back-to-school shopping needs.

To buy or to bring? Either way school lunch will be more expensive

The expiration of Federal pandemic meal waivers (which allowed children across the country to eat school lunches for free over the past two years) is another factor parents have to consider. Our survey found that:

- 39% of parents will continue to purchase school lunch from school for their children

- 26% of parents will continue to pack lunch from home for their children

- 9% of parents stated that they will stop buying school lunch and will start packing lunch from home for their children

- 21% of parents stated that they will be doing a bit of both, buying school lunch and packing a lunch from home for their children

The cost to buy school lunch

This upcoming school year, the national school lunch program costs $2.81 on average. School breakfast is $1.62 on average. In 2019, the average price of school lunch was $2.68, and the price of breakfast on average was $1.43.

While states like California are choosing to continue to provide free lunch to all students across the state, a recent Time magazine report highlighted the fact that inflation-related price increases may push lunch prices up as high as $5 in some school districts across the country.

Within the U.S., this year’s back-to-school season is reflecting a consumer decision making environment that is cautious, considered, and calculated. Heading into the back half of the holiday shopping season, retailers and manufacturers should anticipate and cater to this enduring mindset.

When it comes to spending, consumers will continue to assess priorities based on needs and available wallet spend.